- Home

- »

- Communications Infrastructure

- »

-

Direct Attach Cable Market Size, Share, Growth Report, 2025GVR Report cover

![Direct Attach Cable Market Size, Share & Trends Report]()

Direct Attach Cable Market Size, Share & Trends Analysis Report By Product Type, By Form Factor, By End Users (Networking, Telecommunications, Data Storage), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-696-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Technology

Report Overview

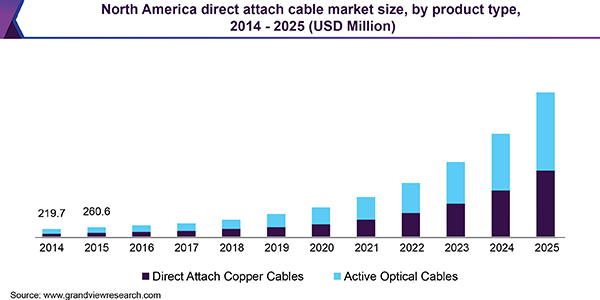

The global direct attach cable market size was valued at USD 1.18 billion in 2017 and is expected to grow at a compound annual growth rate (CAGR) of 36.4% from 2018 to 2025. This growth can be attributed to rising product adoption for data storage. Increasing investments by manufacturers in order to meet evolving requirements of high bandwidth applications and high-density applications, and lower power consumption are expected to drive demand for active optical cables (AOCs) and direct attach copper (DAC) cables.

Datacenter operators use direct attach cable assemblies for data storage on account of the cost-saving and energy-saving benefits they offer. In addition, AOCs act as the main transmission medium in data centers and high-performance computing (HPC) centers to ensure flexibility and stability of data transmission.

The increasing demand for next-generation high-speed pluggable-products is boosting the growth of the market over the forecast period. For instance, Molex, LLC introduced Quad Small Form-Factor pluggable plus products such as QSFP28, and QSFP56-DD interconnect Form Factors for high-density applications they require a speed of up to 400 Gbps. QSPF28 and QSFP56-DD can be combined with servers, switches, routers, and SAN cards. The pluggable products can perform in extreme conditions such as high-temperature data centers. These next-generation cables are used to support the ultra-fast speed required by the hyper-scale industry.

The high installation cost of AOCs is impeding the market growth. An active optical cable undergoes a variety of testing costs such as optical testing and electrical testing. Optical testing accounts for almost 40-50 percent of the total cost of manufacturing. The AOC can be tested in a switch system as an electrical test. Optical cables with its advancements have surpassed the usage of copper-cable for data or network transmission.

However, the high costs associated with the set-up of optical cable networks, as well as the expensive raw materials used in the manufacture of optical cables, for instance, silica and plastic, are additional factors that hinder the growth of the market. Furthermore, the continuous R&D activities undertaken by the manufacturers in order to produce next-generation AOCs and transceivers to meet the evolving requirements of data centers is an expensive process, which impedes the market growth over the forecast period.

The growing use of active optical cables in consumer electronics such as 4K televisions and digital signage is anticipated to spur market growth over the forecast period. For instance, in April 2018, HDMI 2.0 active optic cables of Cosemi Technologies Inc. have been certified by Imaging Science Foundation (ISF) for 18 GB/s performance. With the objective of improving the quality of electronic imaging, extensive field and lab testing was performed by ISF to produce visually superior color-rich images with clarity. Moreover, benefits such as increased bandwidth capacity, a speed of up to 18Gb/s, greater security and reliability as offered by HMDI AOCs are increasing their demand in this market, which in turn, fuels the growth of the market over the forecast period.

Product Type Insights

On the basis of product type, the market has been segmented into direct attach copper cables and active optical cables. DAC cables are of two main types: passive and active. In 2017, the AOC segment accounted for the largest market share primarily owing to the increasing need for bandwidth requirements of high-performance computing centers and surge in deployment of data centers. AOCs are also used in hyper-scale builders and storage subsystems, which run 10G or 25G from a Top-of-Rack switch to subsystems.

Form Factor Insights

On the basis of form factor, the direct attach cable market has been segmented into small form-factor pluggable transceiver (SFP), quad-small form-factor pluggable transceiver (QSFP), common form-factor pluggable transceiver (CFP), CXP, Cx4, and CDFP. The Cx4 and CXP segments are expected to grow at a steady rate over the forecast period.

In 2017, QSFP accounted for the largest market share. The pluggable products can operate even in extreme conditions, such as high-temperature data centers. Increasing investments by manufacturers to introduce next-generation pluggable products is boosting segment growth. For instance, Molex, LLC introduced products such as QSFP28, and QSFP56-DD interconnect form factors for high-density applications with a speed of up to 400 Gbps.

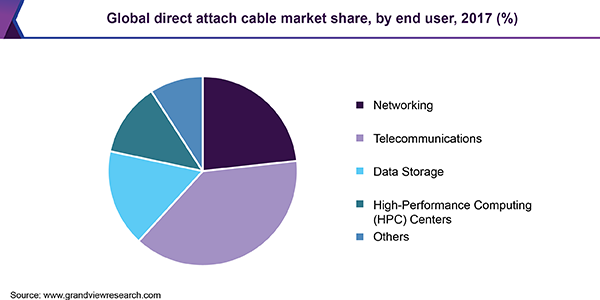

End-user Insights

On the basis of end-user, the market has been segmented into telecommunications, networking, data storage, high-performance computing centers, and others. The others segment, which includes consumer electronics such as 4K TV, is anticipated to grow considerably over the forecast period.

