- Home

- »

- Sustainable Energy

- »

-

Energy Storage As A Service Market Size Report, 2028GVR Report cover

![Energy Storage As A Service Market Size, Share & Trends Report]()

Energy Storage As A Service Market Size, Share & Trends Analysis Report By Service (Customer Energy Management Services, Ancillary Services), By End User, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-665-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Energy & Power

Report Overview

The global energy storage as a service market size was valued at USD 1.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 10.7% from 2021 to 2028. The market is expected to be driven by the increasing demand for power management services and cost-effective battery backup power in case of a power outage. Moreover, the rise in the consumption of energy in developing and undeveloped countries is accelerating market growth. The ESaaS market witnessed a decline in growth owing to the outbreak of the Coronavirus pandemic in 2020. Lockdown across nations and travel restrictions had a negative impact on the market. Various industries and commercial complexes were shut, which resulted in the decline in the service demand in 2020.

Energy storage as a service is a new model. Thus, limited companies are offering these services at the global level. The majority of the players in this market are operating at the local and regional levels only. For instance, YSG Solar, a U.S.-based company, is offering these services in local areas. There is a significant opportunity for these services from the untapped markets and remote areas where there is a lack of power supply.

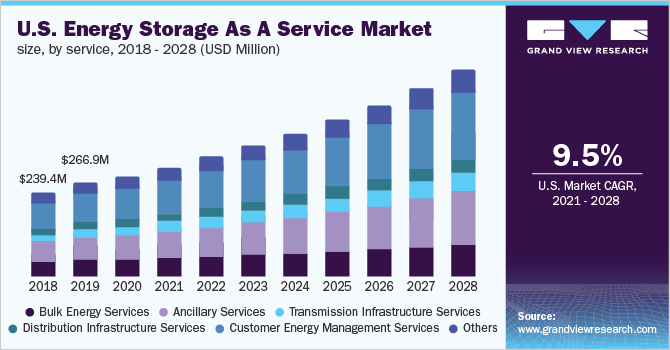

In the developed markets such as the U.S., factors such as peak load challenge and backup power to avoid blackouts are driving the market opportunities. Moreover, the increasing focus towards renewable energy generation in the region and decreasing dependency on fossil fuel energy generation are driving the market demand in the U.S.

According to Synergy BV, the market opportunity for energy storage as a service in the U.S. is driven by factors such as peak load challenges in New York City. Moreover, this model has helped drive the initiative “Renewing the Energy Vision (REV)” of the U.S. states. In addition, the energy storage service model has helped in increasing the focus on identifying non-wire solutions to important CapEx investments in the new distribution grid and substations infrastructure.

However, the ESaaS market has not seen a major dip in growth as it comes under essential services and the government of various countries permitted such services to help public utilities for power management and avoid peak loads and blackouts in the residential areas.

Service Insights

The customer energy management services segment led the market and accounted for over 30.0% share of the global revenue in 2020. Customer energy management services include power reliability, power quality, retail electric energy time-shift, demand charge management, and increased self-consumption of solar PV. Energy storage as a service model has a huge demand for customer energy and power management. It is used as backup power for power reliability when the customer uses solar energy and other renewable energy sources.

The ancillary services segment is likely to expand at the fastest CAGR of 11.7% over the forecast period and is expected to gain high momentum during the upcoming years owing to the increasing adoption of battery storage systems in the ancillary service market. Utilities are decreasing dependency on conventional fossil fuel generation and focusing on renewable and battery storage systems for ancillary services. Ancillary services include frequency regulation, spinning/non-spinning supplemental reserves, voltage support, and black start.

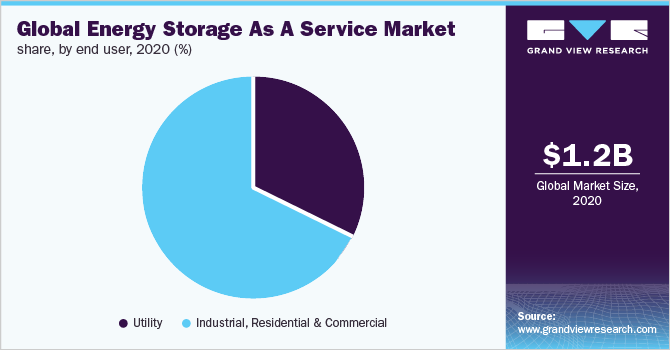

End-user Insights

The industrial, residential, and commercial segment led the market and accounted for over 70.0% share of the global revenue in 2020. Energy storage as a service model is majorly adopted by industrial, residential, and commercial sectors. The industrial sector utilizes these services for reliable power and stable energy supply. Big housing societies and remote residential areas utilize it for regular power supply and lowering the cost of energy consumption.

