- Home

- »

- Communication Services

- »

-

E-commerce Software Market Size And Share Report, 2030GVR Report cover

![E-commerce Software Market Size, Share & Trends Report]()

E-commerce Software Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Application (Food & Beverage, Automotive, Home & Healthcare), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-525-0

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

E-commerce Software Market Size & Trends

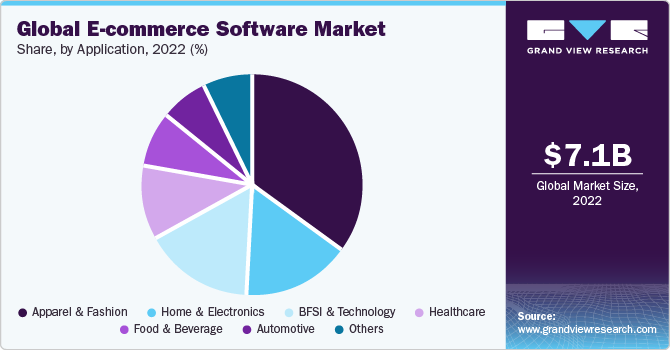

The global e-commerce software market size was valued at USD 7.12 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 15.3% from 2023 to 2030. E-commerce software simplifies complex processes and helps companies manage their inventory, calculate taxes, and manage other business-related functions effectively. The increasing adoption of online shopping among people has led to the demand for e-commerce software among several retailers. For instance, according to the U.S. Department of Commerce, e-commerce sales in the U.S. contributed to around 11.0% of the overall retail sales in 2019. With retailers such as Walmart and The Kroger Co. investing heavily to increase their e-commerce sales, it is expected that the market will witness significant growth over the forecast period.

Reduction in additional costs due to the adoption of online platforms combined with the ease of online business is expected to upkeep market growth from 2020 to 2027. Furthermore, e-commerce software automates business processes by eliminating manual processing errors. The software also provides customers with options to customize delivery dates and times, which enhances customer experience. Companies such as Shopify are integrating Artificial Intelligence (AI) tools to help retailers analyze customer’s buying patterns and estimate the future demand for various products. Owing to these advantages, the number of retailers opting for e-commerce software is bound to rise over the coming years, thereby resulting in market growth.

The increasing adoption of mobile phones for online shopping has led market players such as Shopify to customize their software and operate on these devices. With the high internet penetration rate and the rising number of mobile users, online shopping over these devices is bound to rise. The GSM Association (GSMA) estimates that the internet penetration rate in mobile devices will rise from 48.9% in 2019 to around 60.5% in 2025. Furthermore, the introduction of high-speed internet technology, such as 4G and 5G, is anticipated to impact the growth of the market for e-commerce software positively.

The rising number of e-tailers is also anticipated to generate huge demand for e-commerce software over the forecast period. E-tailers sell their products and services to customers over online platforms and do not need to own or rent a physical store. Their dependency on e-commerce platforms is high as compared to other retailers. However, data security issues due to the increasing cyber-attacks are expected to pose a challenge for the market for e-commerce software. Market players such as 3dcart are focused on offering solutions that have advanced security features to overcome this challenge. The company provides an e-commerce software platform with additional features that reduce the need to install insecure modules and plugins.

Increasing adoption of e-commerce software in the automotive sector is expected to be the additional factor that is driving market growth from 2020 to 2027. Several automotive brands, such as CruiseMaster, JeepPeople, and Awesome GTI, are offering various automotive accessories, parts, and other related services online. These brands are engaged in updating their online storefront channels and are also launching multi-channel initiatives to enhance their business. All these factors are expected to generate growth opportunities for the market players.

Amid the COVID-19 outbreak, governments of various countries have implemented stringent lockdown regulations to prevent the spread of the virus. Shops, malls, and other retail outlets have shut down, which has resulted in bulk buying over online platforms. Limiting shopping of all but life-essential products is becoming a new normal. Retailers are modifying their business strategies accordingly to meet the sudden changes in demand for these products. This factor has a positive impact on the growth of the market for e-commerce software over the long term.

