- Home

- »

- Automotive & Transportation

- »

-

Europe 40-foot Platform Wagons Market Size Report, 2030GVR Report cover

![Europe 40-foot Platform Wagons Market Size, Share & Trends Report]()

Europe 40-foot Platform Wagons Market Size, Share & Trends Analysis Report By Country (Germany, Hungary, Italy, France, Poland, Slovakia, Slovenia, Rest of Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-615-9

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Market Size & Trends

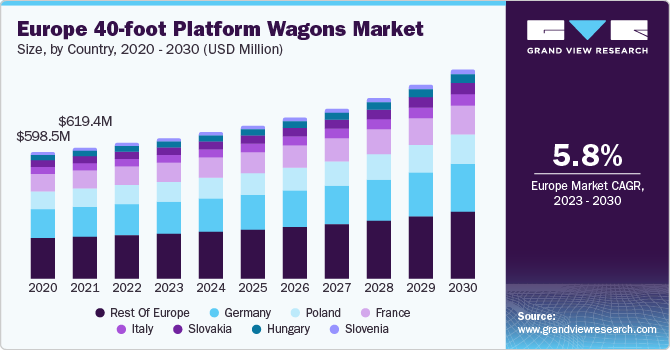

The Europe 40-foot platform wagons market size was valued at USD 642.0 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The outbreak of the COVID-19 pandemic negatively impacted several industries across Europe. Moreover, the subsequent restrictions and resultant supply chain disruptions had a deeper impact on the production of freight wagons. As such, government schemes aimed at mitigating the impact of the pandemic on various sections of the economy, including rail freight transport, are expected to drive the market's growth over the forecast period.

Freight transportation holds a higher weightage in the overall economy of the EU and contributes significantly to the competitiveness of various industries and services. The growing demand for mobility in Europe has created a need for a well-integrated and efficient railway system capable of addressing all the logistical, technical, and environmental constraints and ensuring the sustainable growth of the enlarged European Union. In December 2020, the European Rail Research Advisory Council (ERRAC) proposed to double the rail passenger capacity and triple the rail freight capacity in the region. In the wake of this target, the InteGRail project envisages enhancing railway performance, leveraging better cooperation and information exchange between different subsystems, and encouraging global system-level optimization.

The growing demand for enhanced engine performance and fuel efficiency drives the market's growth. Fuel efficiency is emerging as a major concern for both transportation service providers and end-users amid the rising fuel prices, which show no signs of abating. As a result, locomotive manufacturers are under severe pressure to manufacture engines that can meet the changing requirements and simultaneously enhance performance and deliver fuel efficiency. At this juncture, turbocharged locomotives are considered one of the latest innovations in the industry. They offer advantages such as increased air intake in the combustion chamber, enhanced engine performance, and reuse of exhaust air. Turbochargers typically work at their best at high engine speeds. Besides, they do not require any power source to operate.

The electrification of main lines is gaining traction in European nations such as the U.K. and Germany, where intensive electrification programs are being pursued to improve line capacity and offer better services to rail operators while mitigating the environmental impact. At the same time, several research projects to investigate the potential use of dual-mode or hybrid propulsion systems for low-density lines are being undertaken to reduce the scope of diesel engines.

The building overcapacity in the rolling stock industry is emerging as one of the major market restraints. The rapid increase in production capacity but moderate growth of the rolling stock market resulted in manufacturing overcapacity. The plummeting demand has taken a severe toll on the profitability of the market players, thereby prompting companies such as BEACON RAIL, LOTOS Kolej Sp. z o.o., and DB Cargo to offer low-cost rail vehicles to strengthen their position in the Europe 40-foot platform wagons Industry. Companies are adopting various strategic initiatives, such as pursuing mergers and acquisitions and winning new contracts, to compete with their peers in the market. In March 2019, logistics freight operator, PKP CARGO, signed an agreement worth USD 95.1 million with Tatravagónka, a freight railway wagon manufacturer, to procure 936 flat cars. The agreement envisaged Tatravagónka delivering 400 cars in 2020, 298 cars in 2021, and 188 flat cars at the end of 2022. The first 50 Tatravagónka freight cars were delivered at the end of 2019.

