- Home

- »

- Medical Devices

- »

-

Diabetes Devices Market Size, Share & Trends Report, 2030GVR Report cover

![Diabetes Devices Market Size, Share & Trends Report]()

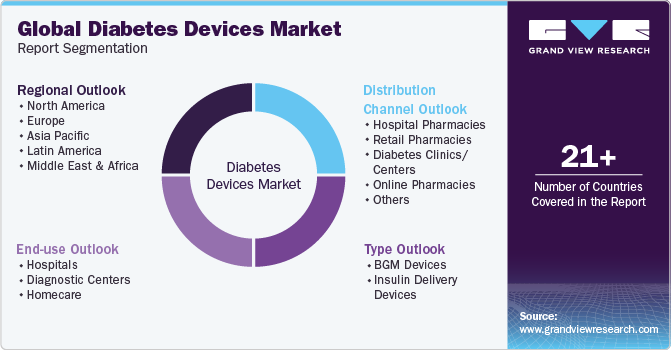

Diabetes Devices Market Size, Share & Trends Analysis Report By Type (Blood Glucose Monitoring Devices, Insulin Delivery Devices), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-873-2

- Number of Pages: 195

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Diabetes Devices Market Size & Trends

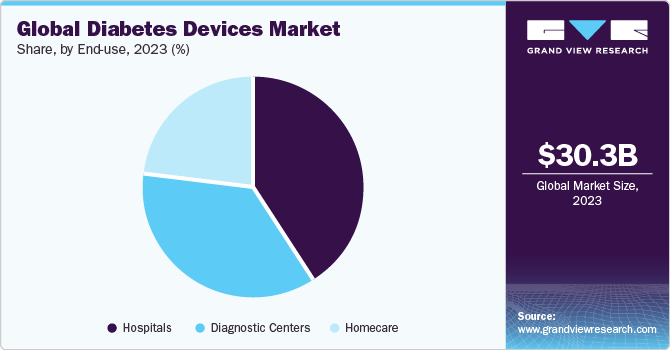

The global diabetes devices market size was estimated at USD 30.31 billion in 2023 and is projected to grow at a CAGR of 7.45% from 2024 to 2030. The market is primarily driven by growing prevalence of diabetes, advanced technology, the growing usage of insulin delivery devices, and the rise in obesity rates. Major manufacturers are concentrating on technological innovation and the creation of advanced products to secure a significant portion of the market. For instance, in February 2023, Insulet Corporation acquired the assets of a California-based company, Automated Glucose Control LLC (AGC), specializing in automated insulin delivery technology.

The increasing prevalence of diabetes worldwide has created a strong demand for market in the forecast period. According to the Institute for Health Metrics and Evaluation in June 2023, over 500 million individuals worldwide are currently living with diabetes, affecting individuals of all ages and genders across every nation. According to the most recent and comprehensive estimations, the current global prevalence stands at 6.1%, positioning diabetes among the top 10 leading causes of death and disability. At the super-region level, North Africa and the Middle East exhibit the highest prevalence rate at 9.3%, which is projected to escalate to 16.8% by 2050. The rate is expected to rise to 11.3% in Latin America and the Caribbean.

The increasing demand for diabetes devices is attributed to preventing longer hospital stays and higher mortality rates in diabetic patients. As these devices facilitate continuous monitoring and management of blood sugar levels, they empower patients to proactively address their condition, thereby potentially avoiding severe complications that could necessitate extended hospitalization. Moreover, by enabling timely adjustments to treatment regimens, these devices contribute to better disease management and outcomes, ultimately leading to improved quality of life for individuals with diabetes. As a result, the increasing use of diabetes devices highlights their vital importance in improving patient care and well-being.

