- Home

- »

- Next Generation Technologies

- »

-

Europe Indoor Farming Market Size Report, 2021-2028GVR Report cover

![Europe Indoor Farming Market Size, Share & Trends Report]()

Europe Indoor Farming Market Size, Share & Trends Analysis Report By Facility Type (Greenhouses, Vertical Farms), By Component (Hardware, Software), By Crop Category, By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-338-6

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Technology

Report Overview

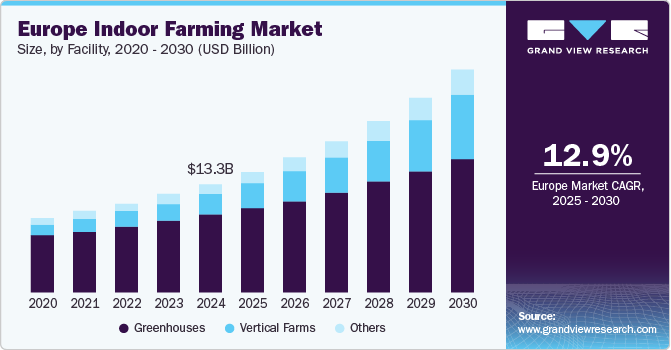

The Europe indoor farming market size was valued at USD 10.38 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 10.4% from 2021 to 2028. The market growth can be attributed to the changing climatic conditions across Europe. Changes in temperature and weather adversely affect crop yield. These factors are promoting the demand for indoor farming in Europe. Various aggrotech companies are making efforts to curb the challenges imposed by climate changes on crops by adopting indoor farming practices. For instance, in August 2020, Urban Crop Solutions, a vertical farming system provider, announced the launch of its Modulex Plant Factory, a vertical farming system focused on helping businesses achieve profitability. This system enables growers to control the internal conditions to keep the crops unaffected by external weather conditions.

The increasing challenges of limited land and space for growing crops in Europe are encouraging cities and companies to adopt controlled environment agricultural practices. According to the statistics provided by the World Bank in 2018, European arable land has been witnessing a continuous drop since 1960. In 1960, 31% of the European land was arable, whereas, in 2018, it dropped to 25%. This problem is mainly high in central European countries such as Estonia, Croatia, and Slovenia, having less than 15% of arable land. Thus, the decreasing arable land in Europe is expected to drive the demand for indoor farming over the forecast period.

Enhanced technologies such as artificial intelligence, the internet of things, and data analytics are increasingly being deployed in indoor farming to improve crop yield. Various companies are investing in research and development for combining technologies with food systems for enhancing productivity and sustainability. For instance, in May 2021, LettUs Grow Ltd, a provider of indoor farming technology, announced its partnership with Harper Adams University. This partnership is aimed toward undertaking the trial of different irrigation systems and technologies within vertical farms and greenhouses. Thus, companies' increasing investments for technologically enhancing indoor farming are expected to create new opportunities for market growth in the forthcoming years.

Government bodies in Europe are funding aggrotech companies for addressing the issues related to food security, land use efficiency, and carbon emission. For instance, in October 2020, GrowPura, an environmental organization based in the U.K., secured USD 5.28 million from the South East Midlands Local Enterprise Partnership, a government office aimed to help economic growth across South East Midlands. The company used this funding to construct a vertical hydroponics facility, which is expected to be completed by end of 2021. Thus, increasing government funding to promote indoor farming across Europe is expected to propel market growth.

