- Home

- »

- Pharmaceuticals

- »

-

Dry Eye Syndrome Treatment Market Size Report, 2030GVR Report cover

![Dry Eye Syndrome Treatment Market Size, Share & Trends Report]()

Dry Eye Syndrome Treatment Market Size, Share & Trends Analysis Report By Type (Evaporative, Aqueous Deficient), By Drug, By Product, By Dosage Form, By Sales Channel, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-974-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global dry eye syndrome treatment market size was valued at USD 5.53 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.85% from 2023 to 2030. The market is witnessing growth due to the factors such as the growing demand for effective treatments, the rising prevalence of dry eye disease, the presence of a lucrative pipeline, and increasing awareness among the population about the condition. The COVID-19 outbreak had an adverse impact on the market in the early phase of the pandemic attributable to the reduced ophthalmology visits. However, as soon as the eye care practices began the market demonstrated a rebound. Moreover, the dry eye persisted in SARS-CoV-2 patients even after treatment of the disease, thus, increasing the target population for treatments. Moreover, during the pandemic sedentary activities and more use of screen has increased the occurrence of dry eye symptoms.

Increasing R&D activities for treating the condition have developed a strong and promising pipeline. This includes products such as CyclASol, SURF-200, SURF-100, OCS-02, and Pro-ocular, which are anticipated to expand the armamentarium of treatment options for patients. Furthermore, NOV03 met all clinical endpoints in September 2021 and is expected to launch by 2023.

The growing geriatric population globally is expected to act as a key driver for the market as eyes produce fewer tears in the elderly leading to increased evaporation and dryness. Furthermore, heightened usage of contact lenses globally serves as a factor for the development of dryness in the eyes leading to the adoption of products for maintaining the health of the eyes.

However, stringent regulations associated with the drugs available for treatment and long-term treatment regimens restrict their use and adoption among the population. On average, the treatment takes weeks or even 3 to 6 months to begin working and may have side effects that restrain the growth of the overall market.

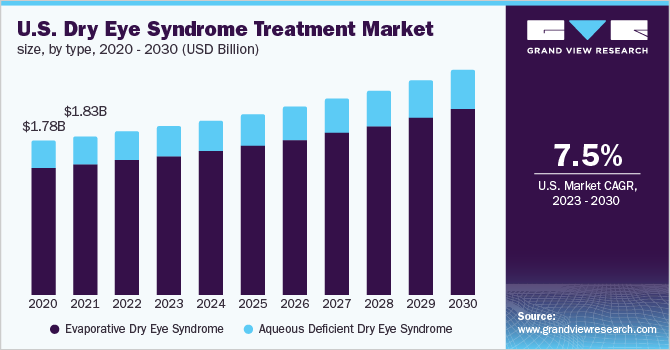

Type Insights

Evaporative dry eye syndrome dominated the market in 2022 with a revenue share of over 82.0% owing to the high prevalence of the disease, which can be associated with factors such as an increase in screen time, reduced rate of blinking, and reduced tear formation due to age. The easy availability of products such as EvoTears targeted at the evaporative type of the disease makes access to treatment easier.

Aqueous dry eye syndrome occurs due to the inability of the lacrimal glands to produce tears. The chronic inflammation along with the thickened tear ducts can result in the accumulation of tears within the lacrimal gland, thus causing aqueous tear deficiency and dry eye. Treatment for aqueous dry eye syndrome includes artificial tears and medicines such as cyclosporine and punctal plugs.

Drug Insights

The Restasis drug segment accounted for the largest revenue share of over 25.0% in 2022 owing to its use in chronic dry eye symptoms. The drug is marketed by Allergan and is highly adopted across the population pertaining to very less side effects associated with the drug. Although the drug requires 3 to 6 months to start working on the condition, it is highly being used as a prescription drug with remarkable treatment results. The segment is expected to register a slow growth rate during the forecast period owing to the approval of generic Restasis from Mylan Pharmaceuticals Inc. by the FDA in February 2022.

