- Home

- »

- Next Generation Technologies

- »

-

ERP Software Market Size, Share & Growth Report, 2030GVR Report cover

![Enterprise Resource Planning (ERP) Software Market Report]()

Enterprise Resource Planning (ERP) Software Market Analysis, By Functions (Finance, HR, Supply Chain, Others), By Deployments, By Enterprise size, By Verticals, By Regions, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-669-1

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

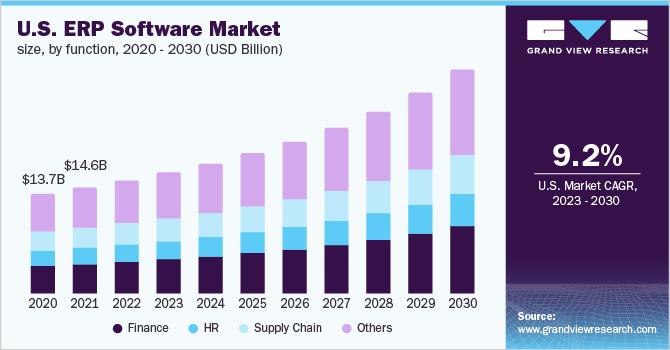

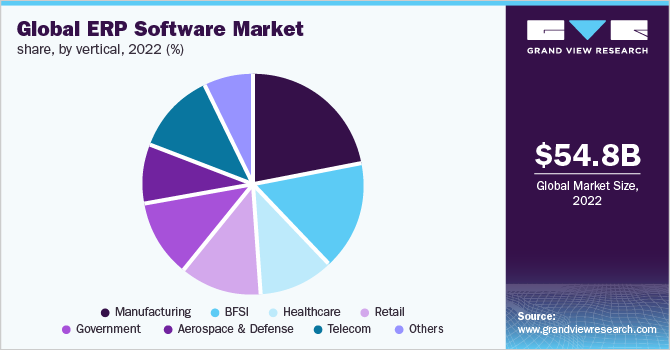

The global ERP software market size was valued at USD 54.76 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.0% from 2023 to 2030. The growing need for operational efficiency and transparency in business processes, the increase in demand for data-driven decisions, and the rise in mobile and cloud applications adoption are key factors propelling the ERP software market growth. However, the growing availability of open-source applications and higher initial investment and maintenance costs are poised to restrain the market growth. An increase in demand for cloud-based ERP solutions, especially from small and medium-sized businesses, is further anticipated to offer numerous opportunities for stakeholders in this market.

ERP implementation in an organization can reduce inventory costs by 25% to 30% and raw material costs by around 15%. Also, it leads to increased profitability for a firm, thus boosting demand. ERP facilitates integration of various organizational processes and the smooth flow of cross-functional information, thus allowing better productivity and decision-making. Moreover, a rising number of SMEs in developing economies, especially China, India, and Brazil, is expected to boost product demand. In addition, penetration of IT technologies in these regions is expected to change consumer behavior, leading to increased adoption of ERP software instead of manual operations.

Low infrastructure costs and the software's ability to integrate with mobile devices are projected to increase the market for cloud services. Mobile is an integral part of the working culture, and enterprises are ready to spend on cloud-connected mobile applications. It allows synchronization, update, and control of documents to individual users. A surge in the adoption of cloud and mobile applications is positively impacting the growth of the ERP market.

In addition, growing business applications and increasing data generation through different supply chains further enable companies to deploy a centralized platform that manages all the operations. Thus, the demand for ERP solutions increased due to rising automation and technological deployments in the supply chain management process, thereby contributing to market growth.

Market Dynamics

Demand for ERP software among businesses is rising as a fully integrated ERP system helps create timely, accurate, and relevant data and assists users in making better business decisions. Customer satisfaction and personalized services have little bearing on an organization's capacity to remain profitable unless its operational efficiency is extraordinary. Companies are considering ERP solutions to increase productivity, transparency, efficiency, and information integration.