It is expected that the online shopping trend will continue even after the lockdown regulations are removed. Due to this factor, market players are adopting various strategies to expand their customer base. Companies such as BigCommerce Pty. Ltd. and Shopify are currently offering three months of free trial of their e-commerce software to all new merchants. Moreover, Shopify is offering discounts, gift cards, free email marketing plans until October 2020, and online support for all merchants to cater to their requirements effectively.

The e-commerce software industry is expected to witness substantial growth in the coming years. This growth is mainly attributed to the rising number of online stores and online/virtual marketplaces worldwide. In addition, the focus of small businesses and e-commerce companies is shifting towards the adoption of advanced solutions such as e-commerce software. It is mainly to control and manage processes and operations efficiently and effectively. Furthermore, the growing prominence of grocery stores, brick-and-mortar stores, and start-up businesses towards digitization is further supplementing the growth of the market for e-commerce software.

Due to the outbreak of the COVID-19 pandemic, several government authorities across various countries have implemented lockdown and stay-at-home policies to avoid the spread of the virus. As a result, the retail stores, malls, shops, and grocery outlets were shut during the first and second quarters of 2020, which resulted in bulk buying across several e-commerce platforms. Retailers are modifying their business strategies accordingly to meet the sudden changes in demand for these products. This factor has a positive impact on the growth of the market for e-commerce software over the long term.

The demand for e-commerce software is expected to increase over the forecast period as smartphones and mobile devices become faster and smarter, and communication and exchange of information get more convenient and efficient than before. The growing transition from desktops to smartphones is particularly expected to drive the demand for e-commerce software. The rapid increase in the number of smartphone users means more individuals would be exposed to online ads and prompted to consider online shopping.

While the number of individuals owning a smartphone or using the internet remains high in developed economies, it is rising continuously in emerging economies. As such, the growing number of internet users, particularly in the emerging economies of Asia Pacific, Latin America, and the Middle East, is expected to contribute to the growth of the market.

Subsequently, the growing preference for online shipping among consumers is prompting businesses to facilitate online purchases of their respective products and services as part of the efforts to create awareness about their respective websites and drive website traffic, which bodes well for the growth of the market. The growing number of smartphone users is also encouraging marketers to extend their advertising capabilities and promote brands on e-commerce websites, thereby contributing to the growth of the market.

The average online shopper penetration in developing nations, such as India, Brazil, and China, is still lower than that in other developed countries. It means the share of online shoppers in the overall number of internet users is still smaller. However, penetration in urban areas is particularly growing at a rapid pace. The annual spend per shopper on online shopping in emerging economies also remains lower as compared to that in countries such as the U.S., the U.K., and Germany. Nevertheless, given that the global e-commerce market is poised for significant growth, the number of new consumers approaching online shopping platforms is also expected to increase, thereby further driving online shopper penetration. The efforts being pursued by e-tailers to ensure a seamless and appealing experience also encourage online shopping, thereby driving the demand for e-commerce software over the forecast period.

Application Insights

The apparel & fashion segment accounted for the largest revenue share of around 35.4% in 2022. It is attributed to the increasing adoption of online shopping for clothing, bags and accessories, and jewelry. Low digital entry barriers for clothing merchants have led to the adoption of online platforms for expanding their customer base. Furthermore, rising disposable income in developing economies coupled with comfort benefits such as doorstep delivery services, cashless transactions, 24-hour access to products, and discounts with online shopping have led merchants to opt for digital platforms.

The healthcare segment is expected to witness significant growth over the forecast period. E-commerce software provides opportunities for hospitals, clinics, and other health institutes to streamline their purchase of medical equipment and other supplies. The shift of medical device manufacturers towards online platforms has generated growth opportunities for market players. Furthermore, the integration of telemedicine with e-commerce software is anticipated to enhance patient experience over the coming years, which in turn will boost market growth.

