- Home

- »

- Homecare & Decor

- »

-

Door Handles Market Size, Share & Trends Report, 2022-2030GVR Report cover

![Door Handles Market Size, Share & Trends Report]()

Door Handles Market Size, Share & Trends Analysis By Type (Lever Handles, Door Knobs), By Material (Metal, Plastic), By Application (Residential, Commercial), By Region (APAC, North America), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-307-2

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Consumer Goods

Report Overview

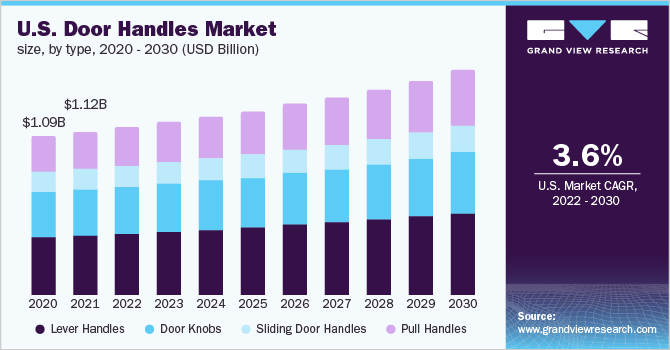

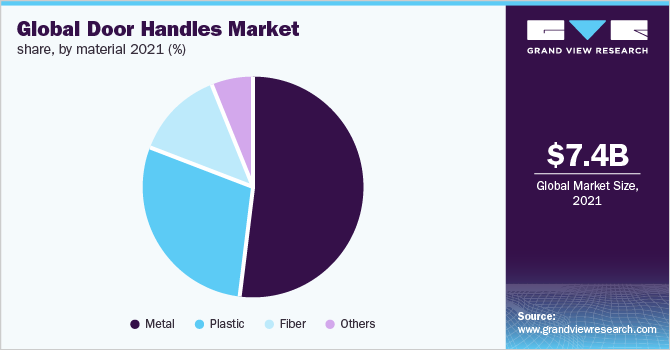

The global door handles market size was valued at USD 7.35 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030. The industry growth is attributed to the growing residential and commercial construction activities, driven by rapid urbanization and industrialization, along with increasing consumer spending on home remodeling and interior fittings. The industry has been gaining increasing traction on account of frequent purchases by consumers to keep up with the latest trends. Moreover, companies are manufacturing fashionable products with modified and improved designs, patterns, and materials that offer rich aesthetic appeal to the infrastructures.

The growth of the remodeling industry across countries in North America is also indicating a surge in home furnishing and fittings, which is expected to positively impact the door handlesindustry. According to the Home Improvement Research Institute (HIRI), home improvement spending by Americans witnessed nearly a 9% increase between 2019 and 2020. Moreover, homeowners have been investing in lifestyle-enhancing projects against merely necessary maintenance activities. Thus, the growing trend of home remodeling projects and home improvements is a key trend making beneficial contributions to the industry growth.The emergence of the COVID-19 pandemic had a substantial impact on the global industry.

Due to the COVID-19 pandemic, countries were forced to implement lockdown and social distancing restrictions, which prohibited the construction of new residential and commercial properties.Door handle manufacturing companies and distributors were compelled to halt their manufacturing and distributing units as a result of border closures, and travel and import-export restrictions. In addition, door handle manufacturing companies witnessed a dip in production due to the lack of workforce to continue the production process. However, the global industry is expected to rebound to the pre-pandemic level as the construction of residential and commercial properties is rising in 2021.

Moreover, rising investments in the real estate sector and sales of new homes are expected to drive industry growth over the forecast period. The rise in government initiatives in several nations aimed at encouraging affordable housing for the lower-income population is a significant element driving the industry. Furthermore, technological improvements and modernization in production techniques, as well as an increase in research and development activities are expected to generate new opportunities for market players to expand their portfolios and generate new revenue streams. However, an increase in the usage of low-quality raw materials may necessitate frequent door handle repairs, which is one of the primary factors obstructing industry expansion.