The market is growing due to the increasing prevalence of diabetes resulting from aging, obesity, and unhealthy lifestyle choices. Obesity is a significant factor leading to diabetes. According to the National Center for Biotechnology Information (NCBI) in October 2023, if the current trends continue, by 2035, more than half of the world's population will be overweight or obese, and the majority of new diabetes cases will be type 2 diabetes, driven by shifts in obesity rates and dietary risks. Factors such as overweight and obesity are contributing to a rise in diabetes cases. Consequently, risk factors like smoking, being overweight or obese, and having high cholesterol levels are anticipated to elevate the prevalence of diabetes, thereby increasing the demand for diabetes devices.

The presence of a substantial elderly population, affordable healthcare options, cost-effective labor, and less rigorous regulatory frameworks are driving diabetic device manufacturers to expand. They are prioritizing exploiting opportunities in emerging markets to increase their market dominance. The demand for diabetes devices is also rising due to technological advancements, including introduction of advanced insulin pumps and pens. Significant companies are concentrating on technological advancements and creating advanced products to secure a significant portion of the market. For instance, in June 2022, Abbott introduced a new continuous monitoring system for glucose and ketones, featuring an innovative bio-wearable design.

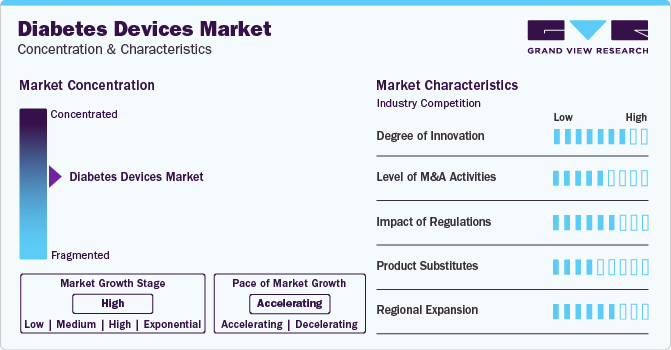

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The market has witnessed a high degree of innovation, marked by several instances of regulatory approvals, partnerships, and collaborations. In recent years, the market has seen a surge in the number of new product launches, making it increasingly challenging for market leaders to sustain themselves in the ever-changing market. However, leading players are investing heavily in R&D activities to develop advanced imaging technologies, which is expected to fuel market growth. For instance, in February 2023, Ascensia Diabetes Care partnered with SNAQ to enable diabetes patients to make informed decisions about meals and enhance diabetes management.

Technological advancements and product launches drive market growth. For instance, in July 2023, Tandem Diabetes Care, Inc., a prominent company in insulin delivery and diabetes technology, unveiled the FDA-approved smallest durable automated insulin delivery system for ages 6 and above. The Mobi insulin pump, controllable via a mobile app, utilizes Control-IQ technology coupled with Dexcom G6 to forecast blood sugar levels 30 minutes in advance. Users can also administer doses via their smartphones. A partial release is scheduled for late 2023, followed by complete commercial availability anticipated for early 2024.

The market has been characterized by a high degree of innovation,focusing on creating solutions for more accurate and efficient diagnosis and treatment. These advancements enhance patient care and improve healthcare outcomes, catering to the diverse needs of individuals managing diabetes. For instance, in July 2023, Afon, a company headquartered in Wales, is developing Glucowear, a non-invasive blood glucose sensor. Placed under the wrist, it utilizes radio frequencies to capture signals beneath the skin, ensuring real-time monitoring without delays, unlike optical sensors. The anticipated launch is set for 2024.

Several market players are engaged in a moderate level of merger and acquisition (M&A) activities. For instance, in February 2023, Insulet Corporation acquired the patents for insulin pumps from Bigfoot Biomedical (Bigfoot), a company specializing in insulin delivery technologies.

The market has a high impact of strict regulations. The U.S. Food and Drug Administration (FDA) has strict regulations regarding the approval of medical devices. For instance, in December 2022, Dexcom, Inc. received U.S. FDA approval for the Dexcom G7 Continuous Glucose Monitoring System.

Product substitutes have a moderate impact on the global market. Alternative products to traditional diabetes devices include continuous glucose monitoring (CGM) systems, which offer real-time glucose readings without finger pricks, and insulin pumps that automate insulin delivery.

