- Home

- »

- Next Generation Technologies

- »

-

E-liquid Market Size, Share, Industry Report, 2021-2027GVR Report cover

![E-liquid Market Size, Share & Trends Report]()

E-liquid Market Size, Share & Trends Analysis Report By Flavor (Menthol, Tobacco, Chocolate), By Type (Pre-filled, Bottled), By Distribution Channel (Online, Retail Store), By Region, And Segment Forecasts, 2021 - 2027

- Report ID: GVR-4-68039-319-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Technology

Report Overview

The global e-liquid market size was valued at USD 1.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 13.4% from 2021 to 2027. The rising adoption of safer alternatives to smoking across the globe is anticipated to drive the demand for e-cigarettes over the forecast period. Furthermore, the availability of e-liquids in various flavors such as tobacco, menthol, chocolate, and fruit & nuts is further anticipated to encourage the usage of e-liquids. Growing health awareness among people, coupled with the availability of e-liquids with a low level of toxicants, is further expected to drive the market over the forecast period.

E-liquids also offer a price advantage over tobacco products and are available in various price ranges, improving the affordability of these e-liquids. Moreover, vaping has the potential of helping smokers quit smoking, thus making e-liquid an effective alternative to smoking. The rising prices of traditional cigarettes have further encouraged the demand for e-liquids and e-cigarettes globally, thereby driving the market. Technologically advanced e-cigarettes are gaining popularity in the market, thus increasing the demand for various e-liquids to enhance the vaping experience.

There has been an increase in the number of vape shops across the globe, particularly in North America, where customers can personally test e-liquid flavors before purchase. The scenario is expected to further encourage the growth of the market over the forecast period. For instance, in June 2019, JUUL Labs, Inc., a provider of e-cigarette and e-liquid, opened a store in Toronto, Canada, which allows customers to test e-liquid flavors before purchase. Various studies have been carried out by medical institutes such as British Medical Association and Royal College of General Practitioners suggesting that smoking exposes the user to over 5000 chemical compounds whereas e-cigarettes expose the user to a negligible number of compounds, most of which are non-toxic. These factors are anticipated to propel the growth of the market over the forecast period.

E-cigarette manufacturers are introducing various device configurations and products at affordable prices to expand their consumer base. Modular e-cigarettes are gaining popularity owing to the customization options available, where the users can interchange parts such as coils, atomizers, and battery mods to get the desired flavor in order to enhance the vaping experience. The growing trend of Do-it-Yourself (DIY) in the market, where the user may develop their own e-liquid by combining various flavors, is further driving the growth of the market over the forecast period. The availability of e-liquids with different nicotine strengths, such as 3 mg, 6 mg, 12 mg, and 24 mg, allowing users to select their e-liquids as per their requirement, is also attracting a large consumer base in the market.

However, stringent regulations imposed by local authorities on the use of e-liquids are expected to hamper the market growth. For instance, in September 2019, the U.S. government announced to ban flavored e-cigarettes to combat a significant rise in the number of teen vaping. The government announced the ban on selling dessert, fruit, and mint-flavored products in the U.S. Amid the ban, companies in the U.S. suspended the sale of non-tobacco flavors in the country. For instance, in November 2019, JUUL Labs, Inc. suspended sales of non-menthol based and non-tobacco flavors in the U.S.

Flavor Insights

The tobacco segment dominated the market and accounted for the largest revenue share of over 30.0% in 2020. This can be attributed to the rising demand for tobacco-flavored e-liquid among smokers as it provides the experience of smoking real tobacco. Furthermore, the increasing consumption of tobacco products among students and females is anticipated to drive the growth of the tobacco segment over the forecast period. On the basis of flavor, the market is segmented into menthol, tobacco, dessert, fruits and nuts, chocolate, and others.

The rising demand has encouraged vendors to increasingly focus on developing and offering new flavors of e-liquids in the market. For instance, in March 2019, Japan Tobacco Inc. launched two new flavors of tobacco capsules for Ploom Tech. The two flavors include menthol and a mixed flavor of peach and pineapple. However, the ban on mint and dessert flavors in some countries is anticipated to hinder the growth of the market to a notable extent.

