- Home

- »

- Next Generation Technologies

- »

-

Education Technology Market Size And Share Report, 2030GVR Report cover

![Education Technology Market Size, Share & Trends Report]()

Education Technology Market Size, Share & Trends Analysis Report By Sector (Preschool, K-12, Higher Education), By End-user (Business, Consumer), By Type, By Deployment, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-878-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2023

- Industry: Technology

Education Technology Market Size & Trends

The global education technology market size was estimated at USD 142.37 billion in 2023 and is expected to grow at a CAGR of 13.4% from 2024 to 2030. Education technology (EdTech) includes hardware and software technology used to educate students on a virtual level to improve learning in classrooms and enhance students education outcomes. EdTech platforms assist students overcome hurdles to receive a comprehensive education by utilizing technology for learning and teaching. Learners are increasingly opting for eBooks that can be accessed online from anywhere in the world.

Digital content is comparatively easier to generate than printed content, which tends to incur higher production costs. Digital books are available in different languages and can be easily translated and retrieved by a wider user base. Moreover, learners, especially those with physical disabilities, can listen to educational content in an audio format to improve their vocabulary and encourage better interpretive reading.

For instance, in January 2022, Texthelp Ltd., a prominent assistive technology provider for the EdTech market, launched OrbitNote, a PDF-enabled app that would be helpful for visually impaired students to access document by leaving voice notes. Users will be able to engage with digital copies in an entirely new way with OrbitNote. They will be able to build an accessible, active, and collaborative space for everyone.

Education technology solutions are expected to evolve in line with the advances in the latest technologies, such as IoT, AI, and AR/VR, and contribute significantly to the market's growth. The integration of AR and VR in EdTech solutions helps offer an interactive experience to learners. It allows learners to explore and seamlessly connect with abstract concepts and subsequently drives student engagement.

For instance, in January 2022, zSpace, Inc., a U.S.-based EdTech firm that offers hybrid or remote learning, launched a new AR/VR learning device that would help engage students with multidimensional content in a virtual world, eliminating the need for glasses. On the other hand, the integration of blockchain technology allows end-users to store and secure records of students and learners, thereby enabling educators to analyze the consumption patterns of the material offered to the learners and make data-driven decisions.

Enhancing student engagement is emerging as a prime concern for educators. Hence, market players respond to such concerns by introducing advanced interactive apps, and whiteboards and shifting from projector-based displays to touchscreen displays. For instance, in January 2023, Creative Galileo, an ed-tech startup announced the release of Toondemy, an educational learning app. The app offers a complete educational journey for students aged 3-10 years in line with NEP, NCERT, and CBSE to construct cognitive capabilities, and strong foundational concepts, learn phonics, and conceive new innovative skills.

However, given that EdTech solutions also store learners’ personal information, market players must abide by the copyrights and data privacy norms while introducing any new EdTech product. On the other hand, all the universities receiving funds from the U.S. Department of Education (DOE) have to abide by the requirements falling under the FERPA and PPRA acts. FERPA aims to protect student records while PPRA puts a strong emphasis on safeguarding students' personal information gathered through surveys.

In the European Union (EU), EdTech companies also fall under the purview of the General Data Protection Regulation (GDPR), limiting the access and processing of users’ data by all types of organizations involved in handling large volumes of information. For instance, in March 2021, the Canadian Government created a Digital Charter where every individual would have control over their personal information. The digital charter has a few principles to be maintained and followed for the privacy of the data.

Smart classrooms are propelling the growth of the EdTech market by offering tech-savvy classrooms that use animations, multimedia, audio, video, and graphics to improve teachers' and students' teaching and learning processes. This enhances student involvement and results in higher academic performance. Smart classrooms are where teachers have access to audio-visual technology and computers that allow them to teach utilizing a range of media. These include a PowerPoint presentation, DVDs, and smart interactive whiteboards, presented using a data projector. Smart class is a digital endeavor that revolutionizes the ways teachers teach and students learn.

Smart classrooms let students accomplish their educational tasks from the comfort of their own homes by utilizing remote learning and various multimedia resources. It has benefitted teachers to call on any student in the room without leaving their desk, track individual student progress and give guidance or support. They also allow students to collaborate on projects from any location in the classroom. For instance, in November 2021, the West Bengal Government partnered with EdTech startup Schoolnet India Limited, an EdTech startup, to drive the career development program and promote digital learning. This platform will also let students access the Geneo eSekha portal, the state’s education website, which covers all the subjects from class 5 to class 10.

In March 2022, Bruhat Bengaluru Mahangara Palike (BBMP) School in Bangalore imparted innovative learning by adding 60 digital classrooms and seven computer labs with 20 computers in each lab. This initiative would help teachers teach students through 3D digital models, improving education and a better understanding of the concepts.

In March 2022, Lenovo, which had launched its Lenovo EdVisions program, updated it to provide a hybrid classroom experience that would offer Lenovo smart education. The curriculum has been upgraded to provide students with a more exciting learning experience. It also creates a forum for educators to share their hybrid classroom experiences and techniques. For instance, in August 2021, Bhubaneshwar, a city in Odisha, started with Bhubaneshwar Smart City Limited (BSCL) to set up smart classrooms for Unit IX Government High School.

The main aim behind this smart classroom project was to provide virtual learning by bringing advanced technology into the classroom for teachers and students. For instance, in September 2021, Kerala's education minister announced introducing smart classrooms with advanced technology for special schools, including visually challenged and hard of hearing students. Further, the State Council of Educational Research and Training (SCERT) would publish audio and videos on special students' various subjects.

