- Home

- »

- Next Generation Technologies

- »

-

Digital Twin Market Size, Share And Growth Report, 2030GVR Report cover

![Digital Twin Market Size, Share & Trends Report]()

Digital Twin Market Size, Share & Trends Analysis Report By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-494-9

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Digital Twin Market Size & Trends

The global digital twin market size was estimated at USD 16.75 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 35.7% from 2024 to 2030. Digital twin technology is gaining traction owing to its potential to bridge the gap between the physical and virtual worlds. The global market is expected to grow significantly over the forecast period in line with the growing adoption of the Internet of Things (IoT) and big data analytics and the growing need to ensure cost-efficient operations, optimized processes, and reduced time to market. Moreover, digital twins would continue to evolve in line with innovations in virtual reality and augmented reality, thereby boosting the market's growth. Increasing public and private investments in digital transformation solutions are creating robust opportunities for market growth. Countries, such as the U.S., India, Australia, Brazil, Saudi Arabia, and South Africa, are significantly investing in digital transformation solutions to accelerate digitization.

Moreover, the growing demand for cloud-based digital applications due to factors like cost-effectiveness, ease of access, and flexibility in terms of usage is encouraging market players to develop and provide advanced cloud-native digital twin solutions. Implementing emerging technologies, such as cloud computing, big data, artificial intelligence (AI), IoT, and machine learning (ML), in digital twin solutions is anticipated to boost market growth during the forecast period. Various end-user companies are deploying IoT and AI technologies to collect and interpret data from connected devices, which can be later used in digital twin models to replicate the operation and performance of the existing device. This assists designers & engineers to monitor performance, identify issues, and predict any iterations of common problems.

The integration of these emerging technologies also helps companies in enhancing system productivity and operations, thereby driving market growth. Companies are focusing on deploying digital twin solutions to optimize their operational processes and supply chains to recover financial losses. Growing demand for digital twin solutions is encouraging industry players to improve their product portfolio and geographic expansion to achieve higher profitability from the market. For instance, in June 2023, a software company, Matterport, Inc., partnered with technology solution distributor CompuSoluciones to accelerate the sales of its digital twin solutions in key regions of Latin America, such as Mexico and Columbia.

With these partnerships, CompuSoluciones will offer Matterport, Inc.’s D cameras and digital twin solutions to various SMEs in Latin America. End-user industries, such as manufacturing, automotive, aerospace, defense, residential & commercial, and retail & consumer goods companies, can obtain greater insights into the features, qualities, specifications, and utilization of the products. Defense organizations are focused on developing their digital & IT infrastructure and the digital twin, which helps them accomplish better communication, thereby driving market growth.

For instance, in February 2024, Matterport, a software development company, partnered with Arcadus, an engineering and consulting services provider, to facilitate digital twin products to federal, state, and local agencies. Using the platform, agencies can remotely oversee operations and generate realistic, interactive 3D models of assets that comply with federal regulations. With the new contract, Arcadus would offer Matterport's three primary solutions in property marketing, design and construction, and facilities management, making it the first reseller of the company's digital twin platform for the public sector.

Market Concentration & Characteristics

Innovation, global competition, and technological advances can be considered key driving factors responsible for market expansion and growth. The digital twin has provided businesses with additional means to cut costs and augment profits effectively. Digital twin providers are anticipated to leverage new technological innovations to manage the time-to-market concerns efficiently, increase the existing system’s productivity, and optimize internal processes, product designs, and systems to reduce energy consumption, enhance the production layout, and minimize investments, among others. Over the past few years, the emergence of technologies, such as Robotic Process Automation (RPA), has started to influence the market.

RPA, with its cost-saving abilities, speed, and efficiency, is gradually making inroads into all industries. RPA has also emerged as the fastest-growing trend in digital twin platforms, particularly in the manufacturing sector, to ensure high-value creation, fast time-to-value, and notable cost savings. In an industrial production site, a significant proportion of the work is based on assembly operations, which require high production flexibility and are also difficult to automate. The need to handle the fluctuating production quantities and complex product geometries further adds to the complexity of assembly lines and their operations. High adoption of process automation in the industry drives market growth.

