- Home

- »

- Healthcare IT

- »

-

EMEA Home Infusion Services Market Report, 2028GVR Report cover

![EMEA Home Infusion Services Market Size, Share & Trends Report]()

EMEA Home Infusion Services Market Size, Share & Trends Analysis Report By Service Type (Pharmaceutical Preparation And Delivery, Patient Training, Administration Service, Clinical monitoring), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-725-9

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Healthcare

Report Overview

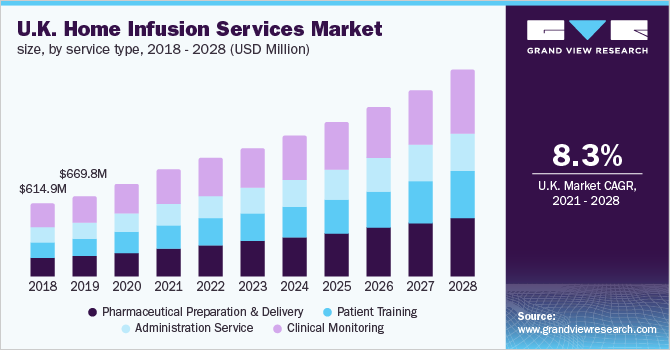

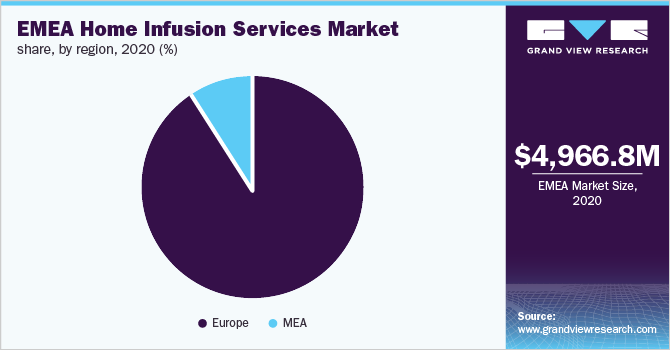

EMEA home infusion services market size was valued at USD 4,966.8 million in 2020 and is expected to expand at a CAGR of 8.3% from 2021 to 2028. An increase in the number of people suffering from long-term chronic diseases, the growing geriatric population, the growing incidence of hospital-acquired infections, and the cost-effectiveness of home healthcare services are expected to boost the market growth.

The advent of the pandemic favored the growth of the market because home infusion services can be carried out safely, effectively and under the supervision of a physician at a patient's home without the risk of the patient getting infected. Several illnesses, including immunological deficiencies, cancer, and congestive heart failure, necessitate infusion therapy since oral medications are ineffective. According to the European Society of Cardiology in 2019, there are more than 6 million new cases of cardiovascular diseases in the EU every year, and more than 11 million in Europe as a whole. With about 49 million people in the EU suffering from the condition, the annual cost to EU economies is considerable at EUR 210 billion. As many patients require long-term care, home infusion services are considered to be a more cost-effective option than hospitalization.

The U.K. home infusion services market is expected to witness the highest compound annual growth rate of 9.7% from 2020 to 2028. According to the WHO, in the last few decades, life expectancy in Europe has increased significantly. In many European countries, the proportion of the geriatric population is steadily increasing and is expected to grow even more in the future. This is expected to increase the number of elderly persons who require care. The needs of people suffering from non-communicable diseases, which are the primary causes of disability and mortality, would likewise alter significantly in the next few decades.

Furthermore, an estimated 4 million people in the EU contract a healthcare-associated infection each year. For example, hospitals throughout Europe, including the U.K., as well as the Middle East and Africa, are attempting to replace millions of pieces of equipment used to treat patients, fearing that these instruments could cause infections as a result of the discovery of a company that falsified sterilization records for more than a decade. This problem affects over 230 different types of infusion lines, connections, and supporting kits, which are used with infusion pumps to provide medicines and fluids to patients. This is projected to increase demand for infusion services at home.

In MEA countries like, South Africa, health insurance coverage among the elderly is low (22.9 %), especially among the black (6%) and colored populations. The rise in the geriatric population is expected to drive the market. However, despite the free services for elderly people provided by the government, the people are facing challenges in accessing the public health system, which is likely to increase the demand for home infusion services provided by private institutions with the help of caregivers.

Despite the COVID-19 pandemic negatively impacting several industries, the demand for home infusion devices and services escalated drastically during the pandemic. Europe and MEA also were adversely impacted by the Covid-19 crisis and this has catalyzed the uptake of digital health solutions and home infusion services to control the spread of the virus. Risk profiling of people with chronic conditions can be done based on vital signs and demographic data. In this manner, nurses can allocate more duration of their services to high-risk clients or those whose health may be critical, allowing easy virtual visits or at-home appointments. Europe is set to rigorously adopt remote monitoring, home infusion, telehealth platforms, AI-powered assessment apps, and devices to identify, manage and engage different healthcare strategies in the future.

