- Home

- »

- Automotive & Transportation

- »

-

Electric Scooters Market Size & Share Analysis Report, 2030GVR Report cover

![Electric Scooters Market Size, Share & Trends Report]()

Electric Scooters Market Size, Share & Trends Analysis Report By Battery (Lithium-ion, Lead-acid), By Drive Type (Belt Drive, Hub Motor), By End-use (Personal, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-196-2

- Number of Pages: 164

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Electric Scooters Market Size & Trends

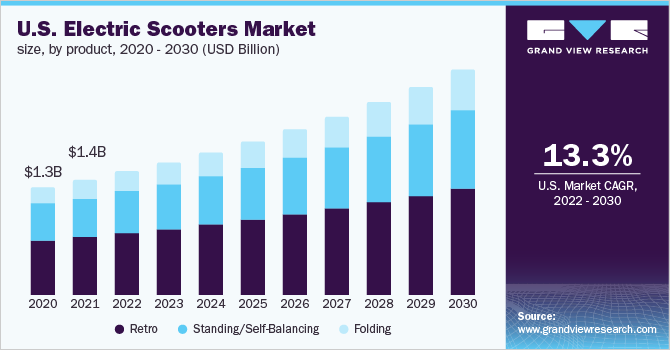

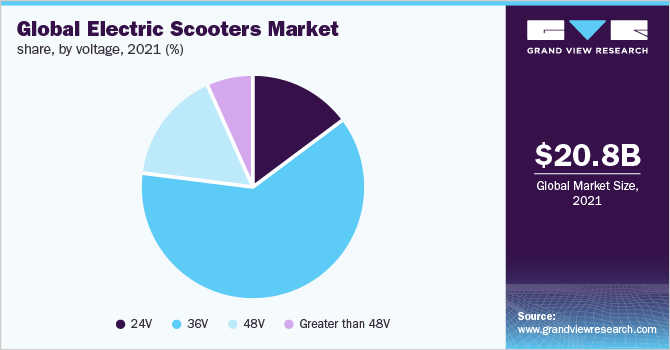

The global electric scooters market size was estimated at USD 37.07 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030. The increasing demand for fuel-efficient vehicles, coupled with growing concerns over greenhouse gas and carbon emissions, is anticipated to drive the adoption of electric scooters (e-scooters) over the forecast period. Stringent emission norms by the government agencies such as emission standards for greenhouse gas (GHG) emissions by the U.S. Environmental Protection Agency (EPA), BS-VI in India and China VI is driving the market for electric scooters. Besides, the electric scooters have high mechanical efficiency, offers quitter operations and requires low maintenance over the conventional counterparts, thus electric scooter are gaining consumers traction in the market. Additionally, the inclusion of electric scooters fleet in shared mobility and vehicle renting ecosystem is propelling the demand for the electric scooters market growth.

The COVID-19 crisis has resulted in a global economic slowdown. Lockdowns implementations in various parts of the world to curb the spread of the virus led to supply chain disruption and a temporary ceasing of manufacturing activities. The electric scooters became particularly vulnerable due to its dependency on global sourcing for its batteries' materials and components. Additionally, initial purchase cost of electric vehicles is more significant than their gas-powered and hybrid counterparts which further impacted the growth of electric scooters in the emerging economies of the world. However, post pandemic increasing government initiatives such tax rebate, policy change and have resulted in surge in demand for electric scooters adoption.

Increasing adoption of electric scooter sharing services in countries such as Spain, the U.S., Germany, and France has spurred the demand for battery-powered two-wheelers. Companies such as Razor, Lime, Bird, Jump, and Spin offering e-scooter sharing services are procuring these vehicles mainly from manufacturers such as Xiaomi; Gogoro, Inc. and Ninebot-Segway. The penetration of these sharing services is witnessing a growth in adoption rate. Moreover, increasing monetary and non-monetary incentives are encouraging the adoption of battery-operated two-wheelers. Moreover, the need for sustainable urban mobility and smart transportation infrastructure is driving the transition from conventional to electric modes of transport.

The participation of vehicle manufacturers and governments in meeting the standards for zero-emissions is significantly contributing to reduce the carbon emission gap significantly by 2030. Furthermore, the issue for battery charging electric scooters is mitigated with increasing interest on building the renewable energy stations and adoption of the updated technologies such as vehicle-to-grid technologies, smart charging etc.

Moreover, governments across the globe have formulated several policies to increase the penetration of electric scooters in the market. The government is offering various benefits to consumers as well as manufacturers in the form of subsidies. For instance, in the U.S., the Corporate Average Fuel Economy (CAFÉ) standards are increasing the adoption of energy-efficient automobiles by framing regulations for enhancing the utilization of alternative fuel vehicles and the reduction of fossil fuel consumption. Similarly, the Canadian government is developing a strategy to reduce the country’s greenhouse gas emissions and increase the number of zero-emission vehicles. Besides this, the swift adoption of scooter-sharing services has triggered the demand for battery-powered two-wheelers. This, in turn, creates a highly conducive environment for electric scooters market growth.

Market Concentration & Characteristics

The current stage of market growth for electric scooters is high, and the growth rate is accelerating. The electric scooter market exhibits a certain level of innovation attributed to the incorporation of new battery technologies. This integration of advanced batteries has played a role in improving the operational life of electric scooters which is expected to drive the electric scooter market.

The electric scooter market is also characterized by product launches and merger & and acquisition (M&A) activity by prominent manufacturers. This is due to several factors, including launching technologically advanced products to maintain a strong brand position in the market.

Fuel-efficient vehicles are being adopted due to the stringent regulations being implemented by authorities worldwide to reduce the environmental impact of greenhouse gases. To lower the concentration of emissions from fossil fuels and to meet the fuel efficiency goals. Moreover, the local governments across the world are permitting the movement of electric scooter on bicycle paths to increase adoption. For Instance, In August 2018, Quebec government permitted a three-year electric scooters pilot project which allows allow the use of electric scooters on bicycle paths and on public roads.

There is a moderate presence of replacements for electric scooters. A notable challenge to the market arises from the emergence and adoption of alternative light duty electric vehicles such electric motorcycle and electric mopeds. However, with the increasing fuel cost, and requirement of highly efficient and easy-to-operate features offered by the electric scooter makes them a preferred choice from the consumer end.

