- Home

- »

- Automotive & Transportation

- »

-

Europe Electric Forklift Market Size & Trends Report, 2030GVR Report cover

![Europe Electric Forklift Market Size, Share & Trends Report]()

Europe Electric Forklift Market Size, Share & Trends Analysis Report By Product (Counterbalanced, Pallet Trucks, Reach Trucks, Pallet Stackers), By Battery Type, By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-949-1

- Number of Pages: 141

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Technology

Report Overview

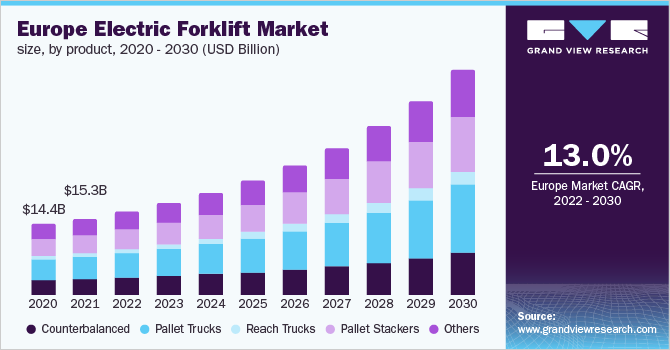

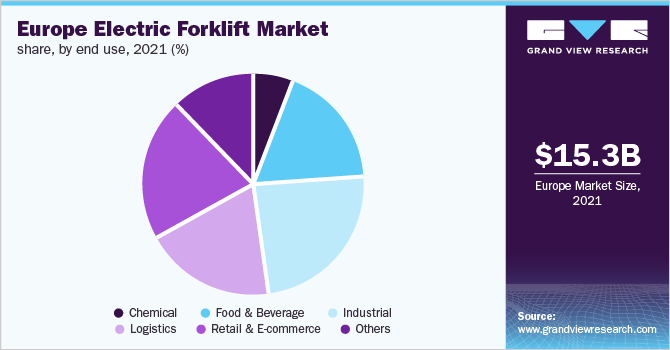

The Europe electric forklift market size was valued at USD 15.30 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.0% from 2022 to 2030. Increasing demand for electric forklifts from the chemical, food & beverage, and logistics sectors for material handling operations is expected to fuel the growth. Stringent government regulations for curbing GHG emissions from ICE forklifts are driving the demand for electric power forklifts from the industrial and construction sectors. This is expected to positively impact the target market growth.

Lift trucks help retailers store and distribute products in huge volumes, allowing them to gain a competitive advantage in their respective sectors. Thus, growing demand from several end-use industries is anticipated to drive market growth.

The COVID-19 outbreak caused a slight slump in the industry’s growth. The government implemented a strict lockdown in the country which resulted in a shutdown of manufacturing facilities and even disruption in the supply chain of raw materials.

However, in 2021, there was a sudden increase in demand for forklifts due to the resumption of construction activity for halted and new projects, which directly increased the demand for electric forklifts. The market is expected to witness growth similar to the pre-pandemic period in 2022 due to the release of backlog orders resulting from the pandemic and the rapid increase in demand from various industrial sectors such as food & beverages, retail, and construction.

The developed economies such as the U.K. Germany, and France are investing heavily in infrastructure development projects which is augmenting the construction activities. For instance, the U.K. government published a document “National Infrastructure and Construction Pipeline” announcing a USD 899.0 billion infrastructure plan for the next 10 years.

The documents stated that USD 41.29 billion is allocated to social & economic projects, the transportation sector has been allocated USD 89 billion, and energy projects with USD 65 billion. Similarly, the government of the Netherlands allocated USD 704 million to boost economic growth. Owing to such infrastructure projects the demand for forklifts is expected to witness a rise over the forecast period.

Government inclination toward attaining net-zero emission has been witnessing traction. Implementing various rules and regulations to lower pollution levels caused by ICE engines. This implementation of the net-zero strategy from the government is forcing auto manufacturers to shift toward developing electric power vehicles. For instance, in October 2021, the U.K. government set out a new Net Zero Strategy to eliminate harmful emissions by 2050.