Increasing adoption of technologies such as AI, ML, IoT, cloud computing, big data analytics, and other related technologies by key market players for building robust digital twin solutions is making it possible to design and represent unreal and epic replicas of real assets in the digital environment.Industrial automation and other automation solutions, such as lean automation, human-machine collaboration, and hybrid automation, have been replacing manual systems to enhance manufacturing productivity, helping overcome the higher production flexibility concerns. Concepts of Robotics 2.0 and industrial robots called cobots or collaborative robots are also transforming the market. A cobot is equipped with advanced safety technologies capable of reaching every coordinate of its workspace in multiple configurations. Additionally, a cobot also adds flexibility and efficiency to manual processes. The emergence of a human-robot collaborative work environment is prompting various players to invest in R&D facilities and manufacturing centers to introduce new technologies, thereby triggering the demand for digital twin platforms over the forecast period.

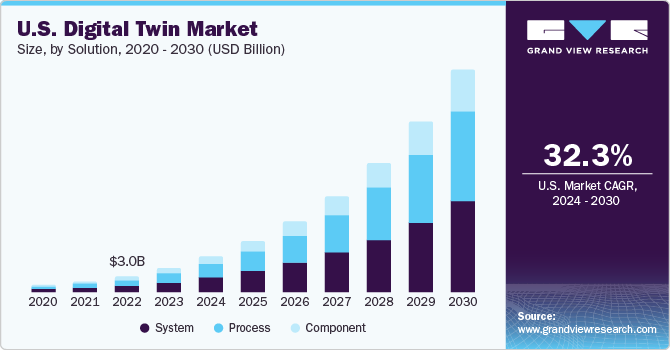

Solution Insights

The system segment led the market and accounted for around 41.0% of the global revenue share in 2023. The high market share can be attributed to the growing usage of digital twin solutions for developing and designing assembly lines, communication systems, and piping systems in oil & gas, automotive models, and aerospace sectors. System twins are an integration of several assets, which allows engineers to observe and interpret the synchronization of components during operation and system performance, supporting segment growth.

The process segment is anticipated to witness a significant CAGR of 37.5% from 2024 to 2030. This growth can be attributed to the increasing usage of digital twins for optimizing & designing workflows in supply chain processes, warehouse processes, smart city projects, and production. Major organizations are significantly emphasizing minimizing operational costs and improving coordination across all operations. Digital twin solutions assist enterprises in developing workflow structures, thereby improving collaboration with suppliers as well as within internal departments.

Deployment Insights

The on-premise deployment segment accounted for the largest revenue share in 2023 due to the high adoption of on-premise solutions by large enterprises for enhanced security and ease of compliance with government regulations. Furthermore, large enterprises have critical business information, and to protect it, these enterprises choose complete ownership of solutions. However, lately, consumer focus is shifting toward cloud-based solutions owing to their easy operation and low operating costs. Therefore, the on-premise segment is expected to witness slow growth during the forecast period.

The cloud-based deployment segment is expected to register the fastest CAGR from 2024 to 2030. Cloud-based platforms offer higher flexibility and cost-effectiveness to businesses by reducing investments in installing physical infrastructure and maintenance costs. The growing popularity of cloud-based solutions is encouraging players to develop and provide advanced cloud-native digital twin technologies. For instance, in November 2022, Dassault Systems transferred its digital twin operation to the cloud with an aim to provide end-to-end independent cloud service that is directly linked to each customer's core business and helps them generate value from data on various levels.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share in 2023. The high market share can be attributed to the increasing use of digital twins by large enterprises to reduce the product time to market and enhance product performance. The digital twin offers end-to-end visibility on the product and its operations, which assists these organizations in planning the maintenance of the machinery, supporting the segment growth.

The small enterprises segment is expected to register the fastest CAGR from 2024 to 2030. There is a growing adoption of digital twin solutions among SMEs to optimize product development costs and easy availability of affordable solutions. Furthermore, with digital twin solutions, SMEs can monitor the device's performance and gain valuable insights to avoid machine failure or damage.

Application Insights

The predictive maintenance segment accounted for the largest revenue share in 2023. With the help of digital twin in predictive maintenance, engineers can determine and schedule the maintenance preventing machine failure by enabling scheduled maintenance as per actual need and reducing downtime. Businesses can leverage digital twins in their predictive maintenance to address various performance issues without under or over-investing in critical resources.

