- Home

- »

- Medical Devices

- »

-

DLIF & XLIF Implants Market Size & Share, Industry Report, 2019-2025GVR Report cover

![DLIF & XLIF Implants Market Size, Share & Trends Report]()

DLIF & XLIF Implants Market Size, Share & Trends Analysis Report by Application (Scoliosis, Degenerative Disc Diseases, Spondylolisthesis), By Region, Competitive Landscape, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-013-2

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Industry Insights

The global DLIF & XLIF implants market size was valued at USD 207.7 million in 2017. It is expected to expand at a CAGR of 8.2% during the forecast period. The rise in prevalence of spinal diseases & injuries and advancements in medical technology have helped the market gain tremendous momentum over the past few years. The burgeoning popularity of minimally invasive procedures and the growing global geriatric population is estimated to stoke the growth of the market. Changing lifestyles have resulted in an increased prevalence of obesity, which is also stirring up the demand for DLIF and XLIF implants.

DLIF & XLIF are minimally invasive surgical procedures used in treating spinal instability and backache. There is a growing preference for minimally invasive surgeries to traditional spinal surgeries due to associated advantages such as lesser trauma and incisions, reduced hospital stays, lower blood loss, duration of surgery, and recovery time. These minimally invasive surgeries provide access to target while potentially minimizing the damage to surrounding tissues and anatomical structures.

Minimally invasive surgeries are gaining traction in the orthopedic segment and are being increasingly used in treating degenerative diseases of the spine. Despite multiple advantages associated with these surgeries, they are not risk free and need to be performed by skilled surgeons and experts. Lack of experienced surgeons is anticipated to negatively influence the growth of the market. However, training and education programs for surgeons offered by manufacturers are expected to help overcome such problems.

Degenerative disc diseases are among the most commonly diagnosed conditions in people suffering from back ache. Back pain is a widespread public health issue and one of the significant causes of disabilities affecting wellbeing of the population. In 2016, the National Spinal Cord Injury Statistical Center stated that the annual incidence of spinal cord injuries in the U.S. was approximately 54 per million population or approximately 17,000 new cases of spinal cord injury every year. Road accidents falls, violence, sports injuries, and recreational activities are some of the leading causes of spinal injuries.

Furthermore, evolution of new and effective technologies in spine care is projected to drive the market. Product and technological innovations for performing advanced surgeries and improving treatment options are among the primary growth stimulants for the market. Manufacturers are focusing on introduction of new technologies for developing minimally invasive approaches, minimizing postoperative pain and complications, and enabling faster recovery.

Application Insights

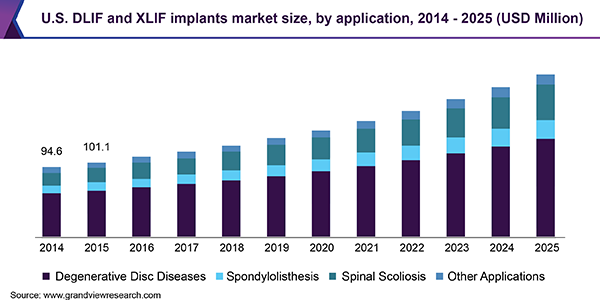

In 2017, the degenerative disc diseases segment dominated the DLIF and XLIF implants market with revenue of USD 129.2 million. The segment is poised to retain its position until 2025, owing to widening base of geriatric population worldwide. Aging is one of the leading causes of degeneration of spine, which results in instability and back pain. In addition, there is an increase in the number of younger patients seeking treatment for back pain and this is likely to boost the demand for DLIF and XLIF implants.

Degenerative disc diseases are among the leading causes of low back pain and neck pain. The North American Spine Society states that back pain is considered the second most common reason for visits to doctors, thus levying a huge financial burden on society. Increasing prevalence of spine degeneration, unhealthy habits, and improvements in treatment technologies are some of the factors contributing to the growth of the segment.

The scoliosis segment is expected to register the highest CAGR during the forecast period. Scoliosis leads to misalignment of the spine, which causes back or neck pain. Patients with scoliosis often require back surgery to correct the alignment of the spine. The National Scoliosis Foundation states that scoliosis affects around 7 million people or approximately 2.0% to 3.0% of the population in the U.S. Thus, increasing incidence of scoliosis, growing awareness public and healthcare professionals, and improvements in diagnosis and treatment are anticipated to supplement the growth of the segment.

Regional Insights

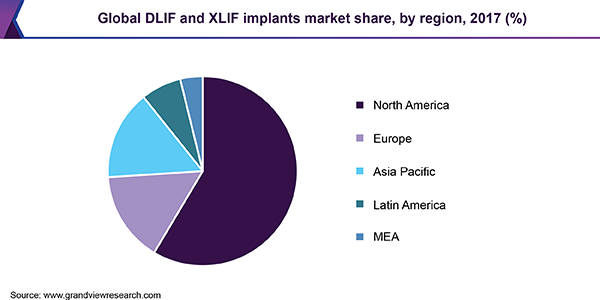

North America led the market in 2017. The region is a large market for the spine care industry with enhanced healthcare facilities. The high prevalence of spinal injuries in the region, large base of geriatric population, and increase in research activities for the development of innovative approaches in spine care are projected to support the dominance of the market throughout the forecast horizon.

The U.S. is the leading revenue contributor in the region as well as across the globe owing to mounting cases of spinal surgeries. In 2017, the National Spinal Cord Injury Statistical Center estimated that approximately 285,000 people in the U.S. are poised to suffer from spinal cord injuries. Rising awareness among the populace and surging demand for minimally invasive spinal surgeries are likely to escalate the growth of the market.

The market in Asia Pacific is expected to witness the fastest growth over the forecast period. Improvements in infrastructure and healthcare facilities in the region and growing popularity of medical tourism due to availability of high quality healthcare services and affordable spinal surgeries are also estimated to fuel the demand for DLIF and XLIF implants in the region.

DLIF & XLIF Implants Market Share Insights

Some of the prominent companies operating in the space are Medtronic; NuVasive, Inc.; Globus Medical, Inc.; Stryker Corporation; DePuy Synthes Companies; Orthofix Holdings, Inc.; and Zimmer Biomet. These companies focus on technological innovations, new product launches, and regional expansion to gain a competitive edge.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Revenue in USD Million & CAGR from 2018 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K., Japan, China, South Korea, Brazil, Mexico, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global DLIF and XLIF implants market report on the basis of application and region:

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Degenerative Disc Diseases

-

Spondylolisthesis

-

Scoliosis

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

Japan

-

China

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."