- Home

- »

- Next Generation Technologies

- »

-

Digital Transformation Market Size, Trends Report, 2023-2030GVR Report cover

![Digital Transformation Market Size, Share, Growth & Trends Report]()

Digital Transformation Market Size, Share, Growth & Trends Analysis Report By Solution, By Deployment, By Service, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-851-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Technology

Digital Transformation Market Size & Trends

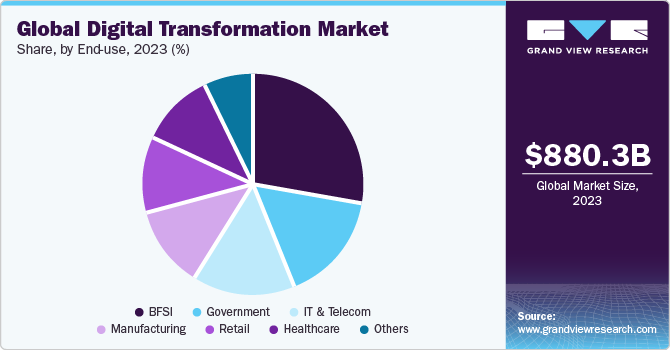

The global digital transformation market size was estimated at USD 880.28 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 27.6% from 2024 to 2030. The market growth can be attributed to the growing adoption of cutting-edge technologies such as cyber security, Artificial Intelligence (AI), big data analytics, Business Intelligence (BI), and cloud, which sparked transformation and innovation in the business environment, resulting in increased revenue. In addition, more businesses are being conducted using email and collaboration & digital tools.

Digital transformation assists organizations in coping with various risks and handling disruptions such as geopolitical conditions, marketplace fluctuation, and rebuilding corporate. Businesses are increasingly utilizing AI, big data, and BI to collect real-time information, get actionable insights, better understand client needs, and boost overall efficiency. The market players emphasize on mergers and acquisitions to help expand their product portfolio and increase market share driving the market growth. For instance, in September 2023, SAP SE announced that they had signed a definitive agreement for the acquisition of LeanIX GmbH. This acquisition will help the company expand their business transformation portfolio and help businesses with AI-enabled process optimization.

Increasing the use of digital experience platforms (DXPs) to enhance the customer experience and brand loyalty is creating a positive outlook for the market. End-use companies from industries/sectors such as BFSI, retail, IT & telecom, and healthcare are implementing DXPs in their business operations to improve customer engagement and accelerate the product’s time to market. End-use companies are partnering with industry players to implement DXPs in their business models. For instance, in August 2021, CoStrategix announced a collaboration agreement with Optimizely to enable its clients to create customer-first digital experiences. CoStrategix simultaneously integrated the Optimizely DXP platform into their current cloud platform to enable data-driven decision-making that is effective and to promote the expansion of the market.

Digital technologies are leading to the rapid shift from legacy systems to modern and efficient systems. For some businesses, digital transformation will be an IT initiative aimed at gaining a competitive advantage. Others will see it as addressing expanding client needs as part of their strategy to stay relevant. Organizations demand an immediate, precise, and real-time feedback with the help of big data analysis to develop new products and services or improve existing ones, to gain a competitive advantage. Further, with the shifting focus of end-user companies on remote working & digital workplaces, AI technological proliferation and automation are playing an important role in creating opportunities for organizations to streamline the process and improve productivity, supporting the market growth.

Digital transformation solutions are designed to enhance the consumer buying experience in both Business-to-Business (B2B) and Business-to-Customer (B2C) scenarios. The evolution of custom development has quickly become a part of the principal methods used by companies to bring customers closer to the company and its brand. Customized development is the creation of a personalized user experience for a brand. Apps are the main customer development sources, and their prevalence reflects their demand. Thus, the demand for customized digitally accessible apps and services that are developing personalized user experience are increasing.

Market Concentration & Characteristics

The market growth is high, and the growth’s pace is accelerating. The rising adoption of industrial robots across the manufacturing sector can be considered one of the major factors driving the market growth. Organizations are focusing on improving their flexibility and agility to adapt to the changing market conditions, regulatory requirements, and customer preferences.

The players are actively focusing on new product development to enhance and extend their current products and services; consequently, organizations have a potential chance to secure new clients and approve the new technological changes. For instance, in June 2021, Accenture plc launched myNav Green Cloud Advisor, which will help assist businesses in achieving their sustainability goals using the cloud. Accenture Cloud First advisors worked with academic specialists to advise clients on long-term cloud migrations and a framework for certifying carbon elimination.

