- Home

- »

- Medical Devices

- »

-

Disposable Endoscopes Market Size & Share Report, 2030GVR Report cover

![Disposable Endoscopes Market Size, Share & Trends Report]()

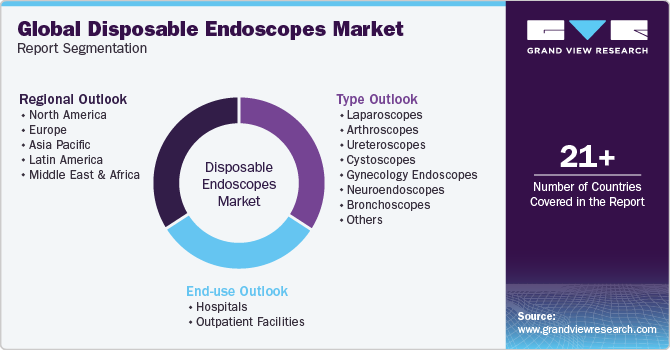

Disposable Endoscopes Market Size, Share & Trends Analysis Report By Type (Laparoscopes, Arthroscopes), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-638-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2022

- Industry: Healthcare

Market Size & Trends

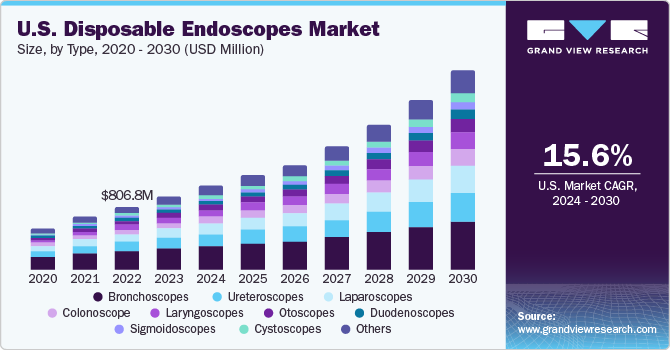

The global disposable endoscopes market was estimated at USD 2.46 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.0% from 2024 to 2030. Rising demand for single use endoscopes for eliminating the risk of device-related infection is a key factor driving the global market growth. Moreover, higher patient preference for minimally invasive procedures, supportive regulatory framework, and favorable reimbursement policies in developed countries are further fueling the market growth. Moreover, the increasing investments, funds, grants by governments and other organizations to improve healthcare infrastructure and research areas of endoscopy has created lucrative growth opportunities for the market.

COVID-19 pandemic partially impacted the market as the number of surgical procedures declined due to reduced hospital and outpatient department visits. In addition, patients emphasized more on safety and elimination of every possible chance of infection. However, in the second phase of pandemic, the adoption of disposable medical devices raised significantly as it reduced the chances of cross contamination. Hence, the raised adoption of single use endoscopy devices and higher burden of target diseases are anticipated to cater market demand during the forecast period.

The increasing adoption of minimally invasive procedures owing to several benefits such as high patient acceptance rate, less pain, cost effective nature and less chances of complications is fueling growth of the global market. For instance, according to NIH as of January 2023, there is an increasing trend of ambulatory minimally invasive procedures in the U.S. In addition, evolving demand of disposable endoscopes across hospitals, diagnostic centers, and escalating adoption of single use endoscopy devices for ENT, bronchoscopy, dentistry procedures are likely to provide growth momentum over the forecast period.

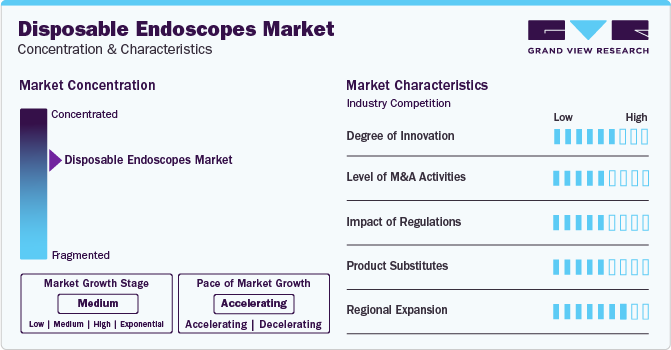

Market Concentration & Characteristics

The global market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced regularly. Companies continually introduce advanced technologies to enhance diagnostic and therapeutic capabilities. Advanced features, such as improved imaging and ergonomic designs, characterize the latest disposable endoscope models.

Several market players such as Ambu A/S; Boston Scientific Corporation; obp Surgical Corporation; COOPERSURGICAL, INC. and Olympus Corporation are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Stringent guidelines and standards imposed by health authorities influence product development, manufacturing processes, and market access. Compliance with these regulations ensures that disposable endoscopes meet the required safety and performance standards, fostering trust among healthcare practitioners and end-users. Navigating the regulatory landscape effectively is crucial for companies aiming to thrive in this dynamic market.

Advances in non-invasive imaging technologies and telemedicine solutions present alternatives to certain diagnostic procedures traditionally conducted using endoscopes. Market players must adapt to evolving trends in diagnostic methods and invest in product differentiation to address the competitive landscape posed by these substitutes.

