- Home

- »

- Food Additives & Nutricosmetics

- »

-

Europe Amaranth Market Size, Industry Report, 2021-2028GVR Report cover

![Europe Amaranth Market Size, Share & Trends Report]()

Europe Amaranth Market Size, Share & Trends Analysis Report By Category (Organic, Conventional), By Product (Seed, Oil, Leaf, Flour), By Application (Food & Beverages, Personal Care), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-452-8

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Specialty & Chemicals

Report Overview

The Europe amaranth market size was valued at USD 2,197.4 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 10.8% from 2021 to 2028. Rising awareness about the high nutritional value of the product and medical benefits associated with its consumption is the key factor driving the market growth. The growing working population over the past few years has led to an increased dependency on a quality diet that covers the requirement of daily nutrition. Furthermore, a high consumer preference for a vegan diet is expected to have a positive impact on the demand for superfoods, such as amaranth, over the forecast period. There is a huge demand for processed food and dietary supplements in Europe due to the presence of the target population with high-income levels.

According to a study conducted in 2020 by a vegan supermarket named Veganz, based in Germany, around 3.2% of the total population was vegan, which rose significantly from 1.6% in 2016. With more people opting for vegan diets, the product demand is expected to grow over the forecast period. Amaranth products include oil, flour, leaf, and seeds. Key players in the market distribute their products through local distributors and online stores.

The manufacturers ensure the highest quality of products with temperature- and pest-controlled warehousing facilities for the storage of raw materials to ensure uninterrupted supply. For instance, FLAVEX Naturextrakte GmbH has a storage capacity of 700 tons of raw material with a climate control facility that allows the company to have an uninterrupted supply of raw materials without compromising the quality during their storage.

Increasing consumer interest in products promoting a healthy lifestyle and rising demand for essential oils in the cosmetics industry is likely to boost the market growth over the forecast years. The growing use of essential oils in the food & beverages industry owing to higher demand from consumers for clean label products with natural ingredients is also expected to drive the market.

Category Insights

The conventional category segment dominated the market in 2020 with a revenue share of 88.2%. Amaranth products from conventional crops have comparatively lower prices than organic products. Conventional products have a higher yield and lower production cost owing to the use of chemical fertilizers and hybrid breeds. The cultivators use herbicides and pesticides to protect the plants from pests and diseases.

Amaranth can adapt to pesticides and herbicides, which can make it difficult to control the growth of amaranth, which requires innovative products for the same. Increasing consumer awareness regarding the harmful effects of chemical residues that may accumulate in humans if the products are consumed for a prolonged time is expected to hinder the demand for conventional amaranth products over the forecast period.

The organic segment is expected to witness the fastest CAGR of over 11% over the forecast period. Increasing awareness among consumers regarding the harmful effects of the chemicals used while processing and cultivation of amaranth are expected to have a positive impact on the organic products demand over the forecast period.

Europe is a developed region and has above-average per capita income levels. Higher disposable income enables the consumers to spend more on organic products, which are typically more expensive than conventional ones leading to higher growth rates. Thus, most regional manufacturers offer organic products like flour, seed, and oil.

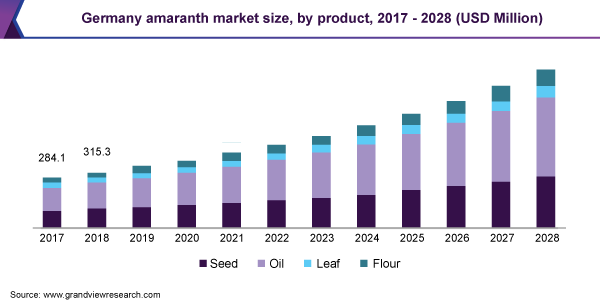

Product Insights

The oil product segment led the market accounting for a revenue share of more than 49% in 2020. Amaranth oil consists of squalene, which has application in pharmaceutical products owing to its anti-oxidation, cell-rejuvenating, and immune system strengthening attributes. The oil is used in cancer therapy to treat the side effects of cancer drugs. In addition, it helps reduce cholesterol levels in the blood, thereby, reducing the risk of Cardiovascular Diseases (CVDs).

The seeds product segment held the second-largest revenue share in 2020. Amaranth seeds are dicotyledonous pseudo-cereal and are gaining popularity among European consumers owing to their nutritional benefits. Amaranth is considered a superfood as it has a high concentration of nutraceuticals including protein, squalene, dietary fiber, vitamins, minerals, and flavonoids.

Amaranth leaves are rich in minerals, vitamins, proteins, and carbohydrates and therefore, help in protection against hair loss as well as premature greying. They work as a natural astringent, thus, curing several skin problems, such as acne and eczema. In addition, the leaves are used in mouthwash products to treat mouth and gum-related conditions, which is likely to augment the growth of the leaves product segment over the forecast period.

The flour product segment is also likely to exhibit significant growth owing to the high demand for amaranth flour due to its fiber, phosphorous, vitamin C & A, potassium, and calcium content. It is used as a thickening agent in sauces, soups, and stews as it absorbs a lot of liquid. Amaranthus cruentus and Amaranthus caudate are the most widely used species for making flour, which is widely cultivated in the U.S., Mexico, India, and Central America.