AOCs are also used in digital signage. For instance, in 2016, Cosemi Technologies, Inc. introduced OptoHD AOCs for various devices at home and work by providing ultra-high-definition quality. In 2012, Hitachi Ltd introduced Active Optical HDMI cables, which transmit image signals through optical fibers as utilized in digital signage and electronics such as Full HD TVs, 4K TVs, 2K TVs, and 3D TVs.

In 2017, the telecommunications segment accounted for the largest market share. AOCs play a crucial role in the telecom industry, facilitating the transmission of information from one point to another with maximum speed and minimum errors. Presently, there is a swift increase in the global population, a factor that necessitates the establishment of more data centers and superior internet capabilities for communication. To meet this surging network demand, effective communication cables, such as AOCs, are required.

Regional Insights

Based on the region, the market has been segmented into North America, Europe, Asia Pacific, South America, and Middle East and Africa. North America is anticipated to dominate the global market over the forecast period, predominantly due to soaring demand for higher bandwidth speeds in high-performance computing centers as well as a consistent increase in data centers.

The Asia Pacific market is expected to register substantial growth over the forecast period, owing to the rising need for enhancements and rising establishment of data centers in countries such as China, India, and Japan. Europe is expected to grow at a stable rate over the coming years owing to increased bandwidth requirements in countries such as U.K. and Germany.

Key Companies & Market Share Insights

Key players operating in the market include Arista Networks, Inc.; Cisco Systems, Inc.; Cleveland Cable Company; Hitachi, Ltd.; Juniper Networks; Methode Electronics; Molex, LLC; Nexans; Panduit; ProLabs Ltd; Solid Optics; The Siemon Company; 3M; Avago Technologies Ltd; Emcore Corporation; FCI Electronics; Finisar Corporation; Shenzhen Gigalight Technology Co., Ltd; Sumitomo Electric Industries, Ltd; and TE Connectivity Ltd.

Various manufacturers are introducing AOCs and DAC cables for data centers. For instance, in January 2018, Nexans announced the addition of these cables to its data center solutions product portfolio. The products were introduced to expand the offerings of the data center segment and were designed to offer cost-effective, high-performance, and reliable solutions. Some of the key players in the global direct attach cable market include:

-

Arista Networks, Inc.

-

Cisco Systems, Inc.

-

Cleveland Cable Company

-

Hitachi, Ltd.

-

Juniper Networks

-

Methode Electronics

-

Molex, LLC

-

Nexans

-

Panduit

-

ProLabs Ltd

-

Solid Optics

-

The Siemon Company

-

3M

-

Avago Technologies Ltd

-

Emcore Corporation

-

FCI Electronics

-

Finisar Corporation

-

Shenzhen Gigalight Technology Co., Ltd

-

Sumitomo Electric Industries, Ltd

-

TE Connectivity Ltd.

Recent Developments

-

In October 2022, Molex launched the PCIe Cable Connection System for Open Compute Project Servers. New direct-attached cable technology is used by NearStack PCIe Connector System and Cable Assemblies to enhance signal integrity, lower insertion loss, and shorten signal delay .

-

In June 2022, Arista launched next-generation 7130 Series Systems for Converged Ultra Low Latency Networking. The new solution was developed to enhance client agility by combining several devices to cut costs, reduce complexity, and optimize power consumption.

-

In September 2021, Nexans launched the VIGISHIELD solution. This solution provides complete control over the projects and timelines, offers constant monitoring of the cables, and delivers a significant decrease in the direct and indirect costs related to cable theft.

-

In May 2022, Sumitomo Electric Industries, Ltd. signed an agreement with Samsung C&T Corporation of South Korea. The main purpose of this agreement was the delivery of high-voltage direct current (HVDC) undersea cables to Abu Dhabi National Oil Company

Direct Attach Cable Market Report Scope

Report Attribute

Details

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative Units

Revenue in USD million & CAGR from 2018 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment covered

Product type, form factor, end-user, region

Regional scope

North America, Europe, Asia Pacific, South America and MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, and Brazil

Key companies profiled

Arista Networks, Inc.; Cisco Systems, Inc.; Cleveland Cable Company; Hitachi, Ltd.; Juniper Networks; Methode Electronics; Molex, LLC; Nexans; Panduit; ProLabs Ltd; Solid Optics; The Siemon Company; 3M; Avago Technologies Ltd; Emcore Corporation; FCI Electronics; Finisar Corporation; Shenzhen Gigalight Technology Co., Ltd; Sumitomo Electric Industries, Ltd; TE Connectivity Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global direct attach cable market report based on product type, form factor, end-user, and region:

-

Product Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Direct Attach Copper Cables

-

Passive

-

Active

-

Active Optical Cables

-

-

Form Factor Outlook (Revenue, USD Million, 2014 - 2025)

-

QSFP

-

SFP

-

CXP

-

Cx4

-

CFP

-

CDFP

-

-

End-user Outlook (Revenue, USD Million, 2014 - 2025)

-

Networking

-

Telecommunications

-

Data Storage

-

High-Performance Computing (HPC) Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."