Market Concentration & Characteristics

The education technology market is characterized by a high degree of innovation by advancements in technologies such as artificial intelligence, virtual reality, big data, and adaptive learning platforms. These technologies transform education by providing personalized learning experiences through AI-powered tutors and virtual environments. The sector is witnessing increased investment from various sources, including venture capitalists and major tech companies, fostering the growth of startups and the expansion of existing EdTech firms. The EdTech industry is at the forefront of this transformation; the industry is reshaping traditional classrooms and empowering educators and learners worldwide.

The EdTech market is characterized by a high level of merger and acquisition (M&A) activity by the leading players as they seek to expand their market share by diversifying their product portfolios, targeting new customer segments, and strategically expanding their global presence into various markets. The companies are also acquiring smaller EdTech startups to integrate innovative technologies such as adaptive learning tools and personalized learning programs.

Regulations play a crucial role in the EdTech market as they safeguard student data privacy, ensuring compliance with laws and preventing unauthorized access. Regulatory measures promote quality and effectiveness by imposing standards on educational content and platforms, encouraging evidence-based practices and improved learning outcomes. For instance, in January 2022, the Ministry of Education in India unveiled plans to regulate the EdTech industry, leading to the formation of the India EdTech Consortium (IEC) by multiple EdTech companies. This initiative reflected a collaborative effort among EdTech firms to respond to government regulatory plans and promote responsible practices proactively.

There is no direct substitute for education technology; however, it faces competition from traditional classroom learning, as it is a foundational component of education. Traditional classrooms offer strengths in social interaction, direct teacher guidance, and hands-on activities, elements that can be challenging in online learning.

End-user concentration is a significant factor in the EdTech market, with the business segment, including corporations and educational institutions, dominating with a high market share. This concentration significantly influences product development, pricing strategies, and the growth of the market.

Sector Insights

The K-12 EdTech segment led the market in 2023, accounting for over 40% share of the global revenue. The high share can be attributed to the growing trend of game-based learning in the K-12 sector. The majority of the teachers in the K-12 sector support gamification initiatives to develop the students’ math learning skills with the integration of practical, project-based work in schools.

Additionally, incorporating technologies in this sector enables immersive content and provides experiences, such as virtual field trips and complex lab-based experiments, resulting in an engaging learning experience. For instance, in January 2023, Leadership Boulevard Private Limited, India's one of immense School EdTech companies announced the acquisition of Pearson’s K-12 learning business in India. The acquisition intends to boost its product portfolio to benefit more than 5 Lakh private schools in the country and expand the company's reach to more than 9,000 schools.

The preschool segment is expected to exhibit the highest CAGR over the forecast period. Technological advancements enable educators to collect assessment data directly on mobile devices, reducing the conventional use of paper and pen. Some of the assessments are eliminating data entry and letting children respond directly through touchscreen-enabled devices.

Leading players are providing various solutions to their customer base, such as app-based learning with videos and curated content, specifically for the early childhood segment. For instance, in March 2022, DY Patil International School in India launched its Mars1 Preschool, an AI-driven interactive learning school. With AI technology, kids would be exposed to learning by audio, visual, and kinesthetic learning. Besides, they would also be able to learn from Cubetto, a wooden robot that would help develop their problem-solving skills and computational thinking.

End-user Insights

The business segment accounting for the largest revenue share of more than 68% in 2023. The high share can be attributed to the upsurge in partnerships among EdTech firms, educational institutes, and content developers to create significant opportunities for the digital education sector. As a result, partnerships and collaborations are increasingly becoming a critical part of this developing ecosystem. For instance, in February 2022, Greenfield Community College (GCC) partnered with Upright Education to offer new skills in software development and technology, including user experience design (UX) and user interface (UI). The partnership would allow students of GCC to focus on self-employment and create a hub for a career in technology training.

The consumer segment is predicted to foresee significant growth in the coming years. Growing awareness among parents and students and the gradual shift from traditional education toward digital formats is expected to drive this segment’s growth. Lifelong learning is becoming a growing trend among adults and corporate workers as it offers flexibility concerning time and location to gain additional knowledge.

Massive open online courses (MOOCs) are gaining increasing prominence across the globe owing to inexpensive online education for consumers. For instance, in November 2021, Dr. Babasaheb Ambedkar Open University (BRAOU) collaborated with Commonwealth Educational Media Centre for Asia (CEMCA) to launch a massive open online course (MOOC) platform. The platform comprises educators teaching from KG to PG level students and enables students to access the content through videos, discussions, and readings.

Deployment Insights

The on-premises segment led the market in 2023, accounting for over 69% of global revenue. The higher share can be attributed to the reliability and scalability of usage in the EdTech market. The on-premises deployment refers to installing software or services on a company's premises or systems. The on-premises division is responsible for maintaining, licensing, and selling on-premises and mobile software products and offering software maintenance services.

Professional services, including educational services, are generally performed by the on-premises segment. In terms of security, the on-premises platform outperforms its competitors. For instance, in August 2021, upGrad Education Private Limited, an EdTech company, acquired Knowledgehut Solutions Private Limited, a prominent player in the EdTech industry.

This acquisition would let upGrad Education Private Limited enter the market for short-term reskilling and upskilling. To capitalize on this market opportunity, it will use its next-generation flagship learning experience on-premises platform, PRISM, to provide learners with a scalable and highly interactive learning model, upskill them, and help them drive meaningful career outcomes.

The cloud segment is anticipated to witness significant growth in the coming years. This can be attributed to the rising usage of learning analytics, reduced cost of ownership, and increase in the adoption of mobile learning. Cloud deployment appeals to enterprises of all sizes because it offers regular data backup, lower operational expenses, lower capital, high security, and rapid deployment features for always-on functioning.

