- Home

- »

- IT Services & Applications

- »

-

Enterprise Search Market Size, Share & Growth Report, 2030GVR Report cover

![Enterprise Search Market Size, Share & Trends Report]()

Enterprise Search Market Size, Share & Trends Analysis Report By Type (Local Search, Hosted Search), By End-use (Government & Commercial Offices, Banking & Financial), By Enterprise Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-303-4

- Number of Pages: 163

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global enterprise search market size was valued at USD 4.21 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. This growth can be attributed to the growing requirement to effectively manage and improve data accessibility across organizations. The businesses are showing greater interest in search solutions that can facilitate time-saving data search. Enterprise search solutions make the required data or information available to the businesses from a pool of databases, emails, intranet, data management systems, etc. These solutions not only increasing the business efficiency but also offer security by providing authorized access to the information.

The technological advancements such as artificial intelligence and machine learning capabilities for these solutions is expected to further transform the outlook of enterprise search market. For instance, in January 2023, Microsoft Azure expanded its service with integration of OpenAI, an advanced artificial intelligence model to the general customer base. The artificial intelligence integration enables efficient search and feature deployment for enterprises. These technologies can make more information accessible through machine vision, optical character recognition, scanning of documents, and analysis of various data types.

Moreover, the rising trend of hashing technology is expected to positively impact the market due to performance boost in search output. The technology further sorts data based on its hash values for easy search functions. For instance, in September 2022, Algolia, a proprietary search engine company, completed the acquisition of Search.io, a company with expertise in hashing technology. The acquisition enabled Algolia to offer faster and efficient search results to its clients.

Additionally, the growing trend of digitization in the industrial sector is significantly driving the market growth as employees use enterprise search solutions to search through terabytes of data instantaneously. Enterprise search solutions are crucial to companies since it reduces search times significantly that translates to an increased productivity. Moreover, enterprise search service providers offer a level of security to the data to prevent unauthorized access. As there are multiple levels of employees in an enterprise, a security layer assists in granting data access only to specific personnel.

Moreover, the trend of enterprise search is anticipated to be significant in large enterprises as they possess vast amount of data. As this data is hosted on premise and on cloud based platforms, the demand for search solutions is in demand as it helps to unify the data and offer instantaneously when required. For instance, the trend of enterprise search in banking & finance companies is high due to the substantial amount of sensitive client data they host that require secure and instant access for operational purposes. This, in turn, is expected to drive the application of enterprise search services and solutions in industries that regularly handle sensitive data.

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on driving the growth of the market. Following the outbreak, there has been a rise in digitization of data in enterprises that in turn has caused a rise in the demand for enterprise search solutions. In addition, industries doubled down on expanding data digitization on cloud premises for the future following the unforeseen shutdown due to the pandemic.

End-use Insights

Banking & financial segment is estimated to expand at a notable CAGR of over 9% from 2023 to 2030 owing to the interconnectivity and sharing of data in different outlets. Banks and financial institutions face challenges pertaining to data accessibility. As a result, they invest in enterprise search applications to leverage their vast database so their employees can retrieve the needed information quickly. The intelligent search solutions enable the financial institutions to transform their legacy databases into accessible resources.

Healthcare segment accounted for a revenue share of over 10% in 2022. The market share can be credited to increasing demand for enterprise search platforms in this sector to effectively leverage the large amounts of unstructured data. The enterprise search platforms enable faster drug discovery, analysis of clinical trial data, and the overall development process. The continuous rise in amount of information, requiring smart search tools will favor the segment growth in the coming years.

Type Insights

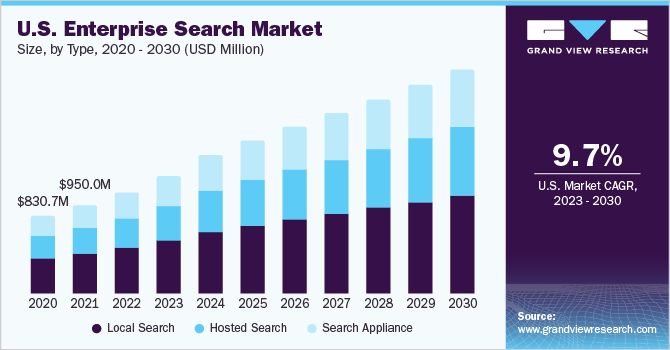

The hosted search segment is expected to attain the highest CAGR of around 10% during the forecast period from 2023 to 2030. This growth can be attributed to the increasing popularity of cloud based data hosting in enterprises due to its benefit of remote data access. For instance, in February 2022, Gartner, Inc. claimed that over fifty percent of enterprise information technology spending would move to cloud technology by 2025. Moreover, the trend of data digitization, accompanied by the pandemic, pushing industries to use cloud based data platforms is expected to drive the market growth.

The local search segment accounted for the largest market share of over 50% in 2022. The segment’s strong market presence can be attributed to the prominent data hosting on local enterprise sites. The concern for data security is anticipated to be resolved by storing data locally as no third party has access to any type of data. Furthermore, the trend of assorting data by type and form is expected to drive the local search segment in the enterprise search market.

Enterprise Size Insights

Small enterprises segment is estimated to record a CAGR of over 7% from 2023 to 2030 with increasing demand for enterprise search solutions across these enterprises. The growing number of small enterprises across the globe is favoring the market expansion. For instance, according to the US Small Business Administration, the number of small businesses in the U.S. reached 33.2 million in 2022. Moreover, the technological penetration is expected to drive the demand for enterprise search solutions among small enterprises for its affordability and process benefits.

