- Home

- »

- Digital Media

- »

-

Digital Out-of-home Advertising Market Size Report, 2030GVR Report cover

![Digital Out-of-home Advertising Market Size, Share & Trends Report]()

Digital Out-of-home Advertising Market Size, Share & Trends Analysis Report By Format (Billboards, Street Furniture, Transit & Transportation, Place-Based Media), By Application, By Industry Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-927-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Market Size & Trends

The global digital out-of-home advertising market size was valued at USD 13.13 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.6% from 2023 to 2030. Digital out-of-home advertising is one of the fastest-growing advertising types due to expansion into new venues & markets, innovation, and enhanced features in outdoor advertising that are accelerating the market growth. Moreover, the increasing demand for creative and interactive displays of full-motion video and the inclusion of animation is expected to drive market growth over the forecast period. Digital out-of-home advertisements provide innovative and creative content, and it becomes more interactive and creative due to the display of data on digital screens in real-time. This feature results in better visibility for digital screens. The growing trend for interactive advertisements for consumers results in increased adoption of digital out-of-home advertisements hence driving the market growth.

Digital out-of-home advertisements are cost-effective using which commercials can reach a wide range of populations thus their usage is high and increasing thus fueling the market growth over the forecast period. Additionally, the growing urbanization and rising infrastructure development across the globe are anticipated to propel market growth over the forecast period. Furthermore, the increasing spending on outdoor advertising by various industries owing to its ability to run multiple advertisements on a single screen is accelerating market growth. For instance, in June 2022, JCDecaux, a provider of outdoor advertising services, in partnership with VIOOH Limited, announced the release of their programmatic digital out-of-home (DOOH) offering in Brazil. The new platform allows advertisers to create efficient, flexible, measurable digital out-of-home campaigns.

Digital outdoor advertising is gaining popularity in the advertising world as it creates brand awareness among people and also compliments the brand’s advertising campaigns on other channels, which are projected to accelerate the market growth. Moreover, as individuals spend much more time outside their offices and home, that allows brands to reach a mass audience consistently and rapidly through out-of-home advertising which is accelerating the market growth over the forecast period. However, intense competition among the vendors of the out-of-home advertising business is restraining the market growth.

Furthermore, the COVID-19 pandemic has accelerated the shift toward digital advertising as brands seek more cost-effective and measurable advertising solutions. Digital out-of-home advertising offers several advantages over traditional advertising, such as real-time tracking and targeting, which make it a more attractive option for brands. The growing popularity of smart cities and the increasing number of public-private partnerships are also expected to drive market growth. For instance, in October 2022, StackAdapt Inc., a company specializing in online advertising services in partnership with Vistar Media, Inc., a location-based ad technology company, announced the launch of a new digital out-of-home (DOOH) channel globally. StackAdapt intends to enhance its ability to deliver scalability and a future-proof differentiated solution through this offering.

Format Insights

The billboards segment contributed to the largest market share of over 67% in 2022. The growing smart advertisement has enabled digital outdoor billboards to interact with the target audience, which is expected to accelerate market growth. Moreover, technological advancements like augmented and virtual reality make outdoor advertising campaigns more engaging and visceral, driving the market growth. For instance, in February 2023, Maxam Ventures Private Limited, a gaming platform that provides various gamified solutions, announced its collaboration with Lemma Technologies to launch its metaverse billboards for real-world digital out-of-home clients. The collaboration intends to assist international brands in making a memorable brand impression on untapped audiences through virtual billboards in the metaverse.

The place-based media segment is anticipated to witness the highest CAGR over the forecast period. Furthermore, the transit & transportation segment held a significant share of the global revenue in 2022. The rising adoption of LCD screens in taxis, buses, or trains for displaying multiple advertisements on a single display accelerates the market growth. Moreover, the consumer's increasing preferences for public transport like buses and trains for daily traveling are the major driving factor for the market growth. Furthermore, the rising adoption of digital transit & transportation advertising for branding and spreading awareness regarding products is expected to accelerate market growth.

