- Home

- »

- Digital Media

- »

-

Global Digital Marketing Software Market Size Report, 2030GVR Report cover

![Digital Marketing Software Market Size, Share & Trends Report]()

Digital Marketing Software Market Size, Share & Trends Analysis Report By Solution, By Service, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-001-9

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Summary

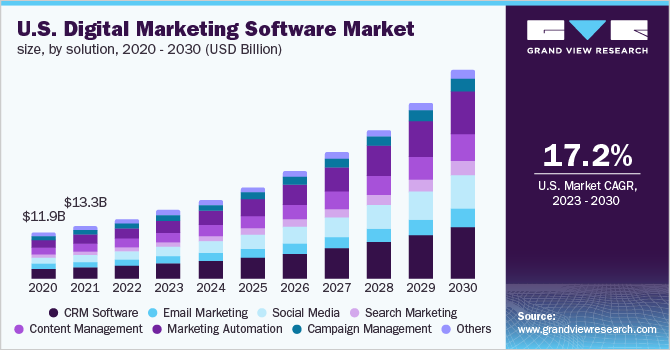

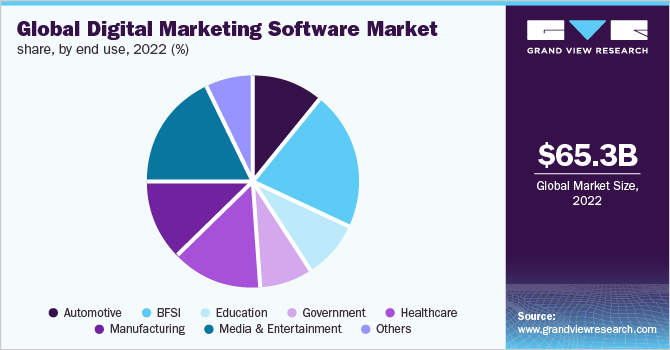

The global digital marketing software market size was valued at USD 65.33 billion in 2022 and is expected to register a CAGR of 19.4% from 2023 to 2030. The digital marketing software market is anticipated to grow over the forecast period due to increased demand for marketing process automation. Additionally, the adoption of modern advertising strategies, such as mobile advertising, has been fostered by the growth of technology and shifting customer behavior. This is mostly due to the consumer's increased attention to brands and goods, supporting market growth. A fundamental shift in business models toward remote working during the COVID-19 pandemic led to an even wider scope for digital marketing services providers. Businesses were compelled to adopt work-from-home policies due to mandatory social distancing regulations, which prompted them to invest in online marketing platforms.

The rising adoption of big data, Augmented Reality (AR), and Virtual Reality (VR) technologies in digital marketing is expected to increase demand for digital marketing software worldwide. With AR and VR, customers can explore a product, engage with the brand, and purchase all at once, providing a genuine try-before-you-buy experience. Big data may help marketers learn more about their customers using predictive analytics, which helps to increase the number of new customers they can acquire. Additionally, the continuous transition from wired to wireless communication and the expansion of wireless communication device usage is expected to trigger digital media consumption and fuel market growth over the forecasted period.

The rising popularity of location-based, video, and social media advertising is expected to boost the market growth. Social media networks' visual nature enables users to develop a visual identity across huge audiences and raise brand awareness. A part of its sales and marketing division's digital transformation. For instance, in March 2022, Adobe, Inc. partnered with BMW Group as a part of its sales and marketing division's digital transformation. The BMW Group is moving closer to its goal of selling a quarter of its automobiles online within the next three years by utilizing Adobe Experience Cloud to provide individualized digital experiences. The BMW Group will provide customers with seamless online and offline experiences, including customized vehicles, doorstep delivery, and post-purchase services, using a data-driven, personalized approach.

