- Home

- »

- Homecare & Decor

- »

-

Europe Reusable Water Bottle Market Size Report, 2021-2028GVR Report cover

![Europe Reusable Water Bottle Market Size, Share & Trends Report]()

Europe Reusable Water Bottle Market Size, Share & Trends Analysis Report By Material (Glass, Aluminum, Plastic, Silicone, Steel), By Type (Insulated, Non-insulated), By Distribution Channel, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-259-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The Europe reusable water bottle market size was valued at USD 1.72 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2021 to 2028. Rising awareness regarding plastic pollution levels across the region is influencing consumers to disregard bottled water, thereby driving the market for the reusable water bottle. In addition, the adoption of a healthier lifestyle among consumers to keep themselves hydrated is expected to boost the sales of the product in the forecast period. The widespread home isolation guidelines have spurred the demand for various kitchen products, including reusable bottles, during the Covid-19 pandemic. According to a blog post by Klarna, millennials and Generation X used a large portion of their income on home and garden products during the lockdown. These items included drinkware, kitchenware, and other household products. Before the pandemic, 42% of people purchased bottled water for consumption at home despite easy access to tap or filtered water, which fell to 32% during the lockdown, according to YouGov’s report in July 2020.

Plastic beverage bottles are among the most dangerous pollutants present on the Earth and are posing a serious threat to human and marine life. A large amount of non-biodegradable plastic waste is present in the oceans and landfills. Ocean plastic waste adversely affects marine life whereas that in landfills affects human life by contaminating underground water.

To restrict such pollutants, in 2019, the European Union approved a ban on certain single-use plastics. This ban will come into effect from July 2021 and be implemented in all EU member countries. It includes single-use plastic items most commonly found on beaches in Europe. Although the law does not fully ban plastic bottles, it includes a 90% collection target for those by 2029. Moreover, the EU mandates plastic bottles to be made with 30% by 2030. These initiatives are likely to automatically drive the need for reusable water bottles across the region.

Over the past few years, a significant increase in the demand for reusable water bottles, majorly at the workplace and for home use, owing to their eco-friendly nature and reusability has boosted market growth across the region. The rising adoption rate of these bottles can be attributed to their cost-effectiveness, environmental friendliness, and durability. Shifting consumer preferences, evolving lifestyles, and improved standards of living are contributing to reusable water bottles becoming more of a style statement at workplaces or colleges. These factors are expected to drive the European market for reusable water bottles over the foreseeable future.

Despite the positive outlook, reusable water bottles are characterized by high manufacturing costs as raw materials such as stainless steel and glass are more expensive than plastic. In addition, the production of water bottles from stainless steel, copper, or other metals involves high consumption of energy. Moreover, even though glass bottles are among the most preferred options to reduce plastic pollution, they are easily breakable and have fewer chances of lasting for a long duration as compared to plastic water bottles. These factors are likely to restrict the market growth up to some extent in the coming years.

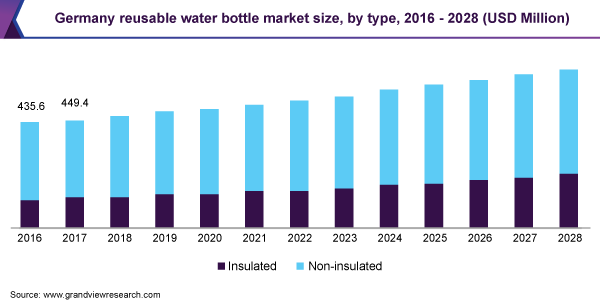

Type Insights

In terms of revenue, the non-insulated segment dominated the market with a share of over 77.0% in 2020. Aided by local government initiatives, various European countries have been installing water refilling stations at public places. Such initiatives include the Join the Pipe project in the Netherlands, the Refill campaign by City to Sea in the U.K., and Refill Deutschland in Germany. Public support for sustainable living and increased access to drinking water in public places will drive the demand for non-insulated water bottles over the forecast period.

The insulated segment is projected to expand at the fastest revenue-based CAGR of 5.6% from 2021 to 2028. The segment growth is fueled by the increasing demand for thermal water insulation in varied climates. With the growing adoption and popularity of vacuum insulation technology, companies such as Thermos, S’well, and Hydro Flask have been incorporating the same into their products to boost sales. Insulation technology is especially popular for keeping water cold in hot and humid regions. These bottles also offer excellent thermal resistance in cold weather to keep water at a desirable and warm temperature.

Distribution Channel Insights

In terms of revenue, the offline segment dominated the market with a share of 87.0% in 2020. The offline channel includes hypermarkets/supermarkets, convenience stores, and specialty stores. Business owners directly buy from either specialty stores or hypermarkets as the price and product availability is better in a store than on websites or e-commerce platforms. Business owners shop from a specific kind of store because they purchase in large quantities and they can get the best price on these products at such stores. These factors are expected to drive the segment over the forecast period.

The online segment is projected to expand at the fastest revenue-based CAGR of 6.3% from 2021 to 2028. The rise in the penetration of e-commerce and smart devices, easy payment options, and discount offers are the factors contributing to the growth of this segment. In 2018, as per Executing Shopper Insights 2020 blog, Amazon witnessed the highest sales of reusable water bottles