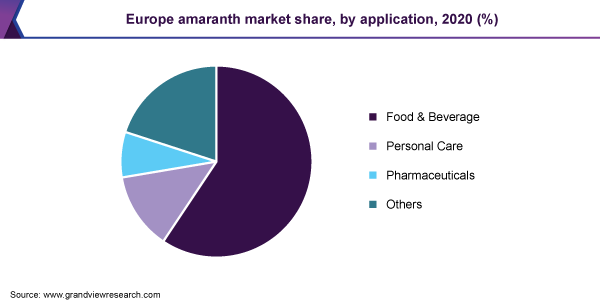

Application Insights

In terms of revenue, food & beverages emerged as the leading application segment with a market share of 59.4% in 2020. Amaranth is rich in protein & fiber and serves high dietary benefits by providing a high level of tocotrienols through its seeds. Several fast-food chains and ready-to-eat food manufacturers are focusing on developing products with high nutritional value owing to changing consumer preferences. In 2020, countries like Italy, the Netherlands, and Germany had a vegetarian population of approximately 5%, 8.9%, and 10% of the total population, respectively.

The growing vegan population in the European countries is expected to be a key factor driving the product penetration in the food and beverage application segment. The personal care application segment is expected to witness the fastest CAGR over the forecast period. Amaranth products help in balancing and rejuvenating the skin. Thus, these products along with other ingredients are used in a wide range of cosmetics.

In addition, these products help in smoothening wrinkles because of their antioxidant properties. The constantly evolving personal care sector in the region has prompted personal care product manufacturers to offer various sophisticated clean-label products and develop formulations for several consumer groups, which is expected to create new growth avenues for the market in Europe.

Country Insights

Germany accounted for 17.6% of total revenue share in 2020 owing to a large consumer base and high awareness levels about the adverse effects of synthetic flavors and ingredients used in food and beverages as well as cosmetic products. As a result, application industries are expected to focus more on offering plant-based products to meet the changing consumer requirements.

The U.K. is expected to witness the fastest CAGR of over 11.4% from 2021 to 2028 owing to the increasing vegan population in the country. According to The Food and Drink Federation of the U.K., the turnover of the food & beverages industry grew at a CAGR of 19.11% from 2018 to 2020. The presence of many food and beverage manufacturers in the country, coupled with the growing awareness about balanced nutrition is expected to be the key factor driving the market.

However, the cosmetics market was severely hit by the COVID-19 pandemic. With many countries in Europe facing several waves of infection, the non-essential sectors, including the cosmetics industry, were adversely affected in terms of production as well as sales, which resulted in a slight decline in product demand in 2020.

Higher per capita income levels and the increasing popularity of vegan diets in the region are the factors driving the product demand. Moreover, amaranth has higher protein content, which makes it an ideal substitute for dairy products. Thus, increasing cases of lactose intolerance are also likely to boost the demand over the forecast period.

Key Companies & Market Share Insights

The market is highly fragmented with a limited number of large-scale companies operating in the region. As amaranth is not a widely produced crop in the region, producers are largely dependent on imports from Asian and American countries, such as India, China, Brazil, and Mexico. Furthermore, acquisition emerged as a popular strategy adopted by companies to enter the market and to increase the existing customer base and geographical reach. In October 2018, The Andersons Inc. acquired all the assets of Nu World Food to add amaranth products to its portfolio. Some of the prominent players in the Europe amaranth market include:

-

Flavekotrade s.r.o

-

FLAVEX Naturextrakte GmbH

-

Proderna Biotech Pvt. Ltd.

-

SAAR

-

The Andersons Inc.

-

DK MASS s.r.o

-

Rusoliva Pvt. Ltd.

-

Dipasa Europe B.V

-

All Organic Treasures GmbH

-

S.A.S Flanquart

Europe Amaranth Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2,425.9 million

Revenue forecast in 2028

USD 4,983.0 million

Growth rate

CAGR of 10.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2021 to 2028

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, product, application, region

Regional scope

Europe

Country scope

U.K.; Germany; Russia; France; Italy; Spain; Benelux; Portugal

Key companies profiled

Flavekotrade s.r.o.; Flavex Naturextrakte GmbH; Proderna Biotech Pvt. Ltd.; SAAR; DK Mass s.r.o; Rusolibe Pvt. Ltd.; Dipasa Europe B.V.; All Organic Treasures GmbH; S.A.S. Flanquart

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Europe amaranth market report on the basis of category, product, application, and region:

-

Category Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Conventional

-

Organic

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Seed

-

Oil

-

Leaf

-

Flour

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Food & Beverages

-

Pharmaceutical

-

Personal Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Benelux

-

Portugal

-

-

Frequently Asked Questions About This Report

b. The oil product segment led the Europe amaranth market accounting for a revenue share of more than 49% in 2020.

b. In terms of revenue, food & beverages emerged as the leading application segment with a Europe amaranth market share of 59.4% in 2020.

b. Germany accounted for 17.6% of the total revenue share in 2020 in the Europe amaranth market.

b. The Europe amaranth market size was estimated at USD 2,197.4 million in 2020 and is expected to reach USD 2,425.9 million in 2021.

b. The Europe amaranth market is expected to grow at a compound annual growth rate of 10.8% from 20201 to 2028 to reach USD 4,983.0 million by 2028.

b. The conventional category segment dominated the Europe amaranth market in 2020 with a revenue share of 88.2%.

b. The key market player in the Europe amaranth market includes Flavekotrade s.r.o.; FLAVEX Naturextrakte GmbH; Proderna Biotech Pvt. Ltd.; SAAR; DK Mass sro; Rusolibe Pvt. Ltd.; Dipasa Europe B.V.; ALL ORGANIC TREASURES GMBH; and S.A.S. FLANQUART.

b. The demand for amaranth as seed or flour in bread, cookies, granola, cereals, noodles, and pancakes is projected to drive the Europe amaranth market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."