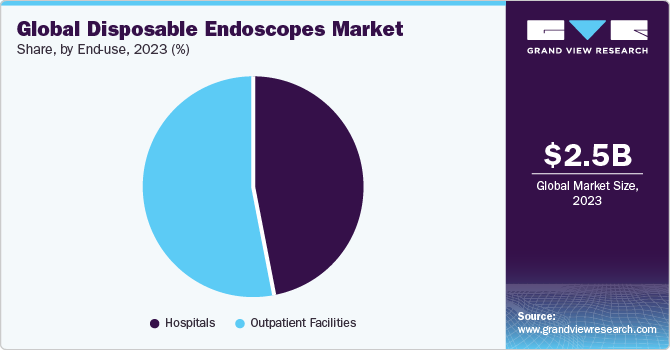

End-use Insights

The outpatient facilities dominated the global market in 2023 and it is projected to exhibit lucrative growth rate throughout the forecast period. Increasing number of outpatient facilities performing endoscopic procedures is the crucial factor driving the segment demand. Moreover, certain benefits like easy accessibility of outpatient facilities, and cost-effective services are supporting market expansion. Furthermore, government initiatives to strengthen healthcare infrastructure is projected to fuel segment uptake in coming years.

Favorable reimbursement scenario, high number of hospitals performing endoscopic procedures, and high preference of hospitals for minimally invasive procedures are the factors responsible for high revenue growth of the hospital segment. In addition, higher adoption of single use endoscopes in hospitals to reduce the chances of infection and leakage is also catering segment demand. Also, technological advancements coupled with high sensitivity of disposable endoscopes is providing momentum to the segment expansion.

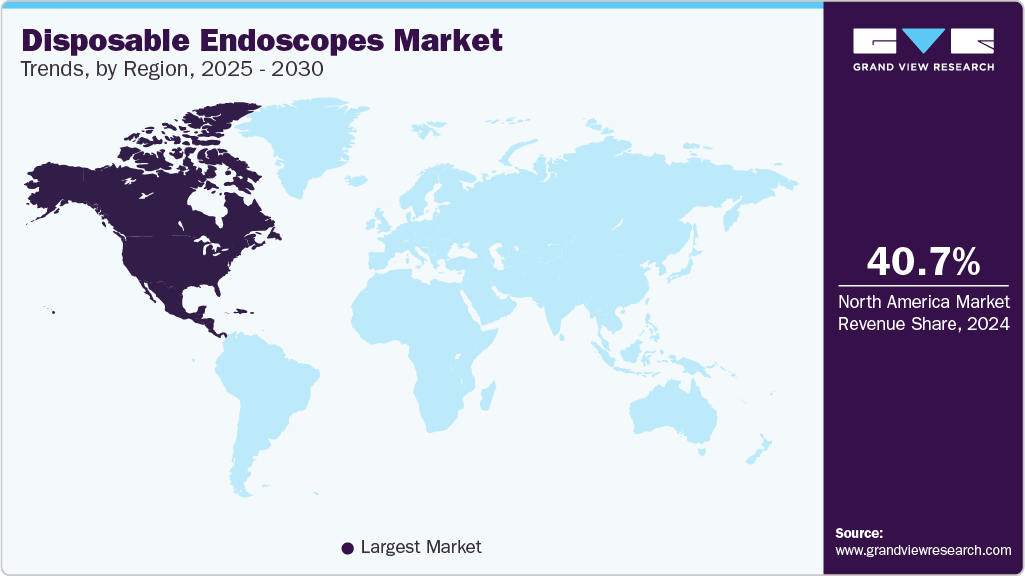

Regional Insights

North America led the overall market and held the largest revenue share of 41.71% in 2023, owing to presence of large number of market players and various strategic initiatives undertaken by them. Within North America, U.S. is the largest market as majority of players initially sought the U.S. FDA approval to launch their product in the country. Moreover, increasing awareness about cost-effective single use endoscopes and high per capita health expenditure is another factor fueling region’s growth. Furthermore, advanced healthcare infrastructure, supportive government initiatives and optimum treatment coverage are also responsible for the robust growth of North America region.

Asia Pacific is anticipated to witness lucrative CAGR throughout the forecast period and this robust growth is accounted to the high burden of target diseases, and larger population pool is likely to provide traction to region’s expansion. The improving healthcare infrastructure and rising investments from market players owing to flourishing demand of medical devices in APAC region has propelled region’s growth to a certain extent. Furthermore, the greater transition from reusable to disposable endoscopes in region and an increase in epidemiological factors hold high promise for region’s growth.