The utility segment is likely to expand at the fastest CAGR of 11.2% over the forecast period. The increasing focus of energy and power facilities on sustainability is one of the major driving factors for energy storage as a service model. Decreasing dependency on the conventional fossil fuel generators for services such as black start, voltage support, and energy arbitrage by the utilities and increasing focus on renewable power generation and battery storage for such services are expected to drive the market.

Regional Insights

North America dominated the market and accounted for over 30.0% share of the global revenue in 2020 on account of several factors including high energy consumption due to the presence of various industries such as automotive, aerospace, chemical, and healthcare. The demand for services such as peak load, energy arbitrage, black start, and demand charge management is high among the industrial, commercial, and residential sectors. Thus, industrialists rather than purchasing the energy storage systems opt for energy storage services for regular energy supply and to avoid blackouts.

Asia Pacific is expected to expand at the highest CAGR of 12.5% over the forecast period. This is due to the presence of various untapped markets, increasing industrialization, and rising energy consumption. The utilities and industries in countries such as India, South Korea, Japan, and China are expected to increase focus on this business model and increase utilization of these services in their system in the future.

The Middle East and Africa is expected to be the second-fastest-growing market over the forecast period. This is due to the presence of emerging markets and remote areas such as Africa where approximately 600 million people do not have reliable power. There is an opportunity for the market players to deploy resilient and distributed microgrids with renewables and energy storage.

Key Companies & Market Share Insights

Energy storage as a service is a business model which came to light in 2016. According to Synergy BV, the term energy storage as a service was trademarked by Constant Power in 2016. The market is in the initial phase of its growth. There is a significant opportunity for players in emerging and untapped markets. Few companies are operating in this market. The competition among players is based on numerous parameters including service offerings, corporate reputation, and price. Distribution network expansion, joint ventures, and mergers & acquisitions are some of the key strategies being adopted by the key players to strengthen their position in the market and gain a greater market share. For instance, Customized Energy Solutions acquired Powerit Solutions (Advanced Demand Management Company) in 2016. Through this acquisition, the company enhanced its demand response services for suppliers, industrialists, and more. Some prominent players in the global energy storage as a service market include:

-

Siemens Energy

-

Veolia

-

Honeywell International Inc.

-

NRStor Inc.

-

ENGIE Storage Services NA LLC

-

Customized Energy Solutions Ltd.

-

YSG Solar

-

Suntuity

-

Hydrostor Inc.

Energy Storage As A Service Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.3 billion

Revenue forecast in 2028

USD 2.7 billion

Growth Rate

CAGR of 10.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; China; Japan; India; Australia; Brazil; Saudi Arabia

Key companies profiled

Siemens Energy; Veolia; Honeywell International Inc.; NRStor Inc.; ENGIE Storage Services NA LLC; Customized Energy Solutions Ltd.; YSG Solar; Suntuity; Hydrostor Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global energy storage as a service market report based on service, end-user, and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2028)

-

Bulk Energy Services

-

Ancillary Services

-

Transmission Infrastructure Services

-

Distribution Infrastructure Services

-

Customer Energy Management Services

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2028)

-

Utility

-

Industrial, Residential & Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global energy storage as a service market size was estimated at USD 1.2 billion in 2020 and is expected to reach USD 1.3 billion in 2021.

b. The energy storage as a service market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.7% from 2021 to 2028 to reach USD 2.7 billion by 2028.

b. North America dominated the energy storage as a service market with a revenue share of 32.0% in 2020, on account of several factors including huge energy consumption due to the presence of various industries such as automotive, aerospace, chemical, healthcare, among others. The demand for services such as peak load, energy arbitrage, black start, and demand charge management is high among the industrial, commercial, as well as residential sectors.

b. Some of the key players operating in the energy storage as a service market include Siemens Energy, Veolia, Honeywell International Inc., NRStor Inc, ENGIE Storage Services NA LLC, Customized Energy Solutions Ltd., YSG Solar, Suntuity, and Hydrostor Inc.

b. The key factors that are driving the energy storage as a service market include increasing demand for power management services and cost-effective battery backup power in case of a power outage and rise in the consumption of energy in developing and undeveloped countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."