- Home

- »

- Next Generation Technologies

- »

-

Enterprise Networking Market Size And Share Report, 2030GVR Report cover

![Enterprise Networking Market Size, Share & Trends Report]()

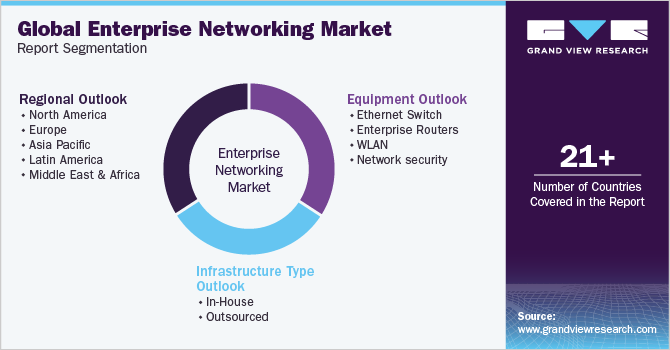

Enterprise Networking Market Size, Share & Trends Analysis Report By Equipment (Ethernet Switch, Enterprise Routers, WLAN, Network Security), By Infrastructure Type (In-house, Outsourced), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-828-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Enterprise Networking Market Size & Trends

The global enterprise networking market size was valued at USD 189.40 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The increasing demand for network systems to connect, supply, and retrieve information among various companies is fueling the growth of the enterprise networking market. The rising corporate need for comprehensive enterprise networking integration for mobile workforces, the Internet of Things (IoT), and cloud applications is projected to augment the growth in demand. As a result of the growing focus on greater bandwidth networks, network modernization of apps, and Wi-Fi expansion, many firms are also expected to accelerate advancements in their networking infrastructure.

Emerging technologies such as machine learning (ML) and artificial intelligence (AI), 5G, cloud computing, the Internet of Things (IoT), and edge computing are transforming the future of networking, with various effects on the industry and society as a whole. One of the acute effects of these technologies is the increased complexity and expense of operating IT networks. Organizations adopting new technologies and applications must invest in new infrastructure, tools, and skills to manage and secure their networks effectively. It can lead to higher operating costs and greater demands on IT resources. On the other hand, these technologies also enable new applications and services that can significantly impact society. For example, smart city transportation systems can use IoT sensors and AI algorithms to optimize traffic flow, reduce congestion, and enhance safety.

Furthermore, machine learning (ML) and artificial intelligence (AI) offer various possible real-time applications in fields including smart cities, transportation, security, and networking. The potential advantages and capacities of AI and ML are rising exponentially in line with the technological breakthroughs that are currently being observed. Also, this indicates a rise in security risks and potential malware assaults. Businesses strive hard to become intelligent, which helps quickly resolve various networking and business issues.

Equipment Insights

The ethernet switch segment led the market with the highest revenue share of over 37% in 2022 and is anticipated to hold the maximum share throughout the forecast period. Ethernet switches connect devices by relaying Ethernet frames between devices connected to the switches. Increasing demand for high-speed Ethernet switches is expected to open up new growth prospects for market participants in the coming years. Government attempts to speed up digital transformation have also increased demand for switches, routers, and wireless LAN networks, which is expected to propel market expansion in the future.

The WLAN segment is estimated to grow significantly over the forecast period. The increasing density effect in the enterprise area of the users and the equipment is magnified by the extended usage of the over-IP audio and video applications on mobile equipment. One for wireless localization - for the companies that allow access to resources and applications only if the user is present in a strict and limited perimeter of the collaborative work solutions with the large volume of file sharing, etc. The mentioned types of applications require more extensive bandwidths, resulting in the congestion of the WLAN networks, which decreases the level of performance. This standard also supports bandwidth-related telepresence applications such as web conferencing and video. Enterprises are ripe for the deployment of 802.11ac, which is expected to increase demand for the new WLAN equipment.

Infrastructure Type Insights

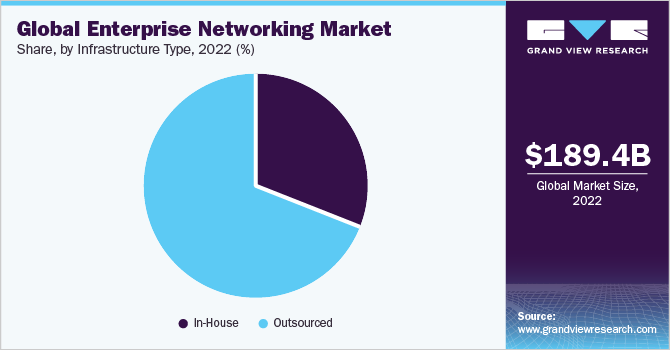

The outsourced segment alone held the largest revenue share of over 68% in 2022. The rising demand for corporate networking outsourcing is driven by enterprises' need to cut costs, improve performance, get access to knowledge, focus on core competencies, and maintain business continuity while taking advantage of the latest technology and industry trends. Furthermore, outsourcing can help organizations focus on their core competencies by allowing them to offload the management and maintenance of their networks to external providers. It frees internal resources to focus on strategic initiatives that drive business growth and innovation.

