- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Molded Pulp Packaging Market Size Report, 2030GVR Report cover

![Europe Molded Pulp Packaging Market Size, Share & Trends Report]()

Europe Molded Pulp Packaging Market Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-wood Pulp), By Type (Transfer, Thermoformed), By Product, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-911-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Market Size & Trends

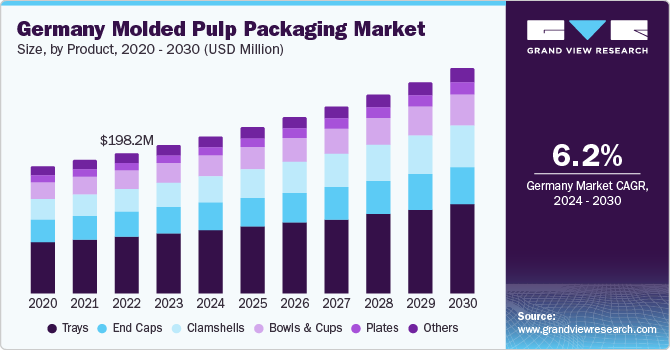

The Europe molded pulp packaging market size was valued at USD 1.20 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030.The market for sustainable packaging of eggs, fruits, and other fresh produce in Europe is anticipated to experience strong growth due to a steadily rising demand for environmentally friendly products. In Europe, eggs are mainly packaged using molded pulp trays and clamshells and then sold to various customers, including restaurants, food service operators, and individual consumers. Egg consumption per person has steadily risen in Europe, owing to its health benefits and a growing demand for protein-rich food. Thus, packaging of eggs is expected to play a vital role in driving market growth in Europe through 2030.

According to the Organization for Economic Co-operation and Development (OECD), in 2021, Germany witnessed a total of 945,726 cataract surgeries, marking a 10.1% increase over 2020. An increase in cataract surgeries has led to a higher demand for medical devices and equipment used in these procedures. Molded fiber packaging can be utilized in such scenarios due to its protective properties, making it an ideal choice as single-use trays to be used in surgeries and for replacing metal trays which require sterilization after use, thus contributing to the growth of molded fiber packaging products in healthcare settings.

The German Association of the Automotive Industry (VDA) predicts that electric passenger car production in Germany, which is Europe’s largest economy, is expected to increase by 50% in 2023, surpassing one million vehicles. This growth is attributed to a rising demand from foreign markets and increased efforts by car manufacturers to expand their production of electric vehicles. Moreover, this source also stated that in 2022, Germany produced a total of 885,000 electric cars, with 300,000 of them being plug-in hybrids.

Electric vehicles (EVs) are equipped with advanced electronic systems for various functions, including battery management, motor control, navigation, entertainment, safety features, and connectivity. These systems rely on electronic semiconductors to operate efficiently, thus increasing semiconductor demand in Germany. This trend is projected to fuel demand for molded pulp packaging, as it provides cushioning properties and prevents small and fragile electronics parts, such as semiconductors, from breakage and damage during transit and shipping.

In 2022, Germany's Federal Statistical Office (Destatis) reported that there were approximately 13.2 billion eggs produced in large-scale holdings, housing at least 3,000 laying hens. This marked a 1.4% increase in production compared to the previous year. This positive egg production outlook is expected to increase demand for molded fiber egg cartons and egg trays, consequently leading to market expansion for molded pulp packaging.

Source Insights

Based on source, Europe’s molded pulp packaging market is segmented into wood pulp and non-wood pulp. Wood pulp held the largest revenue share of nearly 85.0% in 2023. Regional governments are placing a high emphasis on paper recycling initiatives, which are having a favorable impact on wood pulp accessibility for manufacturing molded pulp packaging items. Moreover, in Europe, pulp production is carried out through sustainable forest management initiatives such as Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC). These programs assist the pulp & paper industry in effectively utilizing raw materials by relying on natural resources, thus fostering wood pulp availability.

Non-wood pulp is produced from non-wooden cellulosic plant sources, such as cereal straw, reeds, grasses, and sugarcane bagasse. Adoption of non-wood fibers is increasing due to considerations of sustainability and constraints in wood supply. For instance, PAPACKS Sales GmbH utilizes hemp fibers with a negative CO2 balance, with these products offering robust strength and durability to produce molded pulp packaging items.