These benefits of cloud deployment of various EdTech market solutions are propelling the adoption of these solutions across the world. For instance, in March 2022, ViewSonic Corporation, a global provider of communication and electronics, launched its new cloud-based platform, myViewBoard, an AI-driven technology for students to help them engage in the classroom. It also determines whether or not students are paying attention by assessing human posture and ambient elements that may influence students concentration. This would help teachers use this information and make changes to their lessons.

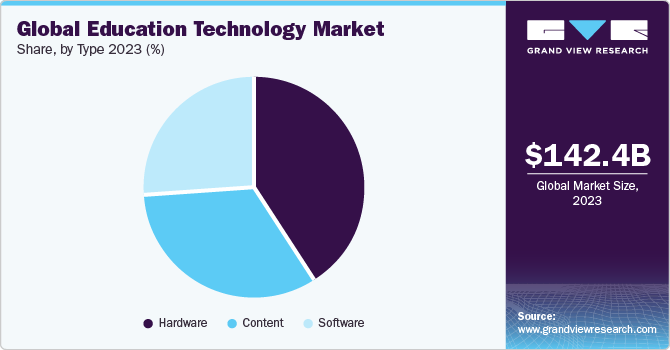

Type Insights

The hardware segment led the market in 2023, accounting for over 41% of global revenue. This can be attributed to the growing prominence of digital classrooms across the education industry. For instance, in February 2022, Veative Labs., a prominent leader in virtual reality for the EdTech market, provided its virtual reality headsets to Smt. Godavari Devi Saraf Senior Secondary School in Andhra Pradesh, India, to let students feel what they are studying. The school gives daily 20 minutes to use the virtual reality headsets. This helps students to have a live experience of what they are learning in subjects like science, where they could learn about the human heart with the help of headsets.

The content segment is anticipated to exhibit the highest CAGR over the forecast period. The EdTech sector is witnessing innovation in content delivery with the incorporation of advanced visualization technologies. This can be attributed to the availability of numerous e-learning portals offering better-quality educational content in the form of study notes, test-prep materials, question banks, and learning videos. For instance, in June 2021, the Government of Odisha launched an e-Pathshala, an e-learning platform containing different courses for students and teachers. This platform would have various features such as online classes, self-learning, evaluation of assignments, and learners’ progress.

Regional Insights

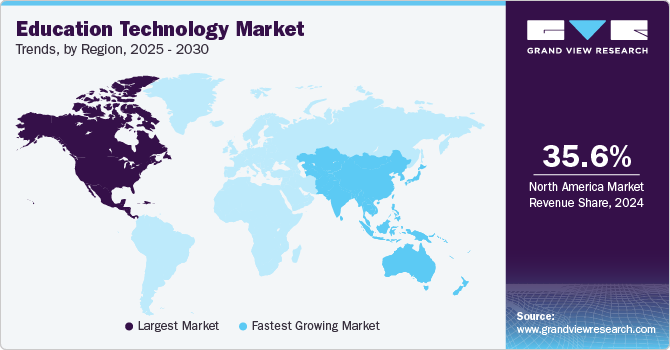

North America dominated with a revenue share of over 36% in 2023. The high share can be attributed to the increased focus on personalized learning and the adoption of digital skills. Moreover, the plenty of investments from venture capitalists and private equity investors in the EdTech sector propelled the market growth. For instance, in December 2023, Achieve Partners, a private equity firm, launched a USD 167 million fund focused on transforming technology approaches in K-12 schools and universities, aiming to enhance learning outcomes. The fund focuses on investing in software and tech-enabled services companies spanning K-12 through higher education and workforce development.

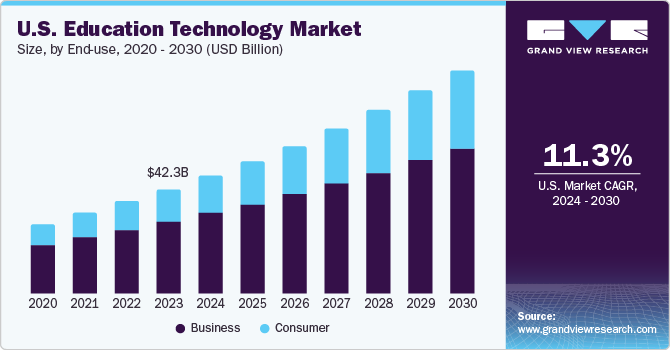

U.S. Education Technology Market Trends

The U.S. EdTech market is expected to grow at a CAGR of 11.3% from 2024 to 2030, owing to the presence of numerous start-ups and well-established EdTech companies in the country. Furthermore, the increased technology adoption by schools and educators and a surge in investments are enhancing learning outcomes within the education sector.

Europe Education Technology Market Trends

The EdTech market in Europe is expected to witness significant growth over the forecast period. Most of the region’s investments have been focused on areas such as corporate training, online training, and language learning. The regional market is gaining traction not only with the growing presence in the number of EdTech hubs in London, Oslo, and Helsinki, among others, but also with increasing attention from venture capitalists, governments, and EdTech accelerators.

The UK EdTech market held a significant share in Europe. The majority of the region's funding is going to the UK and Nordics, as these markets have the highest penetration of devices and broadband in the K-12 segment. For instance, in February 2022, Microsoft partnered with the government's Get Help with Technology initiative by the government of the UK, which provides underprivileged children and youth with laptops and tablets to help with remote education.

Asia Pacific Education Technology Market Trends

The EdTech market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period, attributed to the rising prevalence of computing and smart devices among the masses. In recent times, developing countries such as India have witnessed a wave of affordable broadband connectivity, resulting in numerous education technology companies reaching out to the population. This trend is anticipated to enable users to experience educational learning with the assistance of internet connectivity. Besides, education stakeholders in developing areas are increasingly considering technology to bridge the gap between educational infrastructure and teaching resources.

