- Home

- »

- Next Generation Technologies

- »

-

Development To Operations Market Size & Share Report, 2030GVR Report cover

![Development To Operations Market Size, Share & Trends Report]()

Development To Operations Market Size, Share & Trends Analysis Report By Deployment (On-Premise, Cloud), By Enterprise Size (SMEs, Large), By End-use (BFSI, Retail), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-107-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global development to operations market size was valued at USD 11.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2023 to 2030. Increasing adoption of cloud technologies, fast application delivery, advancements in artificial intelligence, and software automation are the factors expected to drive the growth of the development to operations (DevOps) industry. Organizations adopting DevOps solutions are already benefiting in terms of faster delivery of software, fewer coding errors, faster resolution, and better allocation of IT resources, creating a favorable environment for the development to operations industry.

The onset of the COVID-19 pandemic disrupted several businesses. However, the global DevOps market witnessed an increase in demand during the pandemic period. This was attributed to the fact that there was a sudden rise in demand for online web-based applications, as organizations were focusing on improving their online presence to target a larger potential audience, supporting the DevOps market’s growth.

DevOps tools ensure a smooth collaboration between the development and operations teams of an enterprise to automate the development, testing, deployment, and operations of software, creating a positive DevOps market outlook. This enables organizations to enhance the quality of the deliverables, mitigate risks, save costs and enhance customer engagement.

Organizations adhering to the conventional waterfall model often realize that updating the software is an expensive and time-consuming affair, and also disrupts the service temporarily. This highlights the importance of standardizing and automating the movement and deployment of applications in various environments throughout their lifecycle in a delivery pipeline, creating robust opportunities for development to operations industry.

The growing demand for advanced technologies to enhance business operations and the increasing requirement for business optimization by enterprises are expected to boost the development to operations industry growth. The development to operations tools helps end-user companies in increasing speed and agility throughout the lifecycle of the application and engage in better collaboration across IT teams to make the organization more efficient and proactive.

Additionally, the COVID-19 pandemic has accelerated the growth of the development to operations industry, owing to the growing importance of cloud platforms and systems in enhancing business growth through digital transformation. Furthermore, businesses all over the world are implementing digital transformation solutions and services to resume and sustain operations during the pandemic.

Organizations adopting DevOps practices are managing to bring in more speed and agility throughout the lifecycle of the application, thereby making them more customer-oriented. The companies operating in the development to operations industry are adopting various strategies to assist their clients in implementing and utilizing DevOps tools.

For instance, in December 2022, Salesforce, Inc., a software company, announced the availability of its DevOps Center, making it easy for its partners to implement DevOps practices and develop extensions and packages & sell them to customers. The development to operations center features automatic change tracing, enabling the development of low-code products for non-technical users, and supporting the growth of the DevOps industry.

However, when it comes to implementing DevOps solutions, businesses face several challenges. The lack of standardization in DevOps tools has led to an undefined process framework resulting in automation without a structured approach. The complications in implementing DevOps solutions, and the lack of software expertise further make it difficult for organizations to deliver seamless results, monitor progress and integrate with the existing infrastructure. These are the primary factors expected to hinder market growth. However, organizations are addressing these challenges by implementing standardized workflows, processes, and protocols which will propel market growth.

Deployment Insights

The cloud segment accounted for the largest market share of over 62.0% in 2022. This growth can be attributed to the widespread adoption of IT trends and policies such as Bring your own device (BYOD), Internet of Things (IoT), mobility, containerization, and virtualization across enterprises.

Cloud technology offers several on-demand capabilities such as cybersecurity, automation, Machine Learning (ML), and big data analytics creating ample amount of opportunities in the development to operations industry. For instance, in January 2021, the DevOps platform GitLab partnered with IBM Cloud to use IBM Cloud Pak to speed up the development of cloud-based DevOps applications by automating various tasks and enhancing the developer team's collaboration.

