- Home

- »

- Next Generation Technologies

- »

-

Digital Identity Solutions Market Size & Share Report, 2030GVR Report cover

![Digital Identity Solutions Market Size, Share & Trends Report]()

Digital Identity Solutions Market Size, Share & Trends Analysis Report By Component, By Solution, By Identity Type, By Biometric, By Solution Type, By Authentication, By Deployment, By Vertical, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-023-5

- Number of Pages: 117

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global digital identity solutions market size was valued at USD 27.51 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 17.2% from 2023 to 2030. One of the major factors driving the growth of market is the development of biometrics integration in smartphones. Also, there is a growing demand for digital identity-based authentication methods such as biometric expertise and multi-factor authentication, which are more secure and reliable than passwords.

For instance, in October 2022, Prove Identity, Inc., a provider of digital identity authentication platforms, released Prove Auth, a next-generation solution for omnichannel authentication and passwordless login. Solution enables businesses to reduce their dependence on passwords and one-time passcodes (OTPs). With a simple, cost-effective, and secure solution, it empowers consumers to authenticate in all channels, including desktops, phones, and call centers.

Digital identity solutions are next-generation identity governance and administration solutions that provide a much higher level of assurance and establish a trusted identity. These solutions use cutting-edge technologies such as machine learning (ML), face-based biometrics, blockchain, and artificial intelligence (AI) to determine whether a person is who they claim to be. Identity and payments have become inextricably linked, bringing exciting new opportunities and risks to the payments industry, further increasing need for digital identity solutions. Furthermore, increased data breaches and account takeovers have increased use of digital identity solutions and services.

As organizational structure complexity grows, many people and devices are assigned unique identities across networks to authenticate and verify access privileges and identities. The workforce is becoming more mobile, and the Bring-Your-Own-Device (BYOD) policy encourages mobile applications. A significant increase in e-commerce and consumer demand for mobile computing drives organizations to create mobile applications that customers can use to access their products. Organizations have become more vulnerable to cyber threats due to distributed IT environments and changing scenarios, fueling demand for digital identity solutions.

The rapid emergence and advancement of technological developments propel the market demand for digital identity solutions. Furthermore, as investments in digital transformation increase, identity results have garnered increasing acceptance as they aid in secure identification and positive upgraded security, which supports industry growth. For instance, in July 2022, M2P Fintech acquired Syntizen Technologies Pvt. Ltd., a B2B digital identity-centric product company. The procurement reinforces its strategy to provide a complete platform for financial institutions, offering a comprehensive, integrated technology stack that encompasses identity and onboarding services.

Market Dynamics

Blockchain technology offers a secure and decentralized way of managing identity data, which is becoming increasingly popular in digital identity solutions. It is a distributed ledger technology that enables creation of secure and tamper-proof records of transactions or data. In the case of digital identity, blockchain technology can create a decentralized identity system where individuals have control over their identity information. Users can store their identity data on a blockchain-based platform and have complete control over who has access to it. Decentralized nature of blockchain technology ensures that data cannot be easily manipulated or hacked, providing a higher level of security than centralized identity systems.

Blockchain-based identity systems can enable faster and more efficient identity verification processes. Instead of going through a lengthy and costly process of verifying an individual's identity with multiple parties, blockchain-based identity systems can provide a single source of truth for identity verification, which can be accessed by authorized parties securely and efficiently. Information technology companies continuously develop new and improved products using blockchain to deliver next-generation solutions. For instance, in February 2023, Wipro Lab45, the innovation lab of Wipro Ltd., announced its recently developed Decentralized Identity and Credential Exchange (DICE ID) service that uses blockchain technology to provide users complete control of their private information. DICE ID will issue and verify credentials using tamper-proof, self-verified digital certificates.

Blockchain technology has significant potential to transform digital identity solutions by providing a secure, decentralized, and efficient way of managing identity data. As blockchain technology continues to evolve, it will likely become an increasingly important tool for identity management and verification in various fields.

Component Insights

Solutions segment led the market in 2022, accounting for over 62% share of global revenue. Various vendors provide digital identity solutions as an integrated platform or tool that integrates with the enterprise's infrastructure. Vendors also provide hardware and services to assist organizations in implementing required solutions in their current infrastructure.

Digital identity solutions are intended to improve security, lower costs, streamline business processes, and boost customer satisfaction. Customers in retail, IT, healthcare, and financial services are incorporating digital identity solutions into their operations to save time and automate customer onboarding process.

Services segment is predicted to foresee significant growth in forecast years. Identity verification service is assistance provided by vendors to assist customers in effectively using and maintaining digital identity solutions. As a result, various vendors in the digital identity solutions industry focus on providing managed services, while others outsource these services.

