- Home

- »

- HVAC & Construction

- »

-

Data Center Cooling Market Size And Share Report, 2030GVR Report cover

![Data Center Cooling Market Size, Share, & Trend Report]()

Data Center Cooling Market Size, Share, & Trend Analysis By Component (Solutions, Services), By Type, By Containment, By Structure, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-652-3

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Technology

Data Center Cooling Market Size & Trends

The global data center cooling market size was estimated at USD 18.65 billion in 2023 and is expected to grow at a compounded annual growth rate (CAGR) of 16.8% from 2024 to 2030. The increasing demand for energy-efficient data centers is anticipated to create lucrative growth opportunities for the market. Several key companies are preparing for the expansions. Moreover, the favorable growth prospects can be attributed to the rapid increase in data generation and the subsequent rise in the demand for data centers across the globe. Data centers consume a large amount of power, which generates a massive amount of heat, which creates the need for efficient cooling equipment.

Furthermore, the growing popularity of OTT platforms and streaming services has led to a remarkable increase in data volumes; which is projected to fuel the demand. The rapid growth experienced by cloud services, the growing prominence of big data, and improved penetration of connected devices are encouraging organizations to increase their investments in building new data center facilities. All these factors are anticipated to boost the demand for data center cooling systems. This demand is directly proportional to an increase in the number of data center facilities globally. The increased spending on IT infrastructure after the pandemic is creating avenues for the expansion of new and existing data center facilities across the world. Moreover, software-based data centers are also contributing to market growth by offering an enhanced level of automation.

A shift toward digital transformation amidst the pandemic further prompted the need for building data center facilities that can provide scalability, security, and flexibility. Therefore, as investments in new data center facilities witness an increase, the demand for the data center cooling industry witnesses a favorable outlook. However, the need for specialized infrastructure and high investment costs for arranging and maintaining these data center solutions are anticipated to hinder industry growth. Furthermore, cooling issues during incidences, such as power outages, and reduced carbon emissions are projected to pose challenges to the industry. The pandemic had a major impact on this market. The lack of employees and limited investment costs disturbed data center cooling technology production & sales.

Key companies & governments adopted new safety measures to develop and improve the practices. However, as technology advanced, the industry's sales rate improved as it targeted the right audience. Data centers are a hotspot of all critical IT infrastructures across several verticals including manufacturing, BFSI, retail, and healthcare. The need to manage huge volumes of data while offering networking capabilities is the key reason driving data center investments in these verticals. Data centers emit a high amount of heat and hence require cooling solutions to keep the system working without any outages or other dysfunctions. Thus, data center cooling solutions are of paramount significance to any data center facility.

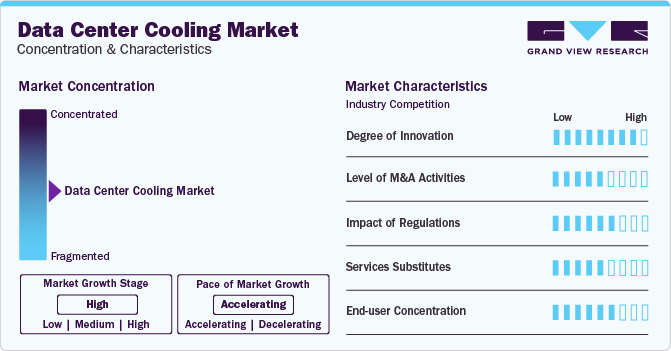

Market Concentration & Characteristics

The market growth is high and the pace of growth is accelerating. With the growing size and complexity of data centers, operators often struggle with ensuring the optimal energy management of data center cooling systems. To resolve these issues, several data center operators are likely to implement intelligent power distribution and monitoring systems to monitor, control, and ensure efficient cooling distribution in data centers.

Several key players are acquiring companies with data center cooling providers to expand their commercial operations in untapped regions. Moreover, key players are undertaking numerous innovations in the data center cooling market, such as the implementation of artificial intelligence and automation for monitoring trends, driving segment growth.