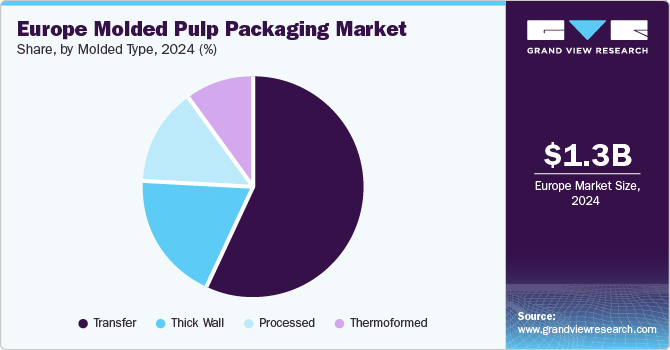

Type Insights

Based on type, the molded pulp packaging market in Europe is segmented into transfer, thick wall, processed, and thermoformed. The transfer segment accounted for the largest market share in 2023, in terms of revenue. Transfer packaging in molded pulp provides effective protection and cushioning for fragile and sensitive products during transportation. The ability of molded pulp to conform to different product shapes ensures a snug fit and minimizes risk of damage during transit.

Thick-wall molded pulp packaging is the thickest among the four types of packaging. It is commonly used as an end cap in protective packaging, particularly in electronics industry, to ensure safe transportation of various products. This packaging solution is lightweight, thus fulfilling requirements for cargo transportation. As a result, growing trade between European countries is anticipated to drive an increase in demand for thick-wall molded pulp packaging.

Thermoformed molded pulp packaging is also referred to as thin-wall molded pulp packaging. These products have gained significant popularity due to their smoother finish and enhanced aesthetic appeal. In food service industry, thermoformed packaging is commonly used to manufacture trays, plates, cups, and bowls. These trays and containers can be made microwave-compatible, making them a preferred choice for fast food packaging that requires reheating. Processed molded pulp packaging is primarily used to fulfill custom requirements such as printing. This method involves additional processing steps such as die-cutting, coating, or incorporating chemicals.

Product Insights

Based on product, the Europe molded pulp packaging market is segmented into trays, end caps, clamshells, bowls & cups, plates, and others. Trays accounted for a dominant market share in 2023, in terms of revenue. This positive segment outlook is due to wide applications of these trays in the food service and food packaging industries. These trays are extensively utilized for packaging eggs in retail distribution channels, offering effective protection against breakage and ensuring product safety.

Eggs are packaged in either plastic clamshells or molded pulp clamshells. The preference for plastic clamshells has been on a downward trend in recent years, primarily due to a growing popularity of molded pulp clamshells. This shift can be attributed to the convenience provided by molded pulp clamshells in terms of both carrying and disposal.

Application Insights

Based on application, the European molded pulp packaging market is segmented into food packaging, food service, electronics, healthcare, industrial, and others. The food packaging segment accounted for the largest revenue share in 2023. Increasing production and consumption of eggs across Europe are expected to boost the demand for molded pulp egg cartons and trays, consequently fostering segment growth. Additionally, rising utilization of molded wine or champagne shippers, aimed at preventing breakage and damage to wine bottles during transit, is poised to contribute significantly to growth.

Molded pulp packaging items, encompassingbowls, plates, rectangular containers, and cup holders, are employed in food service applications extensively due to their adaptability for customization, ensuring a secure and tailored fit for specific food items. The anticipated segment growth is driven by increasing consumption of packaged food products, Ready-To-Eat (RTE) meals, on-the-go snacks, and beverages. This optimistic trend is attributed to a rapid population growth of working professionals in Europe.

In healthcare settings, molded pulp packaging items, including dental tray inserts, specimen trays, surgical instrument trays, hospital bedpans & urinals, medical device trays, and cushioning for medical equipment, find application due to their protective, biodegradable, and cost-effective properties. Moreover, these products serve as an environment-friendly and time-saving substitute for metal utensils, as expenses related to metal utensil reuse are comparatively high. Consequently, this advantage of molded pulp packaging items is expected to boost product demand in the healthcare sector.

Regional Insights

Western Europe led the market in terms of the number of automobile production plants, population, GDP, manufacturing sector value addition to GDP, and healthcare spending, when compared to Eastern Europe and Scandinavia regions. According to EUROSTAT, this region also leads in terms of household spending on dining out, driving growth in the food service application segment. Western Europe’s dominant position, characterized by a substantial population and robust healthcare and manufacturing sectors, establishes it as the primary consumer for molded pulp packaging items.

In Eastern Europe, a fast-growing poultry sector and increasing egg production are key drivers for rising molded pulp packaging product demand. Moreover, in this region, there is a growing emphasis on environmental sustainability and reducing plastic usage, which is expected to have a positive impact on molded pulp packaging demand. For instance, in February 2021, Aldi, a European supermarket chain, announced its initiative to phase out plastic packaging from its egg packaging range. Since Aldi is operational in Poland, this initiative is expected to positively influence the molded pulp packaging market in Eastern Europe.