Product design & development is expected to register the fastest CAGR during the forecast period. Digital twin solutions are experiencing high demand in product design & development owing to their various benefits, such as assisting engineers & designers in visualizing design concepts, reviewing manufacturing operations using computer-aided manufacturing (CAM) software, and simulating design performance.

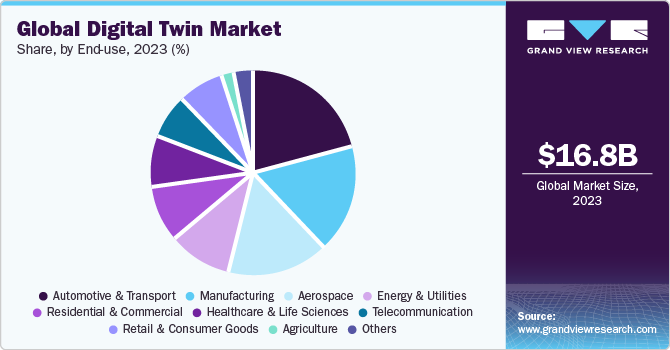

End-use Insights

The automotive & transport end-use segment accounted for the largest revenue share of around 21.0% in 2023. The high market share can be attributed to the growing adoption of digital twins in this sector due to its various benefits, such as cost optimization, enhanced safety of vehicles, and high productivity. Digital twin technology can assist manufacturers and operators in making better decisions about how to design, operate, and maintain vehicles, as well as improve the supply chain by providing real-time data and insights. Real-time vehicle health monitoring can be performed with the help of digital twin technology, which also aids in anticipating maintenance requirements and planning them accordingly.

The telecommunication end-use segment is projected to witness a significant CAGR of 40.0% from 2024 to 2030. Digital twin technology is used in monitoring telecom network systems and identifying potential issues before they become problems. This can reduce maintenance costs and minimize downtime. The telecommunications sector uses digital twin technologies to enhance customer experience, boost efficiency, and optimize network design. Engineers, network managers, and service providers can improve their decisions regarding network planning, resource allocation, and service delivery by using digital twin technology, which offers real-time data and insights.

Regional Insights

North America region dominated the market and accounted for a share of around 34.0% in 2023. The regional growth can be attributed to the emergence of technologies, such as Robotic Process Automation (RPA), Virtual Reality (VR), and the IoT, which has started to influence the digital twin industry. Key companies in the U.S., such as International Business Machines Corporation, Microsoft Corporation, and General Electric, are effectively working on new product development and enhancement of existing products to acquire customers and capture more market shares.

U.S. Digital Twin Market Trends

Key companies in the U.S., such as International Business Machines Corporation, Microsoft Corporation, and General Electric, are effectively working on new product development and enhancement of existing products to acquire customers and capture more market shares.

Europe Digital Twin Market Trends

The digital twin market in Europe is expected to grow at a CAGR of 38.1% from 2024 to 2030. The growth can be attributed to the rising adoption of Industry 4.0 technologies and the development of emerging technologies, such as big data analytics, IoT, AI, and Machine Learning (ML). In February 2023, Ericsson, the Swedish multinational networking, and telecommunications company, announced that it would demonstrate its new indoor and macro equipment, live digital twin of 6G network, and Fixed Wireless Access (FWA) at the Mobile World Congress 2023, Barcelona.

UK digital twin market is expected to grow at a CAGR of 40.6% from 2024 to 2030 on account of various initiatives being pursued by both companies and government agencies to encourage digitization. For instance, in March 2023, The Alan Turing Institute (National Institute for Data Science and Artificial Intelligence) announced the launch of the Turing Research and Innovation Cluster (TRIC), which is focused on digital twins. The TRIC-DT aims to democratize access to digital twins by offering open and reproducible computational and social tools for developing digital twin and deploying national service.

Digital twin market in Germany is expected to grow at a CAGR of 42.8% from 2024 to 2030. Advancements in digital technologies and emerging startups in Germany are driving the growth of the digital twin market. Several residential establishments, academic institutions, and enterprises in the country are focusing on automating their building operations to reduce workforce costs.