Since effective patient record administration is the top priority for hospitals and healthcare organizations, there is a strong demand in the healthcare sector. As ERP has a robust database that can hold extensive, quantitative data, doctors and medical workers may easily access patient records due to an integrated database. These solutions' use in the healthcare sector offers significant advantages such as improved patient care, decreased operating costs, streamlined medical procedures, the introduction of better healthcare practices, and higher patient safety. Additionally, ERPs are designed for manufacturing businesses to maximize every stage of the manufacturing process, from sourcing and procurement to development, quality assurance, storage, and distribution. ERP for production can consequently boost productivity, cut expenses, and increase revenue.

Function Insights

Finance segment held the largest share of over 25.0% of the market share in 2022. ERP provides ease in managing various financial activities, including accounting, investments, assets, and cash flow management. The increasing adoption of ERP in financial functions is expected to augment demand in the forecast period. Human resource segment accounted for a significant market share due to the rapid expansion of organizations, making it difficult to organize processes in a company. Also, increased automation demand for HR processes is expected to propel ERP software market growth.

Supply chain ERP module allows enhanced visibility of various supply chain operations and increases efficiency, speed, and customer satisfaction. Increasing adoption of ERP software in sales and distribution automation is anticipated to enhance market growth. Furthermore, growth in e-commerce enables enterprises to opt for advanced solutions for managing supply chain operations effectively, thereby contributing to segment growth.

Deployment Insights

On-premise segment held the largest share of over 70% of the market share in 2022 owing to benefits such as continuous control and high data security in an organization. Moreover, a need for more awareness regarding the benefits of cloud-based solutions in business facilitates adopting on-premise solutions in several emerging countries. Additionally, extensive use of traditional approaches to managing the supply chain and other business operations with minimal automation and technological use in some emerging countries is also anticipated to drive segment growth.

Cloud deployment segment is estimated to dominate the market by 2030 with a significant growth rate due to its growing adoption. Cloud ERP software enables a company to immediacy, efficiency, optimization of resource planning activities, scalability, and accessibility. Cloud systems benefit the organization by providing features such as faster implementation and lower initial investments to deploy cloud ERP solutions. Moreover, increasing adoption of connected devices that effectively manage business operations and provide real-time insights allows business owners to opt for cloud-based ERP solutions to process excessive data efficiently is anticipated to drive segment growth.

Enterprise Size Insights

Large enterprise segment held the largest share of over 39% of the market share in 2022 owing to factors including a rising need of large enterprises to maintain and align complex processes such as production planning, inventory management, procurement, order fulfillment, and shipping, among others. Additionally, high spending capacity of large-sized enterprises on implementing modern technology and software solutions also facilitates the adoption of cloud-based ERP software.

Medium enterprise segment will witness significant growth and dominate the market by 2030. Factors including cloud-based ERP, increased operational efficiency, reduced production cost, and on-time product delivery are expected to augment demand over the forecast period. Additionally, compliance with stringent government regulations in various industries has facilitated increased productivity and reduced operational complexity in numerous sectors.

Vertical Insights

Manufacturing & services segment held the largest share of over 20.0% of the market share in 2022. ERP software manages operations, including monitoring daily operations, tracking day-to-day performances, and customer services. In addition, ease of inventory management, production scheduling, and real-time data tracking are expected to propel growth. Moreover, tracking vendor performance and enhancing visibility throughout the supply chain enables manufacturers to opt for ERP solutions that assist them with more efficient operations planning and management.

Also, mainstream manufacturing companies and ERP software vendors in North American and European markets engage in numerous partnerships, contributing to segment growth. Furthermore, rising automation and digital transformation processes across the manufacturing industries in emerging Asian countries are anticipated to offer numerous opportunities. Additionally, a growing need for businesses to make quick strategic decisions to enhance the productivity and profitability of the industry allows companies to deploy ERP solutions that generate reports based on real-time insights into market conditions, thereby contributing to market growth.

