- Home

- »

- Next Generation Technologies

- »

-

Embedded Finance Market Size And Share Report, 2030GVR Report cover

![Embedded Finance Market Size, Share & Trends Report]()

Embedded Finance Market Size, Share & Trends Analysis Report By Type (Embedded Payment, Embedded Insurance), By Business Model (B2B, B2C), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-067-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global embedded finance market size was valued at USD 65.46 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 32.2% from 2023 to 2030. The embedded finance growth can be attributed to the increasing smartphone and internet penetration across the globe. The increasing use of the internet and smartphone leads to the high adoption of digital mobile-based financial services, which bode well for the growth of the embedded finance industry. Furthermore, the increasing digitalization across various industries, including the banking and finance industry, is also expected to propel the embedded finance industry growth over the forecast period.

The growth in e-commerce and online shopping across the globe is anticipated to fuel market growth over the forecast period. This can be attributed to the use and integration of financial services into e-commerce platforms for seamless and convenient customer experiences. The e-commerce companies integrate financial services such as payments, lending, and insurance, among others. For instance, various e-commerce platforms such as Amazon.com and Wix e-commerce, among others provide buy now pay later services to their customers.

The embedded finance industry is expected to surge over the forecast period. The growth can be attributed to the technological advancements in Artificial Intelligence (AI). AI being used in embedded finance can help service providers to offer more enhanced and personalized services to their customers, leading to a rise in the utilization of services and increased revenue. Furthermore, the growth in the use of Application Programming Interfaces (APIs) that enable the exchange of data between financial institutions and other businesses, allowing the development of new financial products, is anticipated to fuel the market’s growth over the forecast period.

The increasing investments by several venture capital firms and Fintech companies into embedded finance start-ups bode well with the growth of the market. For instance, in October 2022, Railsr, formerly known as Railsbank, a global embedded finance company, announced that it raised USD 46 million through its series C funding round. The funding included USD 26 million in equity and USD 20 million in debt, the equity investments came from Outrun Ventures, Anthos Capital leading, Ventura, CreditEase and Moneta being participants and the debt funds were provided by Mars Capital, an investment platform. With this funding, the company is focusing towards expanding its business across Europe.

Though the embedded finance industry is expected to witness growth over the forecast period, some of the challenges are anticipated to restrain the growth of the market. The challenges include compliance requirements and financial institution dependency. Furthermore, the consumer in embedded finance has direct contact with the retailer or the service provider, which lacks bank interaction with the customer. Also, banks would not accept such partnerships with non-fintech, where the role of the bank is less important for the end user. However, the benefits such as seamless customer experiences and increase in spending of consumers through offered services such as BNPL are further anticipated to propel the market’s growth over the forecast period.

COVID-19 Impact Analysis

The COVID-19 pandemic positively impacted the growth of the embedded finance industry. The norms and regulations for social distancing have impacted traditional banking services leading to the demand for digital banking services. For instance, according to a global study titled COVID-19 FinTech Market Rapid Assessment, nearly 60% of the surveyed Fintech firms reported the launch of new products and services. Furthermore, the rise in e-commerce and online shopping trends during and post-COVID-19 pandemic have accelerated the adoption of embedded finance solutions, thereby fueling the market’s growth.

Type Insights

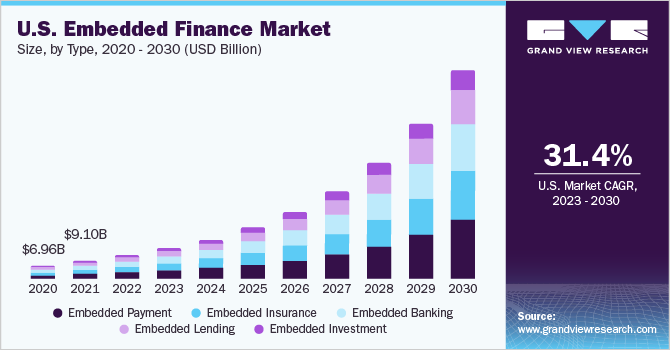

The embedded payment segment dominated the market with a revenue share of over 28.0% in 2022. Embedded payments offer businesses a faster and more efficient way to receive payments than traditional invoicing methods. These payments not only provide access to alternative funding sources but also simplifies the buying process for customers, resulting in higher levels of satisfaction and loyalty. Consequently, businesses can expect to experience increased revenue and strengthened brand loyalty. Hence, it is expected to drive segment growth over the forecast period.

