- Home

- »

- Medical Devices

- »

-

Endoluminal Suturing Devices Market Size Report, 2020-2027GVR Report cover

![Endoluminal Suturing Devices Market Size, Share & Trends Report]()

Endoluminal Suturing Devices Market Size, Share & Trends Analysis Report By Application (Bariatric Surgery, Gastrointestinal Surgery, Gastroesophageal Reflux Disease Surgery), By End Use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-569-4

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

The global endoluminal suturing devices market size was valued at USD 41.9 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 12.0% from 2020 to 2027. The high growth rate of the market is primarily attributed to the factors such as increasing incidence of obesity and the rising preference for minimally invasive weight loss surgeries. Obesity is a major health hazard and is the second most preventable cause of death in the U.S. According to the Centers for Disease Control and Prevention (CDC), the prevalence of obesity in the U.S. was 42.4%, while the prevalence of severe obesity in adults accounted for 9.2% in 2018. Endoluminal surgery is a minimally invasive procedure performed in a hollow organ using surgical techniques such as suturing and stapling. Increasing preference for these surgeries is primarily due to rising awareness about minimally invasive procedures and reduction in post-operative complications.

Technological advancement in endoluminal devices allows doctors and clinicians to explore various weight loss procedures, thereby, increasing the demand for endoluminal suturing devices. In addition, advancement in endoluminal suturing devices has also enabled surgeons to explore the field of gastrointestinal surgeries. Endoluminal surgeries are performed entirely through gastrointestinal tract and include various stand-alone weight loss procedures. These surgeries involve procedures such as complex endoscopic mucosal resection, submucosal tunneling endoscopic resection, endoscopic full-thickness resection, and endoscopic submucosal dissection. These procedures remove lesion through an endoscopic suturing device and helps in avoiding open surgeries.

Moreover, the advent of robotic suturing systems in the field of endoluminal surgeries are also taking traction. The use of robotic arms for endoluminal surgeries allows the operator to recreate manual human wrist movement, which reduces errors significantly. Also, robotic suturing technique gives surgeon a degree of freedom of robotic arm and also provides three-dimensional vision. Thus, the abovementioned factors are improving the surgical outcomes and also increasing the demand for endoluminal suturing devices.

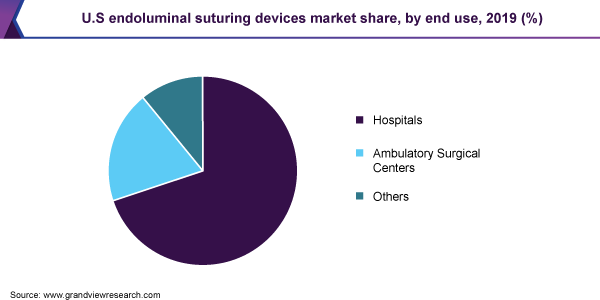

End-Use Insights

The hospitals segment held largest market share of 69.9% in 2019 and is anticipated to continue its dominance over the forecast period. This is due to the increasing incidence of chronic disease and rising number of bariatric surgeries. Moreover, improving healthcare infrastructure and increasing patient pool are also fueling the growth of the market for endoluminal suturing devices. In addition, presence of skilled healthcare professionals in developed countries such as the U.S. and rising private and government healthcare funding are driving the endoluminal suturing devices market.

The ambulatory surgical centers segment is growing at the fastest pace owing to increasing number of minimally invasive surgeries limiting hospital stay. Technological advances in the field of endoluminal surgeries are also permitting more outpatient surgeries. Furthermore, cost of surgeries in these centers is much lower as compared to the hospital charges, thus providing significant savings to patients and insurers.

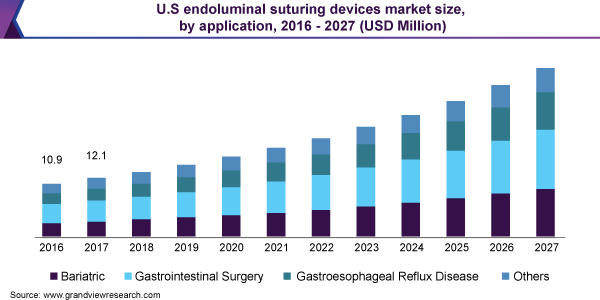

Application Insights

The gastrointestinal surgery segment dominated the market and accounted for largest market share of 35.5% in 2019. This is owing to the increasing number of GI procedures and availability of various applications in the field of GI such as abdominal related illnesses. This disease includes a wide spectrum of disorder affecting pancreas, biliary system, liver, oropharynx, and alimentary canal. According to the Gastroenterology Associates of Pensacola, each year there are more than 60.0 million Americans diagnosed with a digestive disorder.

