- Home

- »

- Medical Devices

- »

-

Endoscopy Operative Devices Market Report, 2021-2028GVR Report cover

![Endoscopy Operative Devices Market Size, Share & Trends Report]()

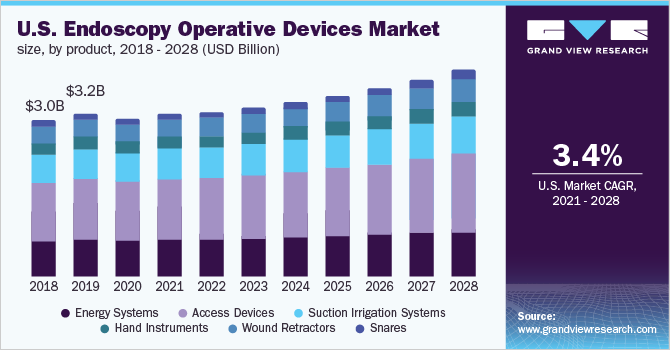

Endoscopy Operative Devices Market Size, Share & Trends Analysis Report By Product (Access Devices, Energy Systems), By Application (Gastrointestinal (GI) Endoscopy, Laparoscopy), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-391-1

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2014 - 2019

- Industry: Healthcare

Report Overview

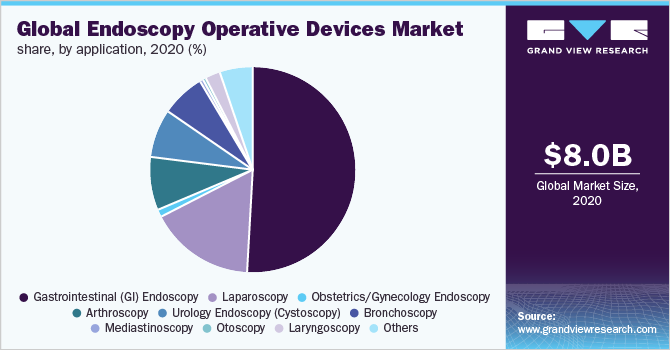

The global endoscopy operative devices market size was valued at USD 8.0 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2021 to 2028. The increasing prevalence of chronic disorders, such as obesity, diabetes, and cancer, coupled with the growing geriatric population, is expected to boost the demand for endoscopies. The rising awareness regarding the benefits associated with minimally invasive procedures, such as lesser post-operative complications and shortened hospitalization and recovery time, is further surging the demand for these procedures. The rising incidence of urological, respiratory, gastrointestinal, and gynecological disorders requiring endoscopy for diagnosing and treating the disorders is expected to propel the market growth.

The growing demand for endoscopy operative devices for diagnostic and therapeutic processes, coupled with the rising prevalence of age-related ailments across the globe, is expected to provide an impetus to the market growth. These devices play a vital role in diagnosing and treating disorders since they enable minimal intervention and results in a shorter recovery period. The global geriatric population suffering from gall stones, liver abscess, pelvic abscess, intestinal perforation, and endometriosis requires endoscopic procedures to treat the underlying disorder. According to the estimates published by the United Nations in 2020, the global geriatric population aged 65 or above in 2019 was nearly 727 million, accounting for 9.3% of the global population, and is expected to reach an estimated population of over 1.5 billion by 2050, representing 16.0% of the global population. This growth in the geriatric population susceptible to contracting chronic disorders requiring endoscopic procedures is expected to drive the market over the forthcoming years.

The growing number of healthcare centers such as hospitals, cancer centers, oncology specialty clinics, endoscopy centers, and diagnostic centers is leading to an increase in demand for endoscopes and operative devices, which is potentially driving the market. Developed and emerging economies are constantly upgrading their healthcare infrastructure to accommodate the growing demand for diagnostic and therapeutic procedures across the patient population. In 2018, approximately 6,396 hospitals were there in the U.S., which is anticipated to expand at a CAGR of 4.6% by 2025. Moreover, in Europe, the U.K. had the highest number of hospitals, accounting for 3,186 in 2018, and it is expected to reach 10,027 hospitals by the end of 2025, expanding at a CAGR of 18.0%. Furthermore, countries such as Brazil and South Africa are expected to register a significant increase in the number of hospitals with a CAGR of 10.1% and 11.8%, respectively. Similarly, oncology specialty centers and diagnostic centers are growing at a lucrative rate. The growth in the number of healthcare centers is expected to support the demand for endoscopy operative devices.