Rapid digitalization has transformed how businesses function and execute their business plans. Digital marketing software has given companies a useful tool for connecting with different market players through various channels, such as email, instant text messaging, and social networking. For instance, in September 2022, Salesforce, inc. announced a partnership with WhatsApp that will enable Salesforce users to communicate with their clients and create brand-new WhatsApp messaging experiences. WhatsApp-first business messaging will leverage the companies' best-in-class capabilities to create advanced, practical, integrated, and individualized interactions between individuals and companies throughout the globe.

However, data security and privacy protection concerns are expected to restrain the market's growth. Malware injections, insecure Application Programming Interfaces (APIs), phishing attacks, and social engineering attacks are some major issues surrounding cloud-based digital marketing software. As enterprises have a large data repository of business and customer data, any of the above security issues could lead to events, such as data theft and identity theft, culminating in major losses.

Solution Insights

The CRM software segment accounted for the largest revenue share of over 20% in 2022. The segment growth can be attributed to companies' growing use of CRM software for effective customer communication. Businesses can turn consumer data into useful content owing to CRM software. CRM software offers several advantages, including the capacity to handle enormous numbers of customer and corporate data and manage customer contacts at optimal levels. Businesses' importance on automating tasks like sales, client retention, and customer acquisition is further expected to drive the segment's growth over the forecast period.

The channels businesses prefer to use to develop and strengthen client relationships have changed significantly due to social media's rising popularity. Another significant factor influencing the growth of the social media market is the increasing use of social media platforms by established players in the e-commerce sector to promote products. These platforms include Instagram, Facebook, Snapchat, Twitter, and Pinterest. The segment's growth is also fueled by the continuing incorporation of cutting-edge technology like big data analytics and AI into social media platforms. For instance, chatbots are actively utilized to gather, examine, and visualize customer-related data, such as reactions to goods and services.

Service Insights

The professional services segment accounted for the largest market share of over 65%% in 2022. The need for professional services is expected to rise due to the increasing demand for accomplished and skilled workers with expertise in managing, installing, and troubleshooting software. Enterprises can increase profitability, assure greater resource use, and reduce spending on administrative costs by using professional services. Professional services also assist businesses in managing their resources more effectively by increasing efficiency through improved planning, integrated knowledge management, and increased cooperation, thereby driving the growth of the professional services segment.

The managed services segment is anticipated to register significant growth over the forecast period. This growth can be attributed to the enhanced features of managed services, such as remote monitoring and efficient IT infrastructure management through subscription-based pricing models. Additionally, as IoT-based solutions are adopted more widely, businesses are increasingly concerned about data safety and privacy protection, choosing managed services to maintain their growing databases. A significant element is also developing as the rising demand for cloud-based managed services and the growing reliance of businesses on IT resources to increase company efficiency contribute to the growth of the managed services segment.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 55% in 2022. Businesses may significantly personalize their products and services due to the flexibility of cloud-based digital marketing software implementation. The establishment of a control center to monitor, manage, and arrange many components of a digital marketing campaign is also facilitated by cloud-based deployment. Organizations can also use cloud deployment to pair virtual cloud servers with dedicated hosting infrastructure.

The on-premise deployment segment is expected to register considerable growth over the forecast period. Due to the security features, it provides, several businesses worldwide continue adopting on-premise deployment models. Highly regulated end users tend to choose an on-premise deployment approach, such as those working in the healthcare and BFSI sectors, thereby driving the growth of the on-premise segment.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 50% in 2022. The market demand for large enterprises is expected to be driven by major companies' increasing adoption of digital marketing tools to manage their enormous consumer information effectively. Additionally, the expansion of the large enterprise segment can be attributed to the growing use of digital marketing tools such as CRM, email marketing, and content management for effectively managing big client databases. Large businesses use digital marketing software to control various information sources, including websites, social media platforms, and emails.

The small and medium enterprises (SMEs) segment is anticipated to register significant growth over the forecast period. The segment's steady growth prospects can be attributable to the growing number of small and medium-sized businesses in Singapore, India, and China. Furthermore, the increasing role of government agencies in financing small and medium-sized businesses' adoption of digitization is anticipated to propel the segment's growth. Small and medium-sized companies are enticed to cloud-based digital marketing software due to its lower setup costs, which bodes well for the digital marketing software market growth.

