- Home

- »

- Petrochemicals

- »

-

Cyclohexanone Market Size, Global Industry Report, 2020-2027GVR Report cover

![Cyclohexanone Market Size, Share & Trends Report]()

Cyclohexanone Market Size, Share & Trends Analysis Report By Application (Adipic Acid, Caprolactam, Solvents), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-450-5

- Number of Pages: 119

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Bulk Chemicals

Report Overview

The global cyclohexanone market size was estimated at USD 7.53 billion in 2019 and and is expected to expand at a compound annual growth rate (CAGR) of 3.3% from 2020 to 2027. The market is mainly driven by its consumption for the production of caprolactam, followed by adipic acid. Caprolactam is majorly used in the production of nylon which is further used across various end-use industries including automotive, construction, consumer goods, and electronics.

Cyclohexanone is a colorless, flammable organic liquid, which is majorly derived from cyclohexane. Some manufacturers have also developed new technologies for the direct production of the chemical from phenol. More than three fourth of the cyclohexanone produced worldwide is manufactured from cyclohexane and the rest is produced from phenol. The majority of the companies have integrated business wherein they utilize cyclohexanone for the production of caprolactam. The high amount of captive consumption has resulted in a significantly low volume of the product being traded globally.

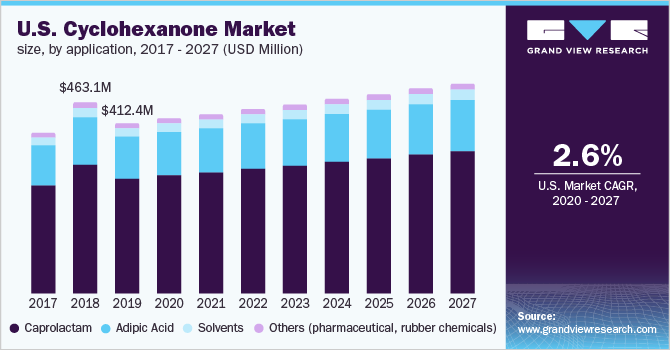

North America is one of the major markets for cyclohexanone owing to the growing demand for caprolactam and adipic acid in the U.S. and Canada. According to the U.S. Environmental Protection Agency (EPA), U.S. accounted for roughly 30% to 35% of the global adipic acid consumption in 2018. Adipic acid is mainly used in the production of nylon 66, which is further utilized for manufacturing different textile products such as apparel, carpets, and upholstery. Growing demand for carpets in the region is further driving the demand for adipic acid. Carpet manufacturing predominantly accounts for around 30% of adipic acid demand in the country.

North America is projected to be the second-largest consumer of textile yarn by 2022, after the Asia Pacific. Polyester and cotton are the two major textile yarns used in the region. Multiple textile yarn manufacturers in the U.S. and Canada are investing heavily in the North America market due to rapidly changing consumption patterns coupled with growing demand for clothing and other home furnishing products. Changing lifestyle and rising health awareness in U.S. have generated a strong demand for sports apparel and gym equipment primarily manufactured from nylon 6 and 66, thereby positively affecting the industry.

High water absorption, ease of dyeing, and high melting point of nylon makes it suitable for several applications including textiles, parachutes, camping fabrics, and fishing lines. The development of engineered plastics, technological advancements in 3D printing, and innovations in the textile industry are anticipated to generate lucrative opportunities for nylon globally. 3D printing technology can be used in a broad spectrum of industries such as aviation, automotive, consumer goods, healthcare, and heavy machinery. The demand for 3D printing technology is growing globally due to high production efficiency and durability.

According to a presentation given at the 5th International Conference on 3D Printing Technology and Innovations, the global value for 3D printing is anticipated to grow from USD 13 billion in 2019 to USD 25 billion by 2023. The demand for 3D printing is anticipated to be driven by its rising use in healthcare, consumer goods, electronics, and automotive industries. This factor is likely to positively influence the demand for cyclohexanone in the production of nylon.

The rising trend for bio-based substitutes is anticipated to hinder the cyclohexanone market growth. Polyester is one of the major threats for the market as it used as a key substitute for nylon in application industries.

Cyclohexanone Market Trends

Cyclohexanone is a colorless liquid that is derived from cyclohexane and phenol. The primary component utilized in the production of the chemical is cyclohexane. However, new technologies have found methods to manufacture cyclohexanone through phenol. The chemical is suitable for industrial use as an industrial chemical to produce specific molecules and for consumer use in products such as paint, adhesives, electronics, cleaning and more. The major utilization of the chemical is in the production of caprolactam which is further consumed to manufacture nylons. Nylon is a widely used product in end-use industries such as automotive, consumer goods, electronics, construction and more.