The India EdTech market held a significant share in Asia Pacific. India has witnessed a wave of affordable broadband connectivity, resulting in numerous companies reaching out to the population. This trend is anticipated to enable users to experience educational learning with the assistance of internet connectivity. In addition, education stakeholders in developing areas are increasingly considering technology to bridge the gap between educational infrastructure and teaching resources. For instance, in January 2022, Teevra Edutech Pvt Ltd (SpeEd Labs), an EdTech platform in India, that offers personalized learning with individualized courses to each student, is expanding its business across the country using AI-powered tools such as a recommendation engine, analytical dashboard, and personalized improvement plan which would help to bridge the gap between teacher and students.

Key Education Technology Company Insights

Key education technology companies include BYJU'S; Coursera Inc.; Microsoft; Udacity, Inc.; and Google LLC. Companies active in the EdTech industry are focusing aggressively on expanding their customer base and gaining a competitive edge. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development.

For instance, in January 2022, Teachmint Technologies Pvt. Ltd, an online app for students and teachers, acquired MyClassCampus, an ERP platform for educational organizations. This acquisition will let Teachmint expand its offerings in schools and various educational institutions by combining its learning management system (LMS) with the ERP software. Besides, in June 2021, BYJU’S, an EdTech company that provides online tuition, partnered with Google LLC to make online learning more consistent for both professors and students. This partnership will allow educational institutions to offer a personalized digital platform for classroom organization.

Key Education Technology Companies:

The following are the leading companies in the education technology market. These companies collectively hold the largest market share and dictate industry trends.

- BYJU'S

- Blackboard Inc.

- Chegg, Inc.

- Coursera Inc.

- Edutech

- edX LLC

- Google LLC

- Instructure, Inc.

- Microsoft

- Udacity, Inc.

- upGrad Education Private Limited

Recent Developments

-

In January 2024, Baims, a Kuwaiti EdTech firm, acquired orcas, an Egyptian online tutoring startup. The acquisition aims to enhance Baims' presence in the MENA region and to expand its offerings to include both pre-recorded courses and personalized 1-on-1 tutoring.

-

In November 2023, Stones2Milestones, an Indian edtech platform, partnered with Finnish Global Education Solutions Oy. The partnership aims to focus on integrating the Finnish learning approach into Indian schools, with a focus on numeracy and literacy and numeracy, teacher professional development, and the development of advanced technology solutions for broader global implementation.

-

In April 2023, Echo360 introduced EdTech SaaS platforms, namely EchoPollTM for interactive polling, EchoVideoTM with enhanced editing tools and accessibility, and ExamViewTM with advanced assessment features. These launches aim to transform learning experiences, emphasizing engagement, accessibility, and streamlined workflows, establishing Echo360's position as an EdTech leader.

Education Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 163.49 billion

Revenue forecast in 2030

USD 348.41 billion

Growth rate

CAGR of 13.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sector, end-user, type, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; China; India; Japan

Key companies profiled

BYJU'S; Blackboard Inc.; Chegg, Inc.; Coursera Inc.; Edutech; edX Inc.; Google LLC; Instructure, Inc.; Microsoft; Udacity, Inc.; upGrad Education Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Education Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global education technology market report based on sector, end-user, type, deployment, and region:

-

Sector Outlook (Revenue, USD Billion, 2017 - 2030)

-

Preschool

-

K-12

-

Higher Education

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Business

-

Consumer

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Classroom Management System

-

Document Management System

-

Learning and Gamification

-

Learning Management System

-

Student Collaboration System

-

Student Information and Administration System

-

Student Response System

-

Talent Management System

-

Test Preparation

-

-

Content

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

MEA

-

Frequently Asked Questions About This Report

b. The global education technology market size was estimated at USD 142.37 billion in 2023 and is expected to reach USD 163.49 billion in 2024

b. The global education technology market is expected to grow at a compound annual growth rate of 13.4% from 2024 to 2030 to reach USD 348.41 billion by 2030.

b. The business segment led the EdTech market in 2023, accounting for above 68% share of the global revenue. The high share can be attributed to the upsurge in partnerships among EdTech firms, educational institutes, and content developers to create significant opportunities for the digital education sector.

b. The hardware segment led the EdTech market in 2023, accounting for over 41% of the global revenue share. The high share can be attributed to the increased prominence of digital classrooms across the education industry.

b. North America dominated the education technology market in 2023 and held over 36% share of the global revenue. The regional market will retain its dominance throughout the forecast period due to plenty of investments from venture capitalists and private-equity investors in the EdTech sector in the U.S.

b. The K-12 sector dominated the education technology market with a share of 40% in 2023. Game-based learning is anticipated to be a growing trend in the K-12 sector.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. K-12 Education Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.1.1. Growing Investments In Education Technology Development

3.4.1.2. Growing Preference For Digital Learning

3.4.2. Market Restraints Analysis

3.4.2.1. Risks Associated With Cyber Security

3.4.3. Industry Opportunities

3.4.4. Industry Challenges

3.4.5. Key Small-Sized EdTech Companies, By Region/Country

3.4.6. Key Company Ranking Analysis, 2023

3.5. K-12 Education Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. EdTech Market: Sector Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. EdTech Market: Sector Movement Analysis, USD Million, 2023 & 2030

4.3. Preschool

4.3.1. Preschool Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. K-12

4.4.1. K-12 Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5. Higher Education

4.5.1. Higher Education Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.6. Others

4.6.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. EdTech Market: End- User Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. EdTech Market: End-User Movement Analysis, USD Million, 2023 & 2030

5.3. Business

5.3.1. Business Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Consumer

5.4.1. Consumer Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. EdTech Market: Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. EdTech Market: Type Movement Analysis, USD Million, 2023 & 2030

6.3. Hardware

6.3.1. Hardware Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. Software

6.4.1. Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4.1.1. Classroom Management System