Application Insights

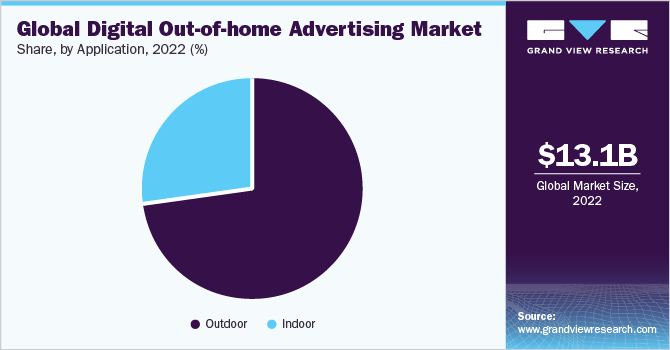

The outdoor segment contributed to the largest market share of over 72% in 2022. Outdoor digital out-of-home kits are more expensive than indoor alternatives. One of the key drivers of the segment's growth is the increasing use of digital technologies such as LED displays, projection mapping, and interactive displays. These technologies allow advertisers to create more engaging and dynamic advertising experiences that can capture consumers' attention in outdoor locations. Additionally, the rise of data-driven advertising solutions contributes to the growth of the outdoor segment. By leveraging data on consumer behavior, demographics, and preferences, advertisers can deliver more relevant and targeted advertising messages to consumers in outdoor locations, increasing their campaigns' effectiveness. For instance, in August 2022, Google, an American multinational technology company, launched digital out-of-home advertising in its display & video 360 ad planning tool. Users can now purchase screens in public sites such as airports, stadiums, shopping centers, bus stops, elevators, and taxis.

The indoor segment is estimated to grow significantly over the forecast period. The indoor segment is a significant part of the industry, encompassing advertising displays and other media in indoor locations such as shopping centers, airports, cinemas, and other public venues. As more business complexes and shopping centers are being built, the indoor segment is projected to grow. Data analytics is increasingly being used to measure the effectiveness of indoor DOOH advertising campaigns. By tracking metrics such as engagement rates, click-through rates, and conversion rates, advertisers can gain insights into which types of ads are most effective and adjust their campaigns accordingly.

Industry Vertical Insights

The real estate segment represented a significant share of above 15% in 2022. Construction industries' rising spending on outdoor advertising to promote their properties and build brand awareness is accelerating market growth. Moreover, the increasing popularity of digital out-of-home advertising for real estate marketing due to the high conversion rate of the ads is accelerating market growth. Furthermore, digital outdoor advertising provides real estate brands an opportunity for creative flexibility to contextually relevant and timely messaging accelerating the market growth over the forecast period.

The government segment is predicted to foresee significant growth in the forecast period. Various governments' rising adoption of digital out-of-home advertising to bring awareness about schemes and newly introduced policies is accelerating market growth. Moreover, increasing political spending on out-of-home advertising during the election campaign and various protests is expected to drive market growth. Furthermore, the automotive segment is also expected to grow at a significant CAGR from 2023 to 2030. The segment's growth is attributed to the elevated use of digital out-of-home advertising in the industry. With the use of digital out-of-home advertising, automotive businesses can launch campaigns in a faster, more flexible, and more accessible manner to raise the level of awareness among consumers regarding dealerships and vehicles. This helps in driving automotive sales, due to which its adoption is increasing hence boosting the market growth.

Regional Insights

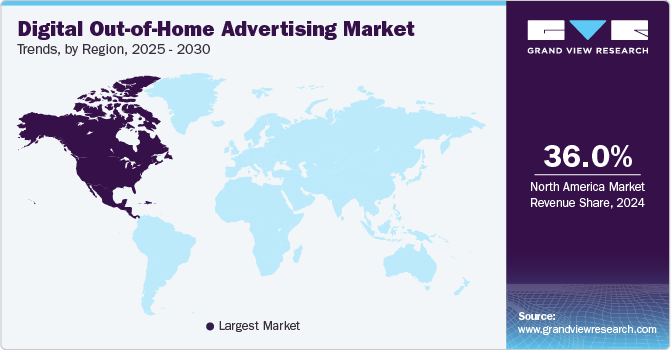

North America dominated the market in 2022, accounting for over 36% share of the global revenue. The growth of the regional market is attributed to the growing adoption of digital out-of-home advertising in commercial verticals, and rapid urbanization in the region's emerging countries, such as the U.S. and Canada. The market's further growth in the region contributes to increasing technological advancements along with the growing proliferation of smart cities. For instance, in February 2022, VIOOH Limited, in partnership with JCDecaux, a provider of outdoor advertising services, launched programmatic digital out-of-home advertising at major U.S. airports. The offering will be available at airports across Texas, California, Pennsylvania, and Massachusetts.