Regional expansion is anticipated to have a moderate to high growth impact on the market. Regional expansion provides market players with an opportunity to tap into previously untapped customer bases. This strategy enables them to strengthen their position in the market and increase their market share. For instance, in February 2023, Dexcom, Inc.launched the Dexcom G6 Continuous Glucose Monitoring System in Singapore.

Type Insights

Based on type, the insulin delivery devices segment dominated the market accounted for the largest revenue share in 2023 andis expected to witness the fastest CAGR of 7.89% during the forecast period. The insulin delivery devices are further categorized into insulin pens, insulin pumps, insulin syringes, and jet injectors. Insulin pens held a larger market share in 2023. However, the insulin pump segment is expected to gain substantial market share as it is estimated to grow at the fastest CAGR during the forecast period.

The blood glucose monitoring devices segment is expected to witness the substantial CAGR during the forecast period. This can be attributed to factors such as the availability of low-cost for BGM devices and their accuracy in reading glucose level in the body. Moreover, with the advancements in technology and launches of innovative and integrated solutions, companies are launching cost-effective, technologically advanced, easy-to-use products. For instance in January 2024, Dexcom intends to introduce Stelo, a novel continuous glucose monitor designed for individuals with Type 2 diabetes who do not require insulin. The submission for review by the Food and Drug Administration occurred in the fourth quarter of 2023. This is expected to boost the demand for the blood glucose monitoring devices market.

The usage of blood glucose meters is rising, driven by their portability and precision benefits. Market participants are prioritizing the development of compact models and introducing advanced technology. Among the smallest and most advanced blood glucose meters in the UK are Abbott Diabetes Care Freestyle Lite, Bayer’s CONTOUR NEXT USB, Lifescan’s One Touch UltraEasy, Accu-Chek Aviva Nano, Accu-Chek Mobile, & TRUEone. The emergence of these compact, user-friendly meters is anticipated to boost the segment expansion.

In addition, Continuous Glucose Monitoring (CGM) is expected to continue collaborating with insulin delivery systems to create a single, integrated system aimed at improving the management of diabetes care efficiently. For instance in December 2023, Tandem Diabetes Care introduced the Slim X2 insulin pump, which incorporates the Dexcom G6 CGM.

Distribution Channel Insights

Based on distribution channel, the hospital pharmacies segment led the market with the largest revenue share of 54.13% in 2023, owing to the high footfall and availability of products. Inpatient and outpatient pharmacies are the two types of pharmacies operating in hospitals. Recently, the use of continuous glucose monitoring has increased in hospitals owing to the rising popularity of these devices for outpatient continuous blood glucose level monitoring and use of devices for ICU patients. Hence, these devices are increasingly being used in hospital settings and majorly distributed by the pharmacies affiliated with these hospitals.

The retail pharmacies segment is anticipated to grow at the fastest CAGR during the forecast period, as they are considered the most accessible buying option for patients. Diabetes care product offered by retail pharmacies to patients includes medication, self-monitoring glucose supplies (meter, testing strips, lancing device), insulin delivery equipment, and OTC products. Each retail pharmacist stocks diabetes devices based on factors such as physician preference, patient preference, profit margin, and insurance coverage.

End-use Insights

Based on end-use, the hospital segment led the market with the largest revenue share of 40.80% in 2023. The rise in hospital admissions among diabetes patients is driving demand for the sector, as people living with diabetes are three times more likely to be hospitalized than non-diabetic individuals. Diabetes technology has rapidly evolved in recent years, focusing on enhancing diabetes care in medical facilities. Consequently, the adoption of insulin pumps in hospitals and clinics has increased significantly. For instance, according to University Hospitals, in November 2023, patients must replace their insulin pumps every three days as the insulin contained within may degrade after this period.

