- Home

- »

- Communication Services

- »

-

Data Center Power Market Size, Share Analysis Report, 2030GVR Report cover

![Data Center Power Market Size, Share & Trends Report]()

Data Center Power Market Size, Share & Trends Analysis Report By Product (UPS, PDU, Busway), By End-use (IT & Telecom, BFSI, Retail, Government), By Region (Asia Pacific, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-959-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018-2021

- Industry: Technology

Report Overview

The global data center power market size was valued at USD 8.17 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. An increasing need to store data on the cloud has resulted in an upsurge in the number of data centers across the globe. These data centers consume a huge amount of energy. The rise in introducing advanced systems to reduce power consumption coupled with the emergence of modular data centers is expected to drive market growth. The COVID-19 pandemic severely affected the market for data center power, especially organizations, owing to the complete ban on offline activities across most parts of the world.

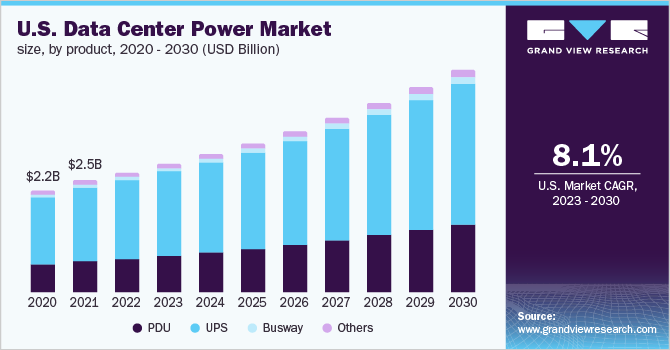

However, the demand for Software as a Service (SaaS) and work-from-home models during the pandemic boost the need for data center power industry. To reduce the Power Usage Efficiency (PUE) ratio and to increase efficiency, companies deploy advanced power management solutions including intelligent rack smart Uninterruptible Power Supply (UPS), Power Distribution Units (PDU), and battery monitoring equipment. This is also driving the industry growth. Furthermore, the increasing cost of energy and awareness regarding energy conservation has ensued designers to opt for intelligent power management solutions.

PUE monitoring devices, intelligent power strips, and battery monitoring devices are some of the latest technologies used to reduce the PUE ratio and optimize energy consumption in data centers. The market has witnessed unprecedented growth in technologies and services driven by data centers. Technologies, such as cloud computing, require high computational power; however, it offers benefits, such as enhanced scalability, efficiency, and flexibility of business operations, which has resulted in many medium-sized enterprises incorporating effective data centers, such as web hosting cloud and colocation data centers.

Furthermore, the rising usage of data centers has resulted in the growing adoption of cloud and mega data centers. These data centers require power in large quantities for peak data-intensive operations, which subsequently drives demand for PDUs and UPSs. Traditional data centers are continuously being replaced by newer systems featuring advanced technologies and power management capabilities. The shift of the industry toward colocation and hyper-scale data centers is expected to fuel industry growth over the forecast period. However, the high initial investment required for these solutions and the inadequate availability of compatible devices may hinder the growth of the industry in the coming years.

Product Insights

Based on products, the industry has been segmented into PDU, UPS, busway, and others. UPS held the largest market share of more than 69.60% in 2022. The increasing implementation of cloud computing along with the requirement for ubiquitous and sensitive data has encouraged the installation of this product. In addition, the use of portable UPS systems in services, such as High-Performance Computing (HPC), SaaS, online media streaming, and online gaming, has also fueled the segment's growth. The PDU segment is expected to register a steady CAGR from 2023 to 2030. The growth is mainly driven by the snowballing demand for intelligent power distribution units.

Over the last few years, companies have been shifting towards the adoption of intelligent PDUs against simple multi-socket racks with server and network equipment. Intelligent power distribution units exhibit the capability of measuring distributed electrical parameters and identifying environmental factors, such as temperature and humidity. Furthermore, these units allow a detailed view of the conditions inside a data center rack and provide information to the data center operators and administrators, thereby enabling fault identification to undertake appropriate measures for energy efficiency.

