- Home

- »

- Medical Devices

- »

-

Disposable Hospital Gowns Market Size Report, 2021-2028GVR Report cover

![Disposable Hospital Gowns Market Size, Share & Trends Report]()

Disposable Hospital Gowns Market Size, Share & Trends Analysis Report By Risk Type (High, Moderate), By Usability (Low-type, Average-type Disposable Gowns), By Product (Non-surgical, Surgical), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-376-6

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global disposable hospital gowns market size was valued at USD 2.04 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2021 to 2028. The product demand is rapidly growing owing to a rise in the number of surgeries, growing instances of Hospital-Acquired Infections (HAIs), technological advancements, increasing cases of hospitalizations due to COVID-19 as well as chronic diseases. HAIs are nosocomial infections that are more frequent in people undergoing long-term care, most notably surgical procedures. Rising cases of HAIs have augmented the product demand to prevent the transmission of diseases. For instance, the Centers for Disease Control and Prevention (CDC) estimates that 1 in 31 hospitalized patients have at least one HAI cases every year.

According to the research article published in NCBI, in 2016-2017, about 6,53,000 Healthcare-Associated Infections (HCAIs) were reported among the 13.8 million adult inpatients in NHS hospitals in England and of these, around 22800 patients died due to infection. Furthermore, according to the 2019 research of “Nosocomial Pneumonia”, about 90.00% of ICU patients are at risk of developing nosocomial pneumonia, propelling the demand for disposable hospital gowns. The aforementioned statistics led to high product usage for protection against contamination and thereby reducing the chance of HAIs. Moreover, it also prevents bacterial and other microbial pathogens from entering the patient’s body.

As a result of the growing concern for safety and cleanliness against hospital-acquired illnesses, as well as to preserve hospital hygiene, the usage of these gowns has been steadily increasing, propelling the market growth. The COVID-19 pandemic has enhanced product demand and usage. According to Worldometer estimates, as of 01 June 2021, there were a total of 171,469,3748 cases globally, of which, 3,565,027 people died and 153,767,405 have recovered. Furthermore, if more individuals become infected with the coronavirus, there will be a greater need for critical care supplies, which will lead to an increase in demand for disposable hospital gowns.

In addition, to meet the rising demand, several major players are ramping up their production capacities and adopting strategies, such as new product launches and mergers & acquisitions. For instance, in August 2020, NovaLink launched disposable, non-surgical medical and isolation gowns. The company manufactures 100,000 units of the product daily. In May 2020, Huntsman Textile Effects and Bao Minh Textile came together to produce a fabric that fulfills the strict quality standards, necessary for isolation gowns. High-quality medical gowns are critical for healthcare workers fighting COVID-19; thus, such strategies will boost the market growth.

The rising number of surgical procedures as a result of sports injuries, accidents, cardiovascular illnesses, and other chronic ailments is fueling the market growth. Medical gown coverings are normally constructed of non-woven fabric and come in a multi-layer (2- or 3-layer) configuration, which helps prevent germs and other microorganisms from coming into direct contact with the person performing the surgery. For instance, as per the research article, there are about 234 million major surgeries performed annually across the globe.

Moreover, the increasing cases of Surgical Site Infections (SSI) are driving the product demand. For instance, as per the article published in Bio Med Central (BMC), the prevalence of SSI was around 24.6%, of which 10.00% develop deep site, 9.2% organ spaced, and 5.2% develop superficial space SSI. Also, the prevalence was high in patients who had undertaken orthopedics (54.3%) and abdominal (30%) surgeries. Thus, rising concerns regarding the safety of patients and healthcare workers are expected to boost the market growth.

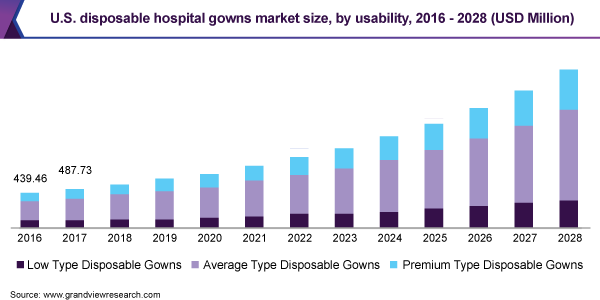

Usability Insights

On the basis of usability, the market has been segmented into low-type, average-type, and premium-type disposable gowns. The Average-type usability segment held the largest revenue share of more than 43% in 2020 and is expected to witness the fastest CAGR over the forecast period. These gowns are manufactured from lightweight white polypropylene fabric and are appropriate for use in hospitals, laboratories, and medical/clinical settings.