The embedded lending segment is anticipated to witness the fastest growth over the forecast period. The rapid growth of embedded lending can be attributed to the increasing demand for seamless and quick access to funds. According to The Future of Customer Experience in Embedded Lending survey in December 2022, a global study of 350 senior executives across the global lending industry, nearly 45% of loans could be withdrawn in the non-financial situation over the next five years. Additionally, 93% of respondents believed that embedded lending would lead to effortless loan applications. Hence, the aforementioned factors are anticipated to drive the segment’s growth over the forecast period.

Business Model Insights

The B2B segment dominated the market with a revenue share of over 30.0% in 2022. The B2B segment includes financial services offerings such as cross-border payments, digital payments, and inventory financing services, among others, by non-financial businesses. In addition, increasing launches of B2B embedded finance platforms globally are projected to drive the adoption of B2B embedded finance. For instance, in March 2023, SAP Fioneer, a software company, recently unveiled a B2B embedded finance platform designed for financial service institutions. The platform aims to help these institutions enhance their services in the rapidly digitalized trade environment and gain a competitive edge.

The B2C segmentis anticipated to witness significant growth over the forecast period. The segment's growth can be attributed to the increasing adoption of B2C embedded finance. The increasing adoption can be attributed to the need for businesses to provide a seamless experience to their customers and increase revenue by offering innovative financial products and services. Furthermore, several e-commerce companies such as Shopify, Inc. and Amazon, Inc. are involved in offering embedded finance services such as buy now pay later and wallet payment services, among others.

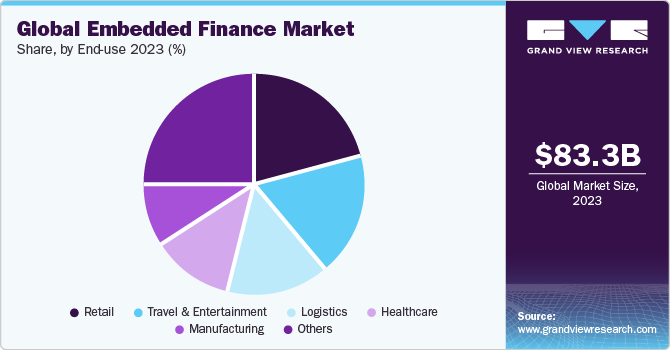

End-use Insights

The retail segment dominated the market with a revenue share of over 20.0% in 2022. Retailers across the globe are investing heavily in embedded finance platforms to offer embedded finance services to their customers. According to the survey by Aion Bank in May 2022, around 74% of European retailers have rolled on the embedded finance offerings to their customers. In addition, 73% of the retailers said that their customers desire embedded finance products. Furthermore, embedded finance services such as cashback loyalty schemes and credit & debit card payments attract customers and help retailers build loyal customer groups.

The travel & entertainment segment is anticipated to witness the fastest growth over the forecast period. Travel & entertainment companies are involved in launching several embedded finance services, including buy now pay later services. For instance, in January 2023, Kayak, a part of Booking Holdings Inc., partnered with Affirm, a financial company, to launch a buy now pay later service for all eligible travelers on the firm's website. As a result of this launch, travelers were enabled with flexibility in payment through a BNPL option while booking trips on KAYAK.com.

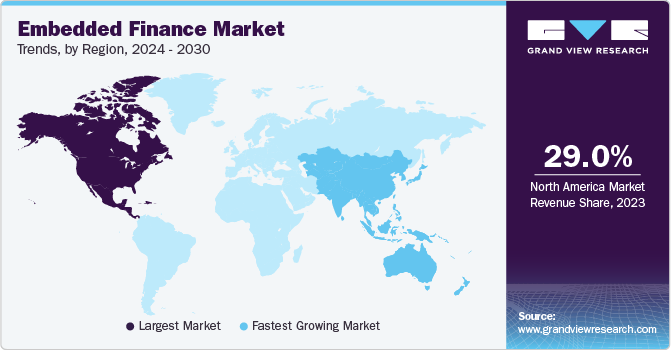

Regional Insights

The North American region dominated the market with a revenue share of over 26.0% in 2022. The presence of prominent market players across the region is expected to drive the regional market's growth. Furthermore, embedded finance startups across the region are involved in fundraising activities to accelerate the adoption of embedded finance. For instance, in August 2022, Parafin, Inc., an embedded finance startup in the U.S., announced that it raised USD 60 million through a series B funding round. The round was led by GIC, Singapore's sovereign wealth fund. The company aimed to utilize funds for introducing new products designed for small businesses.

The Asia Pacific region is anticipated to witness the fastest growth over the forecast period. The growth of the Asia Pacific region can be attributed to the initiatives taken by various players in the market. For instance, in October 2022, KPMG Services Pte. Ltd., a firm providing audit, tax, and advisory services, announced the launch of the embedded finance hub in Singapore. This launch of the embedded finance hub aimed to accelerate the adoption of embedded finance services across the country by offering support to financial institutions and enterprises. Furthermore, the growing e-commerce industry across the Asia Pacific region also bodes well with the growth of the embedded finance industry in the region.