6.4.1.2. Document Management System

6.4.1.3. Learning and Gamification

6.4.1.4. Learning Management System

6.4.1.5. Student Collaboration System

6.4.1.6. Student Information and Administration System

6.4.1.7. Student Response System

6.4.1.8. Talent Management System

6.4.1.9. Test Preparation

6.5. Content

6.5.1. Content Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. EdTech Market: Deployment Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. EdTech Market: Deployment Movement Analysis, USD Million, 2023 & 2030

7.3. Cloud

7.3.1. Cloud Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. On-Premises

7.4.1. On-Premises Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. EdTech Market: Regional Estimates & Trend Analysis

8.1. EdTech Market Share, By Region, 2023 & 2030, USD Million

8.2. North America

8.2.1. North America EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. U.S. EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Canada EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.2. UK

8.3.2.1. UK EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Germany EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.2. China

8.4.2.1. China EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.3. Japan

8.4.3.1. Japan EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.4. India

8.4.4.1. India EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5. Latin America

8.5.1. Latin America EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6. Middle East and Africa

8.6.1. Middle East and Africa EdTech Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Market Share Analysis

9.5. Company Heat Map Analysis

9.6. Strategy Mapping

9.6.1. Expansion

9.6.2. Mergers & Acquisition

9.6.3. Partnerships & Collaborations

9.6.4. New Product Launches

9.6.5. Research And Development

9.7. Company Profiles

9.7.1. Blackboard Inc.

9.7.1.1. Participant’s Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.1.4. Recent Developments

9.7.2. Byju’s

9.7.2.1. Participant’s Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.2.4. Recent Developments

9.7.3. Chegg, Inc.

9.7.3.1. Participant’s Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.3.4. Recent Developments

9.7.4. Coursera, Inc.

9.7.4.1. Participant’s Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.4.4. Recent Developments

9.7.5. Edutech

9.7.5.1. Participant’s Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.5.4. Recent Developments

9.7.6. Edx, Inc

9.7.6.1. Participant’s Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.6.4. Recent Developments

9.7.7. Google LLC

9.7.7.1. Participant’s Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.7.4. Recent Developments

9.7.8. Instructure, Inc.

9.7.8.1. Participant’s Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.8.4. Recent Developments

9.7.9. Microsoft

9.7.9.1. Participant’s Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

9.7.9.4. Recent Developments

9.7.10. Udacity

9.7.10.1. Participant’s Overview

9.7.10.2. Financial Performance

9.7.10.3. Product Benchmarking

9.7.10.4. Recent Developments

9.7.11. Upgrad Education Private Limited

9.7.11.1. Participant’s Overview

9.7.11.2. Financial Performance

9.7.11.3. Product Benchmarking

9.7.11.4. Recent Developments

List of Tables

Table 1 EdTech - industry snapshot & key buying criteria, 2017 - 2030

Table 2 Global EdTech market, 2017 - 2030 (USD Million)

Table 3 Global EdTech market estimates and forecast by application, 2017 - 2030 (USD Million)

Table 4 Global EdTech market estimates and forecast by sector, 2017 - 2030 (USD Million)

Table 5 Global EdTech market estimates and forecast by end-user, 2017 - 2030 (USD Million)

Table 6 Global EdTech market estimates and forecast by type, 2017 - 2030 (USD Million)

Table 7 Global EdTech market estimates and forecast by deployment, 2017 - 2030 (USD Million)

Table 8 Global EdTech market estimates and forecasts by region, 2017 - 2030 (USD Million)

Table 9 EdTech market estimates and forecast by preschool, 2017 - 2030 (USD Million)

Table 10 EdTech market estimates and forecast, by K-12, 2017 - 2030 (USD Million)

Table 11 EdTech market estimates and forecast by higher education, 2017 - 2030 (USD Million)

Table 12 EdTech market estimates and forecast by others, 2017 - 2030 (USD Million)

Table 13 EdTech market estimates and forecast by business, 2017 - 2030 (USD Million)

Table 14 EdTech market estimates and forecast by consumer, 2017 - 2030 (USD Million)

Table 15 EdTech market estimates and forecast, by hardware, 2017 - 2030 (USD Million)

Table 16 EdTech market estimates and forecast by software, 2017 - 2030 (USD Million)

Table 17 EdTech market estimates and forecast, by classroom management system, 2017 - 2030 (USD Million)

Table 18 EdTech market estimates and forecast by document management system, 2017 - 2030 (USD Million)

Table 19 EdTech market estimates and forecast by learning and gamification, 2017 - 2030 (USD Million)

Table 20 EdTech market estimates and forecast by learning management system, 2017 - 2030 (USD Million)

Table 21 EdTech market estimates and forecast by student collaboration system, 2017 - 2030 (USD Million)

Table 22 EdTech market estimates and forecast, by student information and administration system, 2017 - 2030 (USD Million)

Table 23 EdTech market estimates and forecast by student response system, 2017 - 2030 (USD Million)

Table 24 EdTech market estimates and forecast by talent management system, 2017 - 2030 (USD Million)

Table 25 EdTech market estimates and forecast, by test preparation, 2017 - 2030 (USD Million)

Table 26 North America EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 27 North America EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 28 North America EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 29 North America EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 30 North America EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 31 U.S. EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 32 U.S. EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 33 U.S. EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 34 U.S. EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 35 U.S. EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 36 Canada EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 37 Canada EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 38 Canada EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 39 Canada EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 40 Canada EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 41 Europe EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 42 Europe EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 43 Europe EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 44 Europe EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 45 Europe EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 46 UK EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 47 UK EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 48 UK EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 49 UK EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 50 UK EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 51 Germany EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 52 Germany EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 53 Germany EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 54 Germany EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 55 Germany EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 56 Asia Pacific EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 57 Asia Pacific EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 58 Asia Pacific EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 59 Asia Pacific EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 60 Asia Pacific EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 61 China EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 62 China EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 63 China EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 64 China EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 65 China EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 66 Japan EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 67 Japan EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 68 Japan EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 69 Japan EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 70 Japan EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 71 India EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 72 India EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 73 India EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 74 India EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 75 India EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 76 Latin America EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 77 Latin America EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 78 Latin America EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 79 Latin America EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 80 Latin America EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

