- Home

- »

- Clinical Diagnostics

- »

-

Europe In Vitro Diagnostics Market Size, Share Report, 2030GVR Report cover

![Europe In Vitro Diagnostics Market Size, Share & Trends Report]()

Europe In Vitro Diagnostics Market Size, Share & Trends Analysis Report By Product (Instruments, Reagents), By Technology (Coagulation, Molecular Diagnostics) By Application, By End-use, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-667-7

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

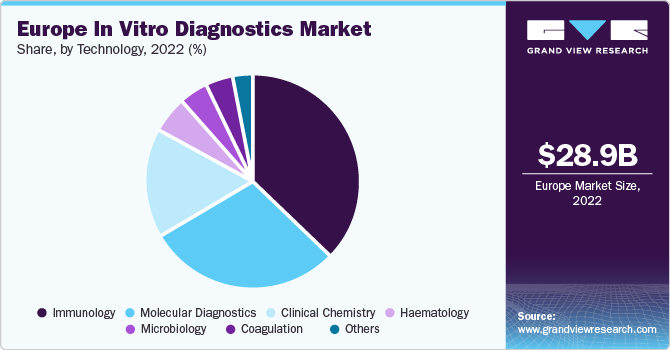

The Europe in vitro diagnostics market size was valued at USD 28.98 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 0.7 % from 2023 to 2030.The growing base of the geriatric population in European countries, the increasing prevalence of chronic diseases, the rising awareness among the population for early diagnosis of life-threatening diseases, government support and investments, and technological developments in in-vitro diagnostics-related goods, services, and software are the high impact drivers for the growth of the Europe IVD market. The rising prevalence of chronic and infectious diseases like cardiovascular disorders, diabetes, cancer, and respiratory diseases drives the in-vitro diagnostics market in Europe. For instance, according to the Global Cancer Observatory study, 4.39 million new cancer cases are expected in Europe in 2020. Breast and colorectal cancer were the most common forms in women, while lung and prostate cancer were the most common in men.

The elderly population is inevitably susceptible to a range of degenerative diseases, which results in the high prevalence of target diseases in this demographic. This is expected to increase the demand for IVDs in this population subset during the forecast period. According to projections by Eurostat, the proportion of people 65 and older in the EU's overall population would rise from 21.1% (94.3 million) at the start of 2022 to 32.5% (136.1 million) in 2100.

Governments in Europe have been actively putting money into the healthcare system's infrastructure while promoting early detection and preventive healthcare programs. The support of diagnostics-related research and development and the facilitation of the implementation of cutting-edge diagnostic technology are regular components of such initiatives. Two major initiatives were announced by the European Commission (EC) in 2020 to combat cancer and the financial burden it places on Europe. DG SANTE's Europe's Beating Cancer Plan and Mission on Cancer.

Positive effects of COVID-19 are shown in the European in-vitro diagnostics market. According to an article published in the Frontiers in Bioengineering and Biotechnology Journal in January 2021, rapid testing using in-vitro diagnostics is crucial in the fight against outbreaks, particularly respiratory viral diseases that are easily spread from person to person. Given the complex workflow and high cost of various testing methods, such as RT-PCR, it was also observed that geographical and economic limits can influence the deployment and frequency of testing in each region. The in-vitro diagnostics industry has benefited from its significant importance in identifying COVID-19 infection, which has led to market expansion during the pandemic years. However, the market started slowing down during the pandemic.

The long-running In-Vitro Diagnostic Directive (VDD) regulation will be replaced by the In-Vitro Diagnostic Device Rule (IVR) in 2022, and it will have a substantial legislative impact on the European market. Due to the anticipated removal of numerous products from the European market, the new regulation puts market participants at a bottleneck. For instance, it was projected in a news report from February 2023 that 1,500 in-vitro diagnostics certified under the IVDD standard had yet to switch to the IVDR standard; these certificates are likely to expire in May 2025. In addition, 78.1% of respondents to a study conducted by the European Commission and released in 2021 stated that they encountered various obstacles that prohibited them from beginning or achieving accreditation under the IVDR.

