- Home

- »

- Next Generation Technologies

- »

-

Energy Management Systems Market Size Report, 2030GVR Report cover

![Energy Management Systems (EMS) Market Size, Share & Trends Report]()

Energy Management Systems (EMS) Market Size, Share & Trends Analysis Report By System Type, By Vertical (Residential, Manufacturing, Retail, Telecom & IT), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-666-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global energy management systems (EMS) market size garnered USD 40.77 billion in 2022 and is expected to witness a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030. An uptick in the management of energy use across commercial, industrial, and public sector organizations has fueled demand for energy management systems (EMS). Implementing advanced energy-efficient technologies and reducing energy waste will gain ground to contain greenhouse gas emissions, minimize potential exposure to fluctuating energy prices and bolster productivity. In February 2020, the World Resources Institute cited data suggesting that energy consumption was the biggest source of human-caused greenhouse gas emissions. Amidst the prevailing trend, industry players could seek IoT-based solutions to optimize energy consumption and control the energy flow.

The competitive landscape alludes to strategic planning, such as technological advancements, collaborations, product offerings, mergers & acquisitions, and geographical expansion to gain momentum globally. For instance, in July 2022, Eaton collaborated with EU-backed Flow Consortium (24 external partners and six leading universities across Europe) to develop and demonstrate an integrated electric vehicle charging infrastructure. The USD 10.4 million project, under the aegis of EU’s Horizon Europe Research and Innovation program, could span till March 2026.

Robust pace of digitization in the energy landscape, along with the paradigm shift witnessed in electrification, has fostered demand for energy management system software. EMS plays an invaluable role in helping companies identify opportunities to enhance and adopt energy-saving technologies. EMS is likely to receive impetus to provide stability in energy provision, flexibility in power generation and boost energy efficiency. Furthermore, environmentally friendly energy consumer framework will emphasize quality and occupancy sensors to regulate energy consumption. Technologies to minimize energy consumption may lead to decarbonization trend to avoid using fossil fuels.

State-of-the-art technologies, such as edge AI have gained considerable traction across advanced and emerging economies, mainly due to the onslaught of COVID-19 pandemic. The prevalence of hybrid work culture and rotating class schedules furthered the trend for smart building management. Additionally, edge AI has underscored building management system (BMS) to bolster safety, minimize energy consumption, better utilize building assets and offer increased occupant comfort. The outbreak prompted building managers to prioritize AI-leveraged BMS and optimize and automate energy usage. Post-COVID outlook suggests an emphasis on EMS could pave a way for low-carbon economic growth.

Market Dynamics

A smart metering system is an electronic device that can measure power fed into the grid or electricity drawn from the grid, delivering more data than traditional meters. Such a system can receive and transmit data for control, monitoring, and information purposes. With smart meters, end users can get a precise and frequent reading of their energy consumption and only be charged for electricity they consume. This ends back billing and inaccurate bills, which are now the greatest complaints from customers. Moreover, Smart meters enable consumers to adjust their energy use to changing energy prices throughout the day, allowing them to use more energy during times of lower prices and reduce their energy bills using a smart meter. There is a huge demand for advanced energy management due to rising investments in smart infrastructure projects, including smart buildings, smart cities, and smart farming. For instance, government of India needs an effective, dependable, and continuous power supply for its projects like "Make in India" and "Smart Cities." To address this, the Ministry of Power established the Indian Smart Grid Forum (ISGF), which collaborates closely with public, private, and research organizations to develop standards and policies for deployment of the "Smart Grid" and to ensure efficient and affordable power for all stakeholders. For instance, in November 2020, according to a European Commission report, about 51 million smart meters for gas and 225 million smart meters for electricity will be installed by 2024, with a prospective investment of €47 Billion. In addition, it is predicted that by 2024, 44% of European customers will have smart gas meters, and 77% of them will have smart electric meters.

System Type Insights

Industrial energy management system (IEMS) segment accounted for the largest market share of over 70% in 2022. Building Energy Management Systems (BEMS) will grow with a soaring penetration of IoT devices and increasing connectivity. Smart buildings are likely to explore IoT and digital building solutions to leverage real-time data for an efficient and sustainable management of buildings. A paradigm shift witnessed towards Industry 4.0 and digital transformation has furthered management, optimization and maintenance of building. Besides, electrification of space heating and cooling in buildings has augured well for market growth. Lately, metering devices have gained prominence to connect with automation system and smartly acquire, assess and store information to boost efficiency. Stakeholders, including energy managers, building owners and electrical installers, are expected to count on BEMs for optimum energy consumption.