Xiidra drug is anticipated to grow at a significant rate of 11.3% during the forecast period. The drug was approved by the U.S. FDA for the treatment of signs and symptoms of dry eye disease. The growth of xiidra is due to the high adoption of the drug. Moreover, it is the first medication in a new class of drugs, called lymphocyte function-associated antigen 1 antagonist for the treatment of the dry eye. Moreover, the drug is a leading product for dry eye commercially marketed by Novartis and approved in major regions across the world.

Product Insights

The cyclosporine segment accounted for the largest revenue share of over 60.0% in 2022 owing to the long-standing use of medications using cyclosporine as a basis. Its effectiveness for dry eye disease symptoms and clinical indicators has been demonstrated through research. As an inflammatory reaction that plays a part in illness, cyclosporine has been found to inhibit T-cell proliferation. FDA-approved medications for treating the symptoms of dry eye include Restasis and Cequa.

Topical corticosteroids are anticipated to grow at the fastest rate of 11.3% over the forecast period. The growth of the market is attributed to the quick action of corticosteroid drugs than immunomodulatory-based drugs. The U.S. FDA-approved Eysuvis launched in Jan 2021 is used for treating both signs and symptoms of dry eye disease.

Dosage Form Insights

The eye drops segment accounted for the largest revenue share of 38.6% in 2022 owing to the ease of usage and administration, which leads to increased patient compliance with the treatment. However, this is a topical mode of administration, which makes the action of the product less sustained and the elimination of the product easy. The launch of products in this segment is common and the movement of players is high. For instance, in April 2021, Alcon announced the launch of its Systane eye drops with hydroboost technology for providing long-lasting relief to patients that apply eye drops over 4 times a day.

Eye solutions are anticipated to grow at the fastest rate of 7.9% owing to the presence of products such as Xiidra and Restasis. However, products such as ointments and gels are preferred for usage at night owing to their long-lasting effects, thereby making this segment lucrative for the key players. For instance, in December 2021, NTC Srl and I-MED announced a partnership for making 0.4% sodium hyaluronate ointment available in the U.S. market.

Sales Channel Insights

The OTC segment accounted for the largest revenue share of 61.4% in 2022 owing to the ease of usage and purchase. The advent of the pandemic and an increasing number of people moving toward self-medication have compelled people to buy drugs over the counter. The availability of various eye drops that are easy to use is leading to the growth of the segment.

Prescription drugs are anticipated to grow at a lucrative rate of 8.3% over the forecast period. The growth of the market is attributed to the increasing prevalence of dry eye among the population. For instance, according to the American Academy of Ophthalmology, over the age of 50 years, 1.68 million men and 3.2 million women experience dry eye. However, out of a total number of patients diagnosed with dry eye syndrome, only 10% of the population is on prescription therapies, while 75% of the population has never tried prescription therapy.

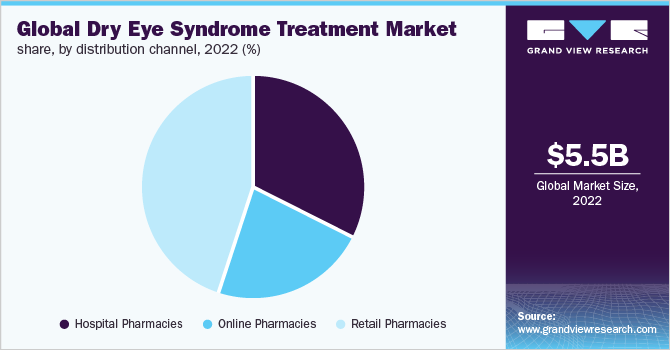

Distribution Channel Insights

The retail pharmacies segment accounted for the largest revenue share of 45.1% in 2022. This is attributed to the ease of access to retail pharmacies. Moreover, the presence of pharmacists to assist with dosages, customer services, and provision of consultations in some regions help the segment gain a competitive edge in the market.

The online pharmacies segment is projected to grow at the fastest rate of 8.4% over the forecast period due to a surge in the number of people buying products due to convenience. Furthermore, the pandemic has increased the adoption of online pharmacies due to restrictions on the movement of people. Moreover, the availability of better pricing in these online stores facilitates repeat purchases.