End-user concentration is a significant factor in the market. The increasing demand for electric, high performance, lightweight commuter creates opportunities for companies that focus on developing advanced electric scooters in line with the growing preference for smarter and environmentally safe offerings.

Drive Insights

Based on the drive type, the electric scooter market can be categorized into belt, chain, and hub motor. The hub drive motor type is expected to hold dominant share with more than 70% in the electric scooters market forecast period. The hub drives offers efficient power transmission, quitter operations and low repair & maintenance over the other counter parts in the market. This is encouraging prominent players in the electric scooters market such as such as Yadea Technology Group Co Ltd., NIU International, Yamaha Motor Corporation and others to offer range hub drive electric scooter in the market.

The belt chain type segment is expected to witness high CAGR of 11.2% in the electric scooter market. The segmental growth is owing to its advantages, such as low maintenance, longevity, and lighter weight. Belt drive electric scooters offers better performance, enhanced pickup, infinite gear ratios and protects the electric scooter from overloading and slips. Thus, belt-drive scooters are expected to experience higher implementation adoption.

End-use Insights

Electric scooters can be classified into personal and commercial use based on end-use. Personal use segment holds dominant share of more than 60% in the electric scooter market. Electric scooter is changing the landscape of personal vehicles, as the scooters are eco-friendly, affordable, lightweight, low maintenance, and easily maneuverable they are widely preferred over other electric counterparts. In addition, electric scooters are popular among millennials and low and middle-income groups. Many manufacturers are integrating connected vehicle technology in these scooters to provide an initiative driving experience. Besides, rising electric scooters manufacturers focus on developing private charging stations or a designated spot to charge for the electric scooter is expected to increase the adoption of e-scooters among consumers.

The commercial segment is expected to witness CAGR growth of the 12.7% during the forecast period. Electric scooters are an economical and viable option for last-mile delivery for commercial applications as in places such as factories, universities, warehouses, and industrial sites construction with large land areas, e-scooters may be an option for efficient and fast transportation. As the trend of shared mobility is gaining traction, many vehicles renting facilities are increasing e-scooters that can be used on per mixture or time duration packages for long distance commute, thus contributing to the segmental growth.

Battery Insights

By battery, the E-scooters market is segmented into Lithium-Ion (Li-ion), Lead Acid and other battery types such as others. The lead acid battery segment witnesses the considered share of less than 20% of the electric scooter market in 2022. The factors such as lesser tolerance to abuse, bulker size and high discharge rapidly, even without handling heavy load this reduces adoption of lead acid batteries in the coming years.

The lithium-ion battery segment is estimated to register a considerable growth rate over the forecast period. The price of lithium-ion batteries is expected to witness a declining trend over the coming years, with the price expected to fall more than 70 percent by 2030. Hence, this is expected to decrease the costs of electric scooters as well. More environmentally conducive batteries and growing demand for high-performance batteries such as Li-ion and NiMH are driving the need for battery operated e-scooters. Some of the benefits offered by these batteries are high charging-discharging efficiency, high charge density, and lightweight.

Regional Insights

Asia Pacific dominated the global industry in 2022 and accounted for the largest share of more than 74.85% of the overall revenue. Most electric scooter manufacturers have emerged from China, Taiwan, and Japan, acquiring the largest share all over the world. China has emerged not only as a leading consumer of electric scooters but also as the leading producer and exporter. Vendors active in the China market include Jiangsu Xinri Electric Vehicle Co., Ltd., Yadea, AIMA Group, Zhejiang Luyuan, and Niu International. In addition to this, the regional market is fueled by the growing awareness among consumers to adopt clean energy transportation to curb vehicular emissions, rapid urbanization, and the increasing affordability of e-scooters. Additionally, research and development activities will continue to give this market a significant boost over the next decade. Prominent Japanese companies such as Honda, Yamaha, Suzuki, and Kawasaki have rolled out their variants of electric scooter which is further intensifying the competition in the Asian market.

Europe electric scooter market is expected to witness the considerable growth rate over the forecast period. Growing investment in electric vehicle charging infrastructure and research support for innovative high-density batteries is anticipated to contribute to overall regional growth. Moreover, witnessing a steep growth in the entry of international electric scooter manufacturers, vendors active in the Europe region are focusing on launching multiple variants of electric scooters to attract the young population. Such strategies adopted by companies operating in the region are expected to fuel the overall growth of the European market.

Key Companies & Market Share Insights

Some of the key players operating in the market include Gogoro, Inc., BOXX Corp and AllCell Technologies LLC

-

Gogoro, Inc. is engaged in designing and manufacturing battery swap stations and electric scooters. The company offers a range of smart scooters with swap battery features, including Gogoro S2 ABS, Gogoro S2 Adventure, Gogoro S2 Café Racer, Gogoro 2 Plus, Gogoro 2 Delight, Gogoro 2 Rumbler, Gogoro 2 Utility, Gogoro 3 Plus, and Gogoro Viva. Also, Gogoro, Inc. also offers the Gogoro Network Battery Swapping Platform, a fast and efficient way to power up smart scooters.

-

BOXX Corp. is a technology-driven firm that offers electric wheel-drive commuting vehicles. The company’s engineering unit is responsible for developing all innovative technologies and the manufacturing of products. From product technology development to manufacturing and branding, everything is managed by the company’s engineering unit.

-

Twenty-Two Motors Pvt. Ltd, Scooterson.,GenZe by Mahindra andGreen Energy Motors Corp. are some of the emerging market participants in the electric scooter market.

-

GenZe by Mahindrais a division of Mahindra Group of India engaged in designing and manufacturing e-bikes and e-scooters. The company offers a range of e-scooters, including the 2.0s Scooter, 2.0e Scooter, and 2.0f Scooter. The company’s two-wheel electric fleet solutions are purpose-built for use for tourism and delivery as well as by corporates, government agencies, colleges, and private operators.

