- Home

- »

- Water & Sludge Treatment

- »

-

Europe Process Chemicals For Water Treatment Market Report, 2025GVR Report cover

![Europe Process Chemicals For Water Treatment Market Size, Share & Trends Report]()

Europe Process Chemicals For Water Treatment Market Size, Share & Trends Analysis Report By Application (Sugar & Ethanol, Fertilizers, Geothermal, Others), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-783-4

- Number of Pages: 99

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Bulk Chemicals

Industry insights

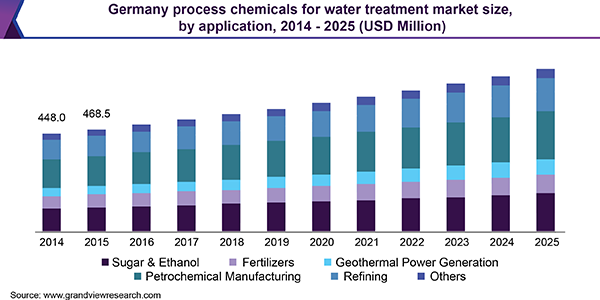

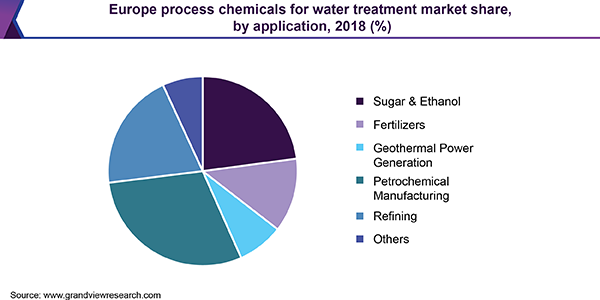

The Europe process chemicals for water treatment market size was estimated at USD 2.58 billion in 2018 and is expected to grow at a CAGR of 5.0% over the forecast period. The growing need for water treatment in the sugar & ethanol, fertilizers, geo-thermal power generation, petrochemical manufacturing and refining industries, specifically in emerging economies of Europe

Europeans use plenty of water not only for drinking but also to use water in manufacturing, farming, heating & cooling, and other services. Moreover, considering the rapid economic growth, growth of wealth as well as disposable income, the water treatment in Europe is anticipated to witness a rapid growth rate over the forecast period.

The rising demand for ethanol is a global trend. Rising output & protecting a quality product are the major challenges for sugar & ethanol plants in Europe to meet in export & domestic markets. For this motive, maintenance of equipment, treatment of water by process chemicals, and the search for extremely influential solutions are necessities for productivity as well as maintaining the quality of the product.

Biocides ensure the safety of manufacturing systems and maintaining operational efficiency by the prevention of hazardous microbial growth, reduce biofouling and contamination. Biocides are used in Sugar & Ethanol sector to ensure if correct water conditions are achieved for wastewater. In addition, biocides are broadly used for the control of bacteria in the ethanol fermentation process.

The growing need to upgrade the current water treatment plants in nations of Europe has fostered the industry growth. The mandatory approval from the pollution control boards as well as the state government levels has further boosted the major industry participants to adopt sustainable water treatment. These companies are expected to comply with stringent environmental regulations pertaining to the appropriate treatment of wastewater.

The rapid industrialization and intensive use of water resources coupled with extensive agricultural development across Europe has hampered the region’s capacity to meet its water needs. This trend has also created significant pressure on aquatic ecosystem as well. The water supply and quality constraints being faced by the emerging economies have propelled the industry participants to adopt sustainable water treatment.

Applications Insights

The increasing demand for renewable fuels has motivated investments in several countries, including Germany, Italy, Austria, and Spain among others. With expansion projects that are already happening in the sugar and ethanol sector in the region, investments in new power plants must stay in the coming years and are predicted to grow the trade of process chemicals for water treatment.

Flocculants are large and heavy particles used in Sugar & Ethanol sector to improve sedimentation or filterability of small particles during water treatment. During sugar processing, removal of impurities from sugar cane juice is a vital part. Thus, they are used to increase the settling rate and to improve the color of finally produced sugar.

During the beet processing, foam is generated owing to the foam active substances and the protein foam formed is stabilized by sugar. Anti-foaming agents are used in sugar & ethanol production for destruction of existing foam and to prevent foam generation further. The antifoaming agents are mostly used at the boiling station.

Decoloring agents are used in the sugar & ethanol industry to treat waste water with acidic, activated and disperse dyestuff. It is an effective polymer developed to improve the color of sugar syrup in sugar refineries. Decoloring agents also remove impurities from the sugar syrup and helps to convert them into flocs.

Regional Insights

Belgium stands out as one of the most industrialized and densely populated nations among the European region. The water treatment facilities in the nation are highly advanced with considerable investments in industrial and residential water treatment plants. For instance, over the past few years, the regions of Wallonia, Brussels and Flanders have made considerable investments in wastewater treatment plans and infrastructure projects for water treatment.

The aforementioned regions jointly with federal government have authority and responsibility to implement EU water treatment directives. Additionally, the stringent EU water treatment directives have been rigorously implemented in Belgium. This has significantly boosted the consumption of processing chemicals in both residential and industrial wastewater treatment.

Moreover, the government is also implementing liberal measures encouraging the flow of foreign direct investment for establishing and renovating water treatment facilities which benefits the processing chemicals market in the region. Furthermore, the Europe process chemicals for water treatment market is propelled by the presence of large players such as Suez Environment, Saur, and Veolia Environment who cater to water treatment solutions domestically and internationally.

Additionally, the increasing industrial output and consumerism have created a high requirement for processing chemicals across various industries such as chemical manufacturing, textiles, paper, and pulp among others. These factors are expected to bolster the demand for process chemicals in the region over the forecast period.

Europe Process Chemicals For Water Treatment Market Share Insights

The key players typically meet the present requirements and have the capability of meeting future requirements. Companies listed in this category are typically major producers who are also leaders in terms of investment in R&D activities, which equips them to meet any prospective changes.

The leading players operating in the market are SUEZ; BASF SE; Ecolab Inc.; Solenis LLC; Nouryon; Kemira OYJ; Baker Hughes, a GE company LLC; Dow; SNF Group; Cortec Corporation; Solvay; Johnson Matthey and Veolia.

In October 2018, SUEZ strengthened its presence in terms of water management for metropolitan cities in Latin America by signing 19 contracts. By signing the aforementioned contracts, the company increased its geographic footprint and the first contract was signed in Ecuador.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million and CAGR from 2019 to 2025

Regional scope

Europe

Country scope

Belgium, France, Italy, Spain, UK, Germany, Austria, Sweden, Finland, Poland, Netherlands, Portugal, Denmark, Norway, Russia

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the Europe process chemicals for water treatment market on the basis of application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Sugar & Ethanol

-

Fertilizers

-

Geothermal Power Generation

-

Petrochemical Manufacturing

-

Refining

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Europe

-

Belgium

-

France

-

Italy

-

Spain

-

UK

-

Germany

-

Austria

-

Sweden

-

Finland

-

Poland

-

Netherlands

-

Portugal

-

Denmark

-

Norway

-

Russia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."