COVID-19 endoscopy operative devices market impact: 3.1% decline in revenue growth in 2020

Pandemic Impact

Post COVID Outlook

The endoscopy operative devices market size decreased by 3.1% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 3.6% to 5.3% in the next 5 years

Several factors such as shortage of facilities, lack of personal protective equipment (PPE) and trained workforce, lockdowns, and travel restrictions forced healthcare institutions to prioritize and reschedule endoscopic procedures into essential and non-essential, resulting in a decline in the number of endoscopic procedures

Healthcare facilities and market players are constantly focusing their efforts on reversing the negative impact caused by the pandemic by innovating and devising new protocols on manufacturing, transportation, precleaning, repair, and reprocessing

The Covid-19 pandemic significantly affected the manufacturing, supply chain, production and distribution, operations, and other endoscopy operative business activities of the key players. Various players witnessed a decline in revenue earnings of their endoscopy operative devices

Various health organizations such as the CDC, the WHO, and the American College of Surgeons are devising strategies to mitigate logistical challenges. The surge in demand for endoscope procedures for diagnostic and therapeutic purposes is expected to provide potential growth prospects in the forthcoming years

The increasing prevalence of cancer and cancer-related mortality is expected to drive the demand for advanced endoscopy operative devices. According to GLOBOCAN 2020 update on cancer incidences and mortalities, an approximate 19.3 million new cancer cases were diagnosed, and 10.0 million cancer mortalities were recorded in 2020 worldwide. Some of the common cancers requiring endoscopic intervention are lung cancer, stomach cancer, and colorectal cancer. Therefore, the rising prevalence of cancer is expected to boost the demand in the market. In addition, the prevalence of obesity and obesity-related disorders is on the rise across the globe. As per the estimates published by Renew Bariatrics, Inc., there are nearly 775 million obese people worldwide. According to OECD estimates, obesity rates are expected to rise significantly by 2030. The emergence of endoscopic bariatric surgeries, namely endoscopic sleeve gastroplasty, which are minimally invasive, is witnessing a surge in demand as a preventive measure. This, in turn, is expected to boost the market growth over the forecast period.

Furthermore, market players are constantly focusing on researching and innovating technologically advanced endoscope systems through collaborations and partnerships with other industry players. Some of the key strategies implemented by these players are mergers & acquisitions, product differentiation, and geographic expansions to gain a competitive edge in the market. For instance, in January 2020, PENTAX Medical launched IMAGINA Endoscopy System for Gastrointestinal (GI) procedures at ambulatory surgery centers in the U.S. The company also announced that it received clearance from the U.S. Food and Drug Administration for this device. IMAGINA offers a modern user interface to the practitioners, and its unique design helps in delivering better visualization, improving the operator’s experience, and positively influencing long-term costs related to patient care.

Product Insights

In 2020, the access devices segment accounted for the largest share of over 35.0% owing to the increasing number of endoscopic procedures. Several key players are designing and developing innovative, advanced endoscopy access devices for improving endoscopies. For instance, in October 2017, Olympus Corporation expanded its GI endoscopic device line with the launch of 3-in-1 SB Knives that enable mucosal incision as well as controlled precision cutting. In August 2018, Pentax Medical announced the acquisition of controlling interest of PlasmaBiotics SAS, which designs, manufactures, and markets devices used for drying and storing endoscopes. This acquisition would strengthen the hygiene portfolio of Pentax Medical and ensure a reduction in the risk of cross-contamination to enhance patient safety during endoscopy. These strategic alliances for expanding the company’s product portfolio or collaborating in terms of technology sharing are among the key factors fueling the segment growth.

The energy systems segment is anticipated to register the fastest growth rate during the forecast period. The majority of the endoscopic procedures necessitate the use of energy from sources, such as electricity, argon gas, microwaves, laser, ultrasound, and radiofrequency waves to cut, desiccate, coagulate, or manipulate tissues with minimal bleeding. The Society of American Gastrointestinal and Endoscopic Surgeons (SAGES) launched an essential educational program called Fundamental Use of Surgical Energy in 2010 to create awareness and train surgeons to avoid any potential thermal injuries during surgical procedures by using endoscopic and surgical energy devices. The introduction of new products is boosting the growth of the segment. For instance, in February 2019, Pentax Medical launched electrosurgical and argon coagulation platforms-ENDO ARC and ENDO PLUS-which strengthen integrated endoscopy solutions offered by PENTAX Medical for screening, diagnostic, and therapeutic purposes. This product helps in minimizing the risk of deep burns and perforation and allows endoscopists to perform reliable, safe, and fast procedures.

Application Insights

In 2020, the gastrointestinal (GI) endoscopy application segment held the largest revenue share of over 50.0% due to the growing burden of gastrointestinal disorders across the globe. The introduction of technologically advanced procedures to diagnose and treat gastrointestinal disorders, such as capsule endoscopy for diagnosing various ailments, is expected to drive the segment. Market leaders such as Olympus Corporation, Medtronic PLC, and Boston Scientific Corporation are constantly investing their R&D initiatives in advanced endoscopy operative devices. EVIS EXERA III (GIF-HQ190EVIS EXERA III Video Gastrointestinal Scope GIF-1TH190), EVIS EXERA III Video Gastrointestinal Scope GIF-H190, Optera Video Gastrointestinal Scope GIF-XP170N, and EVIS EXERA III Video Gastrointestinal Scope GIF-XP190N are some of the examples of gastroscopes manufactured by Olympus, which is the major player in gastroenterology.