Table 81 Middle East & Africa EdTech Market Estimates And Forecast, 2017 - 2030 (USD Million)

Table 82 Middle East & Africa EdTech market estimates and forecast, by sector, 2017 - 2030 (USD Million)

Table 83 Middle East & Africa EdTech market estimates and forecast, by end-user, 2017 - 2030 (USD Million)

Table 84 Middle East & Africa EdTech market estimates and forecast, by type, 2017 - 2030 (USD Million)

Table 85 Middle East & Africa EdTech market estimates and forecast, by deployment, 2017 - 2030 (USD Million)

List of Figures

Fig. 1 EdTechMarket Segmentation

Fig. 2 Technology landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 EdTech - Market Size and Growth Prospects (USD Million)

Fig. 12 EdTechMarket: Industry Value Chain Analysis

Fig. 13 EdTechMarket: Market Dynamics

Fig. 14 EdTechMarket: PORTER’s Analysis

Fig. 15 EdTechMarket: PESTEL Analysis

Fig. 16 EdTechMarket Share by Sector, 2023 & 2030 (USD Million)

Fig. 17 EdTechMarket, by Sector: Market Share, 2023 & 2030

Fig. 18 Preschool Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 19 K-12 Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 20 Higher Education Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million

Fig. 21 Others Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 22 EdTechMarket Share by End-user, 2023 & 2030 (USD Million)

Fig. 23 EdTechMarket, by End-user: Market Share, 2023 & 2030

Fig. 24 Business Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 25 Consumer Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 26 EdTechMarket, by Type: Key Takeaways

Fig. 27 EdTechMarket, by Type: Market Share, 2023 & 2030

Fig. 28 Hardware Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 29 Software Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 30 Classroom Management System Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 31 Document Management System Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 32 Learning and Gamification Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 33 Learning Management System Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 34 Student Collaboration System Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 35 Student Information and Administration System Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 36 Student Response System Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 37 Talent Management System Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 38 Test Preparation Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 39 Content Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 40 EdTechMarket Revenue, by Region, 2023 & 2030 (USD Million)

Fig. 41 Regional Marketplace: Key Takeaways

Fig. 42 Regional Marketplace: Key Takeaways

Fig. 43 North America EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 44 U.S. EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 45 Canada EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 46 Europe EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 47 UK EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 48 Germany EdTechMarket Estimates and Forecasts 2017 - 2030 (USD Million)

Fig. 49 Asia Pacific EdTechMarket Estimates and Forecast, 2017 - 2030 (USD Million)

Fig. 50 China EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 51 Japan EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 52 India EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 53 Latin America EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 54 MEA EdTechMarket Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 55 Key Company Categorization

Fig. 56 Company Market Positioning

Fig. 57 Key Company Market Share Analysis, 2023

Fig. 58 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- EdTech Sector Outlook (Revenue, USD Billion, 2017 - 2030)

- Preschool

- K-12

- Higher Education

- Others

- EdTech End-User Outlook (Revenue, USD Billion, 2017 - 2030)

- Business

- Consumer

- EdTech Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Hardware

- Software

- Content

- EdTech Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- North America EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- North America EdTech Market, By End-User

- Business

- Consumer

- North America EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- North America EdTech Market, By Deployment

- Cloud

- On-Premises

- U.S.

- U.S. EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- U.S. EdTech Market, By End-User

- Business

- Consumer

- U.S. EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- U.S. EdTech Market, By Deployment

- Cloud

- On-Premises

- U.S. EdTech Market, By Sector

- Canada

- Canada EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- Canada EdTech Market, By End-User

- Business

- Consumer

- Canada EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- Canada EdTech Market, By Deployment

- Cloud

- On-Premises

- Canada EdTech Market, By Sector

- North America EdTech Market, By Sector

- Europe

- Europe EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- Europe EdTech Market, By End-User

- Business

- Consumer

- Europe EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- Europe EdTech Market, By Deployment

- Cloud

- On-Premises

- U.K.

- U.K. EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- U.K. EdTech Market, By End-User

- Business

- Consumer

- U.K. EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- U.K. EdTech Market, By Deployment

- Cloud

- On-Premises

- U.K. EdTech Market, By Sector

- Germany

- Germany EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- Germany EdTech Market, By End-User

- Business

- Consumer

- Germany EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- Germany EdTech Market, By Deployment

- Cloud

- On-Premises

- Germany EdTech Market, By Sector

- Europe EdTech Market, By Sector

- Asia Pacific

- Asia Pacific EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- Asia Pacific EdTech Market, By End-User

- Business

- Consumer

- Asia Pacific EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- Asia Pacific EdTech Market, By Deployment

- Cloud

- On-Premises

- China

- China EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- China EdTech Market, By End-User

- Business

- Consumer

- China EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- China EdTech Market, By Deployment

- Cloud

- On-Premises

- China EdTech Market, By Sector

- Japan

- Japan EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- Japan EdTech Market, By End-User

- Business

- Consumer

- Japan EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- Japan EdTech Market, By Deployment

- Cloud

- On-Premises

- Japan EdTech Market, By Sector

- India

- India EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- India EdTech Market, By End-User

- Business

- Consumer

- India EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- India EdTech Market, By Deployment

- Cloud

- On-Premises

- India EdTech Market, By Sector

- Asia Pacific EdTech Market, By Sector

- Latin America

- Latin America EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- Latin America EdTech Market, By End-User