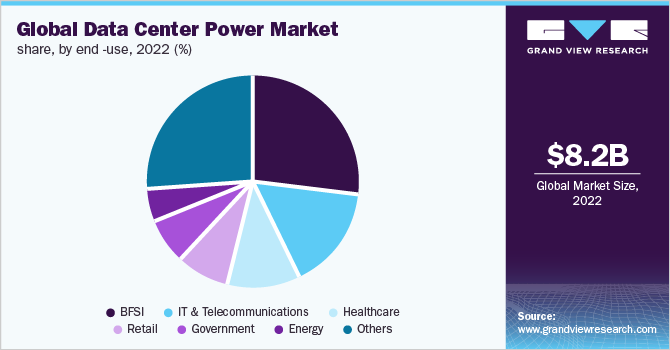

End-use Insights

On the basis of end-uses, the global industry has been further segregated into IT & telecommunications, government, energy, healthcare, retail, banking, financial services, & insurance (BFSI), and others. The IT & telecommunications segment is projected to register the fastest growth rate of more than 10.00% from 2023 to 2030.The rapid upsurge in the growth and construction of IT infrastructure is expected to drive the demand during the forecast period. Furthermore, the developing telecommunication infrastructure requires data storage facilities to manage an enormous amount of data.

In addition, reliability, energy consumption, and maintenance are critical in IT & telecommunication facilities. This factor is anticipated to propel growth in the coming years for the industry. Increasing focus on digitization is one of the main reasons for the high demand for BFSI services. Moreover, the industry has shifted its focus to cloud computing and cloud networking to increase banking capacities, resulting in a huge demand for data centers. This factor is projected to fuel the segment growth over the forecast period.

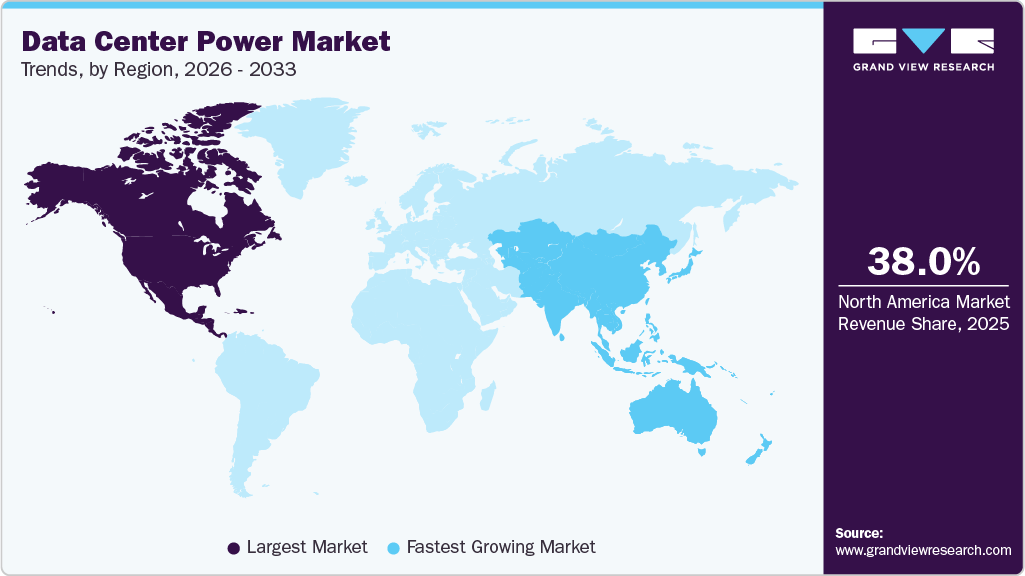

Regional Insights

North America held the largest revenue share of more than 37.85% in 2022 as the region has the highest number of data centers in the world. Various norms and regulations have been introduced and implemented by governments and regulatory bodies to reduce carbon footprints and energy consumption. This has resulted in the high adoption of efficient power management solutions, driving regional demand. For instance, businesses are spending a large portion of their budgets on cooling and maintenance systems.