The government is focused on deploying low carbon options such as offshore wind, low-carbon hydrogen production, carbon capture, electric cars, etc. across the economy in the coming 15 years. Thus, increasing government initiatives to safeguard the environment and the introduction of electric-powered forklifts from auto manufacturers are factors expected to support the market growth.

There is a noticeable increase in construction activities in the countries such as the U.K., Germany, and France, resulting in high demand from the construction sector for equipment to lift and carry goods from one place to another, thus, increasing construction activities in the region is expected to augment the growth of the electric forklift market over the assessment period.

Additionally, the flourishing e-commerce sector in Europe is increasing demand for new warehouses is expected to bode well for the adoption of the electric narrow aisle and electric motorized hand trucks such as pallet trucks and reach trucks. Pallet trucks are used for lifting, steering, and lowering pallets and are available for heavy loads, particular dimensions, flat pallets, and simultaneous weighing within a warehouse.

Manufacturers are focused on introducing new products that are easy to handle, highly efficient, and enhance the operational efficiency in warehouses which is expected to support the market growth. For instance, in December 2021, Clark a global manufacturer of forklifts announced the launch of a new high-lift pallet truck “PSX16”. The newly launched PSX16 is available with a Lithium-Ion battery (Li-Ion) and provides the advantage of easy handling and is free from maintenance.

However, the high cost of the battery is expected to challenge the growth of the Europe electric forkliftmarket. The cost of lithium-ion battery is high, more than double the price of conventional lead batteries. Also, the cost varies depending upon the size and shape. The high upfront costs of batteries are likely to affect the pricing for forklifts thereby may hamper the market growth. In addition, a lack of skilled personnel is expected to challenge the market growth.

Product Insights

The pallet trucks segment accounted for a revenue share exceeding 27% in 2021 and is expected to witness high growth over the forecast period. Pallet trucks are fast and powerful and are used for lifting, steering, and lowering pallets in a warehouse, and factories. Thus, increasing demand for lightweight pallet trucks in warehouses that provide maximum maneuverability is expected to support the growth of the segment.

The reach truck segment is expected to witness a significant CAGR of 15.2% over the forecast period. This can be attributed to increasing demand from storage units, warehouses, and factories to reach and store objects at a much higher level than traditional forklifts.

Manufacturers are investing heavily in R&D activities and introducing new products with maximum productivity and strongeergonomicsic. For instance, in September 2021, Doosan Corporation, a construction equipment manufacturer, announced the launch of new 9-Series electric reach trucks. The newly launched products are 12% narrower than the previous models and can carry heavy loads up to 2.5 tons which helps increase the operational performance.

Battery Type Insights

The others segment includes lead-acid and hydrogen fuel cell. It accounted for a revenue share of 64.46% in 2021 and is expected to witness stable growth in the forthcoming years. The government has restricted the use of conventional lead-acid battery technology to lower their impact on the environment. The lead-acid batteries are rapidly replaced by lithium-ion batteries which is expected to dominate over the forecast period.

Rapid advancements are taking place in battery technology, and players' inclination toward using hydrogen fuel cell battery type is gaining momentum. The fuel cell provides benefits such as less/no need for watering, equalizing, charging, or cleaning of batteries, which is important in conventional battery technology.

Manufacturers are adopting fuel cell technology which will help them attain a competitive edge against the competitor. For instance, in January 2022, Toyota Material Handling UK, launched Electric Counterbalance Forklift Traigo80, a new electric counterbalance forklift. The newly launched product is offered with a choice of lithium-ion, lead-acid, or fuel cell power solutions.

The Li-ion segment is expected to register a CAGR of 20.9% over the forecast period, attributed to increasing R&D activities in Li-ion battery technology. These batteries need to be completely discharged before being recharged to avoid memory loss, whereas Li-ion provides flexibility in terms of work and recharging.

Increasing investments in R&D on materials and chemicals is a major reason behind the rapid decline in Li-ion batteries price. Thus, declining prices of Li-ion batteries are expected to aid manufacturers in the introduction of more efficient and low-priced forklifts. Such low-priced forklifts with higher efficiency are expected to attract customers which is anticipated to support the growth of the Europe market.

