- Home

- »

- Communications Infrastructure

- »

-

Dropshipping Market Size & Share Analysis Report, 2030GVR Report cover

![Dropshipping Market Size, Share & Trends Report]()

Dropshipping Market Size, Share & Trends Analysis Report By Product Type (Toys, Hobby & DIY, Furniture & Appliances, Food & Personal Care, Electronics & Media, Fashion), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-945-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

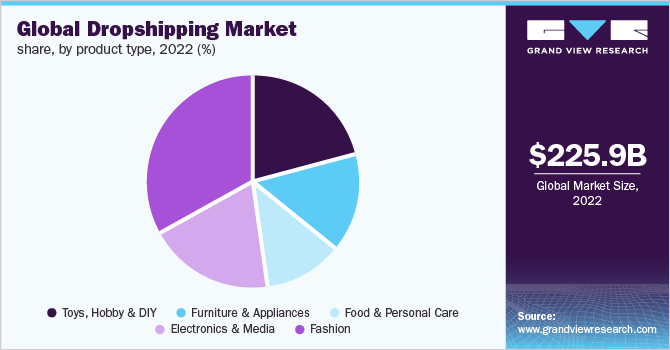

The global dropshipping market size was valued at USD 225.99 billion in 2022 and is expected to register a compound annual growth rate (CAGR) of 23.4% from 2023 to 2030. The market is anticipated to witness significant growth owing to an increase in preference for online shopping, coupled with the rising trend of cross-border e-commerce trade. Hence, the rise in demand for dropshipping services is predominantly influenced by the growth of the e-commerce industry. Dropshipping is the practice of selling products through online stores where the retailers do not keep a stock of goods on hand. The retailer forwards customer orders and shipment information to the wholesaler or manufacturer, who then transports the goods directly to the customer.

With the proliferation of technology, dropshipping has been a quick and fast-moving profit-making business. Dropshipping enterprises offer originality in a variety of ways in the current situation that e-commerce companies and on-demand business models are using to cope with the pandemic. Smartphones have revolutionized online shopping, with numerous mobile applications to make the consumer experience pleasant and convenient. The rising smartphone penetration, coupled with an increasing consumer disposable income, is contributing to the growth of the e-commerce market, thereby driving the demand for dropshipping services. There has been a notable increase in investments by the key players in the e-commerce industry owing to the number of shoppers inclined toward online shopping platforms. For instance, according to The United Nations Conference on Trade and Development (UNCTAD), company sales rose to 2.9 trillion in the year 2021.

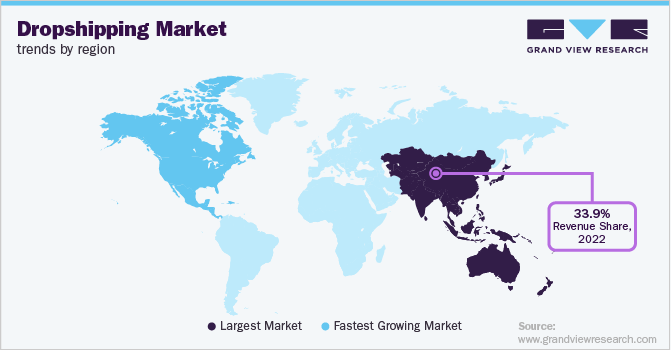

Manufacturers, distributors, suppliers, dropshipping businesses, and end-users/customers make up the majority of the ecosystem's players. APAC has the most developed dropshipping industry. Retailers following conventional distribution routes are aiming to invest heavily in inventory control. However, companies are opting for dropshipping services to lower capital costs for inventory purchase/management as e-commerce platforms are getting more widely used. Additionally, as merchants are investing less in logistics and inventory, dropshipping is getting more popular.

Other elements that are anticipated to boost market expansion include lower overhead expenses and a diverse product portfolio. APAC’s booming e-commerce sector is primarily responsible for the expansion of dropshipping services. The region is home to several prominent e-commerce businesses that have attracted a sizeable portion of the populace from most of the regions. For instance, Japan is considered one of the most high-potential dropshipping countries over any other APAC country. Indian OEMs purchase products from Japanese vendors to profit from low product costs and cost-saving in their commodities, which are high due to international shipping. Many regions have automated dropshipping technologies such as DSers. This dropshipping technology emphasizes the importance of conducting product research prior to opening an online company.

Product Insights

Based on product, the market has been classified into toys, hobby and DIY, furniture and appliances, food and personal care, electronics and media, and fashion. The electronics segment accounted for over 19.15% market share in 2022 owing to the growing demand for electronic products. E-commerce platforms open several avenues for the sale of electronic products, as customers can compare an extensive portfolio of products, avail discounts, and apply for easy returns.

The fashion segment is anticipated to witness positive growth in the dropshipping market from 2023 to 2030, owing to rapid globalization and changes in consumer spending behavior. Growing consumer preference for branded products and the availability of several brands on a common platform are further anticipated to drive the fashion segment over the forecast period.