End-user concentration is a significant factor in the market. Large enterprises are leading with the adoption of digital transformation initiatives due to their vast resources. Similarly, SMEs have recognized the importance of adopting digital transformation helping market growth in the coming years.

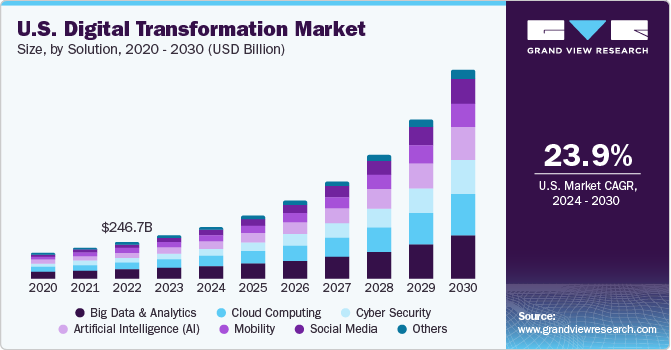

Solution Insights

Based on solution, the big data & analytics segment led the market with largest revenue share of 34.5% in 2023, attributable to the analytical solutions' ability to support a broad range of applications across various end-use industries and growing demand by end-use firms to gain powerful insights from enormous data volumes. The analytical solutions in the market assist industries in increasing operational efficiency, improving yield, and reducing equipment downtime. With the effective use of analytical solutions, end-user companies can understand consumer purchasing patterns and forecast sales more precisely.

The social media segment is anticipated to grow at a CAGR of 29.5% during the forecast period. The shifting focus of end-user enterprises on utilizing social media to reach the maximum potential audience and improve their brand representation is propelling segment growth. Social media is used for promoting sales, marketing of available products & services, maintaining public relations, and product launches. Further, businesses increasingly use social media to gain critical market insights. Higher competition, pressure from consumers, and evolving technologies are compelling businesses to produce, promote, and operate with higher agility & creativity, supporting segment growth.

Service Insights

Based on service, the professional service segment held the market with largest revenue share of 75.0% in 2023. The significant market share can be attributed to the growing demand for professional services such as managed & consulting services in various industries. Organizations focusing on digitalizing their business operations require professional services to solve various issues, such as vendor selection and cultural transformation. The market is anticipated to expand as professional service providers are helping end-user organizations in the deployment and utilization of the appropriate resources.

The implementation and integration service segment is anticipated to grow at the fastest CAGR of 27.4% during the forecast period, owing to end-user organizations' inclination towards implementation service providers for seamless deployment of digital solutions. Further, the implementation & integration of digital transformation solutions is a tedious job which is creating the need for proper assistance for deploying the solutions in the existing framework, supporting the segment growth.

Deployment Insights

Based on deployment, the on-premises segment led the market with the largest revenue share of 49.6% in 2023. On-premises solutions offers high level data security which makes end-users companies easily adopt with various government regulations. Similarly, various on-premises digital transformation solutions offer business a better control over their sensitive data. However, end-use companies are focusing on implementing cloud-based digital transformation solutions owing to its diverse subscription plans and low operating costs, is expected to restrict the market growth in the forecast period.

The hosted segment is expected to grow at the fastest CAGR of 30.8% during the forecast period. This growth can be attributed to the increasing use of mobile devices and advancements in information-sharing technologies Cloud-based digital transformation solutions allow End-use industries, effective and efficient ways to adapt to evolving markets. Simultaneously, increasing private and public investments in cloud-based technology is anticipated to create a lucrative environment for segment growth in the forecast period.

Enterprise Size Insights

Based on enterprise size, the large organization segment led the market with the largest revenue share of 57.8% in 2023. Large enterprises are focusing on digital transformation since it provides cost-effectiveness and seamless business process execution. Large businesses require data safety, enhanced adaptability, and straightforward framework coordination. Due to their greater ability to allocate financial resources, large businesses are better able to implement new strategies throughout the entire organization and increase profitability.

The Small & Medium Enterprise (SME) segment is expected to grow at a significant CAGR of 29.2% over the forecast period. Digitization at a rapid pace, increased company scalability, and improved customer experience are driving the adoption of digital transformation solutions in SMEs. Additionally, there is a growing need for cloud-based solutions due to their greater accessibility and cheaper prices. These factors will drive the market growth in the coming years.

End-use Insights

Based on end-use, the BFSI segment led the market with the largest revenue share of 28.5% in 2023 as banks and financial institutions are focusing on offering enhanced consumer experiences to improve their brand identity and improve their overall customer base. The rising focus of financial institutions on providing support to improve the overall customer retention rate and provide seamless technical support is driving segment growth. The growing popularity of remote working has fueled the market growth in the BFSI industry.

