- Home

- »

- Distribution & Utilities

- »

-

Europe Carbon Capture Utilization Market Report, 2028GVR Report cover

![Europe Carbon Capture Utilization Market Size, Share & Trends Report]()

Europe Carbon Capture Utilization Market Size, Share & Trends Analysis Report By Application (Enhanced Oil Recovery, Industrial, And Agriculture), By Country (Germany, France, Netherland, Poland, Austria), And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-825-9

- Number of Pages: 74

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Energy & Power

Report Overview

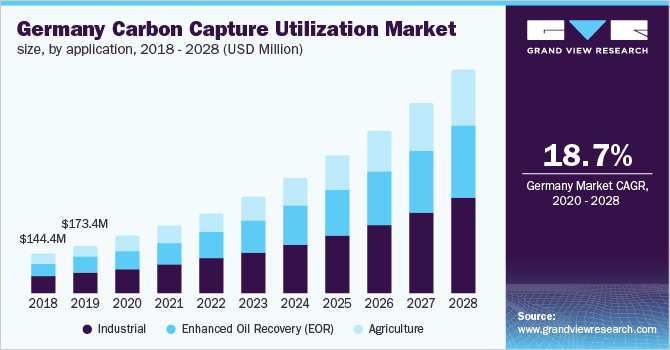

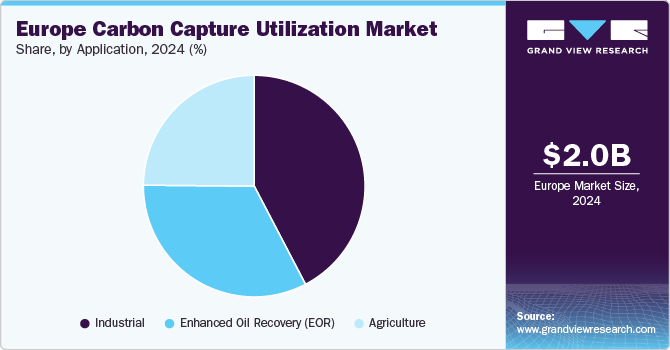

The Europe carbon capture utilization market size was valued at USD 1,032.26 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 18.4% from 2020 to 2028. Factors such as increasing applications of CCU in the enhanced oil recovery (EOR) in the oil & gas segment are expected to contribute to the growth of the market. Further, the food & beverages, chemicals, cement, and other industries are anticipated to be the major application segments that are expected to contribute to the growth of the market for carbon capture utilization in Europe over the forecast period. Germany is one of the major contributors to carbon dioxide emissions and a major market for carbon capture and utilization in Europe.

Government initiatives, supporting policies and plans, and availability of funds are some of the factors that are expected to drive the CCU market in the country. The country is engaged in research and development for finding ways to reduce carbon dioxide emissions. For instance, it is emphasizing on generating power through renewable sources instead of non-renewable sources. Researchers have been trying to find other industrial applications of carbon dioxide to reduce overall carbon dioxide emissions. This is anticipated to boost the demand for CCU technology in the country. The market for carbon capture utilization in Europe is estimated to have a linear growth rate by 2025 due to several installations of CCU facilities at each end-use industry such as chemicals, cement, oil and gas, power, steel, and food and beverages.

The growth is expected to show a slow decline by 2026 due to the market consolidation. Furthermore, in July 2020, the Bundestag and the Bundesrat adopted the act on the phase-out of coal-fired power plants and the structural reinforcement act for mining regions by 2038.

Application Insights

The industrial application segment led the market for carbon capture utilization in Europe and accounted for more than 41.0% revenue share in 2020and is anticipated to maintain its dominance over the forecast period. The industrial segment is further sub-segmented into applications such as Properties such as higher toughness and impact strength, light transmittance, protection from Ultraviolet (UV) radiations, and chemical and heat resistance make recycled PC resins suitable for use in electrical and electronic device components such as television frames, mobile cases, electrical housing, and others. The global demand for recycled PC polymer in electrical and electronics is expected to rise in the forthcoming years.