End Use Insights

The BFSI segment accounted for the largest market share of over 20% in 2022. Digital marketing software is widely adopted in the BFSI industry for applications such as statement generation and automatic notification. Moreover, the use of marketing automation software in the sector allows brands to maintain an omnichannel presence by efficiently detecting the most preferred channels of a customer and sending tailored messages through only those channels. Financial institutions and retail banks are focusing on using location-based advertising for improving consumer engagement. These factors are expected to drive the adoption of digital marketing software in the BFSI industry.

Media & entertainment companies are also focusing on developing online advertising strategies as part of their efforts to cash in on the proliferation of smartphones and the continued rollout of high-speed data networks. For instance, Star India, Netflix, Inc., and The Walt Disney Company are among the media & entertainment firms emphasizing the use of social media advertising to inform people about their latest films and shows. Additionally, incumbents of the gaming industry, such as Activision Publishing, Inc.; Rovio Entertainment Corporation; and Electronic Arts Inc.; among others, are aggressively adopting video sharing and social networking platforms for targeting potential customers. For instance, in December 2021, Rovio Entertainment Corporation announced featuring of Angry Birds on Netflix. These are some of the factors that are expected to drive the growth of the media & entertainment segment over the forecast period.

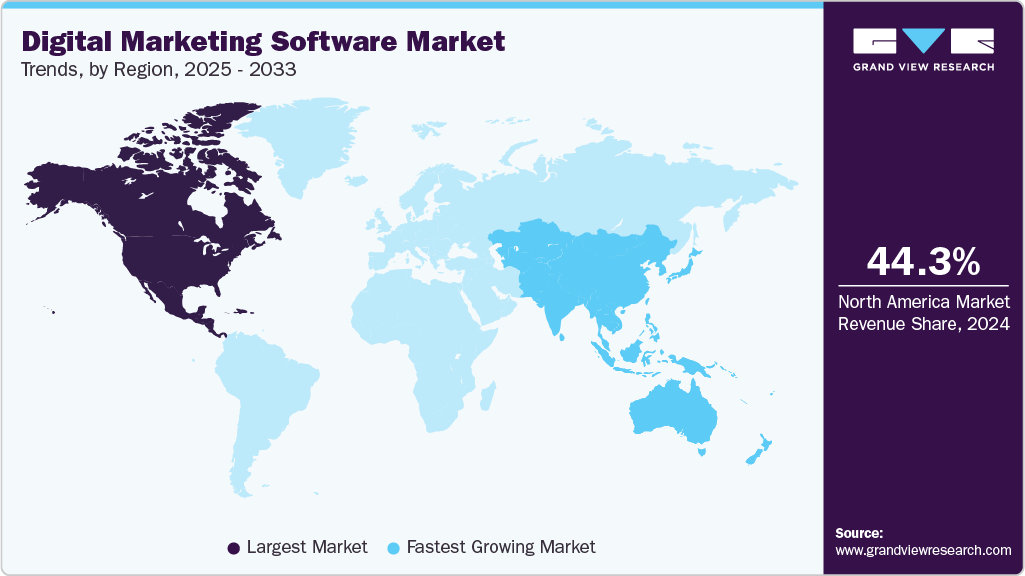

Regional Insights

North America dominated the digital marketing software market in 2022 with a revenue share of over 40%. The regional dominance can be attributed to the prevalence of well-known brands and the reason businesses are discovering a larger target audience to support their content and promote their services and goods online. Additionally, the region's consumers' growing preference for online purchasing would open up opportunities for marketers to promote their services and goods online. In the U.S., various organizations and associations, such as the National Cloud Technologists Association and the Cloud Native Computing Foundation, are encouraging the usage of cloud computing for the deployment of different high-tech solutions, such as content management, marketing automation and CRM on cloud platforms.