Aside from technical services, market participants also offer assistance with planning, designing, consulting, and support. These services assist organizations in selecting the best solution for their needs. Owing to the complexity of IT infrastructure and operating systems (OS), users require guidance; thus, services segment is expected to grow rapidly in coming years.

Identity Type Insights

The biometric segment led the market in 2022, accounting for over 69% of global revenue owing to their more secureness than conventional keys (or keycards) and password systems. Furthermore, passwords were traditionally replaced by biometric authentication methods like fingerprint, facial recognition, retina or eye scan, handprint, and voice recognition as digital identity management solutions evolved. Biometric solutions use lock-and-capture mechanisms to authenticate individuals and grant access to specific services. For instance, in November 2022, a photo verification system based on face biometrics, a key component of an Australian state digital ID being developed, was pilot tested in New South Wales. The opt-in public service decentralizes selfie biometrics and other personal data security, putting it in the hands of citizens. The credentials will be saved on their mobile device, allowing them to control who sees what information about them.

Non-biometric segment is anticipated to witness significant growth in the coming years. It aids in authorization and validation of an individual's identity to facilitate the provision of entitlement or service and to rely on various factors such as passwords, PINs, and knowledge of personally relevant information or events. Incorporating ML and AI, and technologies into non-biometric digital identity solutions aids in highly effective and proactive detection and remediation of unauthorized and suspicious activities and invasive access requests on an enterprise network. Non-biometric solutions segment is an important component of digital identity solutions and has experienced rapid growth in recent years.

Solution Type Insights

Authentication segment led the market in 2022, accounting for over 40% of global revenue. Identity authentication is used to verify a user's authenticity and to prevent fraudulent activities. Market for digital identity solutions has been divided into two categories based on authentication types: single-factor and multi-factor. In single-factor authentication, only one feature is used to verify a person's identity. Passwords, fingerprints, PINs, facial, voice, iris, and vein recognition are some of single-factor authentication solutions available in today's market. Single-factor authentication is simple and widely used in various industries, including government, consumer electronics, banking and finance, and healthcare.

Multi-factor authentication ensures confidentiality of personal information by providing a high level of security. This is more secure than traditional one-factor usernames and passwords/PINs, which are easily guessed and forgotten. For instance, in April 2021, HID Global Corporation, a division of ASSA ABLOY, released WorkforceID Authentication, a workforce multi-factor authentication solution. Solution provides businesses with cloud solutions for organizing, issuing, and deploying digital identity credentials for physical and logical access control.

Deployment Insights

On-premises segment led the market in 2022, accounting for over 60% of global revenue as large businesses have necessary infrastructure for deploying their solutions on-premises. It ensures a high level of flexibility and control. On-premises deployment mode is delivered with a one-time licensing fee and service agreement. Large enterprises prefer on-premises deployment as it offers them control over systems. Digital identity solutions provide comprehensive insights about clients, allowing for a more unified experience.

Cloud segment is anticipated to register a noticeable growth rate over a forecast period owing to benefits such as ease of use and lower installation and maintenance costs. Organizations avoid costs such as infrastructure maintenance and technical staff by utilizing cloud-based digital identity solutions. Many companies use cloud to deploy digital identity solutions because it allows them to focus on their core competencies instead of infusing capital into security infrastructure. For instance, in April 2021, Innovatrics, an EU-based provider of multimodal biometric solutions, launched a cloud API to render its remote digital identity verification with liveness detection and selfie biometrics more accessible to businesses and developers.

Vertical Insights

IT and Telecommunication segment led market in 2022, accounting for over 16% of global revenue. Further, BFSI is expected to generate maximum revenue following IT and Telecom. Bank fraud committed by in-house employees and majority of helpdesk calls relating to forgotten passwords has increased adoption of digital identity solutions in banking and finance sector. Customers expect banking anytime, anywhere, so BFSI firms are deploying various services, including internet banking, mobile banking, and stock trading via web and mobile applications.

Furthermore, BFSI industry vertical is concerned about securing its customers' sensitive data, which in turn is boosting digital identity solutions industry forward. For instance, in November 2022, Daon, Inc. announced that GoTyme Bank Corporation, a joint venture of Tyme, a new digital bank, used Daon IdentityX for digital identity capture and authentication in GoTyme banking app. Solution will assist in lowering barriers to setup accounts for consumers while also ensuring GoTyme Bank has precise proofing and identity verification for all prospective consumers.

