- Home

- »

- Medical Devices

- »

-

ECG Patch And Holter Monitor Market Size Report, 2030GVR Report cover

![ECG Patch And Holter Monitor Market Size, Share & Trends Report]()

ECG Patch And Holter Monitor Market Size, Share & Trends Analysis Report By Product (ECG Patch, Holter Monitors), By Application, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-067-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Report Overview

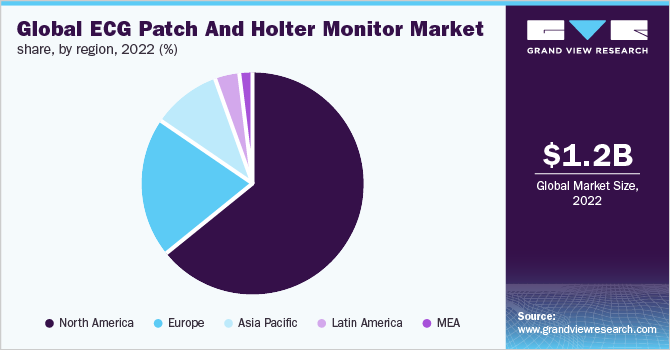

The global ECG patch and holter monitor market was valued at USD 1.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 19.58% from 2023 to 2030. The growing prevalence of atrial fibrillation, aging, and rising incidence of cardiovascular disorders are likely to drive the market during the forecast period. Furthermore, the shift in the trend toward ambulatory monitoring devices, technological advancements in the field, increase in investments for early detection of arrhythmia, advancements in the field of telemetry, and favorable regulatory policies are likely to drive the market growth.

Atrial Fibrillation (AFib) is a common form of arrhythmia diagnosed in clinics and hospitals. With an aging population, the number is expected to rise to 12.1 million by 2030. Moreover, this condition is also responsible for a considerable number of deaths. For instance, according to the CDC, in 2019, AFib was the underlying cause of around 26,535 deaths in the U.S. People of European origin are more likely to develop arrhythmia when compared with African Americans. Because the prevalence of cardiac arrhythmia increases with age, and women have a higher life expectancy than men, more women experience AFib than men.

With the rising incidence of AFib, ventricular fibrillation, Supraventricular Tachycardia (SVT), syncope, palpitations, and post-ablation follow-up worldwide, the demand for ambulatory monitoring devices has increased in the hospitals. In addition, continuous ECG monitoring is a preferred option for obtaining accurate results, when compared to inpatient standard ECG monitoring. The standard ECG test does not provide a clear diagnosis, after which people are referred for further investigations. To avoid such situations, ECG patches and Holter monitors are used. The Holter monitor is the most preferred device worldwide for detecting AFib.

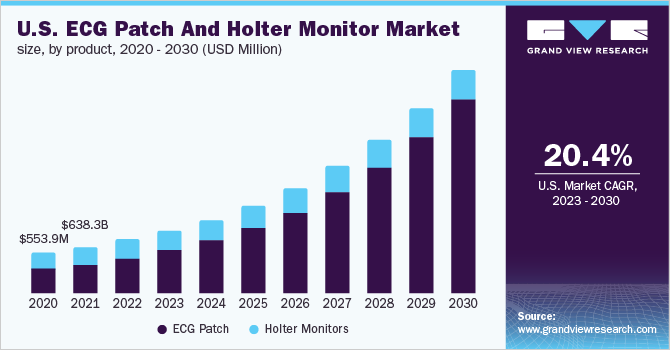

COVID-19 ECG patch and holter monitor market impact: 14.3% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

COVID-19 pandemic has resulted in the high burden on public health and health care delivery globally. The disease has major effects on cardiovascular system. A wide range of arrhythmias has been reported in patients, which complicate the course of COVID-19 due to the associated treatments.

The relaxation of the restrictions is expected to normalize the supply chain and restore manufacturing and distribution capabilities

Along with obtaining approval for innovative products, the market also witnessed strategies such as mergers & acquisitions focused on strengthening solutions offerings

Care providers are expected to have a technologically advanced product portfolio to choose from such as connected care and remote patient monitoring solutions

Increasing competition from technologically advanced and portable devices that are more economical than traditional ECG is expected to create pricing pressure on established manufacturers. Recent government regulations are expected to affect product pricing due to a reduction in reimbursement rates. The Medicare Physician Fee Schedule Final Rule for 2022 was released in November 2021 and yet again excluded to issue of national pricing for extended external ECG monitoring after December 2020. This is likely to lead to reduced Medicare rates for devices, negatively impacting their adoption.

