- Home

- »

- IT Services & Applications

- »

-

Global DevSecOps Market Share Report, 2021-2028GVR Report cover

![DevSecOps Market Size, Share & Trends Report]()

DevSecOps Market Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment (On-Premise, Cloud), By Organization, By Industry Vertical, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-612-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2019

- Industry: Technology

Report Overview

The global DevSecOps market size was valued at USD 2.79 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 24.1% from 2021 to 2028. The increasing need for highly secure and faster application delivery can be attributed to the promising growth prospects for the market. Factors such as the growing internet penetration rate and rise in cybercrimes are also expected to contribute to the growth of the market. Furthermore, the continued rise in the number of businesses and applications migrating to the cloud, 5G rollouts, and Internet of Things deployments are also expected to favor the growth of the development, security, and operation (DevSecOps) market.

The COVID-19 pandemic and subsequent lockdowns and restrictions have had a moderate impact on the development, security, and operation market. As the pandemic disrupted business activities, businesses shifted their focus to cloud services to resume operations. Moreover, the sudden shift to work-from-home practices in the wake of the pandemic to ensure the safety of employees is further anticipated to drive the market growth. The rising number of cyberattacks in different verticals such as IT and telecommunication, BFSI, and retail and consumer goods is also expected to drive market growth.

The rising adoption of advanced technologies by small and medium enterprises and increased IT modernization efforts are expected to further create an opportunity for the market. Factors such as the rising demand for streamlining collaboration between teams, increased adoption of automation in software development and testing, heightened focus on security and compliance, and the rising adoption of microservices and service virtualization are also expected to work favorably for the market.

Rising investment in IT advanced technologies such as artificial intelligence, machine learning, the internet of things, and BYOD across enterprises could drive the market over the forecast period. Large data volumes are being exchanged within an organization that requires security is anticipated to result in the increased adoption of DevSecOps. However, resistance to the adoption of new tools and technologies may hamper the growth of the market.

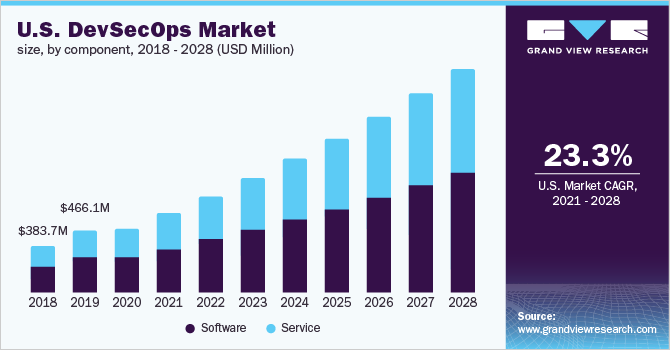

Component Insights

The component segment is bifurcated into software and service. The software segment dominated the market in 2020, accounting for over 50% of the market. This can be attributed to the growing need for highly secure continuous application delivery. Furthermore, the growing preference for the remote working model during the COVID-19 pandemic has increased the risk of cyber threats and data breaches, which is expected to drive the DevSecOps market.

The software segment is expected to witness the highest CAGR during the forecast period. The growing popularity of DevSecOps among organizations, and benefits such as greater speed, agility, better communication & collaboration among teams, early identification of vulnerability, and security, are expected to boost the demand for DevSecOps software over the forecast period. On the other hand, the DevSecOps services segment is expected to witness stable growth over the forecast period. DevSecOps services include consulting services, managed services, and professional services. These services assist in assessments, implementation, and support secure product development with DevSecOps capability.

Organization Insights

Based on organization, the market has been segmented into small and medium enterprise, and large enterprise. The large enterprise segment dominated the market in 2020 with a revenue share of around 60%. Several leading businesses across industries and industry verticals, including IT and telecommunications, BFSI, retail and consumer goods, government and public sector, and manufacturing, are aggressively adopting DevSecOps solutions. Large enterprises are early adopters of technologies to enhance quality and productivity, reduce the time of business operations, streamline workflow, and minimize costs. Hence, large enterprises are the leading adopters of DevSecOps solutions to secure their applications. Furthermore, the increasing number of security breaches/cybercrimes has led to the growing adoption of DevSecOps in large enterprises.

The small and medium enterprise segment is expected to expand at the highest CAGR of 26.4% from 2021 to 2028. Small and medium enterprises are likely to increasingly adopt DevSecOps solutions due to the ease of use, agility, fast application delivery, and flexibility offered. These benefits are expected to drive the demand for DevSecOps in small and medium enterprises over the forecast period.

Vertical Insights

Based on vertical, the market has been segmented into BFSI, IT and telecommunication, government, retail and consumer goods, manufacturing, and others. The IT and telecommunication segment dominated in 2020 with a revenue share of more than 20%. The IT industry deploys DevSecOps to help automate software development, testing, and operations, which enhances the quality of products, improves the customer experience, and reduces delivery time. DevSecOps solutions also help the industry solve issues related to release timelines and software quality. The rising number of cyberattacks and growing awareness about the benefits of DevSecOps could fuel the demand for DevSecOps in the IT and telecommunications industry.

The BFSI segment is expected to expand at the highest CAGR of 25.7% from 2021 to 2028. The BFSI vertical has witnessed a significant increase in cyber threats and attacks in recent years. The growing preference for mobile banking and internet banking has further increased the risk of threats and data breaches, thereby increasing the adoption of DevSecOps. Furthermore, the need to deliver digital services and solutions to enhance customer experience along with changing regulatory mandates could boost the demand for DevSecOps over the forecast period. The government segment accounted for a significant market share as governments need to ensure adequate data security to protect confidential and sensitive data.

