- Home

- »

- Healthcare IT

- »

-

Dental Practice Management Software Market Report, 2030GVR Report cover

![Dental Practice Management Software Market Size, Share & Trends Report]()

Dental Practice Management Software Market Size, Share & Trends Analysis Report By Deployment Mode (On-premise, Web-based, Cloud-based), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-303-4

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Market Size & Trends

The global dental practice management software market size was estimated at USD 2.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.17% from 2024 to 2030. The market is expected to grow significantly, driven by the increasing dental visits, growing focus & awareness about oral health in Europe & the U.S., and rapid technological advancements. The Health Information Technology for Economic and Clinical Health (HITEC) Act encourages and accelerates the use of health information technology in the United States.

The adoption of healthcare IT solutions, especially by speciality clinics such as oral practices, is anticipated to grow insurance coverage. These factors are expected to boost the demand for oral services, thereby driving the need for DPM software.

An increase in independent dental practices due to supportive government initiatives about oral health and an increase in dental visits which has witnessed high footfall in recent years. According to the American Dental Association (ADA), 202,304 dentists were practicing in 2023 in the U.S. According to the American Health Policy Institute, the dentist workforce is expected to witness rapid growth, reaching 67 dentists per 100,000 people in 2040. This increase in dental practices can be attributed to increased awareness and demand for dental care over the past few years.

Furthermore, the market is witnessing a surge in new technologies development and integration, including cloud computing and artificial intelligence (AI). Automation of processes enables patients to access various management solutions. For instance, in January 2024, Smilefy, Inc. launched Smilefy 4.0, a 3D smile design software program powered by AI. The software allows dental professionals to create 3D smile designs, generate 3D print-ready models, and offer patients a trial to view their new smiles in advance. This facilitates communication and helps establish realistic expectations.

The high cost of dental procedures in many countries is due to added lawsuits and malpractice insurance costs. Thus, people residing in the U.S. and Canada travel to other countries, such as Mexico and Costa Rica, for cheaper dental care. According to the Costa Rica Star, over 42 % of the total medical tourists in Costa Rica seek dental care, which includes 80% of visitors from the U.S., 10% from Canada, and the rest from Central America and the Caribbean. In addition, dental clinics meet the national and international standards of hygiene & safety in these countries. Moreover, patients save more than 75% on costs for the same service, quality, and materials.

Market Concentration & Characteristics

The market is witnessing a moderate degree of innovation, with several market players launching new products to improve their market penetration. In January 2024, Napa EX/MEDX LLC introduced Image Sync for Vyne Trellis, a revenue acceleration platform. This innovative tool ensures smooth integration among supported imaging systems. Its primary benefit lies in enabling users to upload high-quality patient images to claims effortlessly. This capability empowers practices to expedite claim processing, reduce reimbursement time, and optimize workflow efficiency.

The level of partnerships & collaborations in market is high due to several key market players including Henry Schein, Inc., Nextgen Healthcare, Inc., Carestream Dental, LLC, and CD Newco, LLC (Curve Dental), involved in partnerships & collaboration activities to expand their market presence. For instance, in November 2022, Henry Schein, Inc. partnered with VideaHealth, a leading dental AI-platform. As a result, Henry Schein One introduced Dentrix Detect AI-powered and manufactured by VideaHealth, an AI-enabled X-ray analysis tool that integrates directly into Dentrix Practice Management Systems.

The impact of regulations on the market is moderate. However, the market is expected to experience growth due to favorable government policies and laws that ensure the data safety and efficacy of dental practice management software services. For instance, in April 2021, the Kuwait Communication & Information Technology Regulatory Authority (CITRA) released the Data Privacy Protection Regulation, No.42 of 2021. All dental practice management vendors and healthcare IT companies are required to comply with these regulations.

The degree of innovation in the market is low due to factors such as slow adoption of new technology by practices, regulatory constraints, and cost considerations. These factors collectively hinder the development of groundbreaking features and solutions, resulting in a relatively low level of innovation compared to other industries.