The fashion segment is estimated to attain the highest CAGR of 24.8% during the forecast period. Customers prefer online shopping for purchasing personal and beauty-related things because they don't need to touch them and can clearly see what they will receive after making a purchase. Data is a top priority for personal and beauty care brand owners and marketers, when it comes to client targeting and product development. Without purchasing or hiring local merchants and distributors, using social commerce, beauty brands open up the possibility of a large global audience and foreign markets.

Sellers on social commerce platforms provide a variety of services that make online shopping convenient and profitable, including cashback, discounts, same-day or next-day deliveries, EMI possibilities, click & collect options, and many more. Demand forecasting is difficult for dropshipping personal beauty product models since a wide range of specialist products are posted on a marketplace platform. This segment has accelerated as more retailers opt for dropshipping goods. However, it can be difficult to locate the ideal vendors and providers at the start.

Regional Insights

Asia Pacific accounted for a 33.92% market share in 2022 and is expected to grow steadily over the forecast period. The e-commerce industry of APAC is growing at an unprecedented rate due to the surge in online shopping platforms. Moreover, the growing popularity of smart gadgets such as laptops, mobile phones, and tablets, among others has accelerated the demand for online shopping.

Additionally, the expansion of this region is largely attributed to the developments in telecommunications infrastructure, the spread of the internet and smartphones, and the broad appeal of social media platforms like Instagram, Facebook, Snapchat, and Twitter. Additionally, the expansion of regional markets is primarily aided by the rise in smartphone and social media usage in nations like China.

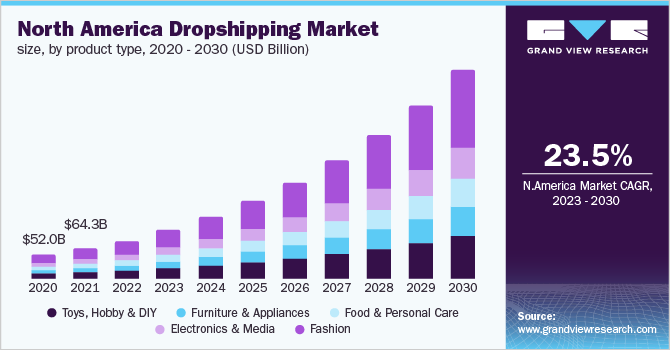

North America emerged as the second-largest social commerce market and is expected to expand at a significant CAGR of nearly 23.5% during the forecast period. The adoption of artificial intelligence for dropshipping operations is anticipated to drive the market in North America. Artificial intelligence has been utilized by online firms to automate parts of their customer communications. Even though e-commerce process automation has been possible for some time, as artificial intelligence develops, it is expected to become more widespread and individualized. Artificial intelligence developments have made it possible for the dropshipping market to increase lead-generating rates without compromising lead quality. The e-commerce and social commerce landscapes in the U.S. are a lot more disintegrated in comparison to developing countries, with a difference in consumer mindsets and behavior toward digital shopping, social media consumption, payments, and online privacy as well.

Key Companies & Market Share Insights

Companies are entering into organic and inorganic growth strategies such as solution/product launches & developments, geographical expansions, mergers & acquisitions, and partnerships to stay ahead in the competitive market scenario. For instance, in February 2022, Alibaba.com entered into a partnership with Dropified for better dropshipping services. Through this collaboration, Dropshippers can link their online storefronts Dropified and Alibaba.com, so that fulfillment companies are informed when an order has been placed and needs to be filled. Some prominent players in the global dropshipping market include:

-

Etsy, Inc.

-

Alidropship, Doba Inc.

-

Megagoods Inc.

-

Inventory Source

-

Modalyst Inc.

-

Shopify Inc.

-

SaleHoo Group Limited

-

Sunrise Wholesale Merchandise LLC

-

Printify

-

Cin7 Orderhive Inc.

-

Wholesale2b

Dropshipping Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 287.36 billion

Revenue forecast in 2030

USD 1,253.79 billion

Growth Rate

CAGR of 23.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Alidropship, Doba Inc.; Megagoods Inc.; Inventory Source; Modalyst Inc.; Shopify Inc.; SaleHoo Group Limited; Sunrise Wholesale Merchandise LLC; Printify; Cin7 Orderhive Inc.; Wholesale2b

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dropshipping Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dropshipping market report based on product type and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Toys, Hobby and DIY

-

Furniture and Appliances

-

Food and Personal Care

-

Electronics and Media

-

Fashion

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dropshipping market size was estimated at USD 225.99 billion in 2022 and is expected to reach USD 287.36 billion in 2023.

b. The global dropshipping market is expected to grow at a compound annual growth rate of 23.4% from 2023 to 2030 to reach USD 1,253.79 billion by 2027.

b. North America dominated the dropshipping market with a share of over 35.72% in 2022. This is attributable to the evolving consumer buying behavior and the proliferation of mobile e-commerce.

b. Some key players operating in the dropshipping market include AliDropship; Doba, Inc.; SaleHoo Group Limited; and Oberlo.

b. Key factors that are driving the dropshipping market growth include an increase in preference for online shopping and the growing cross-border e-commerce trade worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."