Shifting customer preferences from ornate fittings to contemporary patterns has been driving the manufacturers to introduce door handles with sleek and luxurious designs and materials. Knob-style door handles are gaining increasing acceptance among consumers due to their compact structure and availability of various appropriate designs for every infrastructure. Some of the prominent designs trending in the market are polished nickel, matte texture, brass, and bronze finishes, and crystal and satin looks available in various geometric shapes and patterns. Some of the companies offering such products are ASSA ABLOY and Carlisle Brass Ltd.

Brass metal door handles are gaining increasing traction across the hospitality industry, as they offer a shiny and artistic look. The growing tourism sector as well as the increasing establishment of commercial buildings are expected to generate significant demand for these door handles, thereby augmenting the industry growth. For instance, as per the information by Invest India, 2022, international hotel chains have been focusing on establishing their outlets in India, which approximately contributes to a 50.0% share in the Indian tourism and hospitality sector. This initiative is expected to contribute to global industry growth in the near future.

Type Insights

The lever handle segment dominated the global industry and accounted for the largest share of more than 36.00% in 2021. The growth of the segment is primarily driven by the product's popularity among consumers due to its compact structure and durability. Also, lever door handle companies and distributors have started offering handles that are available in different designs for different infrastructures. Door levers offer a wide variety of back plating options that enable several functions. Lever handles are mostly used in European countries for their external doors.

Some of the popular types in Ease of use, high strength, and dexterity are expected to drive the product demand. The pull handle segment is estimated to register the fastest CAGR from 2022 to 2028. The growth of the segment is attributed to the easyfunctionality and wide product availability. Industry players are continually investing in research and development to create cost-effective, highly efficient, and luxurious pull door handles made of various types of composite materials. Improved designs & patterns and durable materials with a strong aesthetic appeal will boost revenue in the pull door handle segment.

Application Insights

The residential application segment dominated the global industry in 2021 and accounted for the largest share of more than 54.00% of the overall revenue. This is attributed to the increasing number of new construction and home remodeling projects. For instance, in Canada, Garibaldi at Squamish Ski Resort is an upcoming residential project, with a project value of 3.5 billion Canadian dollars. Oxford Place, M City Mixed-Use Development - Phase 2+, Rockcliffe Lands Redevelopment, and The Well are some of the few residential projects, each with a project value of more than 1 billion Canadian dollars. The increased population needs additional housing space, particularly in tier 1 cities. Construction operations are being enhanced by both government and private sector enterprises to meet rising demand.

Many governments are putting a strong emphasis on rural development. These are the major elements that have fueled the residential building market's expansion and boosted the product demand in the residential sector.The commercial sector is expected to witness strong demand over the forecast period. The growth of the tourism industry is driving the construction of commercial buildings, such as restaurants and hotels. International sporting competitions, such as the 2020 Summer Olympics, are fueling the capacity of hotels and restaurants in Japan. Hotels, such as Park Hyatt, Hyatt Regency, and InterContinental, are expected to open shortly. The increasing number of construction projects is expected to augment the product demand.

Material Insights

The metal segment dominated the global industry and accounted for the largest share of more than 52.00% of the overall revenue in 2021. The high share of the segment is credited to the growing demand for metals on account of their physical properties, such as durability, lifespan, and design flexibility. The design of these door handles depends on customization requirements from customers, such as application, size, and design of the product. These products' corrosion resistance, along with their improved looks, make them an excellent choice for security applications. Metal handles are fire- and impact-resistant, adding to the overall structure's robustness.

These attributes increase their demand in commercial and industrial structures. The fiber door handle segment also captured a significant share in 2021 and is expected to showcase promising growth shortly. The growth of the segment is significantly bolstered by the surge in the demand for composite handles from commercial and residential applications. Customers are approaching manufacturing companies with their customizations and designs to process fiber handles as per their requirements. In near future, customer desire for personalized and sleekly designed products will aid in the segment growth.