The level of regional expansion in the market is low due to changes in regulatory frameworks and the specific demands of target customers in low- and medium-income countries. However, some of the market players are expanding their presence in various regions to gain market share. For instance, in May 2023, P1 Dental Partners selected Henry Schein, Inc.’s software: Dentrix Ascend, a cloud-based dental practice management software, and Jarvis Analytics, a dental analytics tool, to provide its partner dentists with a seamless practice management workflow across over 40 practices, helping elevate patient care and drive practice success.

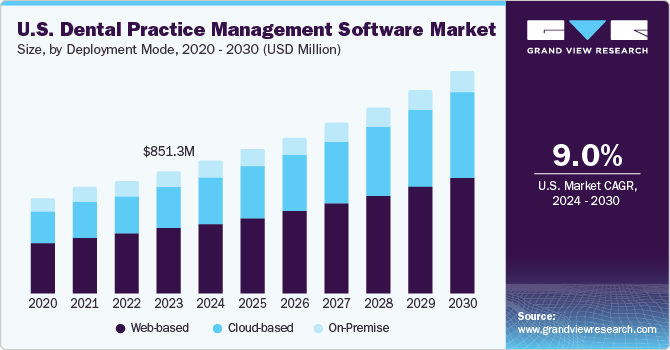

Deployment Mode Insights

Based on deployment mode, the web-based segment held the market with the largest revenue share of 56.3% in 2023. The growth is attributed to its increased security, quick updates, unrestricted storage space, and low cost. The rise in adoption of DPM software in oral practices for reporting, billing, scheduling, patient charting, and treatment planning is expected to boost segment growth.

The cloud-based segment is expected to grow at the fastest CAGR during the forecast period, owing to the new software launches, collaborations, and mergers among key players aimed at providing cloud-based solutions to their consumers are projected to drive this segment's growth. For instance, in September 2022, Carestream Dental launched Sensei Cloud for Oral Surgery, a cloud-based practice management software solution for oral and maxillofacial surgery. This innovation aimed to provide user-friendly and readily accessible management solutions for oral and maxillofacial surgery specialists.

Application Insights

Based on application, the insurance management segment led the market with the largest revenue share of 22.18% in 2023. The growing number improved of dental claims during or after the process and continuous improvement of dental insurance coverage are factors to drive segment growth over the forecast period.According to an ADA report published in February 2021, 51.3% of children aged 2 years to 18 years in the U.S. have private dental insurance, and 38.5% have dental insurance through the Medicaid Children’s Health Insurance Program.

The dental analytics segment is expected to grow at the fastest CAGR during the forecast period. The tool provides real-time insights into the business health of dental practices. These tools analyze data from practice management systems and generate key performance indicators that help monitor and diagnose the overall performance of the practice. These key advantages are driving the increasing demand for dental analytics adoption in the market.

End-use Insights

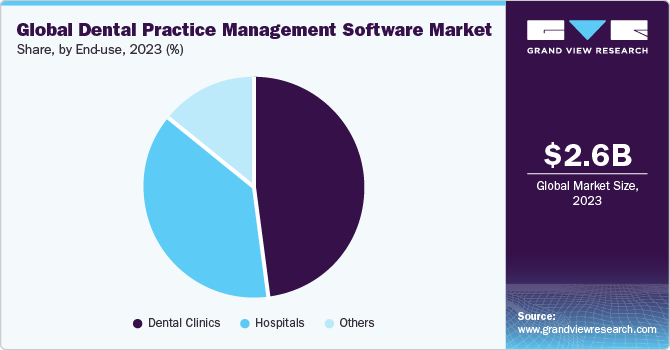

Based on end-use, the dental clinics segment led the market with the largest revenue share of 47.8% in 2023. The rise in dental visits is expected to increase the need for software to manage patient data and treatment regimes. Thus, many dental clinics are adopting Electronic Dental Records (EDR) and appointment scheduling platforms. EDR can be easily integrated with DPM software, which boosts segment growth.