-

Greenwit Technologies Inc.: Greenwit Technologies Inc. designs and manufactures transport automobiles such as electric bicycles, electric scooters, electric motorbikes, and electric skateboards. The company specializes in the engineering, manufacturing, importing, and distribution of Light Electric Vehicles (LEVs). It has established partnerships with various Taiwanese, Korean, and Chinese automotive manufacturers for the purpose of designing and manufacturing of LEVs.

Key Electric Scooter Companies:

- AllCell Technologies LLC

- BMW Motorrad International

- BOXX Corp.

- Gogoro, Inc.

- Green Energy Motors Corp.

- Greenwit Technologies Inc.

- Honda Motor Co. Ltd.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- KTM AG

- Mahindra GenZe.

Recent Developments

-

In January 2024, Riley Scooter, a Cambridge-based company proposed plans to introduce RS3 Electric Scooter, a fully foldable electric scooter in the U.S. at the Consumers Electronics Show held in Las Vegas.

-

In December 2023, Gogoro, a Taiwanese player unveiled Gogoro CrossOver GX250 domestically produced electric scooter in India. The company offers a tailor smart scooter to Indian riders. The introduction of these models marked a strategic move for Komatsu to tap into the Indian electric scooter market.

-

In September 2023, Bird, a key player in the electric micro mobility market acquired Spin, an electric scooter and e-bike rental company for USD 19 million. This acquisition has reduced bird competition and aided in maintaining the company’s dominance in the market.

-

In March 2023, Yadea Technology Group Co, Ltd, launched the range of products YADEA Fierider, YADEA VoltGuard Scooter, and YADEA Keeness Electric Motorcycle in Vietnam. The products offered by the company have premium-level quality and exceptional rider experience which provide a competitive edge to the company.

Electric Scooters Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.07 billion

Revenue forecast in 2030

USD 78.65 billion

Growth rate

CAGR of 9.9% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

In Revenue, USD Billion; Volume, Thousand Unit and CAGR from 2023-2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drive type, battery type, product, battery fitting, end-use, region.

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, France, China, Japan, India, Mexico, and Brazil

Key Company Profiled

Mahindra GenZe; BMW Motorrad International; Vmoto Limited; Terra Motors Corporation; Gogoro Inc.; Jiangsu Xinri Electric Vehicle Co. Ltd.

Customization scope

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Electric Scooters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric scooters market based on drive, battery, product, battery fitting, end use, and region:

-

Drive Outlook (Revenue, USD Million, 2018 - 2030)

-

Belt Drive

-

Chain Drive

-

Hub Motors

-

-

Battery Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead Acid

-

Li-Ion

-

Other

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard

-

Folding

-

Self-Balancing

-

Maxi

-

Three wheeled

-

-

Battery Fitting Outlook (Revenue, USD Million, 2018 - 2030)

-

Detachable

-

Fixed

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global electric scooters market size was estimated at USD 33.19 billion in 2022 and is expected to reach USD 37.07 billion in 2023.

b. The global electric scooters market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 78.66 billion by 2030.

b. Asia Pacific dominated the electric scooters market with a share of 74.91% in 2022. Most electric scooter manufacturers have emerged from China, Taiwan, and Japan, acquiring the largest share all over the world.

b. Some key players operating in the electric scooters market include Mahindra GenZe; BMW Motorrad International; Vmoto Limited; Terra Motors Corporation; Gogoro Inc.; and Jiangsu Xinri Electric Vehicle Co. Ltd.

b. The increasing demand for fuel-efficient vehicles, coupled with growing concerns over greenhouse gas and carbon emissions, is anticipated to drive the growth of the electric scooters market over the forecast period.

Table of Contents

Chapter 1 Electric Scooters Market: Methodology and Scope

1.1. Market segmentation & scope

1.2. Market Definition

1.3. Information procurement

1.3.1. Purchased database

1.3.2. GVR’s internal database

1.3.3. Secondary sources & third-party perspectives

1.3.4. Primary research

1.4. Information analysis

1.5. Market formulation & data visualization

1.6. Data validation & publishing

Chapter 2. Electric Scooters Market: Executive Summary

2.1. Electric Scooters Market Snapshot, 2023 & 2030

2.2. Drive Type Segment Snapshot, 2023 & 2030

2.3. battery Segment Snapshot, 2023 & 2030

2.4. Product Segment Snapshot, 2023 & 2030

2.5. End Use Segment Snapshot, 2023 & 2030

2.6. Competitive Landscape Snapshot, 2023 & 2030

Chapter 3. Electric Scooters Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Challenge Analysis