Europe has witnessed rapid expansion in industrial activities in recent years. Manufacturing units and incumbents of various industries demand efficient and reliable transportation networks to effectively transport raw materials and finished goods. Rail transportation has emerged as a cost-effective and reliable mode of freight transportation compared to road transportation. Over 1.31 trillion tonne-kilometers of cargo were transported on railways in Europe in 2019. The use of rail freight wagons in the mining and metal industry is widespread in Europe. Hence, any potential growth in the mining and metal industry is expected to drive the volume of minerals and metals transported on freight wagons, thereby driving the demand for rail freight wagons in the region.

Country Insights

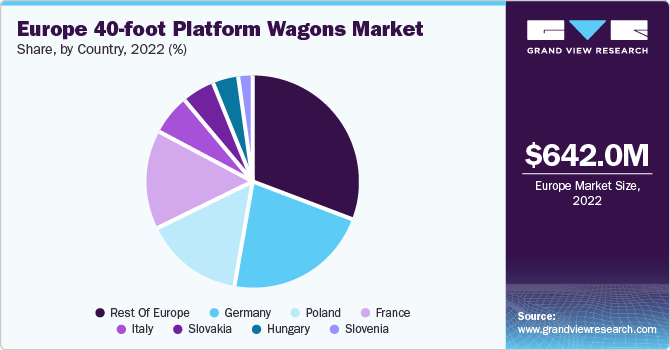

By country, the regional market is segmented into Germany, Hungary, Italy, France, Poland, Slovakia, Slovenia, and the rest of Europe. The rest of Europe accounted for the largest revenue share of 31.0% in 2022. The Rest of Europe comprises Spain, Netherlands, UK, and Denmark.The rise of e-commerce and online retailing has significantly impacted the demand for efficient logistics solutions. With the increasing number of online orders and the need for timely delivery, businesses rely on 40-foot platform wagons to transport goods from distribution centers to various locations across Spain. This surge in e-commerce activities has created a favorable environment for expanding the platform wagon market. Furthermore, the UK market for 40-foot platform wagons is witnessing growth driven by the demand for efficient transportation solutions for heavy and oversized cargo, the expansion of infrastructure projects, the focus on sustainability, and the increasing international trade.

The Germany market is estimated to witness the fastest CAGR of 6.4% over the forecast period. The rolling stock industry has continued to expand in Germany, with numerous new rolling stock manufacturers in recent years. Market players are engaged in the development of freight technologies and the adoption of energy-efficient transportation solutions. Furthermore, the proliferation of the e-commerce industry has resulted in a shift in the shippers’ demand to support omnichannel approaches. The industry primarily focuses on agility and speed in a multifaceted supply chain network with reduced consolidations and delivery optimization time. It, in turn, has led rail freight operators to redesign their supply chain networks to accommodate customer demands, thus driving the demand for platform wagons.

In Hungary, rapid investments in modernizing and repairing wagons and the growth of intermodal services are likely to accelerate the demand for rail freight wagons. The Hungarian government is increasingly supporting the capacity expansion of rail freights, the development of bridges in Budapest to expand rail connectivity and future investment plans such as the Budapest-Belgrade railway line. Such initiatives are expected to propel the demand for freight wagons in the country. For instance, in 2020, the Hungarian government adopted the National Energy and Climate Strategy to focus on a carbon-neutral economy. The strategy focuses on investments in developing rail freight wagons, enabling intermodal transportation options supported by the Budapest Suburban Railway Strategy (2021).

Key Companies & Market Share Insights

The key players are involved in new product developments, agreements, product launches, mergers and acquisitions, and expansion strategies to improve their market penetration. For instance, in May 2020, PKP CARGO bagged a loan agreement approval of USD 70.7 million from the European Investment Bank for modernizing its rolling stock modernization project. The loan allowed the company to finance and refinance its development plan with an available investment of USD 235.9 million.