Regional Insights

Asia Pacific accounted for the maximum revenue share of more than 36.10% in 2021 and is expected to witness significant growth over the forecast period. This growth is attributed to the rising establishment of residential and commercial infrastructures and the booming tourism industry. Operating company Hotel Management Japan is planning to drive investment plans focusing on establishing three new hotels in Andhra Pradesh, which is expected to be one of the prime tourist locations. The state’s tourism department is also aiming to increase guestrooms by 2025. These upcoming projects are expected to drive the demand in the next few years.

The growing demand for modern doors in North America has been inspiring manufacturers to design and launch products that appeal to consumers, which, in turn, is driving industry growth. In March 2021, Masonite International Corp. launched DuraStyle exterior wood doors with AquaSeal technology, engineered to protect the natural beauty of wood doors. AquaSeal technology employs a patented process that seals the edges of wood panels and glass and inserts them with a clear barrier engineered to protect against water penetration, which is a leading cause of door failure. Such product developments and innovations are likely to have a lasting impact on the regional market.

Key Companies & Market Share Insights

The industry players are undertaking various initiatives to strengthen their product portfolio. Companies are actively involved in product upgradation to sustain the competition as well as cater to the consumer’s changing preferences for elegant designs. To meet the rising product demand, companies are pursuing different growth strategies, such as mergers & acquisitions and corporate expansion. For example:

-

In January 2022, Emtek launched a dedicated product line for door hardware and accessories that offer endless customization options and ease of assembly. The new product launch includes cabinet hardware, lever, and door knob

-

In October 2020, ASSA ABLOYacquired Olimpia Hardware to expand its reach in Latin America and the Caribbean. With this acquisition, the company aims to cater to the growing demand for glass and aluminum products

-

In February 2020, Allegion U.S. launched the Schlage ALX Series, a series of modular designs for cylindrical locks. The newly launched product is a grade 2 lock and an evolution of the AL series and offers an ever-changing security landscape by crafting durable and advanced door locks

Some of the prominent players in the global door handles market include:

-

Assa Abloy AB

-

The Häfele Group

-

Allegion Plc

-

Aarkay Vox

-

Hoppe Holding AG

-

Emtek Products Inc.

-

Kuriki Manufacture Co.

-

Ace Hardware Corp.

-

West INX Ltd.

-

Sugatsune America, Inc.

Door Handles Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 7.59 billion

Revenue forecast in 2030

USD 10.55 billion

Growth rate

CAGR of 4.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; South Africa; Brazil

Key companies profiled

Assa Abloy AB; The Häfele Group; Allegion Plc; Aarkay Vox; Hoppe Holding AG; Emtek Products Inc.; Kuriki Manufacture Co.; Ace Hardware Corporation; West INX Ltd; Sugatsune America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Door Handles Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global door handles market report on the basis of type, material, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Lever Handles

-

Door Knobs

-

Sliding Door Handles

-

Pull Handles

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Metal

-

Plastic

-

Fiber

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global door handles market was estimated at USD 7.35 billion in 2021 and is expected to reach USD 7.59 billion in 2022.

b. The global door handles market is expected to grow at a compound annual growth rate of 4.1% from 2022 to 2030 to reach USD 10.55 billion by 2030.

b. The Asia Pacific dominated the door handles market with a share of around 35% in 2021. This is owing to the rising demand for trendy door handles across the region coupled with rising key players' initiatives to manufacture innovative door handle designs.

b. Some of the key players operating in the door handle market include Assa Abloy AB, The Häfele Group, Allegion Plc, Aarkay Vox, Hoppe Holding AG, Emtek Products Inc., Kuriki Manufacture Co., Ace Hardware Corporation, West INX Ltd, Sugatsune America, Inc.

b. Key factors that are driving the door handles market growth include the increasing consumer spending on home remodeling and interior fittings and rising residential and commercial building construction across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."