- Home

- »

- Communications Infrastructure

- »

-

Data Center Substation Market Size Report, 2021-2030GVR Report cover

![Data Center Substation Market Size, Share & Trends Report]()

Data Center Substation Market Size, Share & Trends Analysis Report By Component, By Voltage Type (33kV - 110kV, 110kV - 220kV, 220kV - 500kV, Above 500kV), By Region, And Segment Forecasts, 2021 - 2030

- Report ID: GVR-4-68039-632-8

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2019

- Industry: Technology

Report Overview

The global data center substation market size was valued at USD 9.02 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2030. The growing demand for interrupted and smooth transmission and distribution of electricity to power data center facilities is anticipated to drive the growth of the market over the forecast period. A substation is a structure in the power network where transmission routes and distribution feeders are connected via circuit breakers or switches by busbars. This allows controlling the power flow across the network and general switching procedures for maintenance purposes. These enclosed zones mainly step up or step down the voltage in transmission lines to a particular level suitable for the distribution system. The rapid growth in the volume of structured and unstructured data along with the increasing demand for cloud computing is expected to propel the market growth, subsequently driving the demand for efficient and reliable substations.

Internet of Things (IoT), social media, and digitalization are driving the growth of the global data center industry. In recent years, the rising use of these applications and technologies has increased the need for larger and more sustainable data centers. Moreover, the growing use of social media and a surge in online video content streaming have resulted in increased data volumes that are handled by data centers, propelling organizations to invest in reliable and dedicated data centers to minimize the loss of information and ensure business continuity, energy transmission and distribution, and security. The subsequent expansion of data centers is leading to an unprecedented rise in the demand for electricity to power them. This, in turn, is expected to boost the demand for data center substations.

The outbreak of the COVID-19 pandemic and the subsequent supply chain disruptions and temporary suspension of manufacturing activities have taken a considerable toll on the data center substation market. Besides, the electricity demand dropped during the pandemic as business activities slowed down. With this decrease in power demand, there have been very few investments made in the substation industry in 2020. The pandemic also led to the slowdown of the construction ecosystem and data center construction projects were the first to bear the brunt. Several data center construction projects were put on hold or suspended temporarily to ensure worker safety and adherence to guidelines related to lockdown and social distancing. As a result of this closure, the market witnessed a slight decline.

The growing popularity of digital substations is expected to make the market lucrative over the coming years. Digital substations help to alleviate expenditure on maintenance, provide longer asset life, and reduce environmental footprint. These substations use fiber optic cables to connect to control panels, eliminating the need for copper control cables, in turn reducing installation costs as well as costs associated with decommissioning and recycling. The rising focus on the replacement of old electrical substation infrastructure with upgraded, high-quality, smart, and digital systems is expected to augment the growth of the market.

The market has also benefitted from the rising energy demand for the restoration and retrofitting of existing infrastructure as well as increasing spending on the expansion of long-route high voltage networks. However, data center substation construction projects face challenges such as high initial investment, difficulties in land acquisition, long project cycles, tedious maintenance and repair work, and complicated substation facilities that cannot be well integrated into the surrounding environment. Nevertheless, the long-term benefits associated with the lifecycle of a substation are expected to counterbalance cost-related challenges. As such, continued research and development efforts to manufacture innovative, energy-efficient, and digital or modular substations are expected to bode well for the market growth.

Component Insights

The switchgear segment accounted for the largest market share of over 35.0% in 2020. Switchgear is one of the important substation components and is essentially used to withstand fluctuating operating voltage in extremely volatile environmental situations. The development of new industrial and commercial facilities, including data centers for safe and reliable operations, is also estimated to drive the segment growth. The switchgear segment is further bifurcated into Air Insulated Switchgear (AIS) and Gas Insulated Switchgear (GIS). The GIS sub-segment dominated the market with a revenue share exceeding 60% in 2020. Compared to AIS, GIS is more reliable, environment-friendly, and flexible. Additionally, the maintenance cost and installation time required for GIS is lesser than that of AIS.

The transformer segment is anticipated to register a CAGR exceeding 5% over the forecast period. Transformers help in the widespread distribution of electric power in the data center facility. They are essential components within the substation as they assist in power transmission between networks without any changes in frequency and causing minimum loss. Furthermore, the upgrade and renewal of existing substations are expected to propel the transformers segment growth over the forecast period.

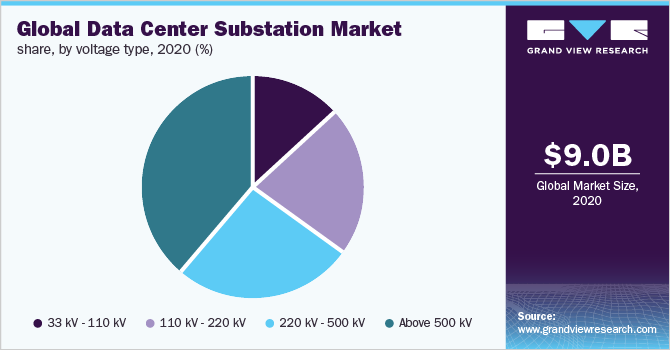

Voltage Type Insights

Based on voltage type, the above 500kV segment recorded the largest market share of over 35.0% in 2020. The segment is expected to retain its dominance, expanding at a CAGR of 7.2% over the forecast period. A surge in demand for high voltage substations played a pivotal role in the market growth. Substations with high voltage are designed to handle the high-power demands of mission-critical facilities such as data centers to provide reliable and quality power supply to server buildings.