Key Europe 40-foot Platform Wagons Companies:

- S.C. Astra Rail Industries S.A

- ALTAIVAGON JOINT-STOCK COMPANY

- ELH Waggonbau Niesky GmbH

- NYMWAG CS a.s.

- RM RAIL

- Tatravagónka a.s.

- UWC RPC PJSC

- VTG GmbH

- Rostec

Recent Developments

-

In June 2023, Ermewa partnered with LTG Cargo Polska Sp. z o. o. to rent 40-foot container wagons. LTG Cargo intends to utilize these wagons mostly in Northern Europe for the trip from Lithuania to Duisburg in West Germany via Gdansk. The partnership is a significant addition to LTG Cargo's current fleet.

-

In May 2023, Wascosa and BOXmover GmbH collaborated to launch Flex Freight System 2.0 rail platform. The Flex Freight System 2.0 is a 40-foot platform wagon that can fit different container types, such as a 20-foot tank container, a 40-foot open-top container, and a 20-foot steel coil container. This innovative method uses automated production techniques to drastically cut the welding time needed for platform production from 300 to 65-100 hours.

-

In April 2021, VTG Rail UK, a subsidiary of VTG GmbH, partnered with GB Railfreight Limited. GB Railfreight Limited has provided VTG GmbH with the first operational sets of Ecofret2 triple-container flat wagons as part of this collaboration. The Ecofret2 is an innovative advancement in maritime container transportation and an innovative addition to VTG Rail's fleet. These wagons offer several significant advantages, such as eliminating the need for empty spaces. Additionally, they feature extra container mounting points on the outer platforms, allowing for the carriage of either two 20ft containers or one 40ft container on all platforms.

Europe 40-foot Platform Wagons Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 666.6 million

Revenue forecast in 2030

USD 990.8 million

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Country

Regional scope

Europe

Country scope

Germany; Hungary; Italy; France; Poland; Slovakia; Slovenia; Rest of Europe

Key companies profiled

S.C. Astra Rail Industries S.A; “ALTAIVAGON» JOINT-STOCK COMPANY; ELH Waggonbau Niesky GmbH; NYMWAG CS a.s.; RM RAIL; Tatravagónka a.s.; UWC RPC PJSC; VTG GmbH; Rostec

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe 40-foot Platform Wagons Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe 40-foot platform wagons market report based on country:

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

Europe

-

Germany

-

Hungary

-

Italy

-

France

-

Poland

-

Slovakia

-

Slovenia

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe 40-foot platform wagons market is expected to witness a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 990.8 million by 2030.

b. The Europe 40-foot platform wagons market size was estimated at USD 642.0 million in 2022 and is expected to reach USD 666.6 million in 2022.

b. Germany held the largest share of over 22% in 2022 and is expected to dominate the Europe 40-foot platform wagons market. The rolling stock industry has continued to expand in Germany with the presence of numerous new rolling stock manufacturers in recent years. Market players are engaged in the development of freight technologies and the adoption of energy-efficient transportation solutions.

b. AstraRail Industries S.A.; Altaivagon Joint-Stock Company; ELH Waggonbau Niesky GmbH; NYMWAG CS; RM RAIL; Tatravagónka a.s.; TMH International; United Wagon Company; UralVagonZavod; VTG AKTIENGESELLSCHAFT are some of the other players driving the Europe 40-foot platform wagons market growth.

b. Key factors that are driving the Europe 40-foot platform wagons market growth include growing demand for mobility in Europe has created a need for a well-integrated and efficient railway system capable of addressing all the logistical, technical, and environmental constraints and ensuring sustainable growth of the enlarged European Union. The growing demand for mobility in Europe has created a need for a well-integrated and efficient railway system capable of addressing all the logistical, technical, and environmental constraints and ensuring sustainable growth of the enlarged European Union.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."