Carbon capture utilization in EOR is one of the significant industries, which has a growth rate of 18.2% from 2020 to 2028. The strong underpinning expertise and the availability of high-end technologies are the most crucial factors favoring the adoption of carbon capture utilization across the oil & gas industry. Furthermore, factors such as comprehensive value chain relationships, access to low-cost finance, and revenues generated by the market players, are used to fund to adopt the carbon capture utilization in the oil and gas industry.

Country Insights

Germany dominated the Europe carbon capture utilization market and accounted for the largest revenue share of 20.0% in 2020. Germany led the market in 2020, in terms of both volume and revenue in the region. The country’s carbon capture utilization Market is driven by the chemical industry which has a highly developed structure in terms of infrastructure, research and production facilities, and access to the national and market. As a global leader in the chemical industry and a well-trained workforce, Germany is a mature partner for foreign investment. In 2019, there were a total of about 2,900 chemical companies in Germany. Thus, there is a huge potential for CCU installation providers to install CCU facilities at the premises of chemical plants due to government support and increased spending in capturing carbon emission technology.

Moreover, in France, the implementation of the carbon tax largely depends on the tax revenue allocation used to fund energy transition. In 2018, the carbon tax was set on a rising price trajectory toward USD 97/tCO2e, however, in 2022, this plan has been modified on account of social protests opposing the rising fuel prices and carbon tax rates, resulting in the implementation of CCU technology in a phased manner.

Key Companies & Market Share Insights

The European Carbon Capture Utilization (CCU) market is moderately consolidated with the presence of various multinational players. This makes the industry highly competitive in nature as it also requires high initial investments and R&D costs. Some of the significant industry participants include Royal Dutch Shell, Equinor ASA, Linde, and Aker Solution. For instance, in April 2021, the company announced to join a project to build UK’s large-scale carbon capture and H2 hub as major oil players are focusing on cleaner energy. The company will team up with Harbour Energy Plc and StoreggaGeotechnologies Ltd.

In addition, in March 2021, Aker carbon capture and Siemens energy joined forces to generate sustainable power. Both companies have signed an MoU to develop a combined offering for the Carbon capture solutions that can be used in gas turbines and gas power plants. This collaboration will help both companies to explore ways to jointly track the development of major projects across the globe. Some of the prominent players in the Europe Carbon Capture Utilization market include:

-

Aker Solutions

-

Equinor ASA

-

Fluor Corporation

-

Linde Plc

-

Mitsubishi Heavy Industries Ltd. (MHI)

-

Royal Dutch Shell

-

Siemens Energy

-

Sulzer Ltd.

Europe Carbon Capture Utilization Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1,216.0 million

Revenue forecast in 2028

USD 3.9 billion

Growth Rate

CAGR of 18.4% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Volume in million tons, revenue in USD million, and CAGR from 2020 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Country scope

Germany; France; Netherlands; Poland; Austria

Key companies profiled

Royal Dutch Shell; Aker Solutions; Equinor ASA; Linde Plc; Siemens Energy; Fluor Corporation; Sulzer Ltd.; Mitsubishi Heavy Industries Ltd. (MHI)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the Europe Carbon Capture Utilization market report based on application and country:

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2017 - 2028)

-

Enhanced Oil Recovery (EOR)

-

Industrial

-

Chemicals

-

Cement

-

Others

-

-

Agriculture

-

-

Country Outlook (Volume, Million Tons; Revenue, USD Million, 2017 - 2028)

-

Germany

-

France

-

Netherlands

-

Poland

-

Austria

-

Frequently Asked Questions About This Report

b. The Europe carbon capture utilization Market value was estimated at USD 1,032.26 million in 2020 and is expected to reach USD 1,216.0 million in 2021.

b. The Europe carbon capture utilization Market is expected to witness a compound annual growth rate of 18.4% from 2020 to 2028 to reach USD 3.9 billion by 2028.

b. Industrial was the largest application segment accounting for 41.63% of the total revenue in 2020 on account of a wide range of CCU applications at various stages in industries such as cement, chemicals. and others.

b. Some of the key players operating in the Europe carbon capture utilization Market include Royal Dutch Shell, Equinor ASA, Linde, and Aker Solution.

b. Key factors driving the growth of the Europe carbon capture utilization market include favorable government regulations and funding initiatives in the European Union and increasing use of carbon dioxide in enhanced oil recovery (EOR).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."