- Home

- »

- Drilling & Extraction Equipments

- »

-

Downhole Tools Market Size, Share, Industry Trends Report, 2019-2026GVR Report cover

![Downhole Tools Market Size, Share & Trends Report]()

Downhole Tools Market Size, Share & Trends Analysis Report By Product (Drilling, Handling, Flow & Pressure Control), By Application (Well Drilling, Well Intervention, Production & Well Completion), And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-014-9

- Number of Pages: 220

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Bulk Chemicals

Industry Insights

The global downhole tools market size was estimated at USD 3.57 billion in 2017. Rising E & P activities in deep-sea bed associated with drilling and completion efficiencies is resulting in maximization of production rates by industry participants. This, in turn, has worked in favor of the market.

Ongoing demand for technologically advanced tools that function optimally in high-pressure and high temperature (HPHT) conditions, for enhancing the rate of penetration (ROP) is also anticipated to stoke the growth of the market. companies are continuously focusing on developing new technologies to sustain the competition and also to enhance drilling activities with higher ROP and minimal cost involvement.

Significant oilfield developments in Texas, the Gulf of Mexico, and North Dakota, coupled with supportive governmental regulations for unconventional hydrocarbon reserves, are projected to boost the growth of the market. Furthermore, increased environmental risks and maintenance costs associated with offshore locations have urged companies to deploy advanced tools for cost-efficient E & P activities.

Ongoing technological advancements for E & P activities are poised to be one of the primary growth stimulants for the market. Moreover, rather than offering operators with a list of tools provided, service providers have advanced the trend to deliver optimized solutions and technologies to overcome challenges faced by operators.

High-capital investments for new product development, coupled with risk factors related to their ability to withstand extreme operational environments, are likely to inhibit the growth of the market. Nevertheless, the leading market participants are focusing on curbing costs and optimizing operational efficiencies with funding from numerous publicly-traded companies.

Downhole Tools Market Trends

Increased drilling activities globally continue to remain the main factor contributing to down-hole tools market growth. Enhanced efficiency of the downhole tools to increase oil production without increasing the cost involved in production provides an edge over conventional equipment.

The operational cost incurred in the E&P activities has declined with the advent of technological innovations and operational efficiencies. Rising demand for crude oil & natural gas has been motivating the E&P companies located across European and North American region to get involved in wide-range of drilling activities taking place in offshore and onshore areas.

Ongoing technological advancements for E&P activities in the oil & gas sector have always been the primary drivers of the market. Rising drilling activities across the globe and the growing demand for the product have spurred market growth. Market leaders continuously focusing on new technologies to sustain in the competition and improve the drilling activities with minimal cost involvement and higher ROP.

Consistent oil & gas sector crashes aside, technological advancements in drilling have substantially added to the production levels and company profits over the decades. With horizontal drilling and hydraulic fracturing, market leaders have gained access to reach the oil & gas reserves. These reserves are located in low-permeability geological formations with a huge amount of capital involved in the extraction via standard drilling.

Ultra-deep drilling has been proved to be more challenging owing to the lack of stability, specifically for floaters, the need for more complex logistics & support, space constraints, and corrosive water environment. Hence, more advanced downhole tools are being required for drilling activities. With rising activities across the Kingdom of Saudi Arabia (KSA), Qatar, and the UAE, it is anticipated that nearly 30 rigs might be added by the end of 2018 and 2019. The majority of the rigs will be located in KSA and Qatar. This, in turn, is predicted to propel the downhole tools market growth in The Middle East.

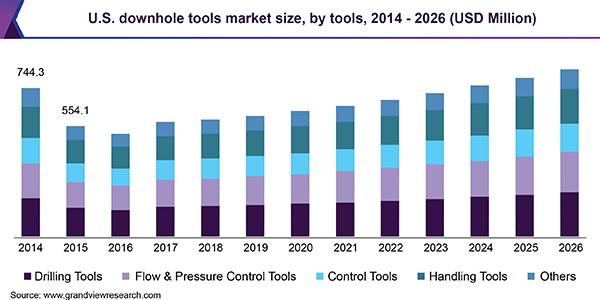

The product life cycle for the drilling tools market has already reached the maturity stage, as most of the global economies have utilized the same for E&P activities. Drilling tools are primarily used to maintain consistency in drilling activities and thus, are widely deployed by the oilfield service providers. The global market for handling tools and flow & pressure control tools is also expected to witness substantial growth due to their increasing applications in the production phase.

Product Insights

On the basis of product, the drilling tools segment is expected to dominate the market through 2026. The growth of the segment can be attributed to heightened rates of drilling activities in various economies such as Argentina and Colombia. This is further supported by recommencing of onshore drilling in countries such as Libya & Republic of Congo, new drilling project startups in Qatar and China, and increased drill bit sales in Algeria.