End-use Insights

The industrial segment accounted for more than 12% of the regional market share in 2021. In industrial applications, forklifts are used for load/unload, elevators, tractor-trailers, straight trucks, and railway cars. Industries are focused on the adoption of energy-efficient solution which is expected to enhance operational efficiency and lower the environmental impact. Electric powered forklift offers various attributes such as lightweight, less noise, and minimal maintenance. These features are expected to increase its demand in the industrial sector.

The retail & e-commerce segment is expected to witness significant growth owing to increasing consumer spending on e-commerce platforms is resulting in rising demand for warehouses, which is further driving demand for forklifts. Growing e-commerce transactions in countries such as the U.K., Germany, and France is resulting in an increasing number of warehouses, this is creating pressure on warehouse owners to efficiently manage the supply chain in the warehouse. This approach toward efficiently managing the warehouse and enhancing productivity is expected to increase demand for electric forklifts.

Regional Insights

Germany accounted for a significant revenue share of the market. The growth of this market can be attributed to increasing demand from the food & beverage industry for electric forklifts as they eliminate harmful fumes that damage the food products. Also, exponential growth in the e-commerce sector resulted in a noticeable change in the way warehouse operates.

The U.K. is expected to witness a significant CAGR of 14.7% over the forecast period, attributed to increasing demand for forklifts from the chemical, food & beverage, and industrial sector. In January 2020, U.K.’S exit from the EU created issues related to import-export, distribution, and shortage of labor.

Owing to a shortage of resources, manufacturers and warehouse owners are inclined toward automating the operations. This fueled the demand for the autonomous forklift to increase transparency, lower operational costs, and enhance productivity at manufacturing and warehouse locations.

Key Companies & Market Share Insights

Key players that dominated the market in 2021 include Anhui Heli Co., Ltd., Clark, Crown Equipment Corporation, and Hangcha Group Co., Ltd. Moreover, major players’ approach toward enhancing the business and acquiring significant market share through new product launches and acquisitions.

For instance, in July 2021, Hangcha Group Co., Ltd. launched an electric forklift truck with a 2.0-3.5 ton weight capacity, equipped with high voltage lithium-ion batteries (309 V). This truck series is expected to charge fully within one hour and have a running capacity of up to 12 hours. Some prominent players in the Europe electric forklift market include:

-

Anhui Heli Co., Ltd.

-

Clark

-

Crown Equipment Corporation

-

Hangcha Group Co., Ltd.

-

Hyster-Yale Materials Handling, Inc.

-

Jungheinrich AG

-

KION Group AG

-

Komatsu Ltd.

-

Mitsubishi Logisnext Co., Ltd.

Europe Electric Forklift Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 16.63 billion

Revenue forecast in 2030

USD 44.24 billion

Growth Rate

CAGR of 13.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, battery type, end use, region

Regional scope

Europe

Country scope

U.K.; Germany; France; Rest of Europe

Key companies profiled

Anhui Heli Co., Ltd.; Clark; Crown Equipment Corporation; Hangcha Group Co., Ltd.; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; KION Group AG; Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the Report

The report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe electric forklift market report based on product, battery type, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Counterbalanced

-

Pallet Trucks

-

Reach Trucks

-

Pallet Stackers

-

Others

-

-

Battery Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Li-ion

-

Others (Lead-acid and Hydrogen fuel cell)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chemical

-

Food & Beverage

-

Industrial

-

Logistics

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe electric forklift market market size was estimated at USD 15.30 billion in 2021 and is expected to reach USD 16.63 billion in 2022.

b. The Europe Electric Forklift market is expected to grow at a compound annual growth rate of 13.0% from 2022 to 2030 to reach USD 44.24 billion by 2030.

b. Germany dominated the regional market with a share of 35.20% in 2021. This is attributable to rising need for pallet trucks in E-Commerce and Manufacturing sectors.

b. Some key players operating in the Europe Electric Forklift market include Anhui Heli Co., Ltd.; Clark; Crown Equipment Corporation; Hangcha Group Co., Ltd.; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG, KION Group AG, Komatsu Ltd., Mitsubishi Logisnext Co., Ltd

b. Increasing demand for electric forklifts from the chemical, food & beverage, and logistics sectors for material handling operations and stringent government regulations related to curb GHG emissions from ICE forklifts is creating the demand for electric power forklift from the industrial and construction sector which is expected to positively impact the target market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."