Product Insights

The healthcare ECG Patch dominated the product segment with a revenue share of 57.60% in 2022. The segment is also expected to exhibit the highest CAGR of 24.72% during the forecast period., which can be attributed to high accuracy, ease of use, and continuous monitoring that helps detect rare arrhythmias. In addition, technological advancements and new product launches for real-time results are likely to drive the market.

ECG patches are leadless, easy to use, have slight interference in daily activities, hygienic as not reusable, water-resistant, and there is no upfront cost for initial investment on the device when compared to Holter monitors. Due to easy application to the skin and no maintenance, ECG patches have a high study completion rate with improved compliance compared to other short- to medium-term devices, such as the Holter monitor.

Holter monitors are the most commonly used device for extended ECG recording. It uses a conventional tape recorder or solid-state storage system for acquiring ECG information that can be reviewed. According to a study published in NCBI, globally, atrial fibrillation is the most common form of cardiac arrhythmia. It has been estimated that around 12.1 million people will suffer from this condition in the U.S. by 2030 and 17.9 million people in Europe by 2060. The rising burden of the disease is expected to increase demand for portable Holter for ambulatory ECG monitoring.

Application Insights

The diagnosis segment held a largest market share of 59.13% in 2022, which can be attributed to the globally increasing prevalence of atrial fibrillation which leads to the growing demand for advanced diagnostics devices for early detection. The monitoring segment is expected to exhibit the highest CAGR of 19.96% during the forecast period, which can be attributed to high accuracy, and continuous monitoring for detecting rare arrhythmia. In addition, technological advancements, and new product launches for real-time results are factors likely to drive the market.

The most common application of ECG patches and portable Holter is in the diagnosis & assessment of conduction abnormalities among symptomatic & asymptomatic patients and detection of the presence of potential arrhythmias in syncope or presyncope patients. It also has a role in the stratification of certain cardiomyopathies for assessing the effectiveness of arrhythmia therapy and in the evaluation of silent ischemia. Factors contributing to the growth of the market are improved clinical accuracy due to advanced data analysis tools, new product launches, and various technological advancements for better care & accurate diagnosis.

The manufacturers are engaging in activities such as mergers & acquisitions to strengthen their monitoring solutions portfolio in the market. In November 2021, Philips acquired Cardiologs, a French medical technology company. The acquisition will help the company make use of Cardiologs’ artificial intelligence model that can interpret data from various monitoring devices, including ECG patches, Holter monitors, and smartwatch to generate medical reports.

End-use Insights

In 2022, the hospitals and clinics segment accounted for the highest market share of 47.89% and is expected to exhibit the highest CAGR of 20.06% during the forecast period. This can be attributed to well-equipped infrastructure, availability of advanced devices, a rise in the number of practitioners & patients, and an increase in collaborations to help reduce the burden of diagnosis & treatment.

Technological advancements, shifting interest toward ambulatory centers for treatment, and availability of advanced devices like ECG patches & portable Holter for ambulatory ECG monitoring have led to an increase in the number of patients opting for diagnosis in the ambulatory facilities, driving the market growth. As these devices facilitate immediate transfer of data pertaining to outpatient procedures, demand for ambulatory centers is expected to increase for accurate assessment of cardiac arrhythmias.

The others segment includes diagnostic laboratories and others. One of the factors boosting segment growth is the rapidly evolving digital technology, which has led to the development of next-generation ECG systems used majorly in academic centers and research institutes. The implementation of such systems is said to improve the quality, efficiency, accuracy, and accessibility of ECG studies. Furthermore, the applicability of portable & user-friendly devices and the development of ECG patches for home use are factors expected to drive the market.

Regional Insights

The market for ECG patch and Holter monitor is expected to grow globally due to the increasing burden of Cardiovascular Diseases (CVD), which increases the demand for wearable ECG monitoring devices. They are required for the early detection of CVDs and fulfill the growing need for arrhythmia detection with lower false-positive results. The rising geriatric population coupled with the increasing incidence of Atrial Fibrillation (AFib) are expected to drive the growth of the market.