The Dental Clinics segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the high frequency of oral care visits and the adoption of DPM software solutions in Dental Clinics. The cloud based DPM software offers greater storage capacity through cloud servers, allowing for the storage of significant volumes of patient data, making it the perfect choice for major Dental Clinics with high patient volumes.For instance, Birmingham Dental Hospital in Europe has invested in a new facility equipped with all dental services for 120,000 patients with 98.7% positive feedback.

Regional Insights

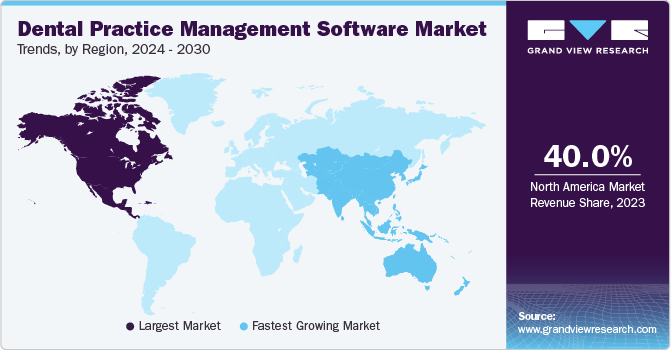

North America dominated the market with the revenue share of 40.0% in 2023. This can be attributed to various factors such as supportive government regulations for healthcare Information Technology (IT), high disposable income, and a large geriatric population in the U.S. & Canada. The presence of major players, such as Curve Dental and Henry Schein One, , increasing funding for start-up businesses, and the growing adoption of oral care services by baby boomers are some of the key factors expected to propel market growth in North America.

U.S. Dental Practice Management Software Market Trends

The dental practice management software market in the U.S. held the largest share in 2023, owing to an increase in number of dental practices & dentists in the U.S. According to the American Dental Association (ADA), there were around 201,117 practicing dentists in 2020 across the U.S., accounting for an increase of 2.7% from 2015.

The dental practice management software market in Canada is expected to witness the fastest CAGR over the forecast period. This can be attributed to growing awareness regarding oral health in the country is expected to propel the demand for dental health services during the forecast period.

Europe Dental Practice Management Software Market Trends

The dental practice management software market in Europe is anticipated to grow at a significant CAGR over the forecast period, due to the rapid technological advancements and increasing spending capacity of the people. According to NHS Dental Statistics for England, a total of 18.1 million adults were seen by an NHS dentist in the 24 months up to June 2023.

The Germany dental practice management software market held the largest share in 2023, owing to the increasing awareness regarding oral health in the country.

The dental practice management software market in Denmark is expected to witness the fastest CAGR over the forecast period. This can be attributed to the implementation of advanced IT frameworks in Dental Clinics and general practitioner centers.

The UK dental practice management software market is expected to grow at a significant CAGR over the forecast period. This can be attributed to the increasing number of dental practices and supportive government initiatives being undertaken to raise awareness about oral care & dental check-ups among children.

Asia Pacific Dental Practice Management Software Market Trends

The Asia Pacific region is expected to witness the fastest CAGR over the forecast period. With the growing investments by healthcare IT companies in the region and improving economic conditions & healthcare infrastructure are favoring the market growth.

The Japan dental practice management software market held the largest share in 2023, owing to the increasing prevalence of dental disorders and the presence of a robust healthcare infrastructure.

The dental practice management market in India is expected to witness growth in the near future. India has one of the world's highest rates of oral cancer. In India, oral health concerns and dental diseases are caused by multiple factors, including poor oral hygiene, tobacco use, and a sugary diet. Thus, the increasing prevalence of dental diseases is anticipated to generate substantial demand for DPM software in the next few years, thereby driving market growth..