The market is subjected to numerous rules and regulations. Moreover, governments across various regions advocate for effective data center incident response and recovery procedures as cooling systems are essential for minimizing equipment overheating and offering data center operations during and after disasters.

The threat of substitutes remains moderate. As energy prices increase and data centers continue to grow with time and respond to rising demand, the cost of mechanical cooling becomes an unwieldy operating expense. The development of virtual containment has emerged as a new and potentially energy-saving alternative to data center cooling products and services. However, the non-scalable nature of this technology obstructs its adoption by major players in the industry.

Buyers seek systems that can grow easily to meet shifting workloads and evolving infrastructural requirements. Buyers prefer solutions that include modular components, allowing them to modify and grow their cooling infrastructure depending on their unique requirements. With growing awareness of the environmental impact of data centers, buyers are looking for cooling solutions that complement their sustainability goals. Energy-efficient cooling systems not only lower operational costs but also help make data centers more sustainable and eco-friendly.

Component Insights

The solution segment accounted for the largest market share in 2023. Businesses can maintain a suitable temperature and guarantee the correct operation of data centers with the help of data center cooling solutions. In addition, to reach appropriate cooling levels when the weather is warm, cooling solutions are frequently used to pre-cool the air. These factors are expected to support the segment expansion.

The services segment is estimated to have the highest CAGR from 2024-2030. Data center operators are increasingly implementing data center cooling services, such as power distribution units, to support the growth in data storage and services delivered, including data backup & archiving, managing authentication, and authorization; thus, driving the growth of the segment.

Solution Insights

The air conditioners segment held the largest share of over 30.0% of the overall revenue in 2023. Air conditioners are a popular choice among most end-users since they meet the demand for 24-hour protection while lowering energy costs. During storage and analysis of data for effective decision-making, heavily packed racks generate a large amount of heat. As such, air conditioners enable businesses to maintain an adequate temperature level and ensure the proper functioning of data centers. In addition, air conditioners are heat exchangers that maintain the required level of room temperature in a sensitive IT environment.

The precision air conditioners segment is estimated to grow at a CAGR exceeding 18% from 2024 to 2030. Technological advancements coupled with the development of energy-efficient units are expected to propel the demand for precision air conditioners. In addition, these air conditioners offer benefits, such as continuous operation, precise humidity control, demonstration of better air distribution, and automatic control of individual AC loads for efficient cooling.

Services Insights

The installation & deployment segment led the market and accounted for the highest revenue share in 2023. Increased installation and deployment of liquid-based heat removal equipment can have a major effect on power-supporting climate control systems, which is driving the segment growth. Higher-density installations are influencing the IT power plan. Other coolants and fan installations are included in the service, which makes it easier to balance design and optimization. When optimization and strategic deployment are coupled, cooling equipment can operate without overheating and with less of an adverse effect on the environment.

The maintenance service segment is anticipated to witness a significant CAGR from 2024 to 2030. The data center cooling maintenance services segment allows enterprises to quickly expand their infrastructure, power consumption, and storage capacity. The maintenance and service sector makes it easier for modular designs to be seamlessly integrated and developed, giving companies the flexibility to modify their cooling systems in response to changing technological requirements. It is anticipated that the maintenance service segment will continue to see innovation in areas like liquid cooling technologies and the growing usage of direct-to-chip cooling techniques for better thermal management.

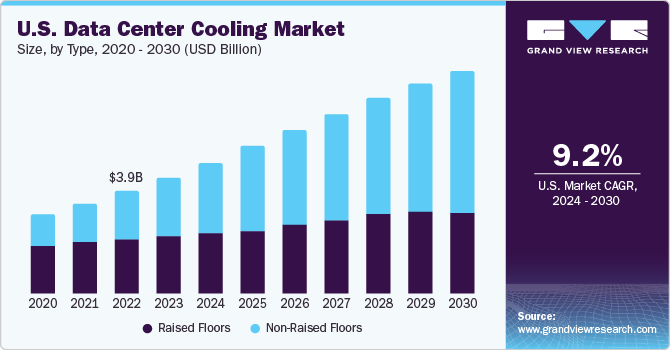

Type Insights

The non-raised floor segment held the largest revenue share of nearly 52% in 2023. Non-raised floor is essential to the integration of contemporary surveillance and thermal assessment systems. It allows the service providers to detect and resolve problems before they arise by giving real-time monitoring of temperature variations across the data center. The streamlined construction process uses less labor and material, which reduces upfront costs. A growing number of non-raised floor options are being offered to meet the demands of sustainability and energy efficiency. Enhancements in material science, design, and cooling technology would reduce the detrimental environmental effects caused by data centers.