Type Insights

The bottled segment dominated the market and accounted for the largest revenue share of over 50.0% in 2020. On the basis of type, the market is segmented into pre-filled and bottled. Bottled e-liquids allow users to refill their vape tanks quickly and easily. Furthermore, bottled e-liquid can be stored securely and safely for a longer time and can also be used for creating DIY e-juices. These factors are likely to help the segment achieve a promising growth rate over the forecast period.

The pre-filled segment is anticipated to register considerable growth over the forecast period. This can be attributed to the fact that cartridges prefilled with e-liquid are easy to dispose of. Furthermore, the cost-effectiveness of the pre-filled e-liquids and the rising demand for new flavors among youngsters is anticipated to drive the growth of the segment over the forecast period. However, the COVID-19 pandemic has negatively impacted the market as lockdowns have ensured the shutting down of facilities manufacturing non-essential items in several countries globally, affecting the production of both pre-filled and bottled e-liquid products.

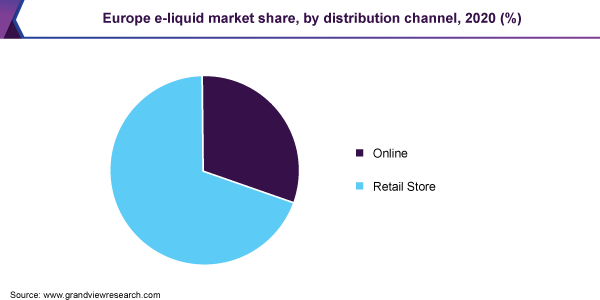

Distribution Channel Insights

The retail store segment dominated the market and accounted for the largest revenue share of over 65.0% in 2020. This can be attributed to the fact that some retail stores allow customers to test various e-liquid flavors and e-cigarette products before making the purchase. On the basis of distribution channels, the market is segmented into retail stores and online. The retail store segment is further segmented into drug stores, convenience stores, newsstands, specialty stores, and tobacconists.

The online segment is expected to register significant growth over the forecast period. Rising developments in the online distribution platforms to restrict the purchase of nicotine products by underaged users are expected to drive the growth of the online segment over the forecast period. For instance, in January 2019, JUUL Labs, Inc. introduced & implemented an online age verification system to enhance the efficiency of its e-commerce platform. The system utilizes third-party age verification to restrict underage people from the website. The new verification system includes four new features, namely two-factor authentication, photo upload, public records check, and protection against fake ID.

However, the COVID-19 pandemic has prompted governments across the globe to implement lockdowns to control the spread of the disease. Vendors in the market are responding to the lockdowns by temporarily ceasing production and logistics providers are no longer transporting goods within and across the borders. Furthermore, owing to varying degrees of lockdowns amid the pandemic, several online retailers across the globe have also temporarily suspended taking online.

Regional Insights

North America dominated the e-liquid market and accounted for the largest revenue share of over 40.0% in 2020. This can be attributed to the presence of key vendors such as JUUL Labs, Inc.; Philip Morris International Inc.; Turning Point Brands, Inc.; and Nicquid in the region. Furthermore, these vendors are focusing on expanding their presence in the region in terms of revenue through mergers and acquisitions. This trend is further expected to drive the growth of the market in North America. For instance, in September 2018, Turning Points Brands, Inc. acquired International Vapor Group, LLC. This acquisition enabled Turning Point Brands Inc. to implement vapor B2C platforms into its electronic vape and component distribution channel.

The Asia Pacific regional market is anticipated to register significant growth over the forecast period. This is attributed to the increasing number of lung cancer cases owing to the growing consumption of tobacco smoking, coupled with the general perception that e-cigarettes and e-liquids are safer than traditional cigarettes. For instance, according to the article published by Oxford University Press, in 2018 over 690,000 lung cancer deaths were reported in China. Furthermore, the high taxes levied on traditional cigarettes in Japan are expected to encourage smokers to increasingly adopt e-cigarettes, thereby stimulating the growth of the market.