Rising demand for nylon from flourishing industries like automotive and construction is expected to contribute to the cyclohexanone market growth over the foreseeable years. The formulation of adipic acid requires cyclohexanone as a key raw material that goes in the production process. The chemical mixes with cyclohexanol to produce adipic acid by oxidation with over 50% HNO3 at about the temperature of 75 °C. Over 3/4th of global adipic acid is used in the formation of nylon 66 which is consumed in the production of products such as carpets, clothing, brushes, tire cords and more.

Caprolactam application dominated the market with the share of 68.7% in 2019. This is attributed to the rising demand for caprolactam in the manufacturing of nylon. Caprolactam is highly utilized in the formulation of nylon 6, films, and resins. Around 70% of total globally produced caprolactam is used for producing nylon 6 and rest 30% are used in films and resins. Automotive industry accounts for the major demand for nylon 6 owing to it high usability in parts manufacturing. Nylon 6 is expected to replace metal in automotive industry due to nylon’s characteristics such as good tensile strength, longer durability, no corrosion and more.

According to National Library of Medicine, 95% of Cyclohexanone is used in the formulation of raw materials that produce nylon. Other 5% are used in the production of solvents. The chemical is widely used as solvents in paint removers, cellulosic, wood stain removers and more. The chemical’s further application as a solvent is likely to enable immense opportunity for the market growth in the coming years.

Rising sincerity towards environment and the shifting trend towards renewable energy resources has prompted the manufacturers to build new production technologies. Increasing environment concerns and growing trend of using conventional method are anticipated to shift caprolactam manufacturers focus to alternative production processes, which is likely to negatively impact the market

Nylon has a significant use in a broad range of industries such as automotive, textile, electronics, consumer goods and more. Rapid increase in demand for nylon from aforementioned industries is anticipated to accelerate the demand for adipic acid and caprolactam over the future years, in turn, will excel the demand for cyclohexanone. In addition, solvent is also considered as an emerging application which is expected to witness a significant growth owing to its increasing consumption in paints & coatings industry in the projected years.

Application Insights

Caprolactam was the largest application of cyclohexanone in 2019 with a market share of 67.6% and is expected to continue its dominance over the forecast period owing to high nylon production. In addition, different commercial processes of producing caprolactam such as Hydroxylammonium ammonium Sulfate Oximation (HSO), Hydroxylammonium Phosphate Oximation (HPO), Honeywell Phenol Process, Enichem and Sumitomo process, and Cyclopol process utilize cyclohexanone as the raw material.

Though major cyclohexanone producers are investing in R&D activities for sustainable production, growing demand for nylon is anticipated to continue the usage of conventional manufacturing processes for the next few years. Caprolactam is an essential raw material for formulating nylon 6 fibers, films, and resins. Around 70% of the world’s caprolactam produced is utilized for producing nylon 6 fibers and the rest 30% is utilized for manufacturing films and resins.

The current penetration of cyclohexanone as a solvent is less; however, it is anticipated to grow at a significant rate of 3.7% from 2020 to 2027, mainly due to its non-corrosive properties. As a solvent, it is used across various application industries including paints and coatings, agriculture, and lubricants.

Regional Insights

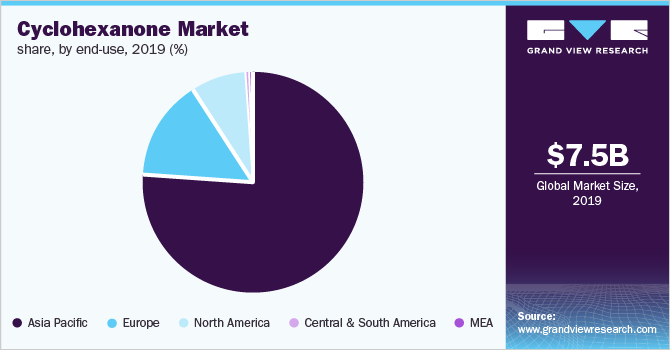

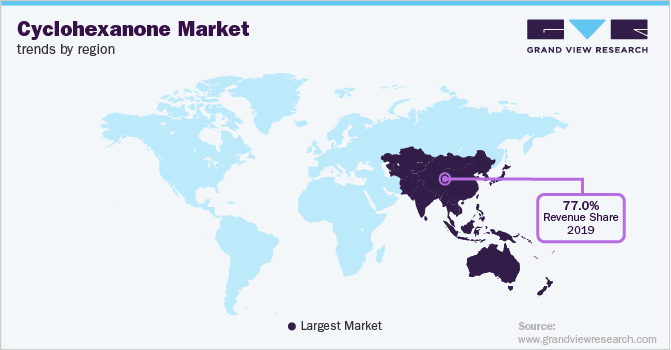

Asia Pacific is anticipated to be the largest as well as the fastest-growing region globally, in terms of volume, over the forecast period. The fast-growing industrial sector in the region coupled with rising economic standards of the Asian countries are anticipated to be the key identified areas pushing the consumption of cyclohexanone with a CAGR of 3.4% in terms of revenue from 2020 to 2027.