France digital twin market in is expected to grow at a CAGR of 34.8% from 2024 to 2030 due to rising government initiatives, such as the National Strategy for AI and France 2030.The COVID-19 pandemic disrupted French multinational companies and prompted them to undertake several initiatives to accelerate digital transformation and change their IT infrastructure to better adapt to the new norm. Several organizations tried to overcome the challenges by rapidly digitizing, enabling remote working, improving online presentation, expanding their online businesses, and finding ways to provide better customer satisfaction.

Asia Pacific Digital Twin Market Trends

The market in Asia Pacific is expected to grow at a CAGR of 36.7% from 2024 to 2030. The regional market growth can be attributed to rising digital infrastructure, increasing manufacturing output, and improved technological adoption, among others. Furthermore, the utilization of digital twins in smart city projects, and supportive government initiatives for digitalization are creating robust growth opportunities for the market.

Digital twin market in China is projected to grow at a CAGR of 38.5% from 2024 to 2030. In terms of economic digitalization, China will boost the construction of digital industrial clusters in Integrated Circuits (IC) and Artificial Intelligence (AI), which will put the country into a key hub of the digital economic network.

Japan digital twin market in is projected to grow at a CAGR of 34.0% from 2024 to 2030. The digital twin market in Japan has made remarkable progress in the field of robotics. Japanese companies and research institutions have been at the forefront of creating innovative robots that leverage AI to perform various tasks. In addition, Japan is actively developing social and companion robots capable of interacting with humans and offering assistance in diverse environments.

Digital twin market in india is projected to grow at a CAGR of 45.8% from 2024 to 2030. The growing deployment of cloud-based solutions, rising demand for big data analytics, and increasing implementation of AI in digital experience platforms have significantly propelled the growth of the India digital twin market. Customer engagement is critical in India. Digital experience platforms can serve as the foundation of the engagement model by assisting brands in listening to their customers, acting on data more spontaneously, and creating an experience to which every customer can relate.

Middle East and Africa (MEA) Digital Twin Market Trends

The market in MEA is projected to grow at a CAGR of 14.9% from 2024 to 2030. The implementation of emerging technologies, such as cloud computing, big data, Artificial Intelligence (AI), IoT, and Machine Learning (ML) in digital twin solutions is anticipated to boost the MEA digital twin market growth. Various end-user companies in the region are deploying IoT and AI technologies to collect and interpret data from connected devices, which can be later used in digital twin models to replicate the operation and performance of the existing devices.

Digital twin market in Saudi Arabia is expected to grow significantly over the forecast period. The Saudi government's initiatives to increase the diversity of its economy and boost the country's manufacturing sector will result in an increased utilization of digital twins. For instance, in March 2023, NAVER Corp., a South Korean internet technology startup, signed a MOU with two Saudi Arabian ministries to help accelerate the country's digital transformation initiatives. The alliance is designed to boost innovation and improve digital skills in terms of digital twins for Saudi Arabia's multiple sectors.

Key Digital Twin Company Insights

Some of the key players operating in the market include ABB Group; International Business Machines Corporation; Microsoft Corporation; and Rockwell Automation.

-

ABB Group is a technology company that aids in the transformation of industry and society toward a productive and sustainable future. ABB operates its business through four business areas, namely Electrification, Process Automation, Motion, and Robotics & Discrete Automation. The Robotics & Discrete Automation segment offers industrial robots, software, robotic solutions and systems, field services, spare parts, and digital services

-

International Business Machines Corporation is a global Information Technology (IT) company that provides software and solutions for digital technologies. The services offered by the company include business process & operations, cloud services, digital workplace services, technology support services, business resilience services, network services, application services, and security services.The company has several fully owned subsidiaries, such as WTC Insurance Corporation, Ltd.; IBM Canada Limited; IBM Global Financing Denmark ApS; IBM Egypt Business Support Services; International Business Machines Gabon SARL; PT IBM Indonesia; International Business Machines Madagascar SARLU; and Companhia IBM Portuguesa, S.A.; among others

PTC Inc. and AVEVA Group Plc are some of the emerging market participants in the digital twin market.