The on-premise segment is expected to grow at a CAGR of 15.6% over the forecast period, owing to a majority of legacy server deployments, across various organizations to support traditional software test and production environments. The license purchase is mandatory in on-premise deployment and it is valid for use within an enterprise’s IT infrastructure.

This improves security & safety and makes it easier to detect threats from malicious software. This would increase demand for on-premise solutions in highly regulated companies that must securely store sensitive data. These factors are predicted to amplify market growth during the forecast period.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of 55.0% in 2022. Large enterprises were amongst the first to foster DevOps to improve quality and productivity, streamline workflows, shorten time to market, and reduce costs associated with IT operations such as software development, delivery, and maintenance. Cloud service providers and large IT organizations are expected to increasingly invest in the development to operations tools to manage the software development lifecycle as their primary strategy.

For instance, in March 2022, HCL Technologies Ltd., an IT service company, launched Design to DevOps framework which bough robust harmony between the technical and creative teams to develop next-generation tools to enrich customer experiences. The framework automates User Experience (UX) designs from various sources such as Figma, Adobe Photoshop, Adobe XD, and Adobe Sketch.

The Small and Medium size Enterprises (SMEs) segment is expected to grow at a CAGR of 18.0% over the forecast period. SMEs are remarkable in their adoption of DevOps tools to shorten the application development process. DevOps tools improve the deployment frequency to meet evolving business needs and remain sustainable in the highly competitive and potential development to operations industry.

SMEs are notably adopting cloud-based DevOps tools to deliver a variety of digital services, owing to the various benefits and cost-effectiveness associated with cloud environments. Increasing customer demands for improved software and services will drive the adoption of DevOps across SMEs to attract potential business clients and increase the revenue stream.

End-use Insights

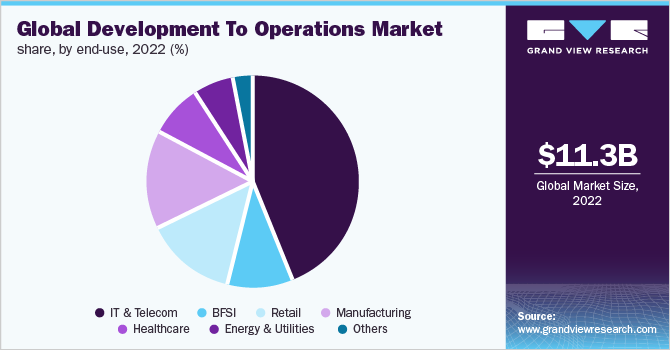

The IT & Telecom segment held the highest market share of more than 42.0% in 2022 and is expected to dominate the market by 2030. The IT & telecom sector faces several challenges, including quality assurance, release timelines, and application downtime. DevOps tools and solutions are intended to increase business efficiency and meet changing business requirements.

As a result, they can easily address the challenges that the IT & telecom industry is facing. The IT & telecom industry in particular is utilizing DevOps solutions to automate its processes associated with software development, testing, and operations, thereby improving software quality, reducing delivery time, and improving customer experience, accelerating the DevOps industry growth.

The manufacturing application segment is expected to grow at the highest CAGR of 18.4% over the forecast period. Shifting manufacturing companies' focus on smart factories and supportive government initiatives for industrialization are accelerating the growth of development to operations industry in the manufacturing segment. The manufacturing software providers are leveraging DevOps tools for their software development and deployment to improve software performance and reliability.

For instance, in May 2022, Manufacturing Execution Systems (MES) provider, Critical Manufacturing launched Version 9 of its MES solution which uses a DevOps center for reliable deployment of manufacturing software at multiple plants, enabling end-use companies’ easy transition toward the smart factory.

Regional Insights

The North America region held the largest market share of the global DevOps industry in 2022 and accounted for a market share of over 35.0%. Increasing market penetration of software automation tools to deliver efficient outcomes across the manufacturing, automotive, & retail sectors is driving the North America DevOps industry growth. The ability to meet ever-increasing user needs with rapid solution delivery has resulted in broader adoption of development to operations industry in the region.