North America accounted for the largest market share of 64.95% in 2022 and is expected to exhibit the highest CAGR of 20.67% during the forecast period, due to the rising incidence of AFib in the region, aging population, technological advancements, shifting patient preference toward ambulatory ECG monitoring, the launch of next-generation wireless ECG monitoring devices, and technological collaborations between manufacturers. Europe held a significant market share in 2021 and is anticipated to grow at a rapid pace during the forecast period. This can be attributed to the adoption of advanced monitoring devices at ambulatory centers and an increase in investments in wearable monitors by the players.

Asia Pacific is the most dynamic region in the market. The market is expected to witness high growth during the forecast period, which can be attributed to the rapidly growing geriatric population coupled with the increasing incidence of CVDs, rising disposable income, and developing healthcare infrastructure. China and Japan play a dominant role in Asia, and the market will continue to grow.

Key Companies & Market Share Insights

The market is highly competitive with the presence of well-established global brands. iRhythm Technology, Inc. is among the key players operating in the ECG patch segment. This can be attributed to the availability of its ZIO patch service products and the development of innovative products through strong investment in R&D. The company provides medical devices, such as resting ECG patch devices for real-time and continuous monitoring. In May 2021, iRhythm Technologies, Inc. announced the receipt of two additional 510(k) certifications-one for a redesigned and improved flagship monitor and another for enhanced Artificial Intelligence (AI) capabilities. Some of the prominent players in the global ECG patch and holter monitor market include:

-

Nissha Medical Technologies (NMT)

-

Medtronic plc

-

Hill-Rom

-

iRhythm Technologies, Inc.

-

Nihon Kohden Corporation

-

Koninklijke Philips N.V.

-

GE Healthcare

-

Fukuda Denshi Co., Ltd.

-

Spacelabs Healthcare

-

AliveCor, Inc.

-

Cardiac Insight Inc.

-

VitalConnect

-

LifeSignals, Inc.

-

Bardy Diagnostics, Inc.

-

Nasiff Associates, Inc.

-

Midmark Corporation

-

Lief Therapeutics, Inc.

-

Schiller AG

ECG Patch And Holter Monitor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.4 billion

Revenue forecast in 2030

USD 4.8 billion

Growth Rate

CAGR of 19.58% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Norway; Sweden China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Nissha Medical Technologies (NMT); Medtronic plc; Hill-Rom; iRhythm Technologies, Inc.; Nihon Kohden Corporation; Koninklijke Philips N.V.; GE Healthcare; Fukuda Denshi Co., Ltd.; Spacelabs Healthcare; AliveCor, Inc.; Cardiac Insight Inc.; VitalConnect; LifeSignals, Inc.; Bardy Diagnostics, Inc.; Nasiff Associates, Inc.; Midmark Corporation; Lief Therapeutics, Inc.; Schiller AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ECG Patch And Holter Monitor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ECG patch and holter monitor market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

ECG Patch

-

Holter Monitors

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Diagnostics

-

Monitoring

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals & Clinics

-

Ambulatory Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ECG patch and holter monitor market size was estimated at USD 1.2 billion in 2022 and is expected to reach USD 1.4 billion in 2023.

b. The global ECG patch and holter monitor market is expected to grow at a compound annual growth rate of 19.58% from 2023 to 2030 to reach USD 4.8 billion by 2030.

b. North America dominated the ECG patch and holter monitor market with a share of around 65% in 2022. This is attributable to an increase in investments for the early detection of arrhythmia, and advancements in the field of telemetry.

b. Key players in the ECG patch and holter monitor market are Hill-Rom Services, Inc., iRhythm Technologies, Inc., AliveCor, Inc., Cardiac Insight, Inc., VitalConnect, LifeSignals, Bardy Diagnostics, Inc., Nasiff Associates, Inc., Midmark Corporation, Lief Therapeutics, Schiller AG, Nihon Kohden, Philips Healthcare, GE Healthcare, FUKUDA Denshi, and Spacelabs Healthcare.

b. Key factors that are driving the ECG patch and holter monitor market growth include the growing prevalence of atrial fibrillation, aging, and rising incidence of cardiovascular disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."