Key Companies & Market Share Insights

The market is fragmented due to the presence of several prominent players in the market. The industry players aim for new product launches and partnerships & collaboration as part of their efforts to improve their offerings and expand their customer base. For instance, in January 2023, Yes Bank, an Indian banking company, partnered with Falcon, a banking-as-a-service company, to enter into the embedded finance market. This partnership aimed to improve the customer banking experience of the customer by offering customized financial solutions to its clients leveraging Falcon’s state-of-the-art technological infrastructure.

Multiple companies and associations are working on strategic planning, such as partnerships, mergers, and acquisitions, to widen their offerings further. For instance, in March 2023, Railsr, formerly Railsbank, announced its acquisition by Embedded Finance Limited, backed by a consortium of global investors, including Moneta VC, D Squared Capital, and Ventura Capital. With this acquisition, the company aims to grow its European customer base. Some prominent players in the global embedded finance market include:

-

Stripe, Inc.

-

PAYRIX

-

Cybrid Technology Inc.

-

Walnut Insurance Inc.

-

Lendflow

-

Finastra

-

Zopa Bank Limited

-

Fortis Payment Systems, LLC

-

Transcard Payments

-

Fluenccy Pty Limited

Recent Developments

-

In June 2023, Stripe partnered with Google Workforce. This partnership enabled customers to make an appointment, book, and pay for services using Google Calendar.

-

In June 2023, Stripe launched a charge card program for Stripe Issuing. This charge card provided new revenue streams for Stripe and it allows customers to spend on credit rather than the funds in their account.

-

In June 2023, Finastra collaborated with ADVANTAQ, the leading compliance technology partner. The objective of this collaboration was to offer a seamless vendor experience and enable increased operational efficiencies for the company.

-

In May 2023, Finastra partnered with Priority Software, a leading provider of open cloud-based business management. This partnership allowed customers to make payments quickly and easily and helped the company to evolve with industry changes globally.

Embedded Finance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 83.32 billion

Revenue forecast in 2030

USD 588.49 billion

Growth rate

CAGR of 32.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, business model, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Stripe, Inc.; PAYRIX; Cybrid Technology Inc.; Walnut Insurance Inc.; Lendflow; Finastra; Zopa Bank Limited; Fortis Payment Systems, LLC; Transcard Payments; Fluenccy Pty Limited

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Embedded Finance Market Report Segmentation

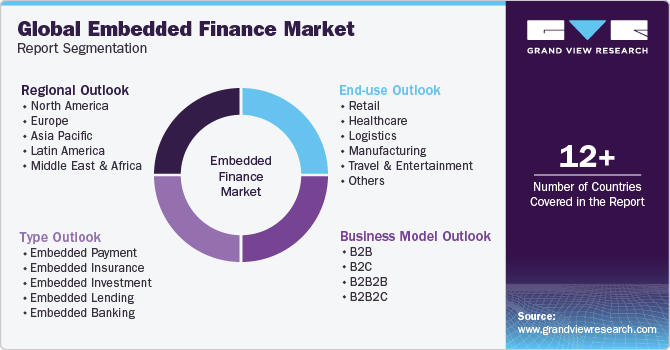

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the embedded finance market based on type, business model, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Embedded Payment

-

Embedded Insurance

-

Embedded Investment

-

Embedded Lending

-

Embedded Banking

-

-

Business Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

B2B

-

B2C

-

B2B2B

-

B2B2C

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail

-

Healthcare

-

Logistics

-

Manufacturing

-

Travel & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global embedded finance market size was estimated at USD 65.46 billion in 2022 and is expected to reach USD 83.32 billion in 2023.

b. The global embedded finance market is expected to grow at a compound annual growth rate of 32.2% from 2023 to 2030 to reach USD 588.49 billion by 2030.

b. North America dominated the embedded finance market with a share of 26.0% in 2022. The presence of prominent market players across the region is expected to drive the regional market's growth. Furthermore, embedded finance startups across the region are involved in fundraising activities to accelerate the adoption of embedded finance.

b. Some key players operating in the embedded finance market include Stripe, Inc., PAYRIX, Cybrid Technology Inc., Walnut Insurance Inc., Lendflow, Finastra, Zopa Bank Limited, Fortis Payment Systems, LLC, Transcard Payments, and Fluenccy Pty Limited.

b. Key factors that are driving embedded finance market growth include rapid digitalization across various industries and increasing adoption of embedded finance by businesses.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."