However, the high cost of installation associated with indoor farming compared to conventional outdoor farming is expected to hinder market growth. According to the research published by AgFunderNews in 2019, traditional outdoor farming requires USD 0.65/Ib to grow greens. On the contrary, hydroponic greenhouses, vertical farms, and container farms require approximately USD 2.33/Ib, USD 3.07/Ib, and USD 7.14/Ib, respectively. The cost of growing greens is high in indoor farming as it requires enhanced lighting systems and irrigation systems, among other facilities. Additionally, the retail prices of these indoor farmed greens are also high compared to conventional ones. All these factors are thereby expected to hinder the market growth.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic adversely impacted the Europe indoor farming market in 2020. The economic slowdown, supply chain disruption, and decrease in consumer demand are the major factors that hindered the market growth during the pandemic. However, the pandemic has changed customers' eating habits and led to an increase in the demand for seasonal, local, and organic foods. According to the survey conducted by Euractiv, in 2021, 57% of consumers indicated that they had started buying more seasonal and fresh products due to the COVID-19 pandemic. Thus, the increasing demand for fresh food among consumers is expected to create the demand for vertical farming post the COVID-19 pandemic.

Facility Type Insights

The greenhouses segment dominated the market and accounted for over 83.0% share of the market revenue in 2020. The segment growth can be attributed to the increasing efforts of European greenhouses to enhance productivity. For instance, in October 2019, Norfolk and Suffolk greenhouses announced their plan of providing 10% tomatoes to the U.K. These greenhouses also have plans to grow millions of tomatoes and create 360 agricultural jobs.

The vertical farms segment is anticipated to expand at the highest CAGR over the forecast period. Various European companies are making investments in vertical farms to make them technologically enhanced and efficient, which is thereby driving the segment growth. For instance, in June 2019, Ocado, a software company, bought a 58% stake in Jones Food, a vertical farm. The company enhanced the operations of Jones Food through its expertise in artificial intelligence and robotics.

Component Insights

The hardware segment dominated the market and accounted for over 69.0% share of the market revenue in 2020. The growing adoption of smart farming across Europe is expected to drive the segment growth. At the same time, the increasing number of vertical farms across Europe is creating the need for various hardware devices. For instance, in June 2020, Infarm, a Germany-based start-up, developed an indoor farm for restaurants and supermarkets, creating the need for hardware tools such as smart motor controllers, heat mapping sensors, and data management, and automated fertigation systems for monitoring the crops.

The software segment is expected to register the highest CAGR over the forecast period. The demand for software is high among indoor farmers as it enables them to keep records of files on their phones, tablets, and computers. It also helps them monitor the estimated and incurred costs of operations conducted on the farms. Thus, the benefits offered by indoor farming software to the growers are driving the segment growth.

Crop Category Insights

The fruits, vegetables, and herbs segment dominated the market and accounted for over56.0% share of the market revenue in 2020. The increasing production of fruits, vegetables, and herbs in solar-based greenhouses is driving the segment growth in the region. According to the statistics provided by FreshPlaza, a publishing company, six out of ten greens consumed in Europe are grown in solar-based greenhouses located in Spain. The family farms that own greenhouses in Spain produce 4.5 million tons of vegetables and fruits, out of which, 75% of the production is exported to EU countries.

The flowers and ornamentals segment is expected to witness significant growth over the forecast period. The growing demand for flowers and ornamentals in Europe is expected to drive the segment growth. The flowers and ornamentals cultivated in indoor farming remain unaffected by weather changes. The Netherlands accounts for the largest share in flower farming and is an important trade hub for flowers compared to other European countries.

Country Insights

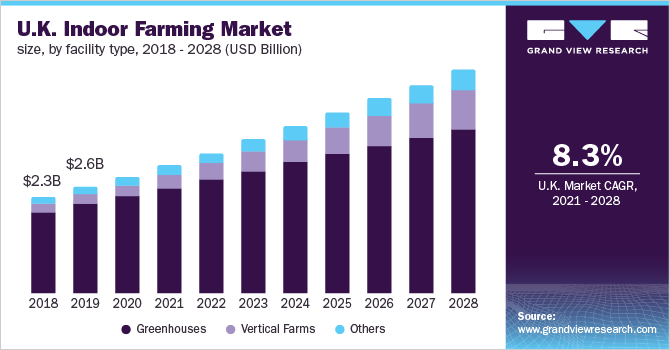

The U.K. dominated the market and accounted for over 26.0% share of the market revenue in 2020. The country's growth can be attributed to the increasing vertical farming projects. For instance, in 2019, Shockingly Fresh, a Scotland-based start-up, announced its plan to develop 40 sites of vertical farms across the U.K. Currently, Shockingly Fresh has five ongoing greenhouse projects.