The raised segment is expected to attain the fastest CAGR from 2024 to 2030. Technological development is fueling the market expansion for raised floor data center cooling. Managing the airflow patterns in data centers is made easier with the adoption of raised floors. The underfloor chamber is used to apply containment strategies, such as mixtures of hot and cool aisles. By preventing the mixing of hot and normal air, strategic airflow control increases the overall effectiveness of the cooling system. The integration of advanced technologies like sensors and tracking systems is made simpler by raised floors. In the data center cooling sector, these systems provide proactive management of the cooling tower infrastructure by providing real-time data on environmental conditions. Thus, driving the segment growth.

Containment Insights

The containment segment is further segregated into raised floor with containment and raised floor without containment. The raised floor with containment segment is further segregated into Hot Aisle Containment (HAC) and Cold Aisle Containment (CAC). The segment captured a considerable share of over 56% in 2023 owing to the increased adoption of hot and cold aisle containment methods. The hot aisle containment segment is expected to grow at the highest CAGR exceeding 15% from 2024 to 2030 owing to the presence of an enhanced return airflow management option.

The hot aisle containment decreases the mixing of air particles, ensures higher electrical cost savings, and increases economizer hours. Furthermore, implementing cold aisle containment in an existing raised floor data center is efficient, easy to retrofit into the existing raised floor data centers, and cost-effective. Owing to these features, cold aisle containment held the largest market share in 2023.

Application Insights

IT & telecom, retail, healthcare, BFSI, and energy are the key sectors with massive data center requirements. In 2023, the demand for data center cooling solutions in IT & telecom witnessed massive growth, which is attributed to the pandemic. As the world moved toward the adoption of a remote working culture, the demand for IT infrastructure witnessed a surge, creating avenues for new cooling solutions. The retail segment is likely to grow at a CAGR exceeding 16.0% from 2024-2030. This is attributed to the extensive use of Image Processing Verification Tools (IPVT), social media, smartphones, and tablet computers, which led to the increasing volume of data, thereby boosting the demand for data center cooling solutions.

The telecom segment captured the largest market share in 2023 and is anticipated to grow at a CAGR of more than 18.0% from 2024 to 2030. The expanding IT & telecommunication industries across the globe are also expected to fuel the demand for data center cooling solutions. In addition, emerging telecommunication infrastructures require equivalent data storage facilities to manage a large number of data sets, which is expected to propel the demand for data center cooling solutions.

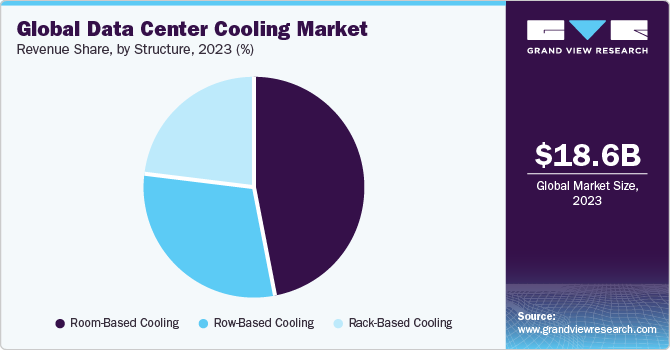

Structure Insights

Rack, row, and room-based cooling are the major cooling types by structure. Of the three, room-based cooling captured a significant share in 2023 and the segment is expected to grow at a CAGR exceeding 15.0% from 2024 to 2030. The room-based cooling technique has become a widely used technique, resulting in a higher market share. The method is popular as it maintains adequate temperature by continuously mixing hot & cold air, ensuring the prevention of hot spots.

