- Home

- »

- Plastics, Polymers & Resins

- »

-

Ethylene Vinyl Acetate Copolymer Market Report, 2020-2027GVR Report cover

![Ethylene Vinyl Acetate Copolymer Market Size, Share & Trends Report]()

Ethylene Vinyl Acetate Copolymer Market Size, Share & Trends Analysis Report By Type, By Application (PV Cells, Film), By End-use Industry (Consumer Goods, Medical & Healthcare, Automotive), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-988-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Bulk Chemicals

Report Overview

The global ethylene vinyl acetate copolymer market size was valued at USD 7.9 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2020 to 2027. Increasing demand for multipurpose solution for adhesives, sealants, and coatings in a wide range of applications, such as flexible hose, footwear components, automobile bumpers, molded automotive parts, toys & athletic goods, flexible packaging, and various others are projected to support market growth over the forecast period. Amid the global COVID-19 pandemic situation, the demand for various medical & healthcare products, such as temperature guns, pharmaceutical packaging, and others has increased. This, in turn, is driving the demand for ethylene vinyl acetate copolymer (EVA) copolymer in medical & healthcare and packaging end-use industry segment.

However, the consumer goods end-use segment is expected to register the fastest CAGR from 2020 to 2027. The growth of the solar industry in North America and Asia Pacific regional markets is expected to drive the demand for EVA copolymer over the forecast period for the manufacturing of photovoltaic cells. The market growth can also be attributed to increased foreign investment in countries, such as India, China, the U.S., and Brazil, in the renewable energy sector along with the government policies, such as Solar Investment Tax Credit (ITC) and plug and play model of solar capacity installed. The growing demand for pharmaceuticals and pharmaceutical packaging products to tackle the COVID-19 pandemic situation is also driving the demand for durable products, which will propel the market growth over the forecast period.

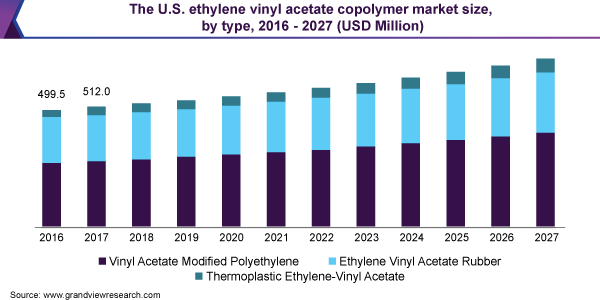

Type Insights

Vinyl acetate modified polyethylene type segment led the market and accounted for more than 55% share of the global revenue in 2019. This significant share is attributable to the product properties, such as low molecular weight, which is useful for packaging material in consumer goods, food & beverage, and industrial packaging applications. EVA copolymer, which comprises low proportion of vinyl acetate, up to 4 %, is referred to as vinyl acetate modified polyethylene. It is primarily used to produce foam blister packs, insulation foams, football shoe soles, pipes, tapes, and others. The ability of the material to provide gas and moisture barrier drives its demand in various applications.

The ethylene-vinyl acetate rubber-type segment is widely used in the production of tough and durable vulcanized rubber, which is used in tires and shoe soles depending upon the hardness. Amid the global COVID-19 pandemic, the demand for healthcare products, such as yoga mats, home gym equipment, specialized shoes, and others, has increased. This will drive the demand for ethylene-vinyl acetate rubber over the forecast period.

Thermoplastic ethylene-vinyl acetate is projected to be the fastest-growing segment over the forecast period. EVA copolymer, which comprises a low proportion of vinyl acetate in the range of 4 to 30% is referred to as thermoplastic ethylene-vinyl acetate. It is primarily used in the production of hot melt adhesives, which are used in packaging, woodwork, labeling, and others.

Application Insights

The photovoltaic cell application segment led the market and accounted for more than 34% share of the global revenue in 2019. This significant share is attributable to the rising demand for clean energy in both public and private infrastructures. The energy generation from photovoltaic cells is expected to increase by 50% from 2019 to 2024. These factors are expected to drive the product demand in photovoltaic cell applications over the forecast period.

Ethylene-vinyl acetate copolymer films have excellent properties, such as heat resistance, humidity resistance, cold resistance, tensile strength, and offer excellent bonding strength. EVA films are used in the manufacturing of bags, bottle sleeving, liners, labels, adhesive tape backing, blood bags, and intravenous bags. Additionally, EVA films are also used in the manufacturing of photovoltaic cells for encapsulation of solar cells.

EVA foam offers properties, such as flexibility and resilience, quickly recovers from compressions, and absorbs colors, which make it suitable for various end-use industries, such as automotive, medical & healthcare, building, packaging, marine, electronics, sports equipment padding, footwear, and various others. In addition, EVA foam is used in cold-flow enhancer for diesel fuel, high-efficiency particulate air filter, and nicotine transdermal patches. The growing application of foams is expected to drive the market over the forecast period.

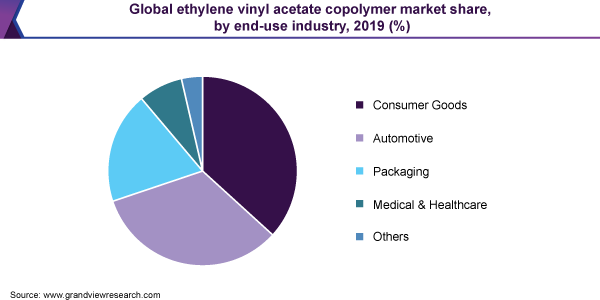

End-use Industry Insights

Consumer goods end-use industry segment led the EVA copolymer market and accounted for more than a 35% share of the global revenue in 2019. This high share is attributable to high disposable income and consumer spending on day-to-day household goods. Manufacturers in the industry are constantly upgrading their product portfolio to accommodate functional, attractive, and simple items for consumers as a step toward convenient living. Personal hygiene products, such as toothbrushes and combs, along with housewares, cosmetic goods, and convenience goods are the major sectors, which drive the demand for EVA copolymer.