The key market players in the U.S. are adopting various business strategies such as mergers and acquisitions to strengthen their DevOps tools portfolio. For instance, in September 2022, a software delivery platform, CloudBees acquired DevOps company, ReleaseIQ to strengthen its cloud-based DevOps service portfolio.

The DevOps industry in the Asia Pacific region is anticipated to be the fastest-developing regional market at a CAGR of 20.2%, due to increasing digitization in the banking sector. Most banks have adopted agile project planning and execution processes to keep up with the frequent business requirements that accompany other efforts to transform clients' banking experiences.

Market players are collaborating with IT companies to accelerate the adoption of DevOps tools in the Asia Pacific region, creating a favorable environment for the Development to operations industry. For instance, in March 2022, JFrog Ltd, a DevOps company, partnered with IT solution provider, Softline India Ltd. to accelerate the adoption of DevSecOps and DevOps in India.

Key Companies & Market Share Insights

The dominant players operating in the development to operations industry include IBM Corporation; Broadcom, Inc.; Cisco Systems, Inc.; Puppet, Inc.; Hewlett Packard Enterprise; and Puppet, Inc. Companies can be seen engaging in mergers and acquisitions as well as partnerships to improve their products and gain a competitive advantage in the market. They are actively working on new product development and improving existing products to gain new customers and increase market share. At the same time, industry incumbents have also been investing in innovation labs and centers of excellence and collaborating with various research institutes to expand their respective market share further.

For instance, in October 2022, Microsoft Corporation announced new updates to its cloud platforms which include the addition of Kubernetes Fleet Manager and other security & service updates. Kubernetes Fleet manager allows the DevOps team in scaling the centralized management for easy orchestration of Kubernetes clusters. This permits policy networking and configuration on a single dashboard monitoring Azure Kubernetes Service clusters across an entire organization. Some prominent players in the global development to operations market include:

-

Amazon Web Services

-

Atlassian Corporation Plc.

-

Broadcom Inc.

-

Cisco Systems, Inc.

-

Docker, Inc.

-

Hewlett Packard Enterprise

-

IBM Corporation

-

Parasoft.

-

Progress Software Corporation

-

Puppet Inc.

Development To Operations Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.54 billion

Revenue forecast in 2030

USD 37.25 billion

Growth Rate

16.8% CAGR from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; China; India; Japan; Australia; Brazil; Mexico; Argentina; UAE.; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Atlassian Corporation Plc.; Broadcom, Inc.; Cisco Systems, Inc.; Docker, Inc.; Hewlett Packard Enterprise; IBM Corporation; Parasoft; Progress Software Corporation; Puppet, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Development To Operations Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global development to operations market report based on deployment, enterprise size, end-use, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail

-

Manufacturing

-

Healthcare

-

Energy & Utilities

-

Others (Food & Beverages, Education, Aerospace & Defense, and Government)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global development to operations market size was estimated at USD 11.3 billion in 2022 and is expected to reach USD 12.54 billion in 2023.

b. The global development to operations market is expected to grow at a compound annual growth rate of 16.8% from 2023 to 2030 to reach USD 37.25 billion by 2030.

b. North America dominated the development to operations market with a share of 37.9% in 2022. This is attributable to the technological proliferation, increased penetration of smartphones, enhanced network connectivity, and high adoption rate of digital services in the region.

b. Some key players operating in the development to operations market include IBM Corporation; Broadcom, Inc.; Cisco Systems, Inc.; Hewlett Packard Enterprise; Docker, Inc.; Puppet, Inc.; Progress Software Corporation; Atlassian Corporation; Amazon Web Services; and Parasoft

b. The increasing adoption of cloud technologies, fast application delivery, advancements in artificial intelligence, and software automation is expected to drive the growth of the DevOps market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."