Key Dental Practice Management Software Company Insights

The market is highly fragmented, with the presence of many country-level players. With the growing elderly population and the need for mobile health, a few smaller competitors are entering the industry and are expected to gain a significant share of the market. Some emerging players in the market are, Dental Intelligence, Inc, Jarvis Analytics, Practice Analytics, ABELMed Inc., and Practice-Web, Inc.

Key Dental Practice Management Software Companies:

The following are the leading companies in the dental practice management software market. These companies collectively hold the largest market share and dictate industry trends.

- Henry Schein, Inc.

- Carestream Dental, LLC

- DentiMax

- Practice-Web, Inc.

- Nextgen Healthcare, Inc.

- ACE Dental Software

- Datacon Dental Systems, Inc.

- CareStack (Good Methods Global Inc.)

- CD Nevco, LLC (Curve Dental)

- Dentiflow

Recent Developments

-

In August 2023, Henry Schein, Inc. acquired majority shares of Large Practice Sales (LPS) LLC, which is a leading consultant to individual dental practices. LPS helps these practices in their sale or partnership with larger general practice and dental specialists

-

In May 2023, Henry Schein, Inc. acquired the Regional Health Care Group Pty Ltd, a medical products distribution company that serves public- and private-sector customers in New Zealand and Australia

-

In November 2022, Pearl and Curve Dental partnered to integrate Pearl’s Second Opinion disease detection abilities within Curve Dental’s SuperHero practice management system, providing Curve’s 70,000 users in the U.S. and Canada with FDA-cleared clinical AI capabilities

Dental Practice Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.8 billion

Revenue forecast in 2030

USD 5.0 billion

Growth rate

CAGR of 10.17% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

CareStack (Good Methods Global Inc.); CD Newco; LLC (Curve Dental); Dentiflow; Dental Intelligence, Inc; Jarvis Analytics; Practice Analytics; ABELMed Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

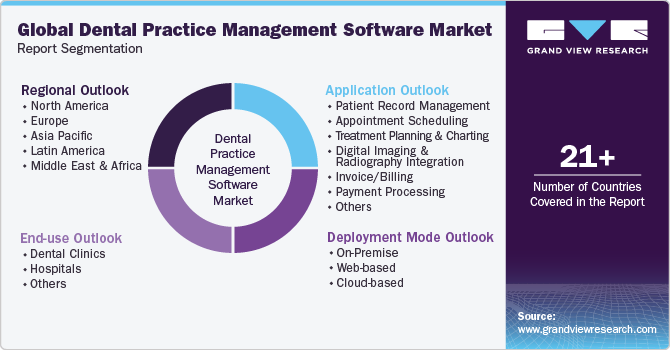

Global Dental Practice Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental practice management software market report based on deployment mode, application, end-use and regions.

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Web-based

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Patient Record Management

-

Appointment Scheduling

-

Treatment Planning and Charting

-

Digital Imaging and Radiography Integration

-

Invoice/Billing

-

Payment Processing

-

Insurance Management

-

Lab & X-Ray Orders

-

Dental Analytics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Clinics

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental practice management software market size was estimated at USD 2.6 billion in 2023 and is expected to reach USD 2.8 billion in 2024.

b. The global dental practice management software market is expected to grow at a compound annual growth rate of 10.17% from 2024 to 2030 to reach USD 5.0 billion by 2030.

b. North America dominated the dental practice management software market with a share of 40.0% in 2023. This is attributable to the strategic presence of major players, increasing funding in start-up businesses, and rapid adoption of the latest technologies.

b. Some key players operating in the dental practice management software market include Henry Schein, Inc., Carestream Dental, LLC, DentiMax, Practice-Web, Inc., Nextgen Healthcare, Inc. (NXGN Management, LLC), ACE Dental, Datacon Dental Systems, Inc., CareStack (Good Methods Global Inc.), CD Newco, LLC (Curve Dental), and Dentiflow.

b. Market growth can be attributed to the growing geriatric population, increasing focus and awareness on oral health in the Europe & United States, and increasing technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."