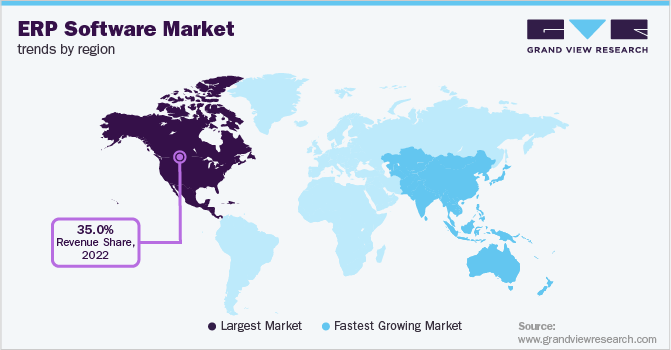

Regional Insights

North America dominated the ERP software market with a share of over 35.0% in 2022. The large share of this region is primarily attributed to the rising adoption of ERP software by small & medium-sized companies, increasing investments by ERP vendors in software development with the latest technologies, and the presence of numerous market players. In addition, the application of ERP software with mobile devices is expected to propel demand in the forecast period.

Asia-pacific market is expected to grow due to the booming manufacturing sector and growing small and medium enterprises. Many enterprises in the region have already implemented on-premise ERP solutions to improve the productivity and performance of their business. Moreover, the increasing number of start-ups and their rising demand for cloud-based solutions is further anticipated to boost the market growth. In addition, government support for implementing IT infrastructure is expected to augment demand over the forecast period.

Key Companies & Market Share Insights

The market is fragmented with numerous companies operating worldwide. To stay competitive in the market, market players are pursuing a variety of growth strategies, including partnerships, strategic agreements and collaborations, mergers and acquisitions, and new product development. For instance, in May 2022, the international business machines corporation extended its partnership with SAP SE. In this expanded partnership, IBM plans to migrate to SAP S/4HANA, an ERP software that supports software, hardware, consulting, and finance across more than 120 countries, 1000 legal entities, and numerous IBM business units. A new partnership will also support AI-driven decision-making and automate workflows. Some of the most prominent players operating in the global ERP software market are:

-

Epicor Software Corporation

-

Hewlett-Packard Development Company, L.P.

-

Infor Inc.

-

International Business Machines Corporation

-

Microsoft Corporation

-

NetSuite Inc.

-

Oracle Corporation

-

Sage Group, plc

-

SAP SE

-

Unit4

ERP Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 59.48 billion

Revenue forecast in 2030

USD 123.41 billion

Growth rate

CAGR of 11.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, function, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India, Japan, and Brazil

Key companies profiled

Hewlett-Packard Development Company, L.P.; Epicor Software Corporation; International Business Machines Corporation; Infor Inc.; NetSuite Inc.; Microsoft Corporation; SAP SE; Oracle Corporation; and Unit4

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ERP Software Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ERP software market report based on deployment, functions, enterprise size, verticals, and regions:

-

Function Outlook (Revenue, USD Million; 2018 - 2030)

-

Finance

-

HR

-

Supply Chain

-

Others

-

-

Deployment Outlook (Revenue, USD Million; 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise size Outlook (Revenue, USD Million; 2018 - 2030)

-

Large Enterprises

-

Medium Enterprises

-

Small Enterprises

-

-

Vertical Outlook (Revenue, USD Million; 2018 - 2030)

-

Manufacturing

-

BFSI

-

Healthcare

-

Retail

-

Government

-

Aerospace & Defense

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global ERP software market size was estimated at USD 54.76 billion in 2022 and is expected to reach USD 59.48 billion in 2023.

b. The global ERP software market is expected to grow at a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 123.41 billion by 2030.

b. North America dominated the ERP software market with a share of over 35% in 2022. This is attributable to rapid technological advancement in ERP software coupled with the presence of numerous market players.

b. Some key players operating in the ERP software market include Oracle Corporation; IBM Corporation; Microsoft Corporation; SAP SE; Infor; NetSuite Inc.; Totvs S.A.; Unit4; and Syspro.

b. Key factors that are driving the ERP software market growth include rising demand from small & medium enterprises and the development of cloud and mobile applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."