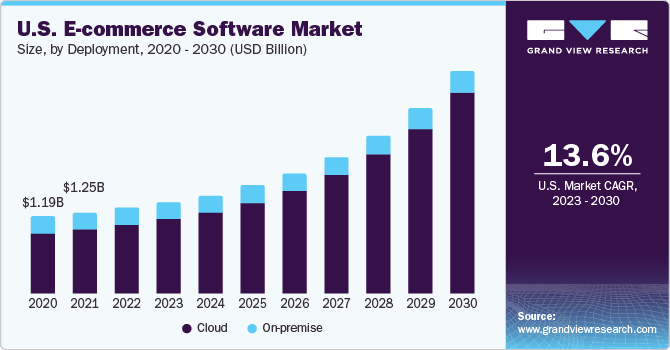

Deployment Insights

The cloud segment accounted for the largest revenue share of 80.2% in 2022 and is expected to grow at the fastest CAGR during the forecast period. It is attributed to the increasing adoption of cloud-based technology across various industry verticals. Cloud-based deployment offers several benefits, such as high storage capacity, centralized access, high speed, and reliability. Furthermore, prominent market players, such as Oracle, SAP SE, and Adobe, are focusing on investing heavily in cloud-based platforms.

The on-premise segment is expected to witness significant growth over the forecast period. On-premise deployment limits the total ownership to the user and thus reduces the need for additional security. The deployment method provides the user with complete control of the configuration and the updates of the software. Furthermore, the growth of the segment is expected to be hindered by the increasing number of startups that conduct their businesses over the internet and companies that have budget constraints.

Regional Insights

North America is expected to witness significant growth over the forecast period. It is due to the presence of prominent market players such as Oracle Corporation, Shopify, and Salesforce.com, Inc. Furthermore, rising e-commerce sales in the U.S. are fueling the demand for e-commerce software among various retailers. Retailers are also taking up new initiatives and investing heavily in e-commerce software to gain an advantage in their respective business sectors. For instance, in 2017, The Kroger Co., one of the major retailers in the U.S., announced the launch of its new initiative named “Restock Kroger,” which aims to develop its e-commerce and omnichannel businesses.

Asia Pacific accounted for the largest revenue share in 2022 and is expected to grow at the fastest CAGR of 17.3% during the forecast period. This upsurge is attributed to the initiatives undertaken by the governments of countries such as China and India to promote digitalization in their respective countries. It has increased the number of internet users. According to the World Bank Group, about 34.5% of India’s population had access to the internet in 2017, an increase of around 12.5% from 2016. This high internet penetration rate has created a huge opportunity for the growth of the e-commerce sector and, in turn, market players to expand their business in this region.

Increased focus on improving e-commerce sales is driving the adoption of e-commerce software across several countries. The U.S. market is poised to experience impressive progress in the near future. This growth is mainly attributed to the rising adoption of m-commerce, increasing number of online marketplaces, expansion of international or cross-border e-commerce, and implementation of cloud-based platforms and technologies such as AI, IoT, and blockchain, among others.

Countries such as India and China are likely to present potential growth opportunities for vendors of e-commerce software due to the growing e-commerce market in the Asia Pacific region. Moreover, blockchain technology is expected to emerge as a potential trend transforming the e-commerce software industry in the region. Blockchain technology has significantly transformed the e-commerce space and, in turn, is fueling demand for e-commerce software.

Key Companies & Market Share Insights

The market for e-commerce software witnessed various inorganic growth strategies such as acquisitions and mergers, partnerships, and collaboration adopted by companies over the recent past. For instance, in March 2019, Shopify announced the acquisition of Handshake Corp., an e-commerce platform provider for B2B wholesale purchasing. With this acquisition, the company plans to enhance its business in the B2B e-commerce sector.

Market players are also focusing on expanding their business by launching various partnership programs across different regions. For instance, in September 2019, SAP SE announced the launch of its “Foundry” program in Germany. According to the program, SAP SE plans to utilize solutions made by start-ups in Munich and integrate them with SAP’s commerce cloud solutions. With this program, the company aims to enhance its customer experience in marketing and commerce cloud solutions.