The diagnostic centers segment are expected to grow at the fastest CAGR during the forecast period. Glucose monitoring devices are being increasingly used in various healthcare settings, such as diagnostic centers. Patients suffering from diabetes prefer examining glucose levels in diagnostic centers due to their effectiveness in providing instant results without long waiting time. Self-Monitoring Blood Glucose (SMBG) devices are widely used in these diagnostic centers.According to the International Diabetes Federation, in November 2023, nearly 537 million people were suffering from diabetes worldwide, which is expected to increase to 643 million by 2030 and 783 million by 2045. Thus, increasing demand for BGM devices is expected to propel segment growth.

Regional Insights

The diabetes devices market in North America accounted for the largest revenue share of 38.66% in 2023, owing to factors such as include increasing geriatric population, growing burden of diabetes due to lifestyle changes, increasing prevalence of obesity, and high cost of treatment. Some of the market leaders, such as Abbott, Medtronic, Dexcom, and Insulet Corporation, have their operational headquarters in this region, which is contributing to the market growth.

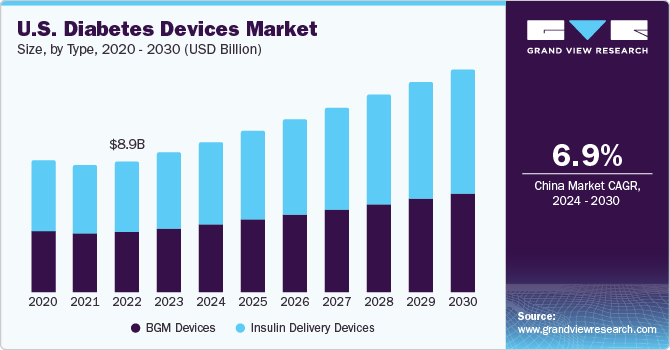

U.S. Diabetes Devices Market Trends

The diabetes devices market in the U.S. is expected to grow at the fastest CAGR over the forecast period. Abbott, Medtronic, Dexcom, and Insulet Corporation are key players in the market operating in the U.S. For instance, according to the Centers for Disease Control and Prevention (CDC) report in November 2023, around 136 million adults in the U.S. are either diagnosed with diabetes or are in a prediabetic condition.

The favorable reimbursement scenario provides access to healthcare services to a large portion of the population. Subsequently, it creates a demand for cost-effective and efficient diabetes devices. This also increases the need for cost-effective diabetes devices and the integration of digital health in the care delivery system. Hence, many companies are seeking U.S. FDA approval to launch their products in the U.S. market.

Europe Diabetes Devices Market Trends

The diabetes devices market in Europe is expected to grow at a lucrative CAGR during the forecast period, due to the increasing prevalence of diabetes and rising awareness about diabetes management & control. Russian Federation, Germany, Turkey, Spain, and Italy are the top five countries in the European region with a high prevalence of diabetes. Medtronic plc was one of the leading player in the market. For instance in October 2023, Medtronic's latest continuous glucose monitor (CGM), known as Simplera, has received approval for use in Europe. Other regional key players include Hoffmann-La Roche AG, Ypsomed AG, and Insulet Corporation. Ypsomed AG is a key distributor of Insulin pumps and auto injectors in Europe.

The UK diabetes devices market is characterized by several small- and medium-sized companies that significantly contribute to the economy. The turnover from these companies is valued at about 99.5% of all businesses currently operating in the UK. The country has a reputation for quality solutions. Hence, in-house manufactured medical devices are anticipated to witness the significant CAGR over the forecast period. Major companies operating in the market are F. Hoffmann-La Roche Ltd.; Lifescan, Inc.; Dexcom, Inc.; Abbott Laboratories; and others. These companies are adopting several strategies to acquire large market shares, including the launches of innovative products in the market. For instance, in October 2022, Dexcom, Inc. launched Dexcom G7 in Germany, Austria, Ireland, UK, and Hong Kong.

The diabetes devices market in Germany has a lucrative environment for technologically innovative startups. Around 80% of the medical device manufacturers, including companies of diabetes devices, in the country, are SMEs. The presence of major market players, such as B Braun Melsungen AG and Abbott Laboratories, is anticipated to create lucrative opportunities in Germany.