The row-based cooling segment is anticipated to grow at a CAGR of more than 18.0% from 2024 to 2030. Row-based cooling is an effective technique to meet the shortcomings of the room-based cooling approach, which is proven to be less effective in the case of heat generated by high and variable-density IT equipment. Furthermore, the room-based cooling approach for high-density IT equipment results in unpredictable and inefficient cooling. As a result, both these cooling techniques are anticipated to gain traction from 2024 to 2030.

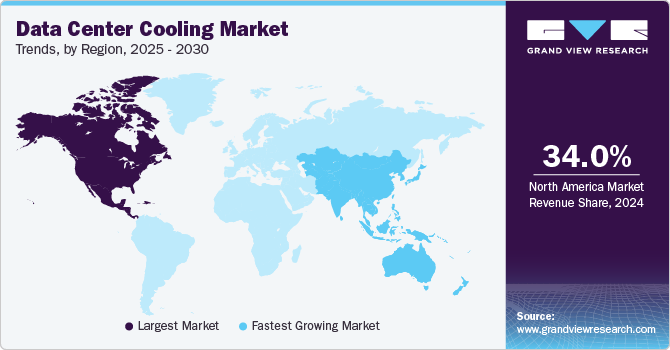

Regional Insights

North America Data Center Cooling Market

In 2023, North America led the global demand for data center cooling solutions and is projected to grow at an estimated CAGR exceeding 12.0% from 2024 to 2030. The region promises to undergo advanced adoption of new technology-based solutions with the prevalence of technology giants, including Facebook, Amazon Inc., and Google Inc. The region has a substantial number of data centers marked by the presence of several IT companies, creating avenues for the data center cooling solutions industry. Thus, driving market growth in North America.

Asia Pacific Data Center Cooling Market Trends

Asia Pacific is expected to gain prominence from 2024 to 2030 as the applications of data center cooling systems are expected to increase in the telecom segment. This may be attributed to the increasing number of service providers for external IT infrastructure services who operate and manage critical business information and applications. The region was closely followed by Europe, which captured over 22% of the global market revenue in 2023.

China Data Center Cooling Market Trends

The data center cooling market in China is expected to grow at a CAGR of 21.9% from 2024 to 2030. A lot of data center operators across the country are expected to implement intelligent power distribution and monitoring systems to monitor, control, and ensure efficient and effective cooling distribution in data centers. Furthermore, the development of advanced data center cooling solutions by Chinese companies is propelling market growth in China.

Japan Data Center Cooling Market Trends

The data center cooling market in Japan is estimated to grow at a CAGR of 18.7% from 2024 to 2030. Japan’s highly developed internet network offers a dependable power supply and sophisticated cooling systems for its data centers. Businesses in Japan are already focusing on expanding their digital transformation offerings. For instance, GLP, a Tokyo-based APAC real estate company, has started building its first data center. Businesses, such as Google and Digital Edge, are already maintaining data center operations in the area, demonstrating the nation's appeal for technological development. Thus, the abovementioned factors are expected to drive market growth.

India Data Center Cooling Market Trends

The data center cooling market in India is projected to grow at a CAGR of 20.2% from 2024 to 2030. The rising adoption of green cooling technologies by Indian data centers has contributed to the regional market growth. For instance, in January 2023, NTT stated its plan to deploy Direct Contact Liquid Cooling and Liquid Immersion Cooling in data centers in India. By adopting these technologies, data centers can reduce their energy consumption by up to 30% compared to when they used traditional cooling systems.

Middle East & Africa Data Center Cooling Market Trends

Middle East & Africa is anticipated to witness a significant CAGR of 17.4% from 2024 to 2030 due to the increasing investments by government entities in digital infrastructure companies. For instance, in May 2023, DigitalBridge Group announced a partnership with the Public Investment Fund (PIF), a Saudi sovereign wealth fund, as an investor. The goal of the new collaboration was to build data centers around the Gulf Cooperation Council (GCC) and in Saudi Arabia. The collaboration intends to grow into towers, fiber, small cell, and Edge infrastructure in the future, with a focus on data center investments initially.