Spunbound polypropylene is the standard fabric for basic protective apparel, made by bonding fibers together to form a single layer of breathable, woven-like material. Its main advantages are economy and comfort. The demand for these gowns is rising owing to an upsurge in the number of surgeries performed across the world, as well as a greater focus on infection control and increased hygiene awareness. For instance, the European Centre for Disease Prevention and Control (ECDC) estimates that 1 out of every 20 patients may contract an HAI. Therefore, such factors are anticipated to boost the segment growth over the forecast period.

Product Insights

The surgical gowns segment held the largest revenue share of more than 44% in 2020 and is anticipated to witness a steady growth rate over the forecast period. Surgical gowns provide protection against infective pathogens. The increasing number of surgical procedures performed across the world and growing awareness regarding SSIs will drive the segment. For instance, according to a report published by the Global Surgery & Anesthesia Statistics in 2016, around 313.00 million surgical procedures take place every year across the world.

Moreover, the growing incidence of diseases and medical crises are leading to a surge in the number of surgical procedures, thereby boosting the segment growth. According to the American Heart Association, approximately 210,000 cases of recurrent and 580,000 cases of new heart attacks were reported in the U.S. in 2017. Furthermore, the growing cases of SSIs are leading to higher demand for surgical gowns. For instance, according to the CDC 2017 estimates, about 157,500 cases of SSIs are reported in the U.S. each year and about 8,205 people die due to such infections.

The patient disposable hospital gowns segment is anticipated to witness a moderate growth rate over the forecast period. Long-term patient admissions in hospitals and clinics are the major factors propelling the demand for these products. Moreover, collaboration and M&A initiatives by leading market players will also boost the segment growth. For instance, in January 2018, Medstar join forces with Care+Wear, a New York health wear firm, which enlisted students from Parsons School of Design to develop innovative patient gowns.

These gowns were tested in hospitals by the firm for quality assurance before the official launch. Moreover, a rise in hospital admissions is likely to boost the segmental growth, as patient gowns are an essential requirement in most admission cases. Patient safety and hygiene, as well as advancements in healthcare infrastructure, are also projected to open up new growth prospects for the segment in the years to come.

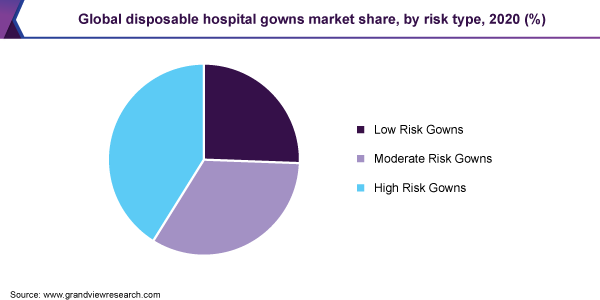

Risk Type Insights

The high-risk type segment held the largest revenue share of over 41% in 2020 and is expected to witness a considerable CAGR from 2021 to 2028. In surgical and fluid-intensive procedures, high-risk hospital gowns work as a barrier and provide protection against non-airborne diseases. These gowns have high tensile strength and are tear-resistant & breathable. Increased hospital admissions and research activities are expected to drive the segment growth over the forecast period.

The moderate risk type segment is expected to witness the fastest CAGR during the forecast period. Level 3 or moderate-risk gowns are suited for intermediate-risk scenarios, such as blood draws from arteries, IV insertion, and ER or trauma work that necessitates clean robes and equipment. These gowns are also resistant to splatters and wetting. The same tests that are used to evaluate the efficacy of level 2 gowns are utilized to evaluate the efficacy of level 3 gowns. Moreover, due to the global COVID-19 pandemic, the risks of becoming infected with the virus are higher than usual. Thus, to minimize cross-transmission and transmission of the fatal virus, all medical staff, and professionals, as well as patients, are required to wear disposable gowns during this health emergency leading to segment growth.