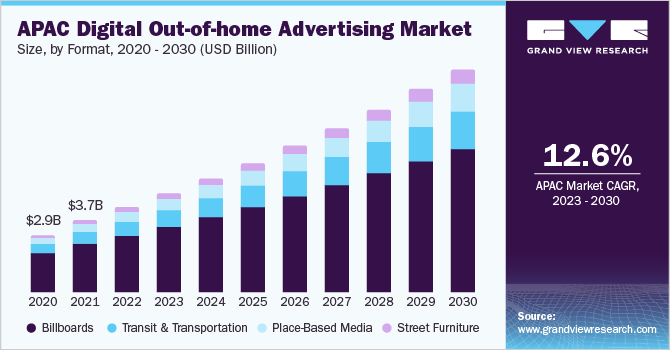

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. This can be credited to the increased spending on digital out-of-home advertising in emerging countries like China, India, and Japan owing to the vast consumer base. Moreover, the increasing popularity and acceptance of out-of-home advertising among the various industry verticals have been projected to boost the digital out-of-home advertising market over the forecast period. Furthermore, the rising infrastructural development in emerging economies like India and China are driving market growth over the last few years. For instance, in February 2023, Closeup, an American brand of toothpaste launched by Unilever, partnered with Times Innovative Media Limited, a provider of customized and comprehensive out-of-home (OOH) solutions, to launch a new digital billboard campaign in Ahmedabad. The campaign targeted the youth audience.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the security industry. For instance, in February 2023, EE Limited, a British national mobile network operator and internet service provider, launched Stay Connected at Night, a billboard-led campaign to deliver agile, technology-enabled routes home. Some of the key players operating in the global digital out-of-home advertising market include:

-

JCDecaux

-

Stroer SE & Co. KGaA

-

Clear Channel Outdoor Holdings, Inc.

-

Outfront Media Inc.

-

oOh!media Limited

-

Lamar Advertising Company

-

Broadsign International LLC.

-

Focus Media

-

Global Outdoor Media Limited

-

Daktronics Dr.

Digital Out-of-home Advertising Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.13 billion

Revenue forecast in 2030

USD 32.63 billion

Growth rate

CAGR of 11.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Format, application, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

JCDecaux; Stroer SE & Co. KGaA; Clear Channel Outdoor Holdings, Inc.; Outfront Media Inc.; oOh!media Limited; Lamar Advertising Company; Broadsign International LLC.; Focus Media; Global Outdoor Media Limited; Daktronics Dr.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Out-of-home Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global digital out-of-home advertising market report based on format, application, industry vertical, and region:

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Financial Services

-

Government

-

Media & Entertainment

-

Retail

-

Real Estate

-

Restaurants

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

Format Outlook (Revenue, USD Million, 2017 - 2030)

-

Billboards

-

Street Furniture

-

Transit & Transportation

-

Roadways

-

Airways

-

Railways

-

Marine

-

Place-Based Media

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital out-of-home advertising market size was estimated at USD 13.13 billion in 2022 and is expected to reach USD 15.13 billion in 2023.

b. The global digital out-of-home advertising market is expected to grow at a compound annual growth rate of 11.6% from 2023 to 2030 to reach USD 32.63 billion by 2030.

b. North America dominated the digital out-of-home advertising market with a share of 37.3% in 2022. This is attributable to the increasing urbanization and rising awareness about the branding of a particular product.

b. Some key players operating in the digital out-of-home advertising market include JCDecaux; Stroer SE & Co. KGaA; Clear Channel Outdoor Holdings, Inc.; Outfront Media; oOh!media Ltd.; Lamar Advertising Company; Broadsign International LLC.; Focus Media; and Global Outdoor Media Limited

b. Key factors that are driving the digital out-of-home advertising market growth include the increasing demand for creative and interactive displays of full-motion video and the inclusion of animation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."