Service Type Insights

The clinical monitoring service type segment held the highest revenue share of 29.8% in 2020. Based on service type, the EMEA home infusion services market is divided into Pharmaceutical preparation and delivery, Patient training, Administration service, Clinical monitoring. The clinical monitoring segment held the largest market share as dosing guidelines for each patient is unique, and the appropriate dose must be customized to both laboratory values and the clinical status of the patient.

Gathering patient data allows the physicians and the nurses to update themselves with the patient’s progress as well as perform appropriate diagnostic procedures and construct a treatment plan accordingly. Clinical monitoring also requires the need for an optimal software program that allows for the efficient collection of clinical data in both breadth and depth.

The pharmaceutical preparation and delivery segment is expected to witness the highest growth over the forecast period. This is because treatment for diseases like cancer is unique for each patient and requires and has to be made based on the condition and severity of the disease. Moreover, many medications have specific intervals and are delivered to patients by Home infusion pharmacists under the consultation of a professional. Pharmacists supervise the dispensing of sterile preparations and delivery activities, as well as clinical monitoring, care planning, and assessment of home infusion patients. Certain medications are temperature sensitive and require adequate storage temperature at the time of delivery and all this is taken care of in Pharmaceutical preparation and delivery service.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 90.8% in 2020 and is estimated to witness lucrative growth over the forecast period. European countries like the U.K., Germany, and Switzerland have well-established home care infrastructure. In addition, the presence of publicly funded home care services is contributing to market growth. Moreover, the increasing number of initiatives undertaken by the government to promote patient safety pertaining to home infusion therapy is expected to drive market growth.

Furthermore, the rising geriatric population coupled with the rising prevalence of diseases such as Parkinson’s, arthritis, paralysis is anticipated to increase the demand for home infusion solutions. For instance, in the U.K., one of the important economies in Europe, the geriatric population accounted for nearly 17.8% of the country’s population in 2015 and it is projected to reach approximately 24.6% by 2025.

Obesity-related illnesses heart ailments in countries like Saudi Arabia and UAE are expected to increase the demand for home infusion services in the region. Moreover, the presence of major home care service providers, such as Manzil Healthcare Services, Americare Home Health Services, is also anticipated to fuel market growth.

Key Companies & Market Share Insights

Mergers and acquisitions are one of the key sustainable strategies undertaken by market players. In October 2021, Mediq partnered with Remedus to strengthen themselves in the field of home care, healthcare solutions, and medical devices in Belgium. Remedus complementary product and service offerings will enhance Mediq’s market position in Belgium. In July 2021, Healthcare at Home rebranded itself and changed its name to Sciensus. The name is expected to reflect the company’s forward-thinking approach, which aims to harness new digital technology and patient insight to provide patients with more knowledge, more choice, and greater convenience. Some of the prominent players in the EMEA home infusion services market include:

-

OMT GmbH & Co. KG

-

Licher MT GmbH

-

Sciensus

-

Mediq

-

Hala Healthcare Services

-

Enayati home healthcare

-

Orkyn

EMEA Home Infusion Services Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 5.7 billion

Revenue forecast in 2028

USD 9.9 billion

Growth rate

CAGR of 8.3% from 2021 to 2028

Base year for estimation

2020

Actual estimates/Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Services type, region

Regional scope

Europe, MEA

Country scope

U.K.; Germany; France; Italy; Spain; Netherlands; Belgium; Switzerland; Russia; Sweden; South Africa; Saudi Arabia; UAE; Israel; Egypt

Key Companies Profiled

OMT GmbH & Co. KG; Licher MT GmbH; Sciensus; Mediq; Hala Healthcare Services; Enayati home healthcare; Orkyn

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the EMEA home infusion services market on the basis of service type and region:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Pharmaceutical preparation and delivery

-

Patient training

-

Administration service

-

Clinical monitoring

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Netherlands

-

Belgium

-

Switzerland

-

Russia

-

Sweden

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The EMEA home infusion services market size was estimated at USD 4,966.8 million in 2020 and is expected to reach USD 5.7 billion in 2021.

b. The EMEA home infusion services market is expected to grow at a compound annual growth rate of 8.3% from 2021 to 2028 to reach USD 9.9 billion by 2028.

b. Germany dominated the European home infusion services market with a share of 20% in 2020. European countries like the UK, Germany, Switzerland has well-established home care infrastructure. In addition, the presence of publicly funded home care services is contributing to market growth

b. Some key players operating in the EMEA home infusion services market include OMT GmbH & Co. KG, Licher MT GmbH, Sciensus, Mediq, Hala Healthcare Services, Enayati home healthcare, and Orkyn

b. Key factors that are driving the EMEA home infusion services market growth include an increase in the number of people suffering from long-term chronic diseases, the growing geriatric population, the growing incidence of hospital-acquired infections, and the cost-effectiveness of home healthcare services

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."