- Business

- Consumer

- Latin America EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- Latin America EdTech Market, By Deployment

- Cloud

- On-Premises

- Latin America EdTech Market, By Sector

- MEA

- MEA EdTech Market, By Sector

- Preschool

- K-12

- Higher Education

- Others

- MEA EdTech Market, By End-User

- Business

- Consumer

- MEA EdTech Market, By Type

- Hardware

- Software

- Classroom Management System

- Document Management System

- Learning and Gamification

- Learning Management System

- Student Collaboration System

- Student Information and Administration System

- Student Response System

- Talent Management System

- Test Preparation

- Content

- MEA EdTech Market, By Deployment

- Cloud

- On-Premises

- MEA EdTech Market, By Sector

- North America

Education Technology Market Dynamics

Driver: Growing Investments in Education Technology (EdTech) Development

The process of learning is evolving gradually in line with advances in technology. From virtual classrooms to massive open online courses (MOOCs), the EdTech sector is transforming rapidly, leading to an influx of massive investments worldwide. The Asia Pacific region is anticipated to witness the fastest growth in investments in the EdTech industry, owing to the continued rollout of high-speed internet networks and the rising penetration rate of smart devices among the masses. For instance, in India, the continued rollout of affordable broadband connectivity is allowing companies to reach out to the population via online media. The trend is gradually paving the way for the adoption of latest technologies to deliver educational content. At the same time, education stakeholders are also considering the adoption of the latest technologies to bridge the gap between the educational infrastructure and teaching resources. Also, in 2020, EdTech has been the most funded sector in India with venture capital (VC) investments in EdTech start-ups having tripled from January to July 2020 to USD 998 million, from USD 310 million.

Driver: Growing Preference for Digital Learning

The education industry has been witnessing a paradigm shift from conventional exam-oriented learning to personalized and interactive learning in recent years. As digitization continues to penetrate the education industry, the latest technologies, and new and creative techniques are being used to deliver knowledge and educational content, thereby transforming learning and development into a lifelong process. Looking forward to the future, digital education is predicted to benefit several beneficiaries across various geographies, demographics, ages, and socioeconomic conditions. Digital education has changed the way people are pursuing learning. The interactive, flexible, high-quality, and collaborative learning facilitated by online learning platforms is particularly stimulating the growth of digital learning. Digital learning also provides users with the flexibility to take courses as per their convenience. Hence, several institutions are offering online learning to their students. Corporates are also adopting online training modules for training their employees and helping them in upgrading their skillsets. Digital learning can also help in overcoming the barriers associated with the conventional teaching approach, such as the difference in the pace of learning of different students.

Restraint: Risks Associated with Cyber Security

The implementation of EdTech solutions for both academic and corporate purposes often involve holding large volumes of data. Universities especially store much more data than just the information of students. The information gathered through EdTech systems can be used for making strategic decisions and setting personalized goals for students. However, the data stored as part of the adoption of EdTech solutions can be vulnerable to potential hacking, data theft, and misuse, thereby triggering concerns over data security and privacy protection. While copyright laws are already in place to restrict the misuse of data, lawmakers across the world are particularly focusing on privacy issues and responding to the concerns raised by citizens. For instance, in February 2022, Global Education Management Systems, known as GEMS Education, faced a cyberattack that impacted the group's operations. The education company has more than 40 schools in the UAE, Qatar, Saudi Arabia, India, Europe, Africa, South-East Asia, and North America. Although the group does not keep financial details, identity documents, payment histories, creditworthiness information, health or medical information, and log-in information, including usernames and passwords, may have been compromised.

What Does This Report Include?

This section will provide insights into the contents included in this education technology market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Education technology market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Education technology market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the education technology market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for education technology market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of education technology market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Education Technology Market Categorization:

The education technology market was categorized into five segments, namely sector (Preschool, K-12, Higher Education), end-user (Business, Consumer), type (Hardware, Software, Content), deployment (Cloud, On-Premises), and regions (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa).

Segment Market Methodology:

The education technology market was segmented into sector, end-user, type, deployment, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The education technology market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into seven countries, namely, the U.S.; Canada; Germany; the UK; China; India; Japan.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Education technology market companies & financials:

The education technology market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Blackboard Inc. - Established in 1997, Blackboard Inc. (Blackboard) is an EdTech company that serves the K-12, higher education, business, and government verticals. The company adopted acquisition as a key strategy in its early days, where it spent approximately USD 500 million for the acquisition of different companies during 2006 and 2012. The company is headquartered in the U.S. and has operating offices across 100 countries globally. Blackboard provides several software platforms for0020applications including Blackboard Learn, Blackboard Connect, Blackboard Mobile, Blackboard Collaborate, and Blackboard Analytics. Blackboard Learn is a web-based teaching and learning platform, while Blackboard Mobile is a mobile platform designed to deliver educational content and communication tool for students, teachers, and parents. Blackboard Analytics provides analytics and metrics, data reporting, and business intelligence for higher education.

-

Byju’s - Headquartered in India, BYJU’S was founded in 2011 as an EdTech and online tutorial firm. The company operates its business mainly through its mobile app, where it provides specified educational content according to the learning phase of students. BYJU’S functions as a brand name for Think and Learn Private Ltd. The company’s primary offering includes educational content for school students from class 1 to 12 (primary to higher secondary). Apart from school-based content, the company also trains its end-customers for various competitive examinations, including IIT-JEE, IAS, GRE, and GMAT. BYJU’S has collaborated with Disney and launched an educational app on June 6, 2019, age groups 6-8 years. This collaboration has helped the company to enhance its video content by including Disney Characters. BYJU’S boasts over 40 million overall users, with an annual retention rate of about 85%. By the end of 2019, BYJU’S reportedly acquired USD 785 million from various investors, including Chan Zuckerberg Initiative (CZI), Tencent, Sofina, Sequoia Capital, Lightspeed Management Company, LLC, Verlinvest, Naspers Ventures, Aarin Capital, General Atlantic, and International Finance Corporation. To improve its market penetration, BYJU’S has started offering its products and services in several regional Indian languages. TutorVista, Osmo, and WhiteHat Jr are some of the company’s subsidiaries.