3.3.3. Market Opportunity Analysis

3.4. Business Environment Analysis Tools

3.4.1. Industry Analysis - Porter’s Five Forces Analysis

3.4.2. PEST Analysis

Chapter 4. Electric Scooters Market Drive Type Segment Analysis

4.1. Belt Drive

4.1.1. Belt Drive electric scooters market, 2018 - 2030 (USD Million)

4.2. Chain Drive

4.2.1. Chain Drive electric scooters market, 2018 - 2030 (USD Million)

4.3. Hub motor

4.3.1. Hub motor electric scooters market, 2018 - 2030 (USD Million)

Chapter 5. Electric Scooters Market Battery Segment Analysis

5.1. Lead Acid

5.1.1. Sealed lead acid electric scooters market, 2018 - 2030 (USD Million)

5.2. Lithium Ion

5.2.1. Lithium Ion electric scooters market, 2018 - 2030 (USD Million)

5.3. Other

5.3.1. Other electric scooters market, 2018 - 2030 (USD Million)

Chapter 6. Electric Scooters Market Product Segment Analysis

6.1. Standard

6.1.1. Standard electric scooters market, 2018 - 2030 (USD Million)

6.2. Folding

6.2.1. Folding electric scooters market, 2018 - 2030 (USD Million)

6.3. Self-balancing

6.3.1. Self-balancing electric scooters market, 2018 - 2030 (USD Million)

6.4. Maxi

6.4.1. Maxi electric scooters market, 2018 - 2030 (USD Million)

6.5. Three-wheeled

6.5.1. Three-wheeled electric scooters market, 2018 - 2030 (USD Million)

Chapter 7. Electric Scooters Market Battery Fitting Segment Analysis

7.1. Detachable

7.1.1. Detachable battery electric scooters market, 2018 - 2030 (USD Million)

7.2. Fixed

7.2.1. Fixed battery electric scooters market, 2018 - 2030 (USD Million)

Chapter 8. Electric Scooters Market End Use Segment Analysis

8.1. Personal Use

8.1.1. Personal use electric scooters market, 2018 - 2030 (USD Million)

8.2. Commercial Use

8.2.1. Commercial use electric scooters market, 2018 - 2030 (USD Million)

Chapter 9. Electric Scooters Market Regional Analysis

9.1. North America

9.1.1. North America electric scooters market, by country, 2018 - 2030 (USD Million)

9.1.2. North America electric scooters market, by drive, 2018 - 2030 (USD Million)

9.1.3. North America electric scooters market, by battery, 2018 - 2030 (USD Million)

9.1.4. North America electric scooters market, by product, 2018 - 2030 (USD Million)

9.1.5. North America electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.1.6. North America electric scooters market, by end use, 2018 - 2030 (USD Million)

9.1.7. U.S.

9.1.7.1. Electric Scooters market by drive, 2018 - 2030 (USD Million)

9.1.7.2. Electric Scooters market by battery, 2018 - 2030 (USD Million)

9.1.7.3. Electric Scooters market by product, 2018 - 2030 (USD Million)

9.1.7.4. Electric Scooters market by battery fitting, 2018 - 2030 (USD Million)

9.1.7.5. Electric Scooters market by end use, 2018 - 2030 (USD Million)

9.1.8. Canada

9.1.8.1. Canada electric scooters market, by drive, 2018 - 2030 (USD Million)

9.1.8.2. Canada electric scooters market, by battery, 2018 - 2030 (USD Million)

9.1.8.3. Canada electric scooters market, by product, 2018 - 2030 (USD Million)

9.1.8.4. Canada electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.1.8.5. Canada electric scooters market, by end use, 2018 - 2030 (USD Million)

9.2. Europe

9.2.1. Europe electric scooters market, by country, 2018 - 2030 (USD Million)

9.2.2. Europe electric scooters market, by drive, 2018 - 2030 (USD Million)

9.2.3. Europe electric scooters market, by battery, 2018 - 2030 (USD Million)

9.2.4. Europe electric scooters market, by product, 2018 - 2030 (USD Million)

9.2.5. Europe electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.2.6. Europe electric scooters market, by end use, 2018 - 2030 (USD Million)

9.2.7. Germany

9.2.7.1. Germany electric scooters market, by drive, 2018 - 2030 (USD Million)

9.2.7.2. Germany electric scooters market, by battery, 2018 - 2030 (USD Million)

9.2.7.3. Germany electric scooters market, by product, 2018 - 2030 (USD Million)

9.2.7.4. Germany electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.2.7.5. Germany electric scooters market, by end use, 2018 - 2030 (USD Million)

9.2.8. U.K.

9.2.8.1. U.K. electric scooters market, by drive, 2018 - 2030 (USD Million)

9.2.8.2. U.K. electric scooters market, by battery, 2018 - 2030 (USD Million)

9.2.8.3. U.K. electric scooters market, by product, 2018 - 2030 (USD Million)

9.2.8.4. U.K. electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.2.8.5. U.K. electric scooters market, by end use, 2018 - 2030 (USD Million)

9.2.9. France

9.2.9.1. France electric scooters market, by drive, 2018 - 2030 (USD Million)

9.2.9.2. France electric scooters market, by battery, 2018 - 2030 (USD Million)

9.2.9.3. France electric scooters market, by product, 2018 - 2030 (USD Million)

9.2.9.4. France electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.2.9.5. France electric scooters market, by end use, 2018 - 2030 (USD Million)

9.3. Asia Pacific

9.3.1. Asia Pacific electric scooters market, by country, 2018 - 2030 (USD Million)

9.3.2. Asia Pacific electric scooters market, by drive, 2018 - 2030 (USD Million)

9.3.3. Asia Pacific electric scooters market, by battery, 2018 - 2030 (USD Million)

9.3.4. Asia Pacific electric scooters market, by product, 2018 - 2030 (USD Million)

9.3.5. Asia Pacific electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.3.6. Asia Pacific electric scooters market, by end use, 2018 - 2030 (USD Million)

9.3.7. China

9.3.7.1. China electric scooters market, by drive, 2018 - 2030 (USD Million)

9.3.7.2. China electric scooters market, by battery, 2018 - 2030 (USD Million)

9.3.7.3. China electric scooters market, by product, 2018 - 2030 (USD Million)

9.3.7.4. China electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.3.7.5. China electric scooters market, by end use, 2018 - 2030 (USD Million)

9.3.8. Japan

9.3.8.1. Japan electric scooters market, by drive, 2018 - 2030 (USD Million)

9.3.8.2. Japan electric scooters market, by battery, 2018 - 2030 (USD Million)

9.3.8.3. Japan electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.3.8.4. Japan electric scooters market, by product, 2018 - 2030 (USD Million)

9.3.8.5. Japan electric scooters market, by end use, 2018 - 2030 (USD Million)

9.3.9. India

9.3.9.1. India electric scooters market, by drive, 2018 - 2030 (USD Million)

9.3.9.2. India electric scooters market, by battery, 2018 - 2030 (USD Million)

9.3.9.3. India electric scooters market, by product, 2018 - 2030 (USD Million)

9.3.9.4. India electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.3.9.5. India electric scooters market, by end use, 2018 - 2030 (USD Million)

9.4. Latin America

9.4.1. Latin America electric scooters market, by country, 2018 - 2030 (USD Million)

9.4.2. Latin America electric scooters market, by drive, 2018 - 2030 (USD Million)

9.4.3. Latin America electric scooters market, by battery, 2018 - 2030 (USD Million)

9.4.4. Latin America electric scooters market, by product, 2018 - 2030 (USD Million)

9.4.5. Latin America electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.4.6. Latin America electric scooters market, by end use, 2018 - 2030 (USD Million)