Home Energy Management Systems (HEMS) segment is expected to depict an impressive CAGR against the backdrop of soaring energy consumption. EIA’s Annual Energy Outlook 2015 claimed that domestic consumption could rise by 0.3% annually through 2040. Energy optimization solutions, including a smart home’s electrical board and use of software that helps detect energy consumption, are likely to foster home energy management systems. As space heating, air conditioning, water heating, lighting and appliances continue to be among the most significant uses of electricity in the residential sector, smart devices-smart sensors and smart meters—could gain further traction in the ensuing period. Expanding footfall of energy-conserving devices is slated to reinforce demand for home energy management systems.

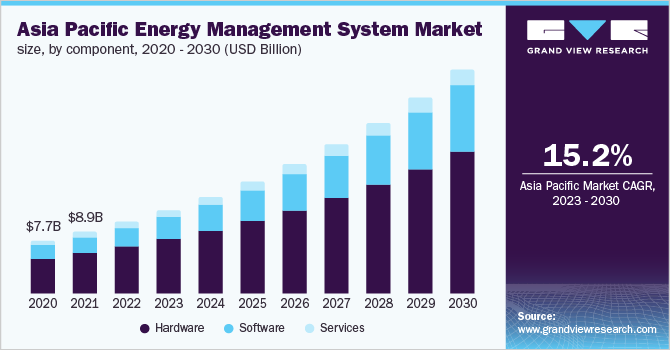

Component Insights

Hardware segment accounted for the largest market share of over 60% in 2022, owing to the growing penetration of sensing technology and communication. Besides, bridges and sensors have gained ground, with wired sensor networks receiving uptake for being more reliable, having longer service lifetimes, and being less vulnerable to interference and disruptions. With monitoring and controlling building operations gaining a foothold to embed intelligence, hardware components could add a fillip to energy management systems market forecast during the forecast period.

Software could be a pivotal contributor to minimizing energy usage and offering information about consumption patterns. Software components have become trendier for actionable insights into energy data, to reduce energy costs and streamline workflow. Software has become sought-after to offer detailed energy information, such as influence of weather and control data centers, HVAC, and manufacturing lines. EMS software has also received an impetus to render accurate expenditure and consumption data. Furthermore, end-users have exhibited a profound inclination for the component to streamline allocation of energy through real-time data-based load changes. With a host of companies assessing the significance of energy efficiency, software could gain traction to boost collaboration and communication related to energy-related issues.

Deployment Insights

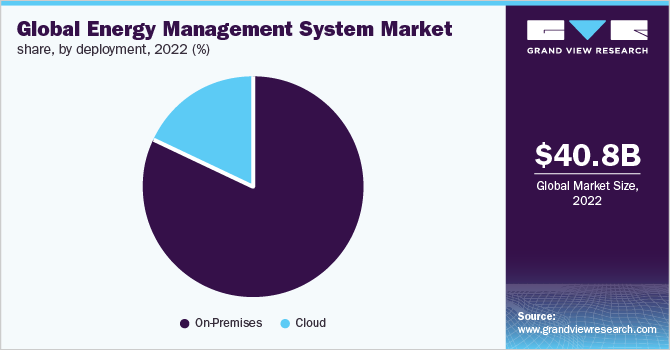

On-premises segment accounted for the largest market share of over 80% in 2022. Cloud-based energy management systems will contribute significantly to the global market on the back of reduced costs and the need to combat carbon emissions. Cloud computing systems have enabled organizations to boost flexibility and help visualize, monitor and assess data remotely. End-users are slated to exhibit demand for cloud-based EMS for real-time visibility of energy. Cloud-based energy management systems have become sought-after to enable end-users to manage and monitor energy practices using IIoT devices. With innovative technologies and IoT playing a pivotal role in minimizing energy usage, cloud will continue to receive impetus globally.

Leading companies have exhibited profound traction for cloud-based business models to combat soaring energy consumption and reduce carbon emissions. For instance, in March 2021, Oracle noted that Oracle Cloud Infrastructure helped Enloc Energy cut infrastructure costs by 30%. Industry players have also sought machine learning and other advanced technologies to adjust building energy settings. In February 2020, Honeywell rolled out its first autonomous building sustainability solution, Honeywell Forge Energy Optimization, to assess energy consumption patterns of buildings and automatically adjust to optimal energy-saving settings. Energy providers are likely to inject funds into cloud for a seamless experience and bullish energy savings.