The others application segment is anticipated to register the fastest growth rate during the forecast period. The other applications where operative devices are used are spinal or neuro, cardiovascular endoscopy, anoscopy, rhinoscopy, and rectoscopy. The growing geriatric population, rising prevalence of chronic disorders, increasing number of accidental injuries, and the growing preference for microsurgical procedures are expected to drive the segment. Market players are investing in conducting awareness campaigns about emerging techniques to drive the adoption rate of the devices for these applications. Some of the key players in this segment are Medtronic PLC, Richard Wolf, B Braun Melsungen AG, and Karl Storz.

Regional Insights

North America accounted for the largest revenue share of over 40.0% in 2020 due to the growing prevalence of cancer and other chronic disorders. The growing preference for minimally invasive procedures using advanced endoscopy operative devices is contributing to the market growth. In addition, the growing demand for endoscopies for diagnostic and therapeutic purposes is propelling the market growth. The rising healthcare expenditure and constantly evolving healthcare infrastructure are driving the North American market.

Asia Pacific is anticipated to register the fastest growth rate during the forecast period due to the growing economies of India and China and rising disposable income in these countries. The increasing prevalence of chronic disorders, growing geriatric population, developing healthcare infrastructure, and the introduction of advanced endoscopic procedures are expected to drive the Asia Pacific market over the forecast period. Global market players are implementing strategies to mark their presence in Asian countries by signing distribution agreements with local vendors and setting up manufacturing facilities in Asia Pacific.

Key Companies & Market Share Insights

The market is fragmented with the presence of some renowned companies. Key players are increasingly investing in the development of new products and improving existing products. Manufacturers are focusing on improving the quality of the products to gain a competitive edge in the market. Key players are implementing strategies such as technological collaborations and acquisitions to expand their product portfolio. For instance, in June 2019, Medtronic announced its 4-year partnership with Karl Storz. The two companies have been working together to integrate Karl Storz’s 3D vision systems into Medtronic’s robotic surgical platform. Some prominent players in the global endoscopy operative devices market include:

-

Cook Medical Inc.

-

Medtronic

-

Boston Scientific Corporation

-

Stryker

-

Ethicon Endo-Surgery, Inc.

-

Karl Storz

-

CONMED Corporation

-

Richard Wolf GmbH

-

Fujifilm Holdings Corporation

-

Olympus

Endoscopy Operative Devices Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 8.3 billion

Revenue forecast in 2028

USD 11.7 billion

Growth Rate

CAGR of 5.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2014 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Spain; Italy; France; Russia; Switzerland; Denmark; Japan; China; India; Australia; New Zealand; Thailand; Indonesia; Malaysia; Vietnam; Philippines; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Israel; Qatar

Key companies profiled

Cook Medical Inc.; Medtronic; CONMED Corporation; Boston Scientific Corporation; Stryker; Ethicon Endo-Surgery, Inc.; Karl Storz; Richard Wolf GmbH; Fujifilm Holdings Corporation; Olympus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2028. For the purpose of this study, Grand View Research, Inc. has segmented the global endoscopy operative devices market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2028)

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

Application Outlook (Revenue, USD Million, 2014 - 2028)

-

Gastrointestinal (GI) Endoscopy

-

Laparoscopy

-

Obstetrics/ Gynecology Endoscopy

-

Arthroscopy

-

Urology Endoscopy (Cystoscopy)

-

Bronchoscopy

-

Mediastinoscopy

-

Otoscopy

-

Laryngoscopy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

New Zealand

-

Thailand

-

Indonesia

-

Malaysia

-

Vietnam

-

Philippines

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global endoscopy operative devices market size was estimated at USD 8.0 billion in 2020 and is expected to reach USD 8.3 billion in 2021.

b. The global endoscopy operative devices market is expected to grow at a compound annual growth rate of 5.1% from 2021 to 2028 to reach USD 11.7 billion by 2028.

b. North America dominated the endoscopy operative devices market with a share of 40.5% in 2020. This is attributable to the growing preference for minimally invasive procedures using advanced endoscopy operative devices.

b. Some key players operating in the endoscopy operative devices market include Cook Medical, Stryker Corporation, Olympus Corporation, Karl Storz GmbH, Boston Scientific Corporation, and Medtronic PLC.

b. Key factors that are driving the endoscopy operative devices market growth include rising awareness levels towards the benefits associated with minimally invasive procedures, rising incidence of urological, respiratory, gastrointestinal, and gynecological disorders requiring endoscopy for diagnosing and treating the disorders, and increasing prevalence of chronic disorders, such as obesity, diabetes, and cancer, coupled with the growing geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."