9.4.7. Brazil

9.4.7.1. Brazil electric scooters market, by drive, 2018 - 2030 (USD Million)

9.4.7.2. Brazil electric scooters market, by battery, 2018 - 2030 (USD Million)

9.4.7.3. Brazil electric scooters market, by product, 2018 - 2030 (USD Million)

9.4.7.4. Brazil electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.4.7.5. Brazil electric scooters market, by end use, 2018 - 2030 (USD Million)

9.4.8. Mexico

9.4.8.1. Mexico electric scooters market, by drive, 2018 - 2030 (USD Million)

9.4.8.2. Mexico electric scooters market, by battery, 2018 - 2030 (USD Million)

9.4.8.3. Mexico electric scooters market, by product, 2018 - 2030 (USD Million)

9.4.8.4. Mexico electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.4.8.5. Mexico electric scooters market, by end use, 2018 - 2030 (USD Million)

9.5. MEA electric scooters market, by drive, 2018 - 2030 (USD Million)

9.6. MEA electric scooters market, by battery, 2018 - 2030 (USD Million)

9.7. MEA electric scooters market, by product, 2018 - 2030 (USD Million)

9.8. MEA electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

9.9. MEA electric scooters market, by end use, 2018 - 2030 (USD Million)

Chapter 10. Competitive Landscape

10.1. Company Categorization

10.2. Company Heat Map Analysis, 2023

10.3. Company Share Analysis, 2023

10.4. Strategy Mapping

10.5. Company Profiles

10.5.1. AllCell Technologies LLC

10.5.1.1. Company Overview

10.5.1.2. Financial Performance

10.5.1.3. Product Benchmarking

10.5.1.4. Strategic Initiatives

10.5.2. BMW Motorrad International

10.5.2.1. Company Overview

10.5.2.2. Financial Performance

10.5.2.3. Product Benchmarking

10.5.2.4. Strategic Initiatives

10.5.3. BOXX Corp.

10.5.3.1. Company Overview

10.5.3.2. Financial Performance

10.5.3.3. Product Benchmarking

10.5.3.4. Strategic Initiatives

10.5.4. Gogoro, Inc.

10.5.4.1. Company Overview

10.5.4.2. Financial Performance

10.5.4.3. Product Benchmarking

10.5.4.4. Strategic Initiatives

10.5.5. Green Energy Motors Corp.

10.5.5.1. Company Overview

10.5.5.2. Financial Performance

10.5.5.3. Product Benchmarking

10.5.5.4. Strategic Initiatives

10.5.6. Greenwit Technologies Inc.

10.5.6.1. Company Overview

10.5.6.2. Financial Performance

10.5.6.3. Product Benchmarking

10.5.6.4. Strategic Initiatives

10.5.7. Honda Motor Co. Ltd.

10.5.7.1. Company Overview

10.5.7.2. Financial Performance

10.5.7.3. Product Benchmarking

10.5.7.4. Strategic Initiatives

10.5.8. Jiangsu Xinri E-Vehicle Co., Ltd.

10.5.8.1. Company Overview

10.5.8.2. Financial Performance

10.5.8.3. Product Benchmarking

10.5.8.4. Strategic Initiatives

10.5.9. KTM AG

10.5.9.1. Company Overview

10.5.9.2. Financial Performance

10.5.9.3. Product Benchmarking

10.5.9.4. Strategic Initiatives

10.5.10. Mahindra GenZe

10.5.10.1. Company Overview

10.5.10.2. Financial Performance

10.5.10.3. Product Benchmarking

10.5.10.4. Strategic Initiatives

10.5.11. Peugeot Scooters

10.5.11.1. Company Overview

10.5.11.2. Financial Performance

10.5.11.3. Product Benchmarking

10.5.11.4. Strategic Initiatives

10.5.12. Suzuki Motor Corporation

10.5.12.1. Company Overview

10.5.12.2. Financial Performance

10.5.12.3. Product Benchmarking

10.5.12.4. Strategic Initiatives

10.5.13. Terra Motors Corporation

10.5.13.1. Company Overview

10.5.13.2. Financial Performance

10.5.13.3. Product Benchmarking

10.5.13.4. Strategic Initiatives

10.5.14. Vmoto Limited

10.5.14.1. Company Overview

10.5.14.2. Financial Performance

10.5.14.3. Product Benchmarking

10.5.14.4. Strategic Initiatives

10.5.15. Yadea Technology Group Co., Ltd.

10.5.15.1. Company Overview

10.5.15.2. Financial Performance

10.5.15.3. Product Benchmarking

10.5.15.4. Strategic Initiatives

10.5.16. Yamaha Motor Company Ltd.

10.5.16.1. Company Overview

10.5.16.2. Financial Performance

10.5.16.3. Product Benchmarking

10.5.16.4. Strategic Initiatives

List of Tables

Table 1 List of Abbreviation

Table 2 Belt drive electric scooters market, 2018 - 2030 (USD Million)

Table 3 Chain Drive electric scooters market, 2018 - 2030 (USD Million)

Table 4 Hub motor electric scooters market, 2018 - 2030 (USD Million)

Table 5 Lead acid battery market, 2018 - 2030 (USD Million)

Table 6 Lithium Ion battery market, 2018 - 2030 (USD Million)

Table 7 Other battery market, 2018 - 2030 (USD Million)

Table 8 Standard electric scooters market, 2018 - 2030 (USD Million)

Table 9 Foldig electric scooters market, 2018 - 2030 (USD Million)

Table 10 Self-balancing electric scooters market, 2018 - 2030 (USD Million)

Table 11 Maxi use electric scooters market, 2018 - 2030 (USD Million)

Table 12 Three-wheeled use electric scooters market, 2018 - 2030 (USD Million)

Table 13 Detachable battery electric scooters market, 2018 - 2030 (USD Million)

Table 14 Fixed battery electric scooters market, 2018 - 2030 (USD Million)

Table 15 Personal use electric scooters market, 2018 - 2030 (USD Million)

Table 16 Commerical use electric scooters market, 2018 - 2030 (USD Million)

Table 17 North America electric scooters market, by country, 2018 - 2030 (USD Million)

Table 18 North American electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 19 North America electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 20 North America electric scooters, by product, 2018 - 2030 (USD Million)

Table 21 North America electric scooters, by battery fitting, 2018 - 2030 (USD Million)