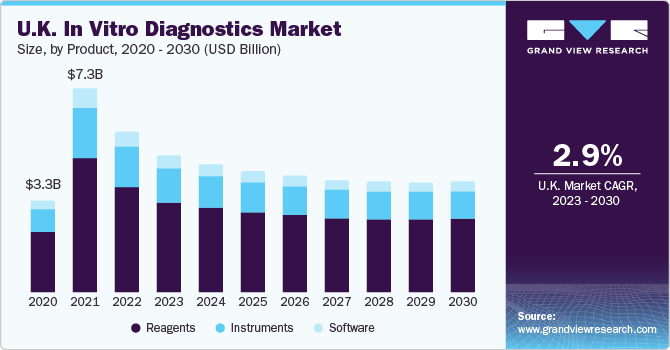

Furthermore, until June 30, 2023, devices in the post-Brexit UK will be acceptable if they have a current CE mark; thereafter, a UKCA mark will be required. The presence of this symbol will signify that the gadgets abide by the current IVDD laws. The increase of Europe's IDV market share has been constrained by the country with the greatest influence from this shifting regulatory environment, the UK, followed by other European nations.

Product Insights

On the basis of product, the market is segmented into instruments, reagents, and software. The reagents segment dominated the market with a revenue share of around 65% in 2022, owing to a spike in the utilization of POC tests, self-testing kits, and various other cutting-edge items in in-vitro diagnosis. The rising volume of research and development efforts for detecting acute diseases is one of the primary reasons fueling the need for reagents and consumables. Furthermore, the growing priority placed on timely diagnosis in established and developing nations is increasing the proportion of patients getting routine tests, adding to the high growth of the category.

The instruments segment held the second largest share in 2022. The advancement in instruments provided a great avenue for the segment's growth. For instance, in September 2022, Sysmex Corporation launched the UD-1500 Completely Automated Urine Particle Analyzer for urine sediment evaluation. The product inherits the excellent capability and ease of use of the UF-5000, an entirely automated urine particle analyzer. The most popular IVD tools include cell imaging and analysis systems, slide processing systems, urine test strips, pregnancy tests, blood sugar monitoring systems, coagulation test systems, and PCR testing platforms.

Technology Insights

On the basis of technology, the market is segmented into immunoassay, hematology, clinical chemistry, molecular diagnostics, coagulation, microbiology, and others. The immunoassay segment held the largest revenue share of over 35% in 2022, as immunoassays are being utilized significantly in alcohol and drug testing as well as cancer. Immunoassays are being furnished with modern technology to aid medical practitioners in generating timely diagnosis, boosting their acceptance.

The microbiology and clinical chemistry segments are estimated to register the fastest CAGR of 4.4% over the forecast period of 2023 to 2030. A proportion of clinical chemistry is accomplished by utilizing high throughput apparatus with cutting-edge automation. However, point-of-care diagnostics continues to grow to address the need for quick diagnosis for chronic and contagious diseases. This factor is a crucial component influencing growth in clinical chemistry. Ongoing advancements in microbiology due to advancements in biotechnological research aimed at investigating the role of microbes in disease pathogenesis are also crucial factors driving the growth.

Application Insights

On the basis of application, the market is segmented into infectious diseases, diabetes, oncology/cancer, cardiology, nephrology, autoimmune diseases, drug testing, and others. The IVD-based infectious disease diagnostics market accounted for the largest market share owing to the rising prevalence of hospital-acquired infections and the high unmet medical needs pertaining to the effective diagnosis of infectious diseases. The substantial share of the market in this category is mainly related to the high frequency of infectious illnesses, the increasing number of elderly people, a growing need for early detection of diseases, and the government's attempt to increase the affordability of services geared towards infectious illness testing. In vitro diagnostics (IVD) is a widely prevalent diagnostic tool that complies with the minimum requirements. IVD kits have become popular and successful in diagnosing infectious illnesses.

The oncology segment is one of the fastest-growing segments due to the introduction of technologically advanced devices and the rising demand for companion diagnostics. The growing need for early disease identification and prevention stimulates development, improving diagnostic capabilities, and personalized medicine strategies, particularly in cancer diagnosis.

End-use Insights

The European in vitro diagnostics market is segmented by end use into hospitals, laboratories, home care, and others. The hospital category dominated the overall segment, considering diagnostics are seamlessly integrated with other disciplines and comprehensive healthcare services are available. They have the facilities, resources, and qualified staff to run a successful IVD operation. Hospitals serve as primary places of care, primary points of referral, and providers of a wide range of medical services. Their range of clinical specialties guarantees precise diagnosis and analysis of IVD test findings. Furthermore, hospitals receive favorable funding and reimbursement policies and must follow strict regulatory guidelines to guarantee patient safety and test accuracy.