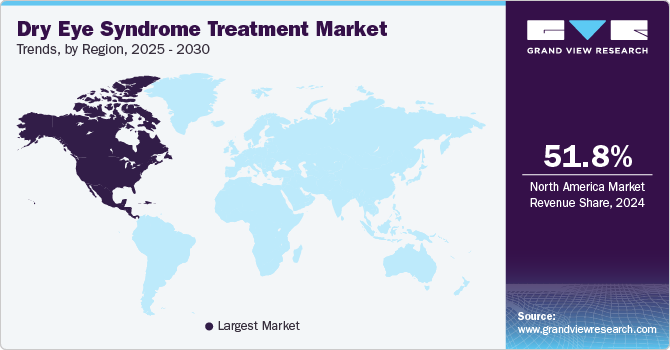

Regional Insights

North America accounted for the largest revenue share of over 39.0% in 2022. The presence of a wide target population, better access to healthcare, and a high rate of treatment adoption are anticipated to drive the market in this region. Moreover, the lucrative nature of the market attracts players in this region. For instance, in October 2019, Cequa was launched by Sun Pharmaceutical Industries Ltd. in the region.

Asia Pacific is estimated to be the fastest-growing segment with a CAGR of 9.4% over the forecast period due to improvements in overall healthcare infrastructure, rising prevalence of dry eye disease, and improved access to healthcare. In addition, the presence of key players in this region such as Otsuka Pharmaceuticals Co. Ltd. and Santen Pharmaceuticals is expected to drive the overall market.

Key Companies & Market Share Insights

The leading players are focusing on growth strategies, such as innovations in the existing product, product launches, R&D, and mergers & acquisitions. For instance, in January 2021, the retail pharmacy availability of Eysuvis in the market was announced by Kala Pharmaceuticals, Inc. for short-term treatment of the dry eye. Some prominent players in the global dry eye syndrome treatment market include:

-

Novartis AG

-

AbbVie, Inc.

-

Sun Pharmaceutical Industries Ltd.

-

Santen Pharmaceutical Co., Ltd.

-

AFT Pharmaceuticals

-

Johnson & Johnson Services, Inc.

-

Otsuka Pharmaceutical Co., Ltd.

-

OASIS Medical

-

Oyster Point Pharma, Inc.

-

Bausch & Lomb

Dry Eye Syndrome Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.92 billion

Revenue forecast in 2030

USD 10.13 billion

Growth rate

CAGR of 7.85% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug, product, dosage form, sales channel, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Novartis AG; AbbVie, Inc.; Sun Pharmaceutical Industries Ltd.; Santen Pharmaceutical Co., Ltd.; AFT Pharmaceuticals; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd.; OASIS Medical.; Oyster Point Pharma, Inc., Bausch & Lomb

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dry Eye Syndrome Treatment Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global dry eye syndrome treatment market report based on type, drug, product, dosage form, sales channel, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Evaporative Dry Eye Syndrome

-

Aqueous Deficient Dry Eye Syndrome

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Restasis

-

Xiidra

-

Cequa

-

Eysuvis

-

Tyrvaya

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cyclosporine

-

Topical Corticosteroids

-

Artificial Tears

-

Punctal Plugs

-

Removable

-

Dissolvable

-

-

Oral Omega Supplements

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Gels

-

Eye Solutions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

OTC

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dry eye syndrome treatment market size was estimated at USD 5.53 billion in 2022 and is expected to reach USD 5.92 billion in 2023.

b. The global dry eye syndrome treatment market is expected to grow at a compound annual growth rate of 7.85% from 2023 to 2030 to reach USD 10.13 billion by 2030.

b. North America dominated the dry eye syndrome treatment market with a share of 39.00% in 2022. The presence of a wide target population, better access to healthcare, and a high rate of treatment adoption are anticipated to drive market growth in this region. A supportive regulatory framework eases the market entry for novel products.

b. Some key players operating in the dry eye syndrome treatment market are Novartis AG; AbbVie, Inc.; Sun Pharmaceutical Industries Ltd.; Santen Pharmaceutical Co., Ltd.; AFT Pharmaceuticals; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd.; OASIS Medical.; Oyster Point Pharma, Inc., Bausch & Lomb

b. Key factors that are driving the market growth include the growing demand for effective treatments, the rising prevalence of dry eye disease, the presence of a lucrative pipeline, and increasing awareness amongst the population about the condition.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."