-

PTC Inc. is a provider of design and modeling software and services. The company offers solutions for improving manufacturing, operations, and designs for industrial products. The company’s product portfolio includes Augmented Reality (AR) tools & solutions, Industrial Internet of Things (IIOT) software, CAD software, PLM software, PTC Mathcad software, and Services Lifecycle Management (SLM) software, among other products. The company caters to the incumbents of various industries and industry verticals, including automotive, life sciences, oil & gas, retail & consumer products, aerospace & defense, electronics & high-tech, and manufacturing

-

AVEVA Group Plc provides industrial and engineering software. The company’s offerings include process engineering & simulation, asset maintenance, asset analysis, industrial information management, supply chain scheduling, network & distribution optimization, and operations optimization, among others

Key Digital Twin Companies:

The following are the leading companies in the digital twin market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Group

- Amazon Web Services, Inc.

- ANSYS, Inc.

- Autodesk Inc.

- AVEVA Group plc

- Bentley Systems Inc.

- Dassault Systemes

- General Electric

- Hexagon AB

- International Business Machines Corporation

- Microsoft Corporation

- PTC Inc.

- Robert Bosch GmbH

- Rockwell Automation

- SAP SE

- Siemens AG

Recent Developments

-

In January 2024, Valeo, an automotive technology provider, partnered with Applied Intuition, a vehicle software supplier, to provide a digital twin platform for advanced driver-assistance systems (ADAS) sensor simulation. OEMs would be able to bring reliable and safe ADAS features to market faster with the joint solution

-

In April 2023, Rockwell Automation installed a Robotic Supervision System (RSS) for TotalEnergies. RSS combines the Internet of Things (IoT), gamification, and digital twin technology to improve industrial robot management and monitoring. The system aims to maximize robot performance, upkeep, and productivity, reflecting the continued growth of manufacturing automation and digital technologies in the renewable energy sector

-

In March 2023, WSP collaborated with Amazon Web Services, Inc. to develop digital twins for complex infrastructure. The collaboration intends to leverage Amazon Web Services, Inc.'s cloud data processing and analytics services to drive innovation and long-term solutions across several industries. It aims to utilize Amazon Web Services, Inc.’s technology to improve WSP's services in areas, such as planning for infrastructure, environmental sustainability, and data-driven choices

Digital Twin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.97 billion

Revenue forecast in 2030

USD 155.84 billion

Growth rate

CAGR of 35.7% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB Group; Amazon Web Services, Inc.; ANSYS, Inc.; Autodesk Inc.; AVEVA Group plc; Bentley Systems Inc.; Dassault Systemes; General Electric; Hexagon AB; International Business Machines Corp.; Microsoft Corp.; PTC Inc.; Robert Bosch GmbH; Rockwell Automation; SAP SE; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Twin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the digital twin market report based on solution, deployment, enterprise size, application, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Component

-

Process

-

System

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product Design & Development

-

Predictive Maintenance

-

Business Optimization

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Agriculture

-

Automotive & Transport

-

Energy & Utilities

-

Healthcare & Life Sciences

-

Residential & Commercial

-

Retail & Consumer Goods

-

Aerospace

-

Telecommunication

-

Others(Aerospace & Defense, Mining, Financial Services)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital twin market size was estimated at USD 16.75 billion in 2023 and is expected to reach USD 24.97 billion in 2024.

b. The global digital twin market is expected to grow at a compound annual growth rate of 35.7% from 2024 to 2030 to reach USD 155.84 billion by 2030.

b. North America accounted for 35.26% revenue share in 2023 in the digital twin market and is expected to grow steadily over the forecast period. The regional healthcare industry is characterized by the extensive use of technology and is anticipated to be one of the early adopters of the digital twin in the healthcare sector.

b. The automotive & transport segment dominated the digital twin market with a share of 21.05% in 2023. The high market share can be attributed to growing adoption of digital twin in this sector due to its various benefits such as cost optimization, enhanced safety of vehicles, and high productivity.

b. The key players operating in the digital twin market include ABB, ANSYS, Inc., Autodesk Inc., AVEVA Group plc, Amazon Web Services, Inc., Dassault Systèmes, GE DIGITAL, General Electric, Hexagon AB, IBM Corporation, Microsoft Corporation, PTC Inc., Rockwell Automation, SAP SE, and Siemens AG;

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."