The home care segment is expected to grow at the fastest CAGR due to the rising demand for rapid diagnostic services for patients at the time of care, the rising government initiatives aimed at lowering hospital stays to curb healthcare expenditure, and the increase in collaboration between the market players. Multiple partnerships between healthcare organizations and various MedTech firms offer a fantastic chance for the efficient implementation of healthcare services at the residence. For instance, Medtronic's Integrated Health Solutions (IHS) presently has 170 in-progress long-term relationships in 24 countries throughout Europe, adding value to healthcare organizations and assisting in the more cost-effective provision of high-quality services at home. As a result, this component spurs market expansion.

Country Insights

The UK, France, Germany, and other countries have a large market for IVD. The expansion of the market is primarily attributable to the rising number of transmissible illnesses and the increasing need for rapid diagnostics. Furthermore, the existence of multiple manufacturing firms is likely to fuel market expansion over the period of forecasting. The UK is also likely to offer major growth prospects during the projection period. For instance, according to the Globocan 2020 research, the UK indicated that the number of cancer cases is predicted to climb to 528,902 by 2030 and 595,909 by 2040. As per the United Nations World Population dashboard information, in 2021, the aggregate population size of the UK was 68.2 million, of which 18.8% of the total population is aged 65 or over, which is believed to accelerate the need for in-vitro diagnostics in the country.

Key Companies & Market Share Insights

The Europe In vitro diagnostics market is extremely competitive, and major market participants have used various tactics to capture the largest share possible. These consist of partnerships, product launches, partnerships, and acquisitions. For instance, Thermo Fisher Scientific Inc. introduced the Renvo Rapid PCR Test to identify SARS-CoV-2 viruses in the air in February 2022. The AerosolSense Sampler is used to gather samples for this test. These new launches are anticipated to aid in expanding the in-vitro diagnostics market.

Another instance is the commercial introduction of its molecular diagnostics platform, EZ2 Connect MDx, and CE-IVD certification enabling automated processing of samples in laboratory diagnostics, which QIAGEN announced in January 2023. The following are some of the major participants in the Europe in vitro diagnostics market:

Key Europe In Vitro Diagnostics Companies:

- Bio-Rad Laboratories, Inc

- Abbott

- Sysmex Corporation

- BD

- BIOMÉRIEUX

- Danaher

- F. Hoffmann-La Roche Ltd

- Siemens

- QIAGEN

- Thermo Fisher Scientific Inc

Europe In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26.77 billion

Revenue forecast in 2030

USD 28.10 billion

Growth rate

CAGR of 0.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end use, application, region

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Bio-Rad Laboratories, Inc; Abbott; Sysmex Corporation; BD; BIOMÉRIEUX; Danaher; F. Hoffmann-La Roche Ltd; Siemens; QIAGEN; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe in vitro diagnostics market report based on product, technology, end-use, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunology

-

Haematology

-

Clinical Chemistry

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology/Cancer

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Home Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Frequently Asked Questions About This Report

b. Europe in vitro diagnostics market size was estimated at USD 28.98 billion in 2022 and is expected to reach USD 26.76 billion in 2023.

b. Europe in vitro diagnostics market is expected to grow at a compound annual growth rate of 0.7% from 2023 to 2030 to reach USD 28.10 billion by 2030

b. Reagents dominated Europe in vitro diagnostics market with a share of 65.8% in 2022. This is attributable to the rising prevalence of hospital-acquired infections and the presence of high unmet medical needs pertaining to the effective diagnosis of infectious diseases.

b. Some key players operating in Europe in vitro diagnostics market include F. Hoffmann-La Roche Ltd., Alere, Inc., Abbott, Hologic, Inc., QIAGEN, Bio-Rad Laboratories, Inc., Quidel Corporation, BD, bioMerieux, Inc., and Siemens Healthcare GmbH.

b. Key factors that are driving the Europe in vitro diagnostics market growth include the growing base of the geriatric population in European countries, the increasing prevalence of chronic diseases, and the rising awareness among the population for early diagnosis of life-threatening diseases

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."