Thus, it becomes essential to incorporate efficient power management devices, such as PDU, busway, and UPS, to control unnecessary spending at data centers.Asia Pacific is expected to witness the fastestgrowthrate over the forecast period. The rapid growth can be attributed to an increase in the volume of colocation data centers in emerging countries, such as India and China. In addition, a rising number of telecom subscribers using smartphones and tablets globally is predicted to boost regional demand over the forecast period.

Key Companies & Market Share Insights

The competitive landscape of the industry is fragmented, featuring many regional and global players. The major participants are entering into strategic collaborations, mergers & acquisitions, and partnerships to expand their footprint and survive the competitive environment. Furthermore, service suppliers are investing significantly in research and development activities to incorporate the latest technologies in their offerings and develop advanced products to gain a competitive advantage over other players.

For instance, in January 2022, Eaton introduced Tripp Lite practical option for connecting and controlling network equipment in industrial conditions, such as factories and warehouses. The industrial Gigabit Ethernet switches are new lite managed and consist of a metal case of IP30-rated that can penetrate shock, vibration, and the high and low temperatures frequently found on the industrial floor. The switches also provide safety from Electrostatic Discharge (ESD) with a rail clip mount to fit DIN standard 35 mm rail and can be wall mounted. Some of the prominent players in the global data center power market include:

-

ABB

-

Black Box

-

Eaton

-

General Electric

-

Generac Power Systems, Inc.

-

Huawei Technologies Co., Ltd.

-

Legrand

-

Rittal GmbH & Co. KG

-

Schneider Electric

-

Vertiv Group Corp.

Data Center Power Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.76 billion

Revenue forecast in 2030

USD 15.01 billion

Growth rate

CAGR 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; The Netherlands; Denmark; Finland; Spain; Russia; China; India; Japan; South Korea; Singapore; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key Companies Profiled

ABB; Black Box; Eaton; General Electric; Generac Power Systems, Inc.; Huawei Technologies Co., Ltd.; Legrand; Rittal GmbH & Co. KG; Schneider Electric; Vertiv Group Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

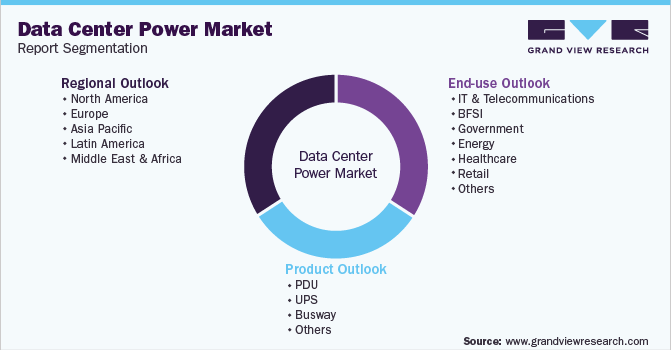

Global Data Center Power Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segmentsfrom 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global data center power market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

PDU

-

UPS

-

Busway

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunications

-

BFSI

-

Government

-

Energy

-

Healthcare

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

The Netherlands

-

Denmark

-

Finland

-

Spain

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global data center power market size was estimated at USD 8,174.6 million in 2022 and is expected to reach USD 8,759.9 million in 2023.

b. The global data center power market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 15,013.7 million by 2030.

b. North America dominated the data center power market with a share of 37.87% in 2022. This is attributable to the presence of various norms and regulations aimed at reducing carbon footprints and energy consumption in the region.

b. Some key players operating in the data center power market include ABB, Black Box Corporation, Eaton, General Electric, Generac Power Systems, Inc., Huawei Technologies Co., Ltd, Legrand, Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Co.

b. Key factors that are driving the data center power market growth include the rise in the introduction of state-of-the-art variants to reduce power consumption coupled with the emergence of modular data centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."