The Gastroesophageal Reflux Disease (GERD) segment is growing at a fastest pace owing to increasing incidence of disease and technological advancement in surgical procedures. According to the Society of American Gastrointestinal and Endoscopic Surgeons, GERD accounted for 8.9 million medical visits annually with an estimated annual cost of USD 24.0 billion dollars in 2017. Moreover, this disease often requires lifelong management and is also associated with several health risks including esophageal stricture, adenocarcinoma, and esophagitis. Endoluminal suturing is one of the preferred therapeutic solution for this condition, thus, the segment is expected to drive the market for endoluminal suturing devices during the forecast period.

The bariatric surgery segment also has considerable market share owing to increasing prevalence of obesity and rising number of bariatric surgical procedures. There are various types of bariatric surgeries performed by the surgeons such as gastric bypass, gastric sleeve, gastric balloon, gastric revisional, mini gastric bypass, and gastric endoscopic sleeve. According to the International Federation for the Surgery of Obesity and Metabolic Disorder (IFSO), in 2016, there were 685,874 bariatric surgeries performed worldwide. Thus, increasing prevalence of obesity and technological advancement in various bariatric surgical procedures are contributing to the growth of the market for endoluminal suturing devices.

Regional Insights

North America dominated the endoluminal suturing devices market and accounted for 44.1% revenue share in 2019. This is owing to the presence of a large patient pool and favorable reimbursement policies. Increasing number of bariatric surgeries is expected to show direct positive impact on the growth of the market for endoluminal suturing devices. According to the American Society of Metabolic and Bariatric Surgery, approximately 252,000 bariatric surgical procedures were performed in the U.S. in 2018 up from 158,000 in 2011.

In Asia Pacific, the market for endoluminal suturing devices is expected to grow at the fastest pace due to improving healthcare infrastructure and the presence of a large population prone to various chronic diseases. Rising urbanization and various changing environmental and lifestyle factors are contributing to the rise of gastrointestinal disease throughout the region. Moreover, developing nations such as India and China are experiencing high demand for minimally invasive surgeries owing to the rise of various chronic and infectious diseases.

Key Companies & Market Share Insights

The key players are focusing on development of advanced endoluminal suturing devices for better patient outcomes. These players are focusing on strategies such as mergers, acquisitions, and innovative product launches. Thus, market leaders in the industries are taking advantage of the low competition in the market for endoluminal suturing devices and trying to capture majority of the market share. Some of the prominent players in the endoluminal suturing devices market include:

-

Apollo Endosurgery, Inc.

-

Ethicon Endo-Surgery (Johnson and Johnson)

-

Medtronic Plc.

Endoluminal Suturing Devices Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 46.8 million

Revenue forecast in 2027

USD 103.8 million

Growth rate

CAGR of 12.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Mexico; Brazil; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Apollo Endosurgery, Inc.; Ethicon Endo-Surgery (Johnson and Johnson); Medtronic Plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels as well as provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global endoluminal suturing devices market report on the basis of application, end-use, and region.

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Bariatric Surgery

-

Gastrointestinal Surgery

-

Gastroesophageal Reflux Disease Surgery

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global endoluminal suturing devices market size was estimated at USD 41.9 million in 2019 and is expected to reach USD 46.9 million in 2020.

b. The global endoluminal suturing devices market is expected to grow at a compound annual growth rate of 12.0% from 2020 to 2027 to reach USD 104.0 million by 2027.

b. Hospital segment dominated the endoluminal suturing devices market with a share of 69.9% in 2019. This is attributable to the increasing incidence of chronic disease and rising number of bariatric surgeries.

b. Some key players operating in the endoluminal suturing devices market include Apollo Endosurgery, Inc.; Ethicon Endo-Surgery (Johnson and Johnson); Medtronic Plc.

b. Key factors that are driving the market growth include the factors such as increasing incidence of obesity and the rising preference of minimally invasive weight loss surgeries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."