Type Insights

The bronchoscopes segment held the largest share of 27.9% in 2023 and is anticipated to grow at a steady rate during the projected period. The largest revenue share of the segment is due to increasing prevalence of respiratory and lung disorders coupled with high adoption of minimally invasive bronchoscopy procedures. According to WHO, COPD is third leading cause of death globally and over 90% of COPD deaths occur in low and middle-income countries. Moreover, rising adoption of single use flexible bronchoscopes and high preference of healthcare professionals to disposable bronchoscopes is further escalating segment expansion. Moreover, rising product approvals is another factor supporting market growth. For instance, in August 2021, the U.S. FDA granted 510 (k) clearance to Boston Scientific’s single use bronchoscope for use in ICU and operating rooms. The device is highly suitable for multiple bronchoscopy procedures.

The ureteroscopes segment held the second largest revenue among type segment and its high revenue is attributed to increasing number of ureteroscopy procedures owing to high disease burden. Moreover, its lower service and cleaning costs coupled with less chances of cross contamination are fueling adoption of advanced ureteroscopes in kidney stones detection. Furthermore, availability of robust product portfolio of technologically advanced ureteroscopes has created a lucrative growth potential for the market. For instance, Olympus Corporation has a wide range of products for improved stone management.

Market Dynamics

The increasing burden of gastrointestinal disorders such as IBS, functional dyspepsia coupled with rising adoption of endoscopic procedures to diagnose GI disorders is anticipated to fuel market growth. For instance, in 2021 a study published in the Gastroenterology journal stated that, worldwide, over 40% of people have functional gastrointestinal disorders. Thus, such high burden of GI diseases is pushing manufacturers to introduce novel endoscope devices into the market. For instance, in February 2022 Ambu announced the U.S. FDA clearance of Ambu aScope Gastro and Ambu aBox 2 in the U.S. With this clearance, the company strengthened its presence in the GI space.

In addition, market players are investing in the development of safer and cost-effective medical devices including disposable arthroscopes, disposable bronchoscopes, disposable gastroscopes. Also, several product approvals and launches are further facilitating market uptake. For instance, in November 2022 Integrated Endoscopy launched a second generation NUVIS disposable arthroscope. The newly launched arthroscope is first of its kind 4K endoscope developed for its adoption in arthroscopic operative procedures.

Furthermore, introduction of wireless, lightweight, single use endoscopes with enhanced illumination and imaging capabilities is further supporting market expansion. For instance, in October 2022 OMNIVISION and AdaptivEndo partnered to provide flexible, unified platform for single use endoscopes, including systems used for different purposes. This platform will provide an improved clinical interface and enhanced imaging capabilities.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, merger & acquisition, and partnership to increase their market share. Market players such as Ambu A/S, Boston Scientific Corporation, obp Surgical Corporation, COOPERSURGICAL, INC., and others are actively involved in the development of novel endoscopes. For instance, In May 2020 Ambu A/S announced its plans to launch “Ambu aView 2 Advance display” unit for use with endoscopes in U.S. and Europe.

Key Disposable Endoscopes Companies:

- Ambu A/S

- Boston Scientific Corporation

- obp Surgical Corporation

- COOPERSURGICAL, INC.

- Flexicare medical Limited

- Welch Allyn (Hill Rom)

- HOYA Corporation

- KARL STORZ

- Olympus Corporation

- OTU Medical

Recent Developments

-

In November 2023, Omnivision launched the OVMed OH0131 image signal processor designed for both disposable and reusable endoscopes fixed to camera control units/handheld tablet consoles. This innovative ISP is compatible with Omnivision's entire range of medical image sensors, supporting resolutions up to two megapixels. These sensors include the OCHSA, OCH2B, OCHTA, OCHFA, and OVM6946 imagers.

-

In September 2023, Scivita Medical revealed the Single Broncho Videoscope solution, comprising a bronchoscope designed for single use and an endoscopic image processor featuring full HD visualization. This complete solution caters to the diverse clinical requirements of respiratory surgeons, providing advanced tools for enhanced diagnostic and therapeutic procedures.

Disposable Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.86 billion

Revenue forecast in 2030

USD 7.32 billion

Growth rate

CAGR of 17.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2016 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Ambu A/S; Boston Scientific Corporation; obp Surgical Corporation; COOPERSURGICAL, INC.; Flexicare medical Limited; Welch Allyn (Hill Rom); HOYA Corporation; KARL STORZ; Olympus Corporation; OTU Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Endoscopes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2016 to 2030. For this report, Grand View Research has segmented the global disposable endoscopes market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Sigmoidoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disposable endoscopes market size was valued at USD 2.46 billion in 2023 and is expected to reach USD 2.86 billion in 2024.

b. The global disposable endoscopes market is expected to grow at a compound annual growth rate of 16.98 % from 2024 to 2030 to reach USD 7.32 billion by 2030.

b. Outpatient facilities dominated the disposable endoscopes market with a share of 53% in 2023. This is attributable to the high usage of these devices in outpatient settings for various diagnostic and therapeutic procedures.

b. Some key players operating in the disposable endoscopes market include Boston Scientific Corporation, Inc.; Flexicare Medical Ltd; Ambu A/S; Hill Rom Holdings.; and OBP Medical.

b. The bronchoscopy application segment dominated the market for disposable endoscopes and held the largest revenue share of 27.9% in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."