Saudi Arabia Data Center Cooling Market Trends

Saudi Arabia's data center cooling market is likely to witness significant growth from 2024 to 2030. Increasing data volumes are particularly necessitating the establishment of hyperscale data centers in the country. Hyperscale data centers host a large IT infrastructure and hence have a complex power architecture involving several components of the power grid, such as USP devices, converters, and other electronics units. Therefore, driving the growth of the regional market.

Europe Data Center Cooling Market Trends

Europe is expected to grow significantly at a CAGR of 15.1% from 2024 to 2030 due to the green data center efforts implemented in the region. For instance, in September 2023, the Danish Data Center Industry, Google, Danfoss, Schneider Electric, and Microsoft initiated the Net Zero Innovation Hub for Data Centers, a pan-European initiative. Headquartered in Fredericia, Denmark, this initiative aims to expedite standard solutions for the green transformation of data centers.

UK Data Center Cooling Market Trends

The data center cooling market in the UK is growing significantly and is expected to register a CAGR of 13.2% from 2024 to 2030 due to the rising number of data center cooling initiatives within the nation, along with the increasing installation of immersion cooling facilities.

Germany Data Center Cooling Market Trends

The data center cooling market in Germany is projected to grow significantly at a CAGR of 14.3% from 2024 to 2030. The market expansion can be attributed to the multiple establishments of green data centers by government and private organizations.

France Data Center Cooling Market Trends

The data center cooling market in Franceis expected to grow significantly from 2024 to 2030. An increasing number of energy-efficient data centers is responsible for the growth of the market in France.

Key Data Center Cooling Company Insights

Some of the key players operating in the market include Vertiv Group Corp. and Schneider Electric.

-

Schneider Electric offers automation management electricity distribution solutions. The company also manufactures components for energy management systems. It operates through two primary business segments, namely Energy Management and Industrial Automation.The Energy Management segment is further divided into medium voltage, low voltage, and secure power subsegments. The secure power subsegment offers products and solutions for hospitals, data centers, and homes & buildings. The data center cooling market belongs to the secure power subsegment

-

Vertiv Group Corp. provides critical infrastructure that caters to vital applications for three primary end markets, namely communication networks, data centers, and commercial and industrial facilities. These end markets are operated through various brands, namely Liebert, NetSure, Geist, and Avocent. The data center market has been further categorized into cloud/hyper-scale, Colocation, Enterprise, and Edge. Vertiv has three principal offerings, namely critical infrastructure and solutions, IT and edge infrastructure, and service and solution

Rittal Gmbh & Co. K.G. and STULZ GMBHare some of the emerging market participants in the data center cooling market.

-

Rittal Gmbh & Co. K.G. supplies power distribution, enclosures, climate control, IT infrastructure, and other software & service solutions. The company operates as a part of the Friedhelm Loh Group. The company's sister companies include Cideon, German Edge Cloud (GEC), EPLAN, Stahlo, LKH, and iNNOVO Cloud

-

STULZ GMBH is one of the leading manufacturers and solution providers of cooling and humidity management technology for mission-critical applications. It offers air conditioning solutions for data centers, low-load applications, homes, IT rooms, chilled water production centers, shelters, free cooling spaces, air handling and chiller units, and shelter cooling products. The company offers its air-cooling products to the data center, telecom, medical, and industrial cooling sectors. It also develops customized in-house energy management systems and solutions to monitor energy consumption

Key Data Center Cooling Companies:

The following are the leading companies in the data center cooling market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these data center cooling companies are analyzed to map the supply network.

- Air Enterprises

- Asetek, Inc.

- Climaveneta

- Coolcentric

- Dell Technologies Inc.

- Fujitsu

- Hitachi, Ltd.

