- Home

- »

- IT Services & Applications

- »

-

Data Center Accelerator Market Size & Share Report, 2030GVR Report cover

![Data Center Accelerator Market Size, Share & Trends Report]()

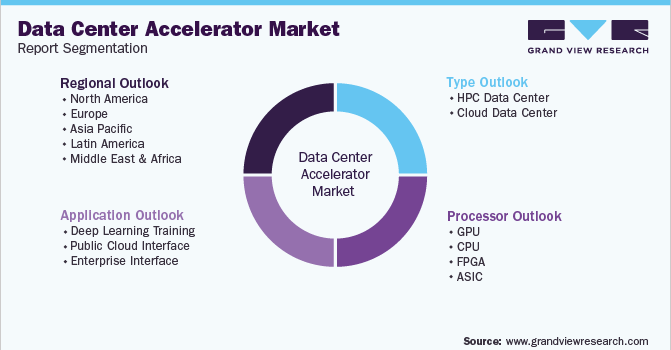

Data Center Accelerator Market Size, Share & Trends Analysis Report By Processor (GPU, CPU, FPGA, ASIC), By Type (HPC Data Center,Cloud Data Center), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-001-0

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global data center accelerator market size was valued at USD 10.78 billion in 2021 and is expected to expand at a CAGR of 23.5% from 2022 to 2030. Factors such as the growing deployment of data centers & cloud-based services are driving the growth of the data center accelerator market. Additionally, the increasing adoption of technologies such as artificial intelligence (AI), internet of things (IoT), & big data analytics is boosting the data center accelerator market growth.

The COVID-19 pandemic positively impacted the data center accelerator market as the pandemic shifted focus towards a digital transformation. Many colleges and institutions quickly shifted to operating and delivering courses online due to the widespread lockdown. The education sector is highly responsive of the cloud technologies to carry out and handle tuition, assessments, and admission exams. According to the World Economic Forum (WEF), approximately 730,000 K-12 students in Wuhan province attended classes online after the government instructed education institutes to carry out classes online in February 2020.

Adaptive acceleration for the modern data center is useful in high-performance computing (HPC), network acceleration, database & data analytics, computational storage, video & imaging, and financial technology. Data center acceleration handles various HPC workloads such as genomics, astrophysics, big data analysis, machine learning, modular dynamics, cyber security, oil & gas, and weather & climate.

There are some challenges associated with the programming and deployment of multiple FPGAs. The initial difficulty in programming a cluster of FPGAs determines how to abstract and utilize the communication links between the FPGAs, as well as how to connect the kernels on numerous FPGAs. The second issue with establishing an FPGA cluster is determining how to distribute, coordinate, and administer a multi-FPGA application once it has been constructed.

IoT is expected to produce significant amounts of data in industrial applications. For instance, according to Quicksilver Capital, a smart factory will produce 5 petabytes of data every week, while an offshore oil rig is estimated to generate 1 to 2 terabytes of data every day. Massive volumes of data are transformed into insights and value by new business models that use artificial intelligence, platforms, and algorithms. According to the World Economic Forum, digitally enabled platform business models will generate 70% of new economic value over the next decade.

Processor Insights

The graphics processing unit (GPU) segment held the maximum revenue share of 46.1% in 2021 and is expected to grow at a CAGR of 22.3% over the forecast period. The growth of the segment can be attributed to the increasing usage of GPU in supercomputing, drug research, AI training and inference, medical imaging, and financial modeling. Moreover, GPUs are better suited to handle many of the calculations required by machine learning and AI in hyper-scale networks and enterprise data centers.

The FPGA segment is projected to attain the highest CAGR of 26.4% in the forecast period. Cloud service providers like Microsoft, Amazon, Alibaba, Baidu, and Tencent have been adopting the FPGAs as a reconfigurable heterogeneous processing asset. Moreover, improvements in architecture, programming paradigms, and security are expected to result in a wider variety of applications for FPGA-based cloud deployment.

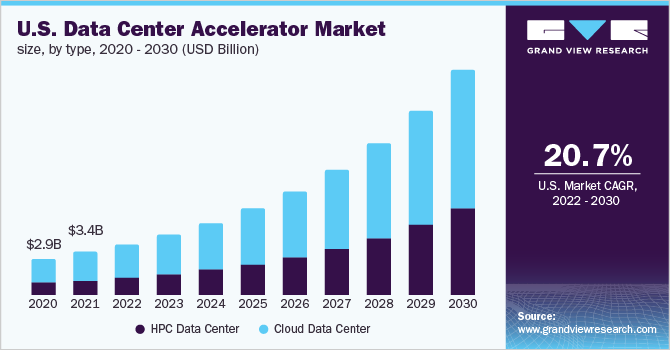

Type Insights

The cloud data center segment accounted for the largest revenue share of 67.8% in 2021. This is attributed to the growing deployment of hybrid cloud and multi-cloud architecture by the businesses.