Regional Insights

North America accounted for the dominant revenue share of over 39% in 2020 and is expected to witness a steady growth rate during the forecast period. The growth can be credited to the increasing prevalence of HAIs. For instance, according to the Massachusetts Health & Hospital Association, Inc., in American hospitals, the CDC estimates that HAIs account for a projected 1.7 million infections and 99,000 associated deaths annually. Of these infections; 32% are UTIs, 22% are surgical site infections, 15% are pneumonia, and 14% are bloodstream infections.

Thus, a substantial number of in-patient hospital admission owing to HAIs is one of the key factors contributing to the regional market growth. Also, the United States is one of the leading countries in terms of product usage, with over 80.00% of gowns being single-use (according to the NCBI). Major market players in the region are extending their production capacities to meet the rising demand, thereby augmenting the market growth. For instance, in April 2020, Kontoor Brands, Inc. started manufacturing about 50,000 Level 1 patient gowns and 10,000 disposable isolation gowns for clinicians to assist hospitals that are dealing with COVID-19 patients.

Asia Pacific is estimated to be the fastest-growing regional market during the forecast period. Rapid healthcare infrastructure development and rising awareness about patient safety & hygiene standards are some of the factors anticipated to drive the regional market. In India, most hospitals have contracts with third parties to manage linen and laundry requirements. The demand for better linen clothing in hospitals has increased in this region due to increasing awareness about maintaining hospital hygiene and its role in preventing the transmission of various diseases.

Key Companies & Market Share Insights

Key players are adopting strategies, such as mergers & acquisitions, partnerships, and new product launches, to gain a higher market share and strengthen their position. For example, in May 2020, Aspen Surgical Products, Inc. acquired Precept Medical Products, a leading producer and marketer of disposable medical products, to strengthen its foothold in the market. Some prominent players in the global disposable hospital gowns market include:

-

Cardinal Health

-

3M

-

Angelica

-

Standard Textile Co., Inc.

-

Medline Industries, Inc.

-

Petoskey Plastics

-

Thermo Fisher Scientific, Inc.

-

Bellcross Industries Private Ltd.

-

Priontex

-

Sara Health Care

Disposable Hospital Gowns Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.29 billion

Revenue forecast in 2028

USD 5.61 billion

Growth Rate

CAGR of 13.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Usability, product, risk type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; Japan; China; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Cardinal Health; 3M; Angelica; Standard Textile Co., Inc.; Medline Industries, Inc.; Petoskey Plastics; Thermo Fisher Scientific, Inc.; Bellcross Industries Private Ltd.; Priontex; Sara Health Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global disposable hospital gowns market report on the basis of usability, product, risk type, and region:

-

Usability Outlook (Revenue, USD Millions, 2016 - 2028)

-

Low-type

-

Average-type

-

Premium-type

-

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Surgical

-

Non-surgical

-

Patient

-

-

Risk Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Low

-

Moderate

-

High

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The disposable hospital gowns market size was estimated at USD 2.04 billion in 2020 and is expected to reach USD 2.29 billion in 2021.

b. The disposable hospital gowns market is expected to grow at a compound annual growth rate of 13.7% from 20201 to 2028 to reach USD 5.61 billion by 2028.

b. The Average-type usability segment held the largest revenue share of more than 43% in 2020 and is expected to witness the fastest CAGR over the forecast period.

b. Some of the key players operating in the disposable hospital gowns market include Cardinal Health, Angelica, Standard Textile Co., Inc., Medline Industries, Inc., and Thermo Fisher Scientific Inc.

b. Key factors that are driving the disposable hospital gowns market growth include the increasing prevalence of hospital-acquired and surgical site infections, the increasing number of surgeries coupled with a surge in the incidence of chronic disorders, and the impact of COVID-19.

b. The surgical gowns segment held the largest revenue share of more than 44% in 2020 and is anticipated to witness a steady growth rate over the forecast period in the disposable hospital gowns market.

b. The high-risk type segment held the largest revenue share of over 41% in 2020 and is expected to witness a considerable CAGR from 2021 to 2028 in the disposable hospital gowns market.

b. North America accounted for the dominant revenue share of over 39% in 2020 and is expected to witness a steady growth rate during the forecast period in the disposable hospital gowns market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."