The healthcare segment is anticipated to grow at a significant CAGR of 29.4% over the forecast period. The healthcare segment is anticipated to witness significant growth over the forecast period. Digital transformation in healthcare can produce beneficial results in marketing and sales while providing a holistic view of each patient. Hence, the key market players are concentrating on modernizing their solutions by integrating advanced technologies, such as ML, AI and big data, across their business portfolios. Further, digitalization in healthcare enables organizations to deliver contextual and predictive offerings to their customers.

Regional Insights

North America dominated the market with the revenue share of 42.6% in 2023, owing to the high adoption of different types of online payment modes and the rapid adoption of cloud computing technologies. Further, the growing consumer preference for digital media to post reviews and share experiences is prompting brands and enterprises to adopt digital transformation solutions and develop a customer-centric business model. Enterprises in the U.S. and Canada are spending aggressively and allocating a dedicated budget for marketing and digital channels, supporting the industry trend.

Europe Digital Transformation Market Trends

The Europe digital transformation market is anticipated to grow at a CAGR of 27.5% from 2024 to 2030. Various factors, such as growing social media penetration, expanding 5G network coverage, rising penetration of smartphones, and development of advanced payment methods, are some of the major factors driving the adoption of these solutions in Europe.

The UK digital transformation market held a share of 20.7% in the Europe market. Aggressive investments to implement digital transformation initiatives, such as Industry 4.0, coupled with the growing use of process automation tools powered by the latest technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), are expected to drive the need for solutions to automate processes, minimize variations, and improve customer experience across the U.K.

The digital transformation market in Germany is expected to witness a high growth rate during the forecast period. In Germany, several industries, including financial services, manufacturing and information technology are focusing on digitizing their business operations, thereby creating growth opportunities for digital marketing software in the country.

The France digital transformation market is expected to grow at a CAGR of 29.0% during the forecast period. Increasing adoption of digital technologies by various end-use industries to enhance efficiency and improve the overall customer experience will help in the market growth.

Asia Pacific Digital Transformation Market Trends

The Asia Pacific digital transformation market is anticipated to rise as the fastest growing regional market at a CAGR of 30.3% due to the rising adoption of digital transformation solutions in SMEs. The growing adoption of AI-driven advanced analytics tools to offer personalized services for both B2B and B2C consumers is one of the major factors impacting the growth of the regional market. A large proportion of smartphone users in the Asia Pacific region are accessing social media through their mobile phones. Therefore, the region offers enormous opportunities for digital transformation solutions.

The China Digital Transformation Market held a market share of 25.04% in the Asia Pacific region. In China, organizations are increasingly adopting big data and for various business processes. At the same time, the government supports on digitization of the workplace, thereby encouraging enterprises to adopt EDM solutions.

The digital transformation market in India is anticipated to witness a high growth rate during the forecast period. In countries, such as India, the number of Small & Medium Enterprises (SMEs) is rising rapidly, and these SMEs are putting a strong emphasis on implementing digital transformation solutions as part of the efforts to drive their regional and global businesses.

The Digital Transformation Market in Japan is expected to grow at a CAGR of 29.4% during the forecast period. In Japan, the advanced information technology infrastructure has enabled high-speed digital connectivity, which is allowing vendors to provide both on-premise and hosted digital transformation solutions. The high rate of adoption of mobile phones and other connected devices is also making it easier for organizations in Japan to draft innovative marketing strategies and boost sales.

Middle East & Africa (MEA) Digital Transformation Market Trends

The Middle East & Africa (MEA) market is expected to grow at a CAGR of 29.2% from 2024 to 2030. Initiatives undertaken by governments and corporations to promote advanced technologies, such as machine learning, business analytics, and Al, coupled with continuous adoption of cloud-based technologies, anticipated to fuel the demand for implementing digital transformation across business processes in Middle East countries.

The Saudi Arabia market is anticipated to grow significantly during the forecast period. Infrastructure developments in Saudi Arabia are likely to produce a large volume of data, particularly across the BFSI, retail & consumer goods, healthcare, and utility sectors, which will increase the demand for digital transformation solutions over the forecast period.

Key Digital Transformation Market Company Insights

The key players operating in the market are Accenture plc; International Business Machines Corporation; Microsoft Corporation; and Google, Inc. among others.