Retail & e-commerce segment is likely to show notable growth over forecast period. Retail and e-commerce sector rapidly implements digital identity solutions that support business stability and increase competitiveness. Due to many monetary transactions by MasterCard and Visa, it is one of most cost-conscious verticals and most aimed at cyberattacks. Increasing complexities of supply chain, channel partners, employees, and customers are also expected to force retailers to impose managed authentication services, boosting digital identity solutions market. For instance, in April 2022, MasterCard, a global payments and technology company, collaborated with Microsoft to develop next-generation identity technology to allow more consumers to shop online safely. Enhanced identity solution is intended to improve online shopping and combat digital fraud.

Organization Size Insights

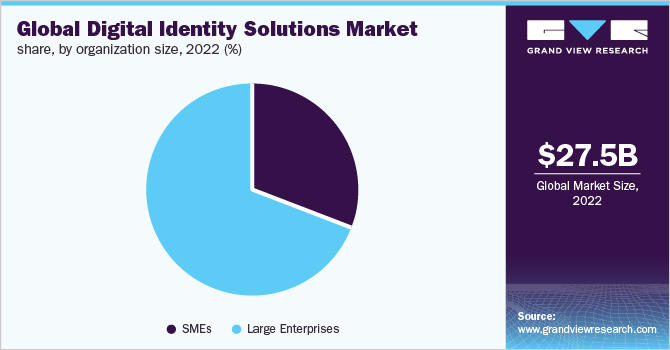

Large enterprises segment led market in 2022, accounting for over 66% of global revenue. Large enterprises were among first to implement digital identity solutions as they possess large workforce and associated networking devices vulnerable to identity-related risk. Organizations with offices in different regions are compelled to provide their solution to their employees through real-time data access and are increasingly implementing digital identity solutions to boost business productivity across regions. Solution can also detect access risk and risk outliers. As a result, large enterprises are expected to adopt more digital identity solutions that adhere to various standards and regulations.

SME segment is anticipated to register fastest CAGR from 2023 to 2030 owing to SMEs' increasing deployment of cloud-based digital identity solutions. Digital identity solutions are becoming increasingly important for SMEs, which are frequently at high-security risk due to lack of formal identity management policies.

Governments are also taking steps to safeguard SMEs in their respective countries. For instance, in October 2022, Seychelles government announced launch of SeyID platform, which WISeKey International Holding, a global cybersecurity company, created. Project creates new Digital Identity platform called "SeyID," linked to various national initiatives covering eGovernment, eHealth, and eTourism.

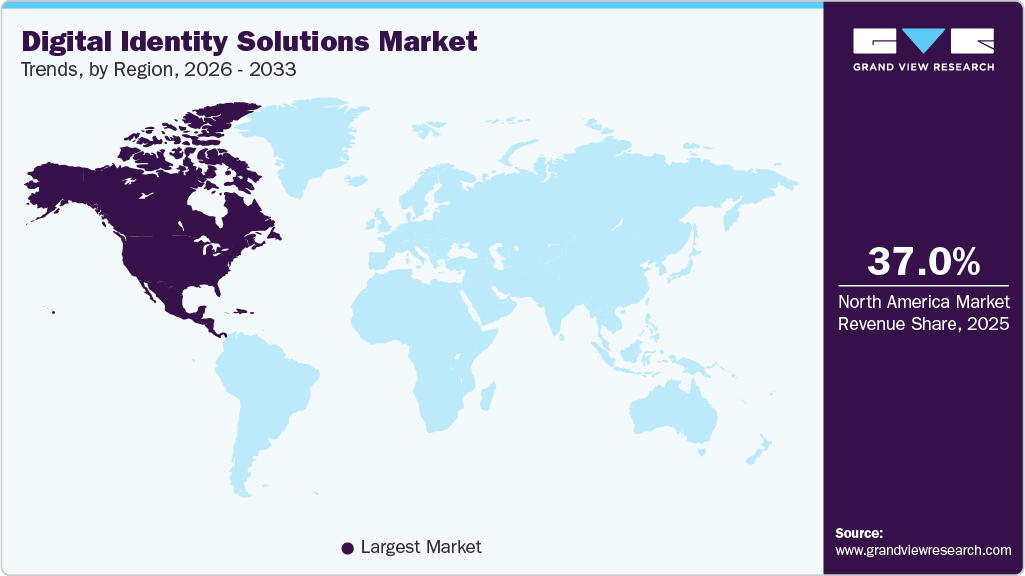

Regional Insights

North America dominated the market in 2022, accounting for over 38% share of global revenue. Governments have taken cautious approach to replacing physical ID with digital ID, frequently opting for hybrid identification credentials to balance accessibility and convenience. Since pandemic accelerated digital transformation in banking, travel, and other industries, there has been tremendous innovation in identity landscape to prioritize citizens and consumers who are digital natives.