Asia Pacific is the largest producer and consumer of cyclohexanone with the global share of 76.6% and likely to continue the dominance owing to the presence of multinationals and growing end-use industries such as automotive, construction, and consumer goods in the region. Growing market in China and India owing to the presence of global players is giving a significant drive to the Asia Pacific market growth. Asia is the largest manufacturer of cyclohexanone. All types of products such as adipic acid, caprolactam, and solvent made with the chemical are consumed in a significant quantity in the region.

The market growth in Asia Pacific is determined by the presence of a significant amount of skilled labor at low cost along with government support for industrial development. These factors have contributed to a shift in production plants toward developing economies, particularly China and India, thus generating lucrative opportunities in the region over the forecast period. China is the largest producer and consumer of cyclohexanone globally. The country also exports a large quantity of cyclohexanone due to its colossal manufacturing industry.

China is the major manufacturer of cyclohexanone across the globe. The country is also involved in the export of the chemical due to its massive manufacturing industry. China imports raw materials from the countries like U.S., Russia, and Indonesia and produces a large quantity of the chemical due to cheap labor availability, relaxing regulations, cheap material cost, and presence of large manufacturers. These factors are expected to bolster the demand for cyclohexanone in the country over the foreseeable future.

Central and South America and Middle East and Africa regions have witnessed a very low penetration of cyclohexanone with a collective share of 7.5%, in 2019. Most of the cyclohexanone in the region is sourced from Asian countries despite vast oil reserves and high oil production. Low level of awareness among consumers along with limited participation and cooperation from the government are the key factors responsible for the slow growth rate of the product in these regions.

Europe is the second largest market for cyclohexanone due to the rising demand for nylon from end-use industries in Europe. Nylon production requires less energy consumption, thus, it is considered as the most viable raw material for nylon production. Shutdown of industries amidst the outbreak of covid-19 has resulted in the decline in the market growth for cyclohexanone. However, the demand for caprolactum remained unaffected owing to its growing demand from manufacturing industry.

The increasing consumption of nylon in automotive, construction and consumer goods industry is expected to make significant positive difference in cyclohexanone market in the future. In addition, its utilization in the formulation of solvents and plastic is also expected to drive the market growth. Adoption of new production technology is expected to ease up the production process and contribute to the market growth in the coming years.

Cyclohexanone Market Share Insights

The global market is categorized by a number a small scale and a few large scale manufacturers. Some of the market participants have complete integration across the value chain, wherein they are involved in the production of cyclohexane, cyclohexanone, as well as caprolactam and adipic acid. Some of the companies in the market are BASF SE, Gujarat State Fertilizers and Chemicals Ltd, and Asahi Kasei Corporation.

BASF and Asahi Kasei Corporation are leading the market owing to their strong geographical presence across the globe. These companies also have a strong customer base, product portfolio as well as integration throughout the value chain. In addition, the top companies also have huge investment capacities for R&D and marketing, thus enabling a well-established supply chain.

Cyclohexanone Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 7.80 Billion

Revenue forecast in 2027

USD 9.77 Billion

Growth rate

CAGR of 3.3% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Million, Volume in Units & CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Middle East and Africa; Central and South America

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Spain, China, India, Japan, South Korea Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Gujarat State Fertilizers & Chemicals Ltd (GSFC); Asahi Kasei Corporation; BASF SE; DOMO Chemicals; Ostchem; Fibrant; Shreeji Chemical; Jigchem Universal; Arihant Solvents & Chemicals; Qingdao Hisea Chem Co., Ltd.; LUXI Group; Taiwan Prosperity Chemical Corporation (TPCC); Ube Industries, Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyclohexanone Market SegmentationThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global cyclohexanone market report on the basis of application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Caprolactam

-

Adipic Acid

-

Solvents

-

Paints & Dyes

-

Agriculture

-

Others

-

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cyclohexanone market size was estimated at USD 7.54 billion in 2019 and is expected to reach USD 7.80 billion in 2020.

b. The global cyclohexanone market is expected to grow at a compound annual growth rate of 3.3% from 2019 to 2027 to reach USD 9.78 billion by 2027.

b. Asia Pacific dominated the cyclohexanone market with a share of 76.6% in 2019. This is attributable to initiatives taken by the government for industrial development coupled with shift in manufacturing facilities to China and India.

b. Some key players operating in the cyclohexanone market include BASF SE, Gujarat State Fertilizers & Chemicals Ltd., and Asahi Kasei Corporation.

b. Key factors that are driving the market growth include rising demand for nylon in 3D printing application and growing automotive production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."