- Johnson Controls

- Mitsubishi Electric Corporation

- Nortek Air Solutions, LLC

- NTT Limited

- Rittal GmBH & Co. KG

- Schneider Electric SE

- STULZ GMBH

- Telx Inc

Recent Developments

-

In October 2023, Schneider Electric announced that it is investing USD 1.2 million to collaborate with the Sustainable Tropical Data Centre Testbed (STDCT), a facility housed at the National University of Singapore (NUS); funded by the National Research Foundation, Singapore; and backed by a group of business partners. Given that maintaining regulated settings in data centers in tropical nations, such as Singapore, usually leads to excessive power and energy usage and the subsequent high costs and carbon emissions, the testbed envisages developing innovative, cost-effective cooling systems enabling data centers in tropical regions to function at peak efficiency

-

In May 2023, Vertiv Group Corp. announced the launch of Liebert PKDX, a single, direct expansion thermal management unit for data centers. The units consist of rack sensors, intelligent controls, and central optimizing system control to facilitate the optimization of data center heat management. India now has access to the Liebert PKDX. With its plug-and-play design, the Liebert PKDX unit is incredibly quick to install, uses zero water, and does not require any white space in the data hall

-

Rittal GmBH & Co. KG and STULZ GMBH entered into a global partnership in 2021 and have now begun following the partnership in the U.S.A. Consequently, the two recognized leaders will possess enhanced capabilities to provide clients with comprehensive, customized solutions. Rittal's extensive range of IT infrastructure will profit from Stulz's portfolio of high-end IT and precision cooling systems

-

In February 2023, Green Revolution Cooling, Inc. announced that SK Enmove, a lubricants company based in South Korea, joined its ElectroSafe Fluid Partner Program, thereby making SK Enmove's patented immersion cooling fluids available to its data center clients worldwide. The two companies would also be working together to develop, innovate, and enhance novel fluid compositions

Data Center Cooling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.13 billion

Revenue forecast in 2030

USD 56.15 billion

Growth rate

CAGR of 16.8% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, services, type, containment, structure, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; UAE; Saudi Arabia; and South Africa

Key companies profiled

Air Enterprises; Asetek, Inc.; Climaveneta; Coolcentric; Dell Technologies Inc.; Fujitsu; Hitachi, Ltd.; Johnson Controls; Mitsubishi Electric Corp.; Nortek Air Solutions, LLC; NTT Ltd.; Rittal GmBH & Co. KG; Schneider Electric SE; STULZ GMBH; and Telx Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Cooling Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center cooling market report based on component, solution, services, type, containment, structure, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air Conditioners

-

Precision Air Conditioners

-

Chillers

-

Air Handling Units

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Installation & Deployment

-

Support & Consulting

-

Maintenance Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Raised Floors

-

Non-Raised Floors

-

-

Containment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Raised Floor with Containment

-

Hot Aisle Containment (HAC)

-

Cold Aisle Containment (CAC)

-

-

Raised Floor without Containment

-

-

Structure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rack-Based Cooling

-

Row-Based Cooling

-

Room-Based Cooling

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecom

-

IT

-

Retail

-

Healthcare

-

BFSI

-

Energy

-

Others

-

-

Regional Outlook (Revenue; USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growing demand for energy-efficient data centers, along with planned future investments, are expected to create avenues for future growth. Several managed as well as cloud service providers in the industry are planning expansions in the near future to meet the growing demand. Furthermore, the hyper-scale data center industry is also gaining traction.

b. The global data center cooling market size was estimated at USD 18.65 billion in 2023 and is expected to reach USD 22.13 billion in 2024.

b. The global data center cooling market is expected to grow at a compound annual growth rate of 16.8% from 2024 to 2030 to reach USD 56.15 billion by 2030.

b. North America dominated the data center cooling market with a share of 34.65% in 2023. This is attributable to the presence of a large number of data centers, especially in the U.S., that is house to tech giants such as Facebook, Amazon, Inc., and Google, Inc.

b. Some key players operating in the data center cooling market include Air Enterprises, Asetek, Coolcentric, Fujitsu Limited, Netmagic Solutions, Rittal GmbH & Co. KG, STULZ GMBH, Schneider Electric, and Telx Holdings, Inc. (Digital Realty Trust, Inc.).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."