-

Accenture plc has a diverse portfolio of digital transformation services, spanning strategy, consulting and operations. This end-to-end approach allows them to guide clients through every aspect of the digital transformation journey

-

Google LLC offers a Google Cloud Platform (GCP) which provides a range of cloud infrastructure and services, including analytics, machine learning, databases and storage. Its infrastructure solutions allow organizations to modernize their IT environment and innovate using their cloud-based solutions

-

BMC Software, Genpact, Software AG, etc. are the emerging players operating in the global market.

-

Genpact leverages data-driven insights and advanced analytics which is useful for organizations to take informed decisions and drive digital transformation initiatives. They help organizations in automating repetitive tasks an important part in the digital transformation journey

-

Software AG offers a variety of analytics and advanced IoT solutions that help organizations harness the power of real-time data from connected devices. Their IoT platform allows businesses to analyze, monitor and optimize processes helping drive the overall efficiency

Key Digital Transformation Companies:

The following are the leading companies in the digital transformation market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these digital transformation companies are analyzed to map the supply network.

- Accenture plc

- Adobe Systems Inc.

- Broadcom, Inc.

- Cisco Systems, Inc.

- Dell EMC

- Dempton Consulting Group

- Google Inc.

- Happiest Minds

- Hewlett Packard Enterprise Co.

- International Business Machines Corporation

- Kellton Tech Solutions Ltd.

- Microsoft Corporation

- Salesforce, Inc.

- SAP SE

- TIBCO Software

Recent Developments

-

In January 2024, Google LLC partnered with Worldline in order to boost its digital transformation initiatives and streamlines their operations. Worldline will use Google’s cloud-based technologies for enhancing their digital payment for customers across Europe

-

In January 2024, Microsoft signed a 10-year partnership agreement with Vodafone for enhancing their customer experience services using generative AI technologies from Microsoft. The companies will develop financial and digital services for SMEs across Africa and Europe

-

In August 2023, HCLTech signed an agreement with TIBCO Solutions, under which the company will upgrade, implement and provide services for TIBCO products globally. This agreement will help strengthen HCL’s professional services portfolio

-

In November 2022, Google LLC partnered with Renault Group with the objective of speeding the digitization of the business and creating and deploying the "Software Defined Vehicle" (SDVdigital) architecture. Through this partnership, the companies will develop a number of software products for the SDV that are both onboard and offboard, and they will increase the use cases and synergies related to the group's "Move to Cloud" agenda

Digital Transformation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,070.43 billion

Revenue forecast in 2030

USD 4,617.78 billion

Growth rate

CAGR of 27.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, Enterprise Size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Accenture plc; Adobe Systems Inc.; Broadcom, Inc.; Cisco Systems, Inc.; Dell EMC; Dempton Consulting Group; Google Inc.; Happiest Minds; Hewlett Packard Enterprise Co.; International Business Machines Corporation; Kellton Tech Solutions Ltd.; Microsoft Corporation; Salesforce, Inc.; SAP SE; and TIBCO Software

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Transformation Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital transformation market report based on solution, service, deployment, enterprise size, End-use, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Big Data & Analytics

-

Artificial Intelligence (AI)

-

Cyber Security

-

Cloud Computing

-

Mobility

-

Social Media

-

Others (Internet-of-Things (IoT), Blockchain, Business Intelligence)

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Implementation & Integration

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others (Education, Media & Entertainment, Transportation, Travel & Hospitality)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital transformation market size was estimated at USD 880.28 billion in 2023 and is expected to reach USD 1,070.43 billion in 2024.

b. The global digital transformation market is expected to grow at a compound annual growth rate of 27.6% from 2024 to 2030 to reach USD 4,617.78 billion by 2030.

b. The Big Data & analytics segment accounted for the largest market share, more than 34.5% in 2023, attributable to the analytical solutions' ability to support a broad range of applications across various end-use industries and growing demand by end-use firms to gain powerful insights from enormous data volumes.

b. The on-premises segment accounted for the market share of 49.6% in 2023. On-premises solutions offer high-level data security which makes end-users companies easily adapt to various government regulations

b. The large organization segment holds the largest market share of 57.8% in 2023. Large enterprises are focusing on digital transformation since it provides cost-effectiveness and seamless business process execution.

b. The key players in the digital transformation market are Accenture plc; Adobe Systems Inc.; Broadcom, Inc.; Cisco Systems, Inc.; Dell EMC; Dempton Consulting Group; Google Inc.; Happiest Minds; Hewlett Packard Enterprise Co.; International Business Machines Corporation; Kellton Tech Solutions Ltd.; Microsoft Corporation; Salesforce, Inc.; SAP SE; and TIBCO Software among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."