The France diabetes devices market is anticipated to grow at the fastest CAGR during forecast period, as the French government is undertaking initiatives to improve the healthcare structure in France. Hence, the major international players are collaborating with local players to launch, market, and distribute their products in the market. Therefore, owing to these collaborations, the local players are gaining significant market shares in the region.

Asia Pacific Diabetes Devices Market Trends

Thediabetes devices market in Asia Pacific is expected to exhibit a fastest CAGR of 8.95% from 2024 to 2030. This can be attributed to presence of major market players and increasing prevalence of diabetes. In addition, technological advancements in blood glucose monitoring devices, increasing geriatric population, and growing prevalence of lifestyle diseases, such as obesity, are among factors anticipated to promote growth of blood glucose monitoring devices market. However, under-diagnosis is common in many Low and Middle-Income Countries (LMIC), and traditional blood glucose testing methods are still used in these countries over continuous glucose monitoring due to lack of awareness and high equipment costs.

The China diabetes devices market is driven by technological advancements and rising healthcare infrastructure. Companies interested in entering China should recognize that they must overcome existing barriers in an ambiguous and changing regulatory environment. The National Medical Applications Administration (NMPA) is responsible for regulation of drugs and medical devices in China. The country also offers high potential for the U.S. companies interested in expanding and entering into the China market.

The diabetes devices market in Japan is moderately competitive, with the presence of some major companies offering diabetes devices. Several government organizations and academic & research institutes have a demand for these devices.In Japan, Pharmaceuticals and Medical Devices Agency along with Ministry of Health, Labor and Welfare regulates medical devices based on the risks associated with the device.The National Health Insurance System is responsible for reimbursement in Japan. The main reimbursement categories for medical devices are A, B, C, and F, wherein C and F are new medical device reimbursement categories. Some medical devices are reimbursed based on application category, while others are reimbursed through procedure fees.

Latin America Diabetes Devices Market Trends

The diabetes devices market in Latin America is primarily driven by Brazil, Mexico, Argentina, and Colombia. Growing investments by market players in the region, proximity to North America, and free-trade agreements with major countries such as the U.S., Canada, Japan, & several European countries are among the factors anticipated to boost the Latin America market during the forecast period.

The Brazil diabetes devices market is the largest market as the country the demand for advanced devices and other home health applications for diabetes in Brazil is high. People in Brazil consider the use of devices manufactured in the U.S., Europe, and Canada. However, they prefer domestic applications because of low costs.

The diabetes devices market in Mexico has become a significant destination for affordable medical device manufacturing with skilled-yet-affordable manufacturing labor, proximity to major markets, and impressive infrastructure capabilities. The presence of a major market player, Medtronic, in the country also represents lucrative growth opportunities.

The Argentina diabetes devices market is a developing market, offers excellent business opportunities as it virtually imports all medical applications.This is due to the current high demand for imported essentials & specialized medical equipment, a reasonable regulatory approval timeline, and the country’s remarkable hospital capacity. Thus, the country represents lucrative growth opportunities for manufacturers of diabetes devices.

Middle East & Africa Diabetes Devices Market Trends

The diabetes devices market in Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period, due to increased prevalence of diabetes and rapidly aging population, as well as growing demand for home-based monitoring devices. According to the International Diabetes Federation (IDF), the Middle East accounted for the second-highest deaths due to diabetes among patients below 60 years. In addition, according to World Health Organization (WHO) in March 2023, IDF estimated that the current 24 million population with diabetes across the region is expected to increase by 129% by 2045.

The South Africa diabetes devices market is anticipated to grow at the fastest CAGR of 8.59% during the forecast period, owing to an increasing prevalence of diabetes and rising demand for diabetes devices. The robust distribution channels and presence of major players such as Roche Diabetes Care, Medtronic, Abbott Laboratories, and Johnson & Johnson fuel the market growth. The South African government has also been implementing various initiatives to improve diabetes management in the country, which is expected to boost the market growth.