In Scandinavia, escalated demand for molded pulp packaging products is primarily attributed to increased home consumption and direct sale of eggs to regional consumers. For instance, according to Statistics Denmark, home consumption and direct sale of eggs to consumers in the country amounted to 12 million kilos in 2020. Also, according to Our World in Data, Denmark has one of the highest egg consumption per capita in Europe.

Key Companies & Market Share Insights

The molded pulp packaging market in Europe is highly competitive, owing to the presence of multiple global and regional players. Key players mainly cater to demand from food service, food & beverages, healthcare, electronics, industrial, automotive, and personal care industries. Prominent players in this market are employing various strategies to strengthen their market presence and drive growth. These strategies include launching new products, engaging in mergers & acquisitions, forming joint ventures, and expanding into new geographic regions. By implementing these initiatives, these companies aim to enhance their competitive position and capitalize on market opportunities.

Key Europe Molded Pulp Packaging Companies:

- Brødrene Hartmann A/S

- Omni-Pac Group

- Huhtamaki

- Pulp-Tec Limited

- TART

- PAPACKS Sales GmbH

- KIEFEL GmbH

- James Cropper plc

- TRIDAS

- Goerner Formpack GmbH

- buhl-paperform GmbH

- International Paper

- Robert Cullen Ltd.

- Eco-Products, Inc.

- Graphic Packaging International, Inc.

- Great Northern Corporation

- MFT-CKF, Inc.

- Transcend Packaging

- Ecolution Packaging

Recent Developments

-

In May 2023, OMNI-PAC Group unveiled a new 60,000 sq. ft. manufacturing facility at Normanby Enterprise Park in Scunthorpe, North Lincolnshire, making it the company’s third UK site. The facility has been equipped with advanced conventional pulp fiber molding and pressing equipment to improve its production capabilities and address the rising demand for sustainable packaging solutions

-

In March 2022, Huhtamaki, a prominent global supplier of sustainable packaging solutions, enhanced its manufacturing capabilities in smooth molded fiber, a versatile material used for producing precise and high-quality food packaging, while serving as a substitute for rigid plastics. To cater to increasing demand for plastic-free alternatives in food packaging, Huhtamaki's facility in Alf, Germany, is undergoing a transition from plastics to smooth molded fiber (SMF) products

Europe Molded Pulp Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.28 billion

Revenue forecast in 2030

USD 1.89 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, type, product, application, region

Regional scope

Western Europe; Eastern Europe; Scandinavia

Country scope

UK; Germany; France; Italy; Spain; Netherlands; Belgium; Austria; Slovakia; Czech Republic; Poland; Hungary; Romania; Sweden; Denmark; Finland

Key companies profiled

Brødrene Hartmann A/S; Omni-Pac Group; Huhtamaki; Pulp-Tec Limited; TART; PAPACKS Sales GmbH; KIEFEL GmbH; James Cropper plc; TRIDAS; Goerner Formpack GmbH; buhl-paperform GmbH; Robert Cullen Ltd.; Eco-Products, Inc.; Graphic Packaging International, Inc.; Great Northern Corporation; MFT-CKF, Inc.; Transcend Packaging; Ecolution Packaging; International Paper

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe molded pulp packaging market report on the basis of source, type, product, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wood Pulp

-

Non-wood Pulp

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Western Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Belgium

-

Austria

-

Slovakia

-

Czech Republic

-

Rest of Western Europe

-

Eastern Europe

-

Poland

-

Hungary

-

Romania

-

Rest of Eastern Europe

-

Scandinavia

-

Sweden

-

Denmark

-

Finland

-

Rest of Scandinavia

-

Frequently Asked Questions About This Report

b. The Europe molded pulp packaging market was estimated at around USD 1.20 billion in the year 2023 and is expected to reach around USD 1.28 billion in 2024.

b. The Europe molded pulp packaging is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach around USD 1.89 billion by 2030.

b. Food Packaging emerged as a dominating application with a value share of around 45.0% in the year 2023 owing to the expanding poultry sector in the European region. In addition, increasing consumers preference for packaged food products, Ready-To-Eat (RTE) meals, on-the-go snacks, and beverages is driving the molded pulp packaging market growth across Europe.

b. The key market player in the Europe molded pulp packaging market includes Brødrene Hartmann A/S, Omni-Pac Group, Huhtamaki, Pulp-Tec Limited, TART, PAPACKS Sales GmbH, KIEFEL GmbH, James Cropper plc, TRIDAS, Goerner Formpack GmbH, and buhl-paperform GmbH.

b. The demand for molded pulp packaging products is projected to increase in Europe due to several factors. These include the growing consumer preference for recyclable materials, rising disposable incomes, and the increasing demand for packaging solutions that are both reusable and sustainable.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."