Asia Pacific is anticipated to register significant growth over the forecast period. A high population density, proliferation of smartphones, and continued rollout of high-speed data networks characterize the region. For instance, in September 2022, Bharti Airtel announced a partnership with International Business Machines Corporation to set up 120 network data centers across 20 locations on Airtel's edge computing platform in India. The forum is intended to enable large businesses in various industries, including manufacturing and the automotive sector, to accelerate the development of innovative solutions that provide new value to their clients and operations while operating securely at the edge once deployed.

Key Companies & Market Share Insights

Several market players are active in the market, including established players with worldwide operations and regional and local market players catering to a limited number of clients. Hence, the digital marketing software market can be described as a highly fragmented market characterized by intense competitive rivalry. In response to the intensifying competition, some market players are upgrading their existing products and launching new ones. For instance, in May 2022, Accenture plc and SAP SE launched a new collaborative service to assist big businesses with cloud migration and continuous innovation. The new joint offering combines the RISE with an SAP solution and the SOAR with Accenture services offering. It has also been enhanced with new features that cover Accenture's full range of transformation services, including tailored cloud services and exclusive intelligent tools. It is provided through a seamless as-a-service model.

Market incumbents are tweaking their business strategies in line with the proliferation of smartphones and the growing preference for personalized advertising. They are also pursuing various initiatives, such as strategic partnerships and merger & acquisitions, to remain competitive in the market. For instance, in February 2021, HubSpot, Inc. acquired The Hustle, a media company that provides newsletter, podcast, and premium research content. With this acquisition, HubSpot aims to provide its network of scaling businesses with more valuable content across a wider range of topics and media.Some prominent player in the digital marketing software market include:

-

Adobe, Inc.

-

Hewlett Packard Enterprise Company

-

Hubspot, Inc.

-

International Business Machines Corporation

-

Marketo, Inc.

-

Microsoft Corporation

-

Oracle Corporation

-

Salesforce.com, Inc.

-

SAP SE

-

SAS Institute, Inc.

Digital Marketing Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 76.27 billion

Revenue forecast in 2030

USD 264.15 billion

Growth rate

CAGR of 19.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, Brazil

Key companies profiled

Adobe, Inc.; Hewlett Packard Enterprise Company; Hubspot, Inc.; International Business Machines Corporation; Marketo, Inc.; Microsoft Corporation; Oracle Corporation; Salesforce.com, Inc.; SAP SE; and SAS Institute, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Marketing Software Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global digital marketing software market report based on solution, service, deployment, enterprise size, end use, and region:

-

Solution Outlook (Revenue, USD Million; 2018 - 2030)

-

CRM Software

-

Email Marketing

-

Social Media

-

Search Marketing

-

Content Management

-

Marketing Automation

-

Campaign Management

-

Others

-

-

Service Outlook (Revenue, USD Million; 2018 - 2030)

-

Professional Services

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million; 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million; 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Automotive

-

BFSI

-

Education

-

Government

-

Healthcare

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global digital marketing software market size was estimated at USD 65.33 billion in 2022 and is expected to reach USD 76.27 billion in 2023.

b. The global digital marketing software market is expected to grow at a compound annual growth rate of 19.4% from 2023 to 2030 to reach USD 264.15 billion by 2030.

b. North America dominated the digital marketing software market with a share of 44% in 2022. This is attributable to the fact that major companies and brands are finding a broader target audience to promote their content and market their products and services online.

b. Some key players operating in the digital marketing software market include Adobe, Inc.; Hewlett Packard Enterprise Company; Hubspot, Inc.; International Business Machines Corporation; Marketo, Inc.; Microsoft Corporation; Oracle Corporation; Salesforce.com, Inc.; SAP SE; and SAS Institute, Inc.

b. Key factors that are driving the digital marketing software market growth include growth in internet penetration and digitalization across the globe and the rising popularity of social media websites and e-commerce platforms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."