The diabetes devices market in UAE is experiencing growth due to multiple factors, such as the high prevalence of diabetes, the adoption of innovative products, increased research and development initiatives, and a stronger emphasis on preventive care. The market is expected to be further fueled by government initiatives that promote awareness and adoption of diabetes devices. Arab Health hosted a dedicated conference track on diabetes from January 31 to February 1, 2024, which addressed the growing prominence of diabetes in the UAE and wider MENA region by showcasing the latest technology and devices used to combat the disease. Several industry experts from reputable institutions also provided insights during the conference. In addition, companies such as New Country Healthcare, Prahem Laboratories, and Iraqi Pharma exhibited new medicines and technology. Medical professionals attending Arab Health 2024 had access to 10 Continuing Medical Education (CME) conferences covering various fields, including diabetes. Arab Health 2024 was supported by multiple government entities, including the UAE Ministry of Health and Prevention, the Government of Dubai, the Dubai Health Authority, the Department of Health, and the Dubai Healthcare City Authority.

Key Diabetes Devices Company Insights

The major market players operating in the diabetic devices market include Medtronic plc, Abbott Laboratories; F.Hoffmann-La-Ltd.; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Lifescan, Inc., and others. These players are focusing on enhancing their product offerings through product upgrades, strategic collaborations, merger & acquisition activities. Additionally, the emerging players operating in the market include Companion Medical; Sanofi; Valeritas Holding Inc.; Novo Nordisk; and Arkray, Inc., and others.

Key Diabetes Devices Companies:

The following are the leading companies in the diabetes devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- Abbott Laboratories

- F.Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk

- Arkray, Inc.

Recent Developments

-

In May 2023, Medtronic has reached an agreement to purchase EOFlow, a manufacturer of insulin devices. Integrating EOFlow with Medtronic's Meal Detection Technology algorithm and advanced continuous glucose monitor (CGM) is anticipated to enhance the company's capacity to serve a broader range of people with diabetes

-

In April 2023, Undbio disclosed its intention to invest USD 100 million in constructing a US-based insulin manufacturing plant. The South Korean firm plans to establish a new facility in West Virginia to produce insulin and distribute its products within the country

-

In July 2023, CharmHealth and Bioverge have jointly invested in My Diabetes Tutor, a startup dedicated to improving the lives of individuals with diabetes

Diabetes Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.70 billion

Revenue forecast in 2030

USD 50.33 billion

Growth rate

CAGR of 7.45% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Singapore; South Korea; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic plc; Abbott Laboratories; F.Hoffmann-La-Ltd.; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Lifescan, Inc.; Dexcom Inc.; Insulet Corporation; Ypsomed Holdings; Companion Medical; Sanofi; Valeritas Holding Inc.; Novo Nordisk; Arkray, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diabetes Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the diabetes devices market report based on type, distribution channel, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

BGM Devices

-

Self-Monitoring Devices

-

Blood Glucose Meters

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitters

-

Receiver

-

-

-

Insulin Delivery Devices

-

Pumps

-

Pens

-

Syringes

-

Jet Injectors

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/Centers

-

Online Pharmacies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diabetes devices market size was estimated at USD 30.31 billion in 2023 and is expected to reach USD 32.70 billion in 2024.

b. The global diabetes devices market is expected to grow at a compound annual growth rate of 7.45% from 2024 to 2030 to reach USD 50.33 billion by 2030.

b. North America dominated the diabetes devices market with a share of 38.66% in 2022. This is attributable to the presence of a large number of patients and a favorable reimbursement scenario.

b. Some key players operating in the diabetes devices market include Medtronic plc; Abbott Laboratories; F.Hoffmann-La-Ltd.; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Lifescan, Inc.; Dexcom Inc.; Insulet Corporation; Ypsomed Holdings; Companion Medical; Sanofi; Valeritas Holding Inc.; Novo Nordisk; and Arkray, Inc.

b. Key factors that are driving the diabetes devices market growth include the increasing incidence of diabetes due to the rising geriatric population and an increasing number of obesity cases, along with technological advancement in the field of diabetes preventive care.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."