The HPC data center segment is projected to grow at the highest CAGR of 26.0% over the forecast period. The growth of this segment can be attributed to the rise of quantum computing and its use as an accelerator in HPC. Also, supercomputing labs, governments, and businesses have already started to study how quantum processing units, or QPUs, could fit into HPC environments.

Application Insights

The deep learning training segment accounted for the largest revenue share of 40.8% in 2021 and is expected to grow at a CAGR of 20.7% over the forecast period. The market growth is attributed to the increase use of deep learning for specific use cases. For instance, use of deep learning in automotive and self-driving cars, voice assistance, image recognition, texts classification, insurance claim cost estimation, etc.

The enterprise interface segment is projected to grow at a highest CAGR of 25.7%, over the forecast period. Hyper-scale cloud-based organizations like Amazon.com, Inc., Google, and Facebook are increasingly targeting digital transformation to create similar kinds of cloud-native applications likely to contribute to the growth of the segment. Also, many enterprises are adopting cloud migration and cloud-first policies by increasing their cloud spend and workload volumes.

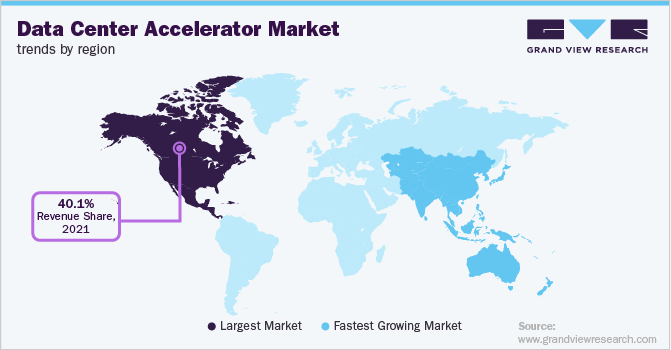

Regional Insights

North America dominated the market with a share of 40.1% in 2021. Factors such as the presence of prominent market players including Advanced Micro Devices, Inc., NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., etc., and the presence of developed technology and data center infrastructure are the major contributor of regional market growth.

Asia-Pacific is expected to grow at the highest CAGR of 26.8% during the forecast period. The market growth across the region can be attributed to the growing adoption of cloud-based services such as IoT and big data analytics. Moreover, suitable government policies and the need for data center infrastructure upgradation in the Asia Pacific are driving the growth of the data center accelerator market in the region.

Key Companies & Market Share Insights

The competitive landscape of the data center accelerator market is fragmented, having numerous local and global data center accelerator companies. The key participants are adopting advanced technologies to offer better solutions to their customers. Moreover, companies are launching a new line of products and services for advanced applications such data analytics and AI. In November 2020, Advanced Micro Devices, Inc. launched AMD Instinct MI100 Accelerator and next-generation AMD EPYC processors dedicated to High-Performance Computing (HPC) workloads. Combining instinct accelerators and AMD EPYC processors with critical application software and development tools enables AMD to deliver redefine performance for HPC workloads. Some prominent players in the global data center accelerator market are:

-

Advanced Micro Devices, Inc

-

NVIDIA Corporation

-

Intel Corporation

-

Qualcomm Technologies, Inc.

-

Advantech Co., Ltd.

-

Achronix Semiconductor Corporation

-

Micron Technology, Inc.

-

Marvell

-

KIOXIA Holdings Corporation

-

Western Digital Technologies

Data Center Accelerator Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 13.11 billion

Revenue forecast in 2030

USD 70.99 billion

Growth Rate

CAGR of 23.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Processor, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; and South Africa

Key companies profiled

Advanced Micro Devices, Inc; NVIDIA Corporation; Intel Corporation; Qualcomm Technologies, Inc.; Advantech Co., Ltd.; Achronix Semiconductor Corporation; Micron Technology, Inc.; Marvell; KIOXIA Holdings Corporation; and Western Digital Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Accelerator Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global data center accelerator market report based on, processor, type, application, and region:

-

Processor Outlook (Revenue, USD Million, 2017 - 2030)

-

GPU

-

CPU

-

FPGA

-

ASIC

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

HPC Data Center

-

Cloud Data Center

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Deep Learning Training

-

Public Cloud Interface

-

Enterprise Interface

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center accelerator market size was estimated at USD 10.78 billion in 2021 and is expected to reach USD 13.11 billion in 2022.

b. The global data center accelerator market is expected to grow at a compound annual growth rate of 23.5% from 2022 to 2030 to reach USD 70.99 billion by 2030.

b. North America dominated the data center accelerator market with a share of 40.1% in 2021. This is attributable to the presence of numerous data center accelerator market players in the region.

b. Some key players operating in the data center accelerator market include Advanced Micro Devices, Inc, NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., Advantech Co., Ltd., Achronix Semiconductor Corporation, Micron Technology, Inc., Marvell, KIOXIA Holdings Corporation, Western Digital Technologies.

b. Key factors driving the data center accelerator market growth include the growing deployment of data centers & cloud-based services, and the increasing adoption of technologies such as AI, IoT, & big data analytics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."