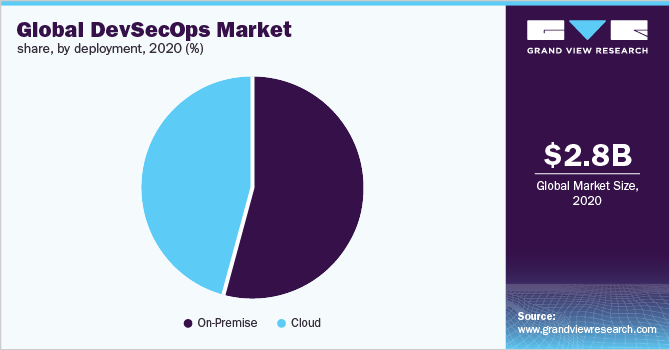

Deployment Insights

Based on deployment, the market has been segmented into on-premise and cloud. The on-premise segment dominated the market in 2020 with a revenue share of more than 60%. Several companies prefer on-premise deployment of DevSecOps solutions due to the growing concerns about data security and privacy protection. In addition, on-premise DevSecOps solutions do not require an internet connection and can be easily customized to the business requirement. The segment is expected to witness steady growth over the forecast period.

The cloud segment is expected to expand at the highest CAGR of 25.7% from 2021 to 2028. The cloud deployment model supports multiple devices and channels, such as smartphones, tablets, and social media. Furthermore, cloud deployment benefits organizations through increased speed, scalability, 24/7 services, and enhanced IT security. These factors are expected to boost the demand for solutions deployed on the cloud over the forecast period. The growing demand to lower capital and operational expenditure is also expected to drive the demand for cloud deployment for DevSecOps solutions over the forecast period.

Regional Insights

North America accounted for a revenue share of more than 30% of the overall market in 2020. North America consists of developed economies, such as the U.S. and Canada. The growth of the regional market is favored by the early and quick adoption of technologies such as cloud computing and the Internet of Things (IoT). Furthermore, the high adoption rate of DevSecOps solutions across various industries, including BFSI, IT and telecommunications, and retail, along with the growing frequency of data breaches are driving the market growth.

Asia Pacific is expected to expand at the highest CAGR over the forecast period. Asia Pacific is home to some of the fastest-growing economies, such as India and China. The growing adoption of cloud technologies and rising demand for IT and business services are expected to increase the demand for DevSecOps during the forecast period. Furthermore, the development of advanced infrastructure and the increasing adoption of smartphones, tablets, smart devices, and digital services in this region are likely to drive the regional market.

Key Companies & Market Share Insights

The market is competitive and characterized by the presence of several prominent market players, including CA Technologies, Google LLC, IBM, Microsoft Corporation, PaloAltoNetworks, Copado, Riverbed Technology, and Synopsys. These players are pursuing growth strategies such as new product launches, mergers and acquisitions, and strategic partnerships to strengthen their foothold in the market and expand further. For instance, in March 2021, Capado announced that it had acquired NewContext, a multi-cloud DevSecOps service provider. The acquisition would help expand Capado’s DevSecOps platform, enabling companies to make compliance, quality, and security the foundation of their DevOps practices. Major players are also investing in the innovation of labs and centers and collaborating with various research institutes to increase their market share. Some of the prominent players operating in the global DevSecOps market are:

-

CA Technologies

-

Copado

-

Google LLC

-

IBM

-

Microsoft Corporation

-

PaloAltoNetworks

-

Riverbed Technology

-

Synopsys

DevSecOps Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 3.79 billion

Revenue forecast in 2028

USD 17.24 billion

Growth Rate

CAGR of 24.1 % from 2021 to 2028

Base year for estimation

2020

Actual estimates/Historical data

2018 - 2019

Forecast period

2021 - 2028

Quantitative Units

Revenue in USD Million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; Japan; India; Mexico; Brazil

Key companies profiled

CA Technologies; Google LLC; IBM; Microsoft Corporation; PaloAltoNetworks; Riverbed Technology; Synopsys

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2028. For this study, Grand View Research has segmented the global DevSecOps market report based on component, deployment, organization, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2028)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2028)

-

On-Premise

-

Cloud

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2028)

-

Small and Medium Enterprise

-

Large Enterprise

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2028)

-

BFSI

-

IT & Telecommunication

-

Government

-

Retail & Consumer Goods

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global development, security, and operation market size was estimated at USD 2.79 billion in 2020 and is expected to reach USD 3.79 billion in 2021.

b. The global development, security, and operation market is expected to grow at a compound annual growth rate of 24.1% from 2021 to 2028 to reach USD 17.24 billion by 2028.

b. North America dominated the development, security, and operation market with a share of 28.9% in 2020. The high adoption rate of development to operation solutions across various industries, including BFSI, IT & Telecommunication, and retail, among others, along with the growing data breaches, is driving the market growth.

b. Some key players operating in the development, security, and operation market include CA Technologies; Google; IBM; Microsoft; PaloAltoNetworks; Riverbed Technology; and Synopsys.

b. Key factors that are driving the development, security, and operation market growth include the increasing need for highly secure and faster application delivery. Factors such as the growing internet penetration rate and rise in cybercrimes are also expected to contribute to the growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."