Table 22 North America electric scooters, by end use, 2018 - 2030 (USD Million)

Table 23 U.S. electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 24 U.S. electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 25 U.S. electric scooters market, by product, 2018 - 2030 (USD Million)

Table 26 U.S. electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 27 U.S. electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 28 Canada electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 29 Canada electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 30 Canada electric scooters market, by product, 2018 - 2030 (USD Million)

Table 31 Canada electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 32 Canada electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 33 Europe electric scooters market, by country, 2018 - 2030 (USD Million)

Table 34 Europe electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 35 Europe electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 36 Europe electric scooters market, by product, 2018 - 2030 (USD Million)

Table 37 Europe electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 38 Europe electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 39 Germany electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 40 Germany electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 41 Germany electric scooters market, by product, 2018 - 2030 (USD Million)

Table 42 Germany electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 43 Germany electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 44 U.K. electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 45 U.K. electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 46 U.K. electric scooters market, by product, 2018 - 2030 (USD Million)

Table 47 U.K. electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 48 U.K. electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 49 France electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 50 France electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 51 France electric scooters market, by product, 2018 - 2030 (USD Million)

Table 52 France electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 53 France electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 54 Asia Pacific electric scooters market, by country, 2018 - 2030 (USD Million)

Table 55 Asia Pacific electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 56 Asia Pacific electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 57 Asia Pacific electric scooters market, by product, 2018 - 2030 (USD Million)

Table 58 Asia Pacific electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 59 Asia Pacific electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 60 China electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 61 China electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 62 China electric scooters market, by product, 2018 - 2030 (USD Million)

Table 63 China electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 64 China electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 65 Japan electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 66 Japan electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 67 Japan electric scooters market, by product, 2018 - 2030 (USD Million)

Table 68 Japan electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 69 Japan electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 70 India electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 71 India electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 72 India electric scooters market, by product, 2018 - 2030 (USD Million)

Table 73 India electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 74 India electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 75 Latin America electric scooters market, by country, 2018 - 2030 (USD Million)

Table 76 Latin America electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 77 Latin America electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 78 Latin America electric scooters market, by product, 2018 - 2030 (USD Million)

Table 79 Latin America electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 80 Latin America electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 81 Brazil electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 82 Brazil electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 83 Brazil electric scooters market, by product, 2018 - 2030 (USD Million)

Table 84 Brazil electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 85 Brazil electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 86 Mexico electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 87 Mexico electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 88 Mexico electric scooters market, by product, 2018 - 2030 (USD Million)

Table 89 Mexico electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 90 Mexico electric scooters market, by end use, 2018 - 2030 (USD Million)

Table 91 MEA electric scooters market, by drive, 2018 - 2030 (USD Million)

Table 92 MEA electric scooters market, by battery, 2018 - 2030 (USD Million)

Table 93 MEA electric scooters market, by product, 2018 - 2030 (USD Million)

Table 94 MEA electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Table 95 MEA electric scooters market, by end use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Electric scooters segmentation

Fig. 4 Electric Scooters market snapshot

Fig. 5 Electric Scooters market, 2018 - 2030 (USD Million)

Fig. 6 Electric scooters market, by drive, 2018 - 2030 (USD Million)

Fig. 7 Electric scooters market, by battery, 2018 - 2030 (USD Million)

Fig. 8 Electric scooters market, by product, 2018 - 2030 (USD Million)

Fig. 9 Electric scooters market, by battery fitting, 2018 - 2030 (USD Million)

Fig. 10 Electric scooters market, by end use, 2018 - 2030 (USD Million)

Fig. 11 Electric scooters market, by region, 2018 - 2030 (USD Million)

Fig. 12 Electric scooters market: value chain analysis

Fig. 13 Electric scooters market: key company analysis, 2020

Fig. 14 Electric scooters market: PEST analysis

Fig. 15 Electric scooters market: Porter’s five forces analysis

Fig. 16 Electric scooters market: Drive analysis

Fig. 17 Electric scooters market: Battery analysis

Fig. 18 Electric scooters market: End use analysis

Fig. 19 Electric scooters market: Regional analysis

Fig. 20 North America electric scooters market- key takeaways

Fig. 21 Europe electric scooters market - key takeaways

Fig. 22 Asia Pacific electric scooters market - key takeaways

Fig. 23 Latin America electric scooters market - key takeaways

Fig. 24 MEA electric scooters market - key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Electric Scooters Drive Outlook (Revenue, USD Million, 2018 - 2030)

- Belt Drive

- Chain Drive

- Hub Motors

- Electric Scooters Battery Outlook (Revenue, USD Million, 2018 - 2030)

- Lead Acid

- Lithium Ion

- Other

- Electric Scooters Product Outlook (Revenue, USD Million, 2018 - 2030)

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Electric Scooters Battery Fitting Outlook (Revenue, USD Million, 2018 - 2030)

- Detachable

- Fixed

- Electric Scooters End use Outlook (Revenue, USD Million, 2018 - 2030)

- Personal

- Commercial

- Electric Scooters Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- North America Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- North America Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- North America Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- North America Electric Scooters Market, by End use

- Personal

- Commercial

- U.S.

- U.S. Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- U.S. Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- U.S. Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- U.S. Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- U.S. Electric Scooters Market, by End use

- Personal

- Commercial

- U.S. Electric Scooters Market, by Drive

- Canada

- Canada Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Canada Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Canada Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Canada Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Canada Electric Scooters Market, by End use

- Personal

- Commercial

- Canada Electric Scooters Market, by Drive

- North America Electric Scooters Market, by Drive

- Europe

- Europe Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Europe Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Europe Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Europe Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Europe Electric Scooters Market, by End use

- Personal

- Commercial

- U.K.