-

Chegg, Inc. - Chegg, Inc. (Chegg) provides a direct-to-student learning platform for high-school and college students. The company’s product offerings primarily fall into two categories, namely Chegg Services and Required Materials. Under Chegg Services, the company provides digital products and services. Under Required Materials, the company offers print textbooks and eTextbooks. The company operates its business through direct marketing channels to reach students. As of 2019, the company held 30 patents and had 13 patent applications pending in the U.S. The company also owns 700 registered domains, some of which are Research Ready, Cheggs Study, internship.com, easyBib, and Thinkful. As of 2019, Chegg had a subscription base of 5.8 million individuals who have paid for products and services.

-

Coursera, Inc. - Coursera, Inc. (Coursera) is a provider of an online learning platform for higher education. The company offers educational programs in subjects, such as biology, mathematics, finance, computer science, business, analytical solutions, and medicine. The company works with various universities and organizations to offer their online courses and degrees in various subjects. Princeton University, Stanford University, University of Michigan, University of London, Indian School of Business, and the University of Pennsylvania are some of the leading universities working with Coursera to offer their course modules online. The company has more than 200 partners across 29 countries globally. Coursera is backed by leading investors including Learn Capital, Kleiner Perkins, New Enterprise Associates, and SEEK Group.

-

Edutech - Edutech’s main business revolves around the provision of technology-based solutions across classrooms, libraries, innovation centers, and science and engineering labs in educational campuses and organizations. EduTech focuses on K-12, higher education, vocational education, and corporate learning segments. EduTech has partnered with market players, such as Canvas, zSpace, OCLC, and Labster, for providing EdTech solutions. The company has also formed alliances with companies, such as Schneider Electric, ABB, Bosch, and MapleSoft, for engineering labs. UAE, Saudi Arabia, Kuwait, Oman, and Bahrain are the key market areas of the company.

-

edX LLC. - edX LLC. (edX) offers university-level online courses. The initial stage of the edX educational platform was created by the Harvard and MIT universities using the python platform. The company works as a nonprofit organization and provides some courses free of cost. In June 2021, the company was acquired by 2U to create one of the world's complete free-to-degree online learning systems. The organization runs the edX open-source software platform for other higher-learning institutions. edX operates across 162 countries and provides educational content in English, Thai, Ukrainian, French, Indonesian, Polish, and Hebrew languages. edX has collaborations with more than 110 educational institutions, including Berkeley University, Boston University, Brown University, and Indian Institute of Technology Bombay, for offering educational content. The organization also provides a range of academic courses through a blended classroom model. Under this model, edX provides online interactive sessions along with traditional classes. The organization has partnered with various educational institutes to offer the blended classroom module across the U.S., Japan, China, and Mongolia.

-

Google LLC - Google LLC operates as a subsidiary of Alphabet Inc. The company offers internet-related services and products, including display advertising tools, cloud computing, search engines, software, and hardware, to its customers. Under the education segment, the company offers various software and solutions for institutions and students. Chromebooks, G Suite for Education, G Suite Enterprise for Education, and Google Cloud Platform are some of the key products offered by the company under education. The company’s G Suite for Education provides various productivity tools including Google Classroom, Gmail, Google Docs, and other communication, classroom, and collaboration tools. Google’s G Suite Enterprise for Education is designed to be used by large educational institutions.

-

Instructure, Inc. - Instructure, Inc. operates as a wholly owned subsidiary of Thoma Bravo. The company provides its learning content through Canvas and Bridge, its cloud-based platforms. Canvas acts as a learning management platform for K-12 and higher education segments whereas Bridge serves as an employee development and engagement platform. Bridge and Canvas platforms provide data analytics access through open application programming interfaces, which allow for individual analysis. Instructor, Inc. delivers its applications through a Software-as-a-Service business model. Education and corporate organizations are the main end-users of the company’s products and services. The company operates across 80 countries globally and has offices in London, Sydney, Sao Paulo, and Budapest. The U.S. is the company’s highest revenue-generating regional market.

-

Microsoft - Microsoft is a global provider of a wide range of software, services, devices, and solutions. The company also provides licensing and support services across the globe. Microsoft’s product/ solution portfolio is offered across multiple domains, namely software, PCs & devices, entertainment, business, developer & IT, and others. The company provides Windows apps, OneDrive, Outlook, Skype, and OneNote, under its software domain. It offers PCs & tablets and Accessories, under PCs & devices. The offerings under entertainment are Xbox games, PC games, Windows digital games, and Movies & TV. It offers Microsoft Azure, Microsoft Dynamics 365, Microsoft 365, Microsoft Industry, Data Platform, Microsoft Advertising, and Licensing, under the business domain. It provides Visual Studio, .NET, Windows Dev Center, Windows Server, and Docs, under the developer & IT domain. It offers other services, such as Microsoft Store, Microsoft Rewards, free downloads & security, store locations, and gift cards.

-

Udacity, Inc. - Udacity is an educational organization that offers Massive Open Online Courses (MOOCs). The company operates across the U.S., U.K., India, Egypt, Germany, and UAE. The company has formed collaborations with industry partners, including Facebook, Google, NVIDIA Corporation, and AT&T, to enhance its offerings in the field of technical education. Udacity provides online courses in areas, such as ML, AI, data science, cloud computing, and autonomous systems.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Education Technology Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-