The in-house segment is predicted to foresee significant growth in the forecast years. In-house networking product production can save on management costs associated with outsourcing. There is complete control over the product output when in-house manufacturing is used. Moreover, production spikes can be planned with enough labor and equipment to meet demand. The quality of in-house networking products can be better controlled, and quality control is critical for businesses, which leads to the growing use of the in-house segment.

Regional Insights

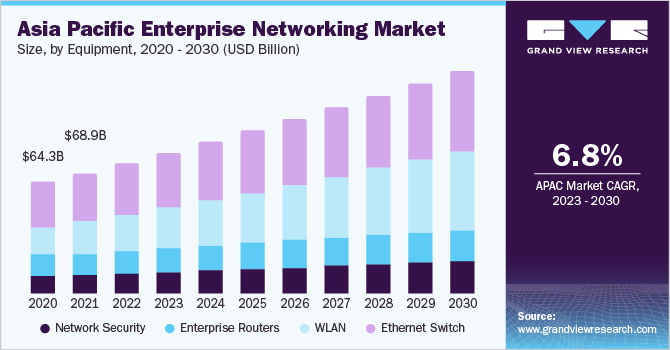

Asia Pacific dominated the market in 2022, accounting for over 38% of global revenue. The significant transition across many regional nations and their propensity to use cloud services is a factor in the region's growth. Additional evidence of a growing demand for top-notch precision equipment in this area comes from the continually expanding manufacturing activity. However, the Asia-Pacific market is also growing due to the region's strong IT sector and enormous demand for advanced technology, particularly in China and India.

MEA is anticipated to register a significant CAGR from 2023 to 2030. The growth is due to the telecom sector's development and industrial re-focusing to generate new economic development. Routers are expected to witness slow adoption owing to the capability of advanced ethernet switches to operate more routing protocols. It has enabled enterprises to consider switches over routers.

Key Companies & Market Share Insights

Notable players have embraced product developments and launches as their primary business strategy to grow their market share, followed by mergers, expansions, acquisitions, contracts, partnerships, agreements, collaborations, and inventions. Companies are collaborating with Enterprise Networking suppliers with more extensive product lines. For instance, in December 2022, ALE International collaborated with Auroz, the distributor that offers systems integrators and technology resellers solutions and services. Through this new agreement, Auroz will provide services to ALE's channel partners throughout Australia and the whole ALE portfolio of communication, networking, and cloud solutions. Furthermore, suppliers with different backgrounds are expanding their portfolios by launching new services and products. For instance, in March 2023, Wipro Limited, an Indian multinational corporation, announced the release of its 5G Def-i platform. The new platform combines applications, networks, and cloud services to enable enterprises to connect systems and assets quickly and seamlessly on 5G networks. Some of the prominent players in the enterprise networking market include:

-

A10 Networks Alation Inc.

-

ALE International

-

Broadcom Inc.

-

Cisco Systems, Inc.

-

Dell Inc.

-

Hewlett Packard Enterprise Development LP

-

Huawei Technologies Co., Ltd.

-

Juniper Networks

-

Riverbed Technology, Inc.

-

ZTE Corporation

Enterprise Networking Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 201.65 billion

Revenue forecast in 2030

USD 298.31 billion

Growth Rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, infrastructure type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; Japan; India; Brazil; Mexico.

Key companies profiled

A10 Networks Alation Inc.; ALE International; Broadcom Inc.; Cisco Systems, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; Juniper Networks; Riverbed Technology, Inc.; ZTE Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Networking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global enterprise networking market report based on equipment, infrastructure type, and region.

-

Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

Ethernet Switch

-

Enterprise Routers

-

WLAN

-

Network security

-

-

Infrastructure Type Outlook (Revenue, USD Million, 2017 - 2030)

-

In-House

-

Outsourced

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global enterprise networking market size was estimated at USD 189.40 billion in 2022 and is expected to reach USD 201.65 billion in 2023.

b. The global enterprise networking market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 298.31 billion by 2030.

b. Asia Pacific dominated the enterprise networking market with a share of 39.2% in 2022. This is attributable to the growing outsourcing of manufacturing activities to low-cost developing countries.

b. Some key players operating in the enterprise networking market include A10 Networks Alation Inc., ALE International, Broadcom Inc., Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Juniper Networks, Riverbed Technology, Inc., ZTE Corporation.

b. Key factors that are driving the enterprise networking market growth include the increasing need for enterprises to become digital and the growing upgradation of networks to increase wireless capacity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."