- U.K. Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- U.K. Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- U.K. Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- U.K. Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- U.K. Electric Scooters Market, by End use

- Personal

- Commercial

- U.K. Electric Scooters Market, by Drive

- Germany

- Germany Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Germany Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Germany Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Germany Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Germany Electric Scooters Market, by End use

- Personal

- Commercial

- Germany Electric Scooters Market, by Drive

- France

- France Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- France Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- France Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- France Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- France Electric Scooters Market, by End use

- Personal

- Commercial

- France Electric Scooters Market, by Drive

- Europe Electric Scooters Market, by Drive

- Asia Pacific

- Asia Pacific Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Asia Pacific Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Asia Pacific Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Asia Pacific Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Asia Pacific Electric Scooters Market, by End use

- Personal

- Commercial

- China

- China Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- China Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- China Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- China Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- China Electric Scooters Market, by End use

- Personal

- Commercial

- China Electric Scooters Market, by Drive

- Japan

- Japan Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Japan Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Japan Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Japan Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Japan Electric Scooters Market, by End use

- Personal

- Commercial

- Japan Electric Scooters Market, by Drive

- India

- India Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- India Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- India Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- India Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- India Electric Scooters Market, by End use

- Personal

- Commercial

- India Electric Scooters Market, by Drive

- Asia Pacific Electric Scooters Market, by Drive

- Latin America

- Latin America Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Latin America Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Latin America Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Latin America Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Latin America Electric Scooters Market, by End use

- Personal

- Commercial

- Brazil

- Brazil Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Brazil Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Brazil Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Brazil Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Brazil Electric Scooters Market, by End use

- Personal

- Commercial

- Brazil Electric Scooters Market, by Drive

- Mexico

- Mexico Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Mexico Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Mexico Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Mexico Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Mexico Electric Scooters Market, by End use

- Personal

- Commercial

- Mexico Electric Scooters Market, by Drive

- Latin America Electric Scooters Market, by Drive

- Middle East & Africa

- Middle East & Africa Electric Scooters Market, by Drive

- Belt Drive

- Chain Drive

- Hub Motors

- Middle East & Africa Electric Scooters Market, by Battery

- Lead Acid

- Lithium Ion

- Other

- Middle East & Africa Electric Scooters Market, by Product

- Standard

- Folding

- Self-Balancing

- Maxi

- Three wheeled

- Middle East & Africa Electric Scooters Market, by Battery Fitting

- Detachable

- Fixed

- Middle East & Africa Electric Scooters Market, by End use

- Personal

- Commercial

- Middle East & Africa Electric Scooters Market, by Drive

- North America

Electric Scooters Market Dynamics

Drivers: Surging Implementation of Electric Scooters Sharing Service

The surging adoption of electric scooter sharing services in nations such as France, Germany, the U.S., and Spain, among others, has encouraged the demand for electric scooters. Companies such as Bird Rides, Inc., Uber Technologies Inc., Lime, Spin, Scooty, and Razor USA LLC, emmy-sharing, Cooltra Motos SL, offering electric scooter sharing services, are acquiring electric scooters primarily from producers such as Gogoro, Inc., Ninebot-Segway, and Xiaomi. The penetration of electric scooter sharing service is observing an outstanding adoption rate since 2016. Presently, over 90 cities and numerous universities across the world make use of electric scooter sharing service, with nearly 95 percent of the scooters consisting an electric drivetrain. The growth of the electric scooter market can be credited to the surging adoption of scooters as the favored mode of transportation, specifically since electric scooters have made an entrance into this market space.

Growing Consumer Cognizance Towards Eco-Friendly Transportation

Over the past decade, the rising carbon secretion levels due to traditional fuel-based automobiles has remained a prime distress for government bodies. The move of sustainable smart cities is among the crucial factors accountable for the adoption of eco-friendly and cost-effective transportation. As electric scooters function on batteries, therefore, there are no carbon or gaseous secretions from cars or scooters. This mode of transportation is gaining penetration amongst the ecologically-conscious travelers. Using such eco-friendly vehicles not only drops the carbon and sulphur emissions in the air, but also reduces fuel usage by approximately 25%. Further, such vehicles make usage of ultra-quiet chains for operating the electric motor, thus endorsing noise-free rides. The advent of increasing greenhouse gas emissions has led to the implementation of several initiatives to combat climate change enabling policymakers to pin hopes on electric vehicles. This has led to the enactment of an action plan for climate change to reduce the emissions from transport by adopting a sustainable and eco-friendly transportation alternative such as public transport and electric vehicles.

Restraint: Range Anxiety Amongst Consumers Problematic for Adoption of Electric Scooter

Several potential consumers are worried about the distance or range covered in a single charge of the electric scooter. Therefore, electric scooter possessors are a bit disinclined towards buying these scooters owing to the fact that an electric scooter might not have the needed range for transportation to their chosen destination. The traveling distance or capacity of electric scooters on a single charge is not sufficient in comparison with the distance covered by the normal scooters on a full-tank of traditional fuel. This problem is primarily related to the failure of charging infrastructure across various regions. Average scooters can be refueled at petrol stations, such standardized infrastructure (charging station) is currently unavailable for electric scooters, therefore hampering the market growth.

What Does This Report Include?

This section will provide insights into the contents included in this electric scooters market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Electric scooters market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Electric scooters market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the electric scooters market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for electric scooters market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of electric scooters market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Electric Scooters Market Categorization:

The electric scooters market was categorized into four segments, namely drive type (Belt Drive, Chain Drive, Hub Motors), battery (Lead Acid, Li-ion), end-use (Personal, Commercial), and region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa)

Segment Market Methodology:

The electric scooters market was segmented into drive type, battery, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The electric scooters market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into ten countries, namely, the U.S.; Canada; the UK; Germany; France; China; Japan; India; Mexico; Brazil.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Electric scooters market companies & financials:

The electric scooters market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

AllCell Technologies LLC - AllCell Technologies LLC is engaged in the manufacturing of lithium-ion batteries. The company develops lithium-ion battery packs for portable, stationary, and transportation applications. It is a patented manufacturer of compact, lightweight, and durable batteries as well as battery systems. It provides a customized thermal management solution for electric bikes, electric automobiles, hybrid electric vehicles, and electric scooters. The company specializes in lithium-ion battery packs and lithium-ion thermal management systems.