Different approaches to digital identification in U.S. are more about distinct viewpoints on function of state and business about identity than other technology options. For instance, whereas national ID is concept that is accepted (and even desired) among EU citizens, most Americans reject idea because they believe it to be overreach of state.

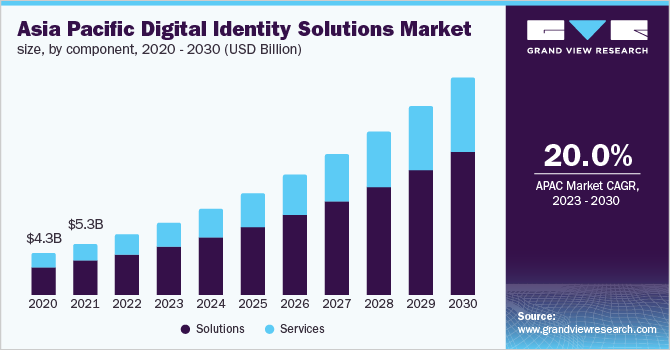

Asia Pacific is likely to pose lucrative market opportunities in coming years. Asia Pacific includes major developing economies such as China, Japan, India, Singapore, and South Korea. This region's digital identity solutions industry is experiencing rapid growth due to technological advancements. Digital IDs have gained popularity on a global scale, given their potential to increase effectiveness, functionality, scalability, and coverage of governmental programs and regulations.

For instance, in November 2022, Sterling, a background and identity solutions provider, collaborated with digital identity company Yoti Ltd to facilitate background checks and broaden their digital identity solutions. Global collaboration will broaden Sterling's digital identity capabilities in Asia Pacific and Middle East, and Africa (EMEA) and accelerate company's vision of creating privacy-centric portable identities for candidates.

Key Companies & Market Share Insights

Active players in the digital identity solutions industry are striving to come up with new ways to assist clients and improve risk profiles. Top firms stated below hold most of the market share for digital identification solutions, and it is anticipated that this trend will persist. Top companies use organic and inorganic growth strategies to expand their global presence, helping them increase their market shares. These companies have concluded many significant partnerships and collaborations in market for digital identification solutions during past five years. Some prominent players in the global digital identity solutions market include:

-

NEC Corporation

-

Thales.

-

GB Group plc

-

TELUS

-

Tessi

-

Daon, Inc.

-

IDEMIA

-

ForgeRock, Inc.

-

Imageware.

-

Jumio

Digital Identity Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32,542.6 million

Revenue forecast in 2030

USD 98,638.6 million

Growth Rate

CAGR of 17.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, identity type, solution type, deployment, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

NEC Corporation; Thales., GB Group plc; TELUS; Tessi, Daon, Inc.; IDEMIA; ForgeRock, Inc.; Imageware; Jumio

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Identity Solutions Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital identity solutions market report based on component, identity type, solution type, deployment, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Hardware

-

Software

-

-

Services

-

-

Identity Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Biometric

-

Fingerprint Recognition

-

Facial Recognition

-

Iris Recognition

-

Voice Recognition

-

Palm/Hand Recognition

-

Others

-

-

Non-biometric

-

-

Solution Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Identity Verification

-

Authentication

-

Single-factor Authentication

-

Multi-factor Authentication

-

-

Identity Lifecycle Management

-

Other

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Banking, Financial Services, and Insurance

-

Retail and Ecommerce

-

Travel & Hospitality

-

Government and Defence

-

Healthcare

-

IT and Telecommunication

-

Energy and Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global digital identity solutions market size was estimated at USD 27,508.5 million in 2022 and is expected to reach USD 32,542.6 million in 2023.

b. The global digital identity solutions market is expected to grow at a compound annual growth rate of 17.2% from 2023 to 2030 to reach USD 98,638.6 million by 2030.

b. North America dominated the digital identity solutions market with a share of 39.6% in 2022. Governments in the region have taken a cautious approach to replacing the physical ID with a digital ID, frequently opting for hybrid identification credentials to balance accessibility and convenience.

b. Some key players operating in the digital identity solutions market include NEC Corporation, Thales., GB Group plc, TELUS, Tessi, Daon, Inc., IDEMIA, ForgeRock, Inc., Imageware., and Jumio

b. Key factors that are driving the digital identity solutions market growth include the development of biometrics integration in smartphones. Also, there is a growing demand for digital identity-based authentication methods such as biometric expertise and multi-factor authentication, which are more secure and reliable than passwords.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."