High and medium-voltage substations are likely to witness considerable growth in the coming years. The growth is mainly accredited to the rise in data center construction across developing economies. Substations with voltage rating 220kV - 500kV and above 500kV play a vital role in providing optimal power transmission and distribution for mission-critical facilities, such as data centers. However, owing to the outbreak of the COVID-19 pandemic, most of the data center projects were at a standstill in 2020, which led to a negative impact on the market growth. Although the market is poised for a gradual recovery in 2021, it would be able to attain its pre-pandemic growth levels over the coming years.

Regional Insights

North America emerged as a market leader and captured 38.0% of the global market share in 2020 owing to the presence of major players such as Eaton and General Electric. The regional growth is mainly led by the U.S., as the country has demonstrated continuous growth in data center construction activities. Moreover, North America boasts the largest market of cloud computing, creating a lucrative opportunity for data centers. This, in turn, offers avenues for energy transmission and distribution solutions such as data center substations. Datacenter colocation providers in North America are focused on making significant investments for constructing additional data center facilities, which is also expected to fuel market growth in the region.

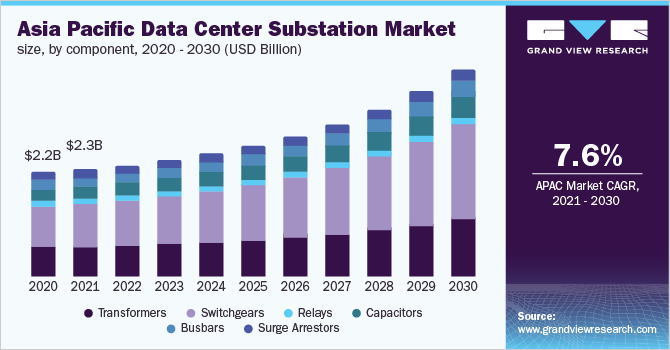

Asia Pacific is expected to emerge as the fastest-growing regional market for data center substations with a CAGR of 7.6% over the forecast period. The increasing demand for data storage and cloud-based applications is contributing to the regional market growth. Furthermore, the implementation of cloud-based services in sectors such as IT, education, and healthcare, coupled with increasing support from the governments, has increased the construction of data centers in this region. The high penetration of smartphones and internet availability, along with increased demand for mobility, is also projected to increase the demand for data center construction in this region, subsequently contributing to the growth of the market.

Key Companies & Market Share Insights

The market is characterized by the presence of both large-scale and medium-scale data center substation players. It demonstrates strong competition amongst key players and calls for constant development and innovation in data center substation designs. Market players adopt various inorganic strategies, such as mergers and acquisitions and joint ventures, to sustain themselves in the competitive market environment. Companies are also developing and introducing new products to gain a competitive advantage in the market. For instance, in June 2021, Eaton acquired a 50% stake in the busway business of Jiangsu YiNeng Electric, a manufacturer of busways in China. This acquisition is projected to help Eaton strengthen its position in the commercial and data center market while expanding the portfolio of its power distribution products in the Asia Pacific region. Some of the prominent players operating in the global data center substation market are:

-

Eaton

-

General Electric

-

Hitachi ABB Powergrids Inc.

-

NEI Electric Power Engineering, Inc.

-

NR Electric Co., Ltd.

-

S&C Electric Company

-

Tesco Automation Inc.

-

Hyosung Heavy Industries

-

Schneider Electric

-

Siemens Energy

Data Center Substation Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 9.08 billion

Revenue forecast in 2030

USD 14.80 billion

Growth Rate

CAGR of 5.6% from 2021 to 2030

Base year for estimation

2020

Historical data

2018 - 2019

Forecast period

2021 - 2030

Quantitative units

Revenue in USD million and CAGR from 2021 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, voltage type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Netherlands; Ireland; China; India; Japan; Brazil; Mexico

Key companies profiled

Eaton; General Electric; Hitachi ABB Powergrids Inc.; Schneider Electric; Siemens Energy

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center substation market report based on component, voltage type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Transformers

-

Switchgears

-

Air Insulated

-

Circuit Breakers

-

Others

-

-

Gas Insulated

-

-

Relays

-

Capacitors

-

Busbars

-

Surge Arrestors

-

-

Voltage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

33 kV - 110 kV

-

110 kV - 220 kV

-

220 kV - 500 kV

-

Above 500 kV

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Ireland

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East

-

Africa

-

Frequently Asked Questions About This Report

b. The global data center substation market size was estimated at USD 9.02 billion in 2020 and is expected to reach USD 9.08 billion by 2021.

b. The global data center substation market is expected to grow at a compound annual growth rate of 5.6% from 2021 to 2028 to reach USD 14.80 billion by 2028.

b. North America emerged as a market leader and captured 38.0% of the global market share in 2020.

b. Some key players operating in the data center substation market include Eaton, General Electric, Hitachi ABB Powergrids Inc., Schneider Electric, and Seimens Energy among others.

b. Key factors that are driving the data center substation market growth include the growing demand for interrupted and smooth transmission and distribution of electricity to power data center facilities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."