-

BMW Motorrad International - BMW Motorrad is a motorcycle brand of BMW Group of Germany and is a part of BMW Group’s corporate and brand development division. The company designs and develops a variety of motorcycles and scooters. BMW Group began as a manufacturer of aircraft engines and later forayed into the motorcycles and automotive segments. BMW Group operates its business through four business segments, namely automotive, motorcycle, financial services, and other entities. The company offers motorcycles and scooters under various model segments, including sports, tour, roadster, heritage, adventure, and urban mobility. Besides, the company also offers motorcycle accessories. BMW Motorrad offers C-series scooters, including C 650 GT, C 400X, and C evolution under the urban mobility model segment. The C evolution electric scooter happens to be the company’s modern solution for sustainable and eco-friendly urban mobility. The company’s geographical footprint spans Europe, North America, South America, Asia Pacific, and Africa.

-

BOXX Corp. - BOXX Corp. is a technology-driven firm that offers electric wheel drive commuting vehicle. The company’s engineering unit is responsible for developing all innovative technologies and the manufacturing of products. From product technology development to manufacturing and branding, everything is managed by the company’s engineering unit. The company offers its BOXX 1 Meter Vehicle to the consumer and commercial markets. BOXX Corp. also aims at undertaking partnerships, as part of their growth strategy, for the purpose of expanding its presence and reach amongst its customers and local business partners.

-

Gogoro, Inc. - Gogoro, Inc. is engaged in designing and manufacturing of battery swap stations and electric scooters. The company offers a range of smart scooters with swap battery features, including Gogoro S2 ABS, Gogoro S2 Adventure, Gogoro S2 Café Racer, Gogoro 2 Plus, Gogoro 2 Delight, Gogoro 2 Rumbler, Gogoro 2 Utility, Gogoro 3 Plus, and Gogoro Viva. Gogoro, Inc. also offers the Gogoro Network Battery Swapping Platform, a fast and efficient way to power up smart scooters. Gogoro Network is an open platform for smart mobility and battery swapping services designed to deliver a fresh alternative to legacy fuel. It combines the power of artificial intelligence (AI), machine learning, and connectivity to build a new generation of swappable battery refueling platform, i.e. a scalable and smart battery refueling system continually optimizing itself to be versatile and dynamic for communities, businesses, and people. Gogoro Inc. is highly focused on expanding its product offerings and the Gogoro network across the European market.

-

Green Energy Motors Corp. - Green Energy Motors Corp. is engaged in the designing and manufacturing of electronic consumer goods. It primarily focuses on the design and development of personal commute products. The company’s Commute-Case is an eco-friendly, energyefficient, and green personal mobility product. It uses a safe rechargeable battery package. It is a simple plug-in electric vehicle, which can be used to drive an adult rider within an indoor or outdoor environment. The device is portable and is transportable in a briefcase styled casing. The company aims at partnering with the technological, innovative, and developmental companies in order to improvise the product designs.

-

Greenwit Technologies Inc. - Greenwit Technologies Inc. designs and manufactures transport automobiles such as electric bicycles, electric scooters, electric motorbikes, and electric skateboards. The company specializes in the engineering, manufacturing, importing, and distribution of Light Electric Vehicles (LEVs). It has established partnerships with various Taiwanese, Korean, and Chinese automotive manufacturers for the purpose of designing and manufacturing of LEVs. Greenwit Technologies Inc. has also extended its partnerships with the Canadian Universities in order to deploy the latest LEV technologies. In addition to designing and manufacturing, the company also engages in the export and import of its LEV products. The company is headquartered in Canada and distributes its products under two subsidiary companies namely Motorino Electric and E-Ride Vancouver.

-

Honda Motor Co. Ltd. - Honda Motor Co. Ltd. is a multinational company that engages in the manufacturing of aircraft, automobiles, motorcycles, and power equipment. The company “Honda Motor Co. Ltd.” belongs to the Honda Group of Companies and is primarily involved in automotive manufacturing, including motorcycles and automobiles as well as related accessories and spare parts. The company’s key product offerings range from cars, scooters, motorbikes, and all-terrain vehicles (ATVs). The company offers an electric scooter called PCX ELECTRIC for Japan and the overall Asia market. PCX ELECTRIC is powered by the Honda Mobile Power Pack, a swappable and portable battery that stores electricity generated using renewable resources and can be used as a power source either for households or for small-sized electric mobility.

-

JIANGSU XINRI E-VEHICLE CO., LTD. - JIANGSU XINRI E-VEHICLE CO., LTD. is engaged in the designing, manufacturing, and sales of electric cars and motorcycles. The company offers a wide range of electric two-wheeler models, including ebike-XR-EM07, ebike-XR-EM04 EEC, ebike-XR-EM31, ebike-XR-EM32, ebike-XR-EM02 (XR2.0), and ebike-XR-EM01 EEC, among others. The company is also involved in setting up a platform for the global trade of machinery & electronic products. JIANGSU XINRI E-VEHICLE CO., LTD. is investing aggressively in research and development activities. The company has three main production units in China in Tianjin, Wuxi, and Xiangyang.

-

KTM AG - KTM AG is involved in the manufacturing of sports cars and motorcycles. The company operates as a part of the Pierer Mobility AG, a Europe based two-wheeler manufacturer. Furthermore, KTM has several subsidiary companies, including KTM Technologies GmbH, Husqvarna Motorcycles GmbH, KTM Sportmotorcycle AG, and KTM Immobilien GmbH, KTM, and Knuz GmbH, among others. The company is recognized for the production of two-stroke and four-stroke motorcycles. It has increased its production capacity of street motorcycles and sports cars and sells its motorcycles under two brands: KTM and Husqvarna Motorcycles.

-

GenZe by Mahindra - GenZe by Mahindra is a division of Mahindra Group of India engaged in designing and manufacturing e-bikes and e-scooters. The company offers a range of e-scooters, including the 2.0s Scooter, 2.0e Scooter, and 2.0f Scooter. The company’s two-wheel electric fleet solutions are purpose-built for use for tourism and delivery as well as by corporates, government agencies, colleges, and private operators. The 2.0e Scooter and 2.0f Scooter are secure and connected through API and telematics and are also equipped with removable batteries so that riders can replace the discharged batteries with a freshly-charged battery conveniently. At a top speed of 30mph, a newly-charged battery can offer a ride of up to 30 miles. According to the company, GenZe stands for Generation Zero Emissions.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Electric Scooters Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Electric Scooters Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."