Vertical Insights

Manufacturing segment accounted for the largest market share of over 20% in 2022. While the automotive sector has emerged as a promising sub-segment in the energy management systems market, mainly due to the global push to migrate to a sustainable form of mobility. Heightened awareness about upsides of electric vehicles and soaring environmental concerns have augmented the need for EMS. To illustrate, in September 2021, Ford Motor announced plans to bring electric zero-emission vehicles at scale with an auto production complex to boost sustainability solutions. Automakers are likely to bank on energy management to optimize energy consumption without hampering driving comfort and performance. EMS will be sought to offer visibility of energy usage and tools to reduce, manage and save consumption. EMS will continue to provide a promising opportunity to boost the capacity of electrical infrastructure through load management and connecting/disconnecting processes.

Commercial segment could exhibit notable growth during the forecast period on the back of strong government policies and soaring electricity consumption. Commercial sectors, including service-providing facilities, government facilities and private organizations, are expected to bank on EMS. With air conditioning, lighting, and heating and ventilation accounting for significant applications of electricity, EMS will receive a notable uptick across the U.S., the U.K., China, Australia and India. Energy management smart solutions have gained ground as cloud connectivity continues reinforcing market growth. Energy management plans are poised to help identify energy consumption and production solutions. EMS could be ripe with energy-efficiency potentials by helping make informed energy management investment decisions.

Regional Insights

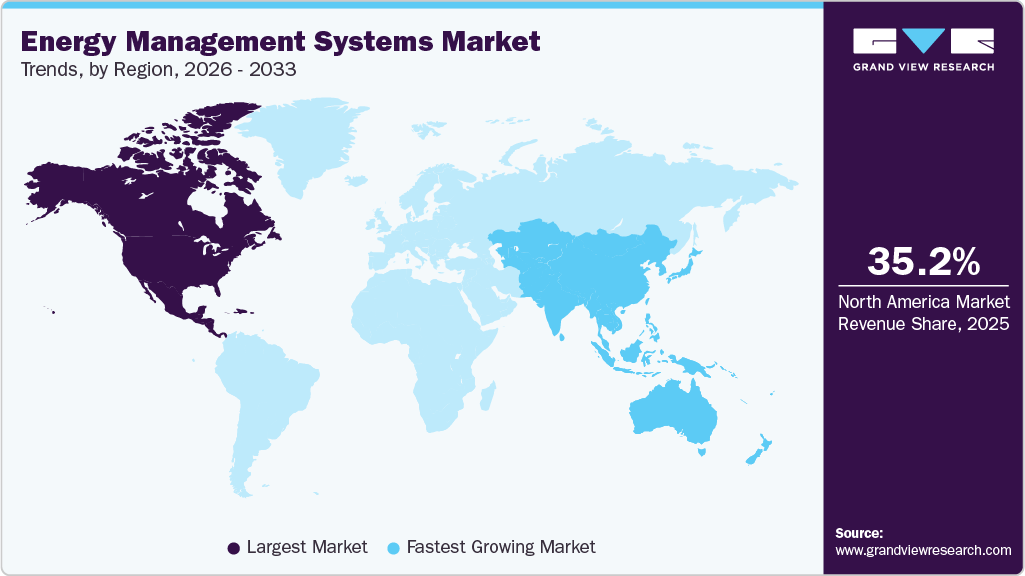

North America accounted for the largest market share of over 35% in 2022. The U.S. and Canada are slated to provide revenue-generating opportunities with surging penetration of smart grids and infrastructural spending. The IEA estimated investments in electricity grids would surge by 10% in 2021, with the U.S. being one of the major sources of infrastructural investments. Moreover, smart energy demand has witnessed a notable uptake across the region, encouraging stakeholders to inject funds into EMS. Prominently, residential, commercial, and building sectors are slated to exhibit strong demand for IoT-based solutions.

This growth trajectory is mainly attributed to an uptick in energy consumption for space heating and cooling. For instance, in June 2022, the U.S. Energy Information Administration cited the Annual Energy Outlook 2022 to suggest that almost 50% of energy consumption in U.S. buildings in 2021 was used for heating and cooling. Furthermore, electricity providers and commercial and industrial companies are anticipated to emphasize clean energy technologies and connectivity to minimize carbon emissions and tap into the global market.