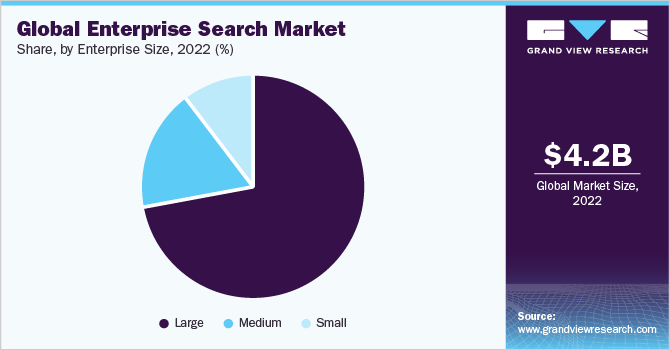

Large enterprises segment had captured the largest revenue share of over 70% in 2022. This can be credited to increasing demand for efficient tools for accurate data search in large enterprises as they have a vast database. Moreover, the large enterprises operate around the world that needs a database search solution to assist employees in collaboration projects with diverse teams at levels in different locations. Additionally, the enhanced security tools in such solutions for safeguarding data from breaches and unauthorized access is expected to drive the segment growth.

Regional Insights

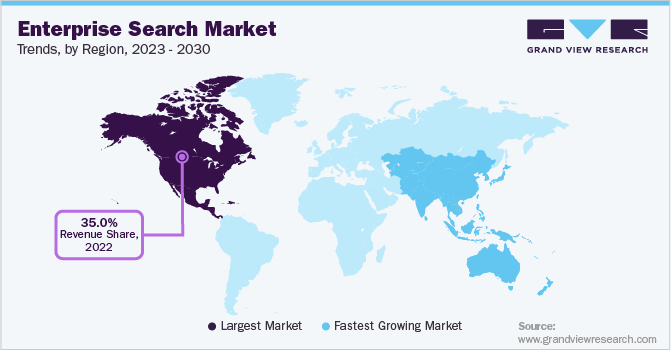

North America accounted for the largest market share of around 35% in 2022. This can be attributed to the strong presence of several major industry participants in the region and technological developments initiated by them. The growth of the regional market will be further driven by the convergence of enterprise security solutions and information systems. Additionally, rapid technological advancements and adoption in the region is expected to positively impact the North American enterprise search market during the forecast period.

Asia Pacific is expected to exhibit the fastest CAGR of over 10% during the forecast period, considering the expansion of information technology sector in countries such as China, India, South Korea, Japan, and the Philippines among others. The region is witnessing a considerable rise in the number of small and large-scale software companies, which will create lucrative opportunities for the market. For instance, in February 2022, The Nasscom Centre of Excellence for Internet of Things and Artificial Intelligence mentioned that the number of startups are steadily increasing in India, with around 10% new startups adding annually.

Key Companies & Market Share Insights

The key players use strategies, such as partnerships, acquisitions, ventures, innovations, R&D, and geographical expansions, to solidify their industry position. Key players focus on improving their product offerings to better suit the changing needs of users and stay competitive. For instance, in October 2022, adesso SE, an IT service provider, announced patnership with Sinequa, an enterprise search solution provider, to develop an enterprise search competence center. The partnership was undertaken to exchange respective expertise of the two companies. Some prominent players in the global enterprise search market include:

-

Attivio

-

Coveo Solutions Inc.

-

Dassault Systemes Inc.

-

Dieselpoint Inc.

-

EMC Corporation

-

Expert System Inc.

-

Alphabet Inc

-

HP Autonomy

-

IBM Corporation

-

Lucidworks Inc.

-

MarkLogic Corporation

-

Oracle

-

Perceptive Software Inc.

-

PolySpot

-

Recommind Inc.

-

SAP AG

-

Sinequa Inc.

-

Thunderstone Software

-

X1 Technologies

-

ZyLabs

Enterprise Search Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.86 billion

Revenue forecast in 2030

USD 8.85 billion

Growth rate

CAGR of 8.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, enterprise size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Italy; France; Russia; China; Japan; South Korea; India; Brazil; Argentina; Colombia; Saudi Arabia; UAE

Key companies profiled

Attivio; Coveo Solutions Inc.; Dassault Systemes Inc.; Dieselpoint Inc.; EMC Corporation; Expert System Inc.; Alphabet Inc.; HP Autonomy; IBM Corporation; Lucidworks Inc.; MarkLogic Corporation; Oracle Corporation; Perceptive Software Inc. PolySpot; Recommind Inc.; SAP AG; Sinequa Inc.; Thunderstone Software; X1 Technologies; ZyLabs

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Search Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise search market report based on type, end-use, enterprise size, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Local Search

-

Hosted Search

-

Search Appliance

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Commercial Offices

-

Banking & Financial

-

Healthcare

-

Retail

-

Media

-

Manufacturing

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

South America

-

Brazil

-

Argentina

-

Colombia

-

-

MEA

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global enterprise search market size was estimated at USD 4.21 billion in 2022 and is expected to reach USD 4.86 billion in 2023.

b. The global enterprise search market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 8.85 billion by 2030.

b. North America dominated the enterprise search market with a share of over 34% in 2022. This is attributable to the presence of the major industry participants and technological advancements.

b. Some key players operating in the enterprise search market include IBM Corp; Coveo Corp.; Polyspot & Sinequa Inc.; Expert System Inc.; HP Autonomy; Lucidworks; Esker Software Corp.; Dassault Systemes Inc.; Perceptive Software Inc.; and Marklogic Inc.

b. Key factors that are driving the market growth include increasing data volumes, enterprise search combined with big data, and rising technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."