Key Companies & Market Share Insights

Key market players are engaging in new product development, partnerships, and acquisitions to strengthen their positions in the market and expand their operations across the globe. For instance, in April 2018, Turning Point Brands, Inc. acquired Vapor Supply’s assets, which include VaporSupply.com and part of its affiliates. The acquisition helped the former to sell e-liquids in the U.S. market and also helped it in expanding its presence in the vaping segment.

Manufacturers are dependent on a number of small and medium-sized third-party suppliers or manufacturers. However, failure to renew agreements or the failure of the distribution channels of third-party suppliers significantly affect the operations of manufacturers is anticipated to hamper the market growth. Key players are heavily investing in the development of e-liquids based on government guidelines issued by local authorities. For instance, in 2019, Turning Point Brands, Inc. invested USD 2.5 million in R&D activities to develop high-quality products. Some of the prominent players in the e-liquid market include:

-

Black Note, Inc.

-

Breazy

-

BSMW Ltd.

-

Crystal Canyon Vapes LLC

-

eLiquid Factory

-

Mig Vapor LLC

-

Molecule Labs, Inc.

-

Nicopure Labs LLC

-

Philip Morris International Inc.

-

Turning Point Brands, Inc.

-

VMR Products LLC

E-liquid Market Report Scope

Report Attribute

Details

Market size in 2021

USD 1.6 billion

Revenue forecast in 2027

USD 3.3 billion

Growth Rate

CAGR of 13.4% from 2021 to 2027

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2027

Quantitative units

Revenue in USD million and CAGR from 2021 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; Australia; Japan; Brazil

Key companies profiled

Black Note, Inc.; Breazy; BSMW Ltd.; Crystal Canyon Vapes LLC; eLiquid Factory; Mig Vapor LLC; Molecule Labs, Inc.; Nicopure Labs LLC; Philip Morris International Inc.; Turning Point Brands Inc.; VMR Products LLC

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global e-liquid market report based on flavors, type, distribution channel, and region:

-

Flavors Outlook (Revenue, USD Million, 2016 - 2027)

-

Menthol

-

Tobacco

-

Dessert

-

Fruits & Nuts

-

Chocolate

-

Others

-

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Pre-filled

-

Bottled

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Online

-

Retail Store

-

Convenience Stores

-

Drug Stores

-

Newsstands

-

Tobacconists

-

Specialty Stores

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

The Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global e-liquid market size was estimated at USD 1.4 billion in 2020 and is expected to reach USD 1.6 billion in 2021.

b. The global e-liquid market is expected to grow at a compound annual growth rate of 13.4% from 2021 to 2027 to reach USD 3.3 billion by 2027.

b. North America dominated the e-liquid market with a share of 41.1% in 2019. This is attributable to the increasing adoption of vape Flavors and e-cigarettes.

b. Some key players operating in the e-liquid market include Black Note, Inc.; Breazy; Crystal Canyon Vapes LLC; eLiquid Factory; VMR Products LLC; Mig Vapor LLC; Nicopure Labs LLC; Savage Enterprises, LLC.; BSMW Ltd.; and Molecule Labs, Inc.

b. Key factors driving the e-liquid market growth include the evident trend of eco-friendly vaping, as it removes an environmental load of disposing of massive volumes of discarded cigarette butts.

b. The COVID-19 pandemic has adversely affected the e-liquid market as lockdowns had ensured the shutting down of manufacturing facilities of non-essential items.

b. A noteworthy development was made in the e-liquid market in March 2019, when Japan Tobacco Inc. launched two new flavors of tobacco capsules for Ploom Tech.

b. The tobacco segment accounted for the largest e-liquid market revenue share of over 30.0% in 2020 due to the rising demand for tobacco-flavored e-liquid among smokers.

b. The retail store segment dominated the e-liquid market, accounting for the largest revenue share of over 65.0% in 2020 as the retailers allow customers to test various e-liquid flavors before making the purchase.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."