Key E-commerce Software Companies:

- Shift4Shop

- Adobe.

- BigCommerce Pty. Ltd.

- HCL Technologies Limited

- Intershop Communications AG

- Oracle

- Pitney Bowes Inc.

- Salesforce.com, Inc.

- SAP SE

- Shopify

Recent Developments

-

In July 2023, the National Cooperative Union of India (NCUI) and Google Cloud worked together to create an app that intends to deliver scalable, user-friendly technology for the cooperatives' economic empowerment. This app enables cooperatives to market their goods globally without the use of intermediaries.

-

In June 2023, Google partnered with Open Network for Digital Commerce (ONDC). As a part of this partnership, Google announced the launch of an accelerator program for ONDC to help firms with various tools and resources in building and measuring their e-commerce operations.

-

In April 2023, Reliance Retail introduced Tira, an omni-channel retail platform for beauty products. Tira offers a convenient and personalized purchasing experience to users. It is a go-to location for both international and domestic brands, which it delivers through its omnichannel retail strategy.

-

In July 2022, Shopify Inc., a provider of important internet infrastructure for commerce, finalized the acquisition of Deliverr, Inc. Shopify Fulfillment Network (SFN) provides retailers with a one-stop shop for all of their logistics requirements, from initial inventory receipt to intelligent distribution, via quick delivery and simple returns.

-

In January 2022, to automate its marketing platform with dependable and adaptable AI-driven technological solutions, YESSTYLE.COM LTD., an online retailer of clothing, accessories, cosmetics, and lifestyle goods, chose Oracle Fusion Cloud Customer Experience (CX). Under Oracle Cloud CX, the company is leveraging Oracle Infinity Behavioral Intelligence, Oracle Audience Segmentation, and Oracle Responsys Campaign Management to combine all current customer and prospective marketing signals and launch cross-channel marketing programs.

-

In February 2021, a leading provider of IT services and technology solutions, SONATA SOFTWARE, collaborated with Microsoft to introduce "Microsoft Cloud for Retail." The collaboration with Microsoft Cloud for Retail focuses on the usage of data to enhance the shopping experience, create real-time and sustainable supply chains, and empower store employees to improve their capabilities further.

E-commerce Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.71 billion

Revenue forecast in 2030

USD 20.90 billion

Growth rate

CAGR of 15.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, Application, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan,; India,; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Shift4Shop; Adobe.; BigCommerce Pty. Ltd.; HCL Technologies Limited; Intershop Communications AG; Oracle; Pitney Bowes Inc.; Salesforce.com, Inc.; SAP SE; Shopify

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-commerce Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global e-commerce software market report on the basis of deployment, application, and region:

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Apparel & Fashion

-

Food & Beverage

-

Automotive

-

Home & Electronics

-

Healthcare

-

BFSI & Technology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global e-commerce software market size was estimated at USD 7.12 billion in 2022 and is expected to reach USD 7.71 billion in 2023.

b. The global e-commerce software market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 20.90 billion by 2030.

b. North America dominated the e-commerce software market with a share of 20.8% in 2022. It is due to the presence of prominent market players such as Oracle Corporation, Shopify, and Salesforce.com, Inc. Furthermore, rising e-commerce sales in the U.S. are fueling the demand for e-commerce software among various retailers. Retailers are also taking up new initiatives and investing heavily in e-commerce software to gain an advantage in their respective business sectors.

b. Some key players operating in the e-commerce software market include Shift4Shop; Adobe.; BigCommerce Pty. Ltd.; HCL Technologies Limited; Intershop Communications AG; Oracle Corporation; Pitney Bowes Inc.; Salesforce.com, Inc.; SAP SE; Shopify

b. The increasing adoption of mobile phones for online shopping has led market players such as Shopify to customize their software and operate on these devices. With the high internet penetration rate and the rising number of mobile users, online shopping over these devices is bound to rise.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."