Germany is expected to emerge as the fastest-growing regional market over the forecast period. Rapid developments in indoor farming in Germany are expected to drive the country's growth. Various companies in Germany are making efforts to develop vertical farms, which is thereby increasing the number of farms in the country. For instance, in September 2020, Infarm, a Berlin-based company, raised an investment of USD 170.72 million during the pandemic to set up the world's largest vertical farming network.

Key Companies & Market Share Insights

The market is highly fragmented in nature. The players operating in the market are focused on strategies such as partnerships, mergers, and acquisitions. For instance, in February 2020, Bridge Vertical Farming announced its indoor AG product offering with a modular vertical farming system designed by Urban Crop Solutions, its Belgium partner. This initiative helped the former company in expanding its product offerings.

Numerous vendors are investing in research and development activities to develop differentiated products that help them stay ahead of the competition. For instance, in 2020, Signify Holding, a Netherland-based company, invested 4.8% of its revenue in research & development. This investment is expected to help the company in enhancing its product offerings. Some of the prominent players operating in the Europe indoor farming market are:

-

Bridge Greenhouses Ltd.

-

LettUs Grow Ltd.

-

V-Farm

-

Agrilution

-

GrowUp Farms Limited

-

Netafim

-

PRIVA

-

Richel Group

-

Signify Holding

-

Everlight Electronics Co., Ltd

Europe Indoor Farming Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 11.67 billion

Revenue forecast in 2028

USD 23.26 billion

Growth rate

CAGR of 10.4% from 2021 to 2028

Base year of estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Facility type, component, crop category, country

Regional scope

Europe

Country scope

U.K.; Germany; France; Netherlands

Key companies profiled

Bridge Greenhouses Ltd.; LettUs Grow Ltd.; V-Farm; Agrilution; GrowUp Farms Limited; Netafim; PRIVA; Richel Group; Signify Holding; Everlight Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThe report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the Europe indoor farming market report based on facility type, component, crop category, and country:

-

Facility Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Greenhouses

-

Plastic

-

Glass

-

-

Vertical Farms

-

Shipping Container

-

Building-based

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2028)

-

Hardware

-

Climate Control Systems

-

Lighting Systems

-

Sensors

-

Irrigation Systems

-

-

Software

-

Web-based

-

Cloud-based

-

-

-

Crop Category Outlook (Revenue, USD Million, 2017 - 2028)

-

Fruits, Vegetables, & Herbs

-

Tomato

-

Lettuce

-

Bell & Chili Peppers

-

Strawberry

-

Cucumber

-

Leafy Greens

-

Herbs

-

Others

-

-

Flowers & Ornamentals

-

Perennials

-

Annuals

-

Ornamentals

-

-

Others

-

-

Country Outlook (Revenue, USD Million, 2017 - 2028)

-

U.K.

-

Germany

-

France

-

Netherlands

-

Frequently Asked Questions About This Report

b. The Europe indoor farming market size was estimated at USD 10.38 billion in 2020 and is expected to reach USD 11.67 billion in 2021.

b. The Europe indoor farming market is expected to grow at a compound annual growth rate of 10.4% from 2021 to 2028 to reach USD 23.26 billion by 2028

b. The U.K. dominated the Europe indoor farming market with a share of 26.0% in 2020. The country's growth can be attributed to the increasing vertical farming projects.

b. Some key players operating in the Europe indoor farming market include Bridge Greenhouses Ltd.; LettUs Grow Ltd.; V-Farm; Agrilution; GrowUp Farms Limited; Netafim; PRIVA; Richel Group; Signify Holding; and Everlight Electronics Co., Ltd.

b. Key factors that are driving the Europe indoor farming market growth include a rise in the need for higher yields using limited resources, increasing demand for organic foods, and shrinking per capital arable land.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."