Industry participants are slated to unlock opportunities across the U.K., France, Italy and Germany as EMS continues to gain ground across the region. The growth is primarily due to the adoption of buoyant energy policies. In July 2021, the European Commission (all 27 EU member states) committed to reducing emissions by at least 55% by 2030. In addition, the U.K. government claims all buildings will be energy efficient with low carbon heating by 2050, while around 700,000 homes will be upgraded by 2025. Governments are likely to focus on minimizing energy consumption to cut energy costs and emissions; the trend could foster Europe energy management systems market share.

Key Companies & Market Share Insights

Incumbent players and startups envisage EMS as cash cows and could prioritize organic and inorganic strategies, including technological advancements, innovations, product offerings, collaboration, and mergers & acquisitions. Moreover, microeconomic, and macroeconomic factors could redefine the global landscape following the fluctuation in demand and supply, interest rates, inflation, and GDP. Major players are likely to harness opportunities in smart energy management and cloud solution.

Of late, industry players could explore opportunities in grid software as energy companies emphasize smart meters to boost efficiency, agility, and flexibility. To illustrate, in May 2022, Siemens announced building grid software for economic efficiency and grid stability. The company infers its software ramps up grid simulations up to 6 times and enhances efficiency by 85% in grid management tasks. Meanwhile, in December 2021, GE Digital announced it teamed up with U.K. Power Networks to optimize the utilization of the distribution network. The innovation project could expedite integration of renewables and save around 17.8m tons of CO2 emissions by 2050. In June 2022, Schneider Electric joined hands with Hitachi Energy to expedite energy transition and boost customer value.

Smart home has also gained the trend globally, prompting leading companies to create technological synergies and adopt a strategic approach. For instance, in January 2022, Zigbang announced the acquisition of Samsung SDS’ home internet of things (IoT) unit to enter the global smart home industry. The former is gearing to digitize smart home devices, living space and real estate transactions. Furthermore, in August 2021, Mitsubishi Electric Corporation inked a deal to acquire Smarter Grid Solutions (SGS). Mitsubishi Electric noted that SGS solutions were in line with Mitsubishi Electric Environmental Sustainability Vision to witness a decarbonized society by 2050 with reduced greenhouse gas emissions. Some of the prominent players in the global energy management system market include:

-

Schneider Electric SE

-

Honeywell International Inc.

-

Siemens AG

-

Johnson Controls, Inc.

-

C3.ai, Inc.

-

GridPoint

-

General Electric

-

ABB

-

International Business Machines Corporation

-

Cisco Systems, Inc.

Energy Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 46.64 billion

Revenue forecast in 2030

USD 111.86 billion

Growth Rate

CAGR of 13.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System type, component, deployment, vertical, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Brazil

Key companies profiled

Schneider Electric SE; Honeywell International Inc.; Siemens AG; Johnson Controls, Inc.; C3.ai; Inc.; GridPoint; General Electric; ABB; International Business Machines Corporation; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Management Systems Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global energy management system market report based on system type, component, deployment, vertical, and region.

-

System Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial energy management systems (IEMS)

-

Building energy management systems (BEMS)

-

Home energy management systems (HEMS)

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premises

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Energy & Power

-

Telecom & IT

-

Manufacturing

-

Retail

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global energy management systems market size was estimated at USD 40.77 billion in 2022 and is expected to reach USD 46.64 billion in 2023.

b. The global energy management systems market is expected to grow at a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 111.86 billion by 2030.

b. North America dominated the energy management systems market with a share of 36.5% in 2022. This is attributable to a well-established infrastructure network and widespread adoption of EMS across verticals such as manufacturing, retail, power, and other industries.

b. Some key players operating in the energy management systems market include Honeywell Inc., Schneider Electric, Siemens AG, C3 Energy, General Electric Company, Emerson Process Management, Daikin Industries, Daintree Networks, Jones Sang LaSalle, Gridpoint Inc., Schneider Electric, Siemens AG, Honeywell International Inc., Elster Group GmbH, ABB, IBM, Toshiba Corporation, and Johnson’s Control International.

b. Key factors that are driving the market growth include improving energy efficiency, energy price volatility, and regulatory mandate and incentive program.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."