Increasing incorporation of EVA copolymer in automotive components as metal replacement parts and a simultaneous rise in the production of electric passenger cars and heavy-duty vehicles, particularly in Asia and Central & South America, is expected to propel the growth of the automotive & transportation application segment over the forecast period. Moreover, standardization of emission norms and vehicular weight regulations are likely to aid the segment growth in the future

The product is also being used for manufacturing medical devices and pharmaceuticals as they offer better optical clarity and biocompatibility. EVA copolymer is used in the manufacturing of drug delivery systems and low temperature (-150 to -196°C) storage solutions in medical research & development activities. Asia Pacific will witness immense growth owing to the rising medical & healthcare expenditure in the countries, such as China, India, and Japan. In addition, the presence of various medical & healthcare equipment and pharmaceutical manufacturers, which are involved in research & development activities will propel industry growth over the forecast period.

Regional Insights

Asia Pacific dominated the market and accounted for over 44% share of the global revenue in 2019. Asia Pacific medical & healthcare industry is expected to grow on account of rising COVID-19 positive cases, which is expected to drive the demand of medical equipment, specialized medical-grade containers, and various other products.

Additionally, the packaging end-use industry is expected to witness considerable growth owing to increasing demand for consumer goods and delicate & smart electronics products, such as shoes, laptops, mobile phones & accessories, etc. This is expected to drive the demand for EVA copolymer over the forecast period.

Europe ranks second, in terms of revenue. The EVA copolymer market is driven by the growth of the major end-use industries, such as packaging, consumer goods, medical & healthcare, and automotive, on account of combined economic effects due to the pandemic. Rising demand for consumer goods, such as home security systems, burgers, laptops, and others along with the growth of the medical & healthcare industry in Italy, Germany, the U.K., and France, is anticipated to augment the market growth in the near future.

The market in the Middle East & Africa is expected to witness slow growth as the cross-border trade among the economies has been affected due to the COVID-19 pandemic. The market is primarily driven by the rising demand for the photovoltaic cell as the region has the highest per-year average solar irradiance of 1753 kilowatt-hour per meter square.

Key Companies & Market Share Insights

Companies in the market compete on the basis of product quality offered and technology used for the production of EVA copolymer. Major players focus on seeking opportunities to vertically integrate across the value chain, expanding their manufacturing facilities, infrastructural development, and R&D investments to gain a higher market share. These initiatives help them cater to the increasing global demand, enhance their sales & operations planning, develop innovative products & technologies, bring down the production costs, and expand the customer base. The global market is found to be significantly fragmented in nature owing to the presence of a large number of manufacturers across the globe. Some of the prominent players in the ethylene vinyl acetate copolymer market include:

-

Exxon Mobil Corp.

-

Dow Inc.

-

LyondellBasell Industries Holdings B.V.

-

Eastman Chemical Company

-

Arkema

-

Celanese Corp.

-

Total

-

LG Chem

-

Braskem

-

Dairen Chemical Corp.

-

Lotte Chemical Corp.

Ethylene Vinyl Acetate Copolymer Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.2 billion

Revenue forecast in 2027

USD 10.7 billion

Growth rate

CAGR of 3.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Southeast Asia; Central & South America; Middle East & Africa

Country Scope

The U.S.; Canada; Mexico; Germany; The U.K.; France; Italy; China; India; Japan; South Korea; Malaysia; Indonesia; Thailand; Brazil; Saudi Arabia

Key companies profiled

Exxon Mobil Corp.; Dow Inc.; LyondellBasell Industries Holdings B.V.; Eastman Chemical Company; Arkema; Celanese Corp.; Total, LG Chem.; Braskem; Dairen Chemical Corp.; Lotte Chemical Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global ethylene vinyl acetate copolymer market report on the basis of type, application, end-use industry, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Vinyl Acetate Modified Polyethylene

-

Thermoplastic Ethylene-Vinyl Acetate

-

Ethylene Vinyl Acetate Rubber

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Film

-

Foam

-

Hot Melt Adhesives

-

Photovoltaic Cells

-

Others

-

-

End-use Industry Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Automotive

-

Packaging

-

Medical & healthcare

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global ethylene vinyl acetate copolymer market size was estimated at USD 7.9 billion in 2019 and is expected to reach USD 8.2 billion in 2020.

b. The global ethylene vinyl acetate copolymer market is expected to grow at a compound annual growth rate of 3.8% from 2020 to 2027 to reach USD 10.7 billion by 2027.

b. Asia Pacific dominated the ethylene vinyl acetate copolymer market with a share of 44.5% in 2019. This is attributable to the rising demand for sustainable packing and components used in various end-use industries to reduce the carbon footprint.

b. Some of the key players operating in the ethylene vinyl acetate copolymer market include Exxon Mobil Corp., Dow Inc, LyondellBasell Industries Holdings B.V., Eastman Chemical Company, Arkema S.A., Celanese Corporation, LG Chem, LOTTE Chemical CORPORATION, Braskem, DCC, ADTEK Consolidated Sdn Bhd, Hanwha Solutions/Chemical Corporation, and Total.

b. Key factors driving the ethylene vinyl acetate copolymer market growth include laws & regulations enforced by governments, increasing awareness regarding sustainable plastic waste management, and reduction in environmental impact from plastic production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."