The global market for handling tools and flow & pressure control tools is also estimated to witness substantial growth over the forecast period owing to their increasing applications in the production phase. These tools are useful in addressing several challenges such as extreme depth, high temperatures, and pressure differentials associated with producing formations.

Application Insights

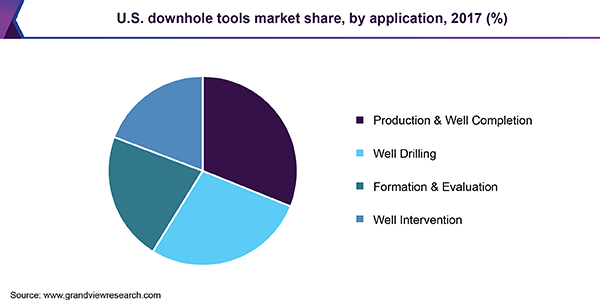

Based on application, the downhole tools market has been segmented into well intervention, drilling, production & well completion, and formation and evaluation. The production & well completion segment is anticipated to hold the largest share in the market, followed by well drilling. The equipment demand in well drilling applications is projected to amount to over USD 1.43 billion by 2026.

The growth of the formation and evaluation segment in North America is driven by the advent of advanced evaluation technologies such as radiology and logging while drilling. The market for formation and evaluation in Asia Pacific is poised to expand at a CAGR of 4.4% over the forecast period.

Regional Insights

Middle East and Africa dominated the downhole tools market and accounted for the largest revenue share of 33.57% in 2017. Rising concern towards sampling and oily drilled cuttings coupled with environmental effects in tandem with the waste discharge is anticipated to drive completion & brine fluids to demand over the next eight years for the region. The increasing number of ongoing investments in the exploration and production activities by numerous market participants such as Abu Dhabi National Oil Company, NDC (National Drilling Co.), and others, are contributing in the growth of the market.

In Saudi Arabia rising concern towards environmental impacts of offshore E&P activity coupled with stringent environmental regulations regarding carbon footprint, is expected to drive biodegradable brine fluids demand over the forecast period.

In UAE, growing domestic demand for natural gas coupled with the deployment of advanced techniques such as EOR has further steered the natural gas production in the region. Increasing demand for petroleum products such as diesel fuel and gasoline has led to the expansion of refining facilities in the area. Growing concern towards environmental impacts coupled with cost-intensive waste disposal process in offshore projects is expected to drive Downhole Tools demand over the forecast period.

In the Asia Pacific, the exploration of deep water and unconventional reserves is gaining attention from the market players located in the region. Advancements in technologies for reduced production cost and increasing productivity play a vital role in the market growth and are further expected to speed up over the upcoming years. In Indonesia, growing oil consumption owed to a rise in energy demand is expected to boost the market over the forthcoming years. The downhole tools market in Indonesia is moderately consolidated.

Most of the oil production in China comes from large mature oil fields which are situated in the northern part of the country. One of the China’s largest oil-producing oilfield, PetroChina’s Daqing field is located in the northeastern part of China.

Downhole Tools Market Share Insights

The market is marked by the presence of key multinational players that are actively engaged in mergers & acquisitions, technological innovations, research & development, and partnerships to improve their dominance among competitors. Furthermore, companies such as Halliburton, Schlumberger, and Weatherford International have invested in the expansion of their production capabilities to enhance their portfolios and regional presence.

Other significant players include Stabiltec Downhole Tools LLC; BILCO Tools, Inc.; Frank's International N.V.; Varel International Energy Services, Inc.; Ulterra Drilling Technologies, L.P.; Baker Hughes; and National Oilwell Varco, Inc.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2026

Market representation

Revenue in USD million and CAGR from 2018 to 2026

Regional scope

North America, Europe, Asia Pacific, MEA and Central & South America

Country scope

U.S., Canada, Mexico, U.K., Norway, Russia, Kazakhstan, China, India, Indonesia, Australia, Saudi Arabia, U.A.E., Qatar, Kuwait, Iran, Iraq, Nigeria, Brazil, Venezuela

Report coverage

Revenue forecast, company share, competitive landscape, and growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2026. For this study, Grand View Research has segmented the global downhole tools market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2026)

-

Drilling Tools

-

Handling Tools

-

Flow & Pressure Tools

-

Control Tools

-

Others

-

-

Application Outlook (Revenue, USD Million, 2014 - 2026)

-

Well Drilling

-

Well Intervention

-

Formation & Evaluation

-

Production & Well Completion

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2026)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Russia

-

Norway

-

Kazakhstan

-

-

Asia Pacific

-

China

-

Australia

-

India

-

Indonesia

-

-

MEA

-

Saudi Arabia

-

U.A.E.

-

Qatar

-

Kuwait

-

Iran

-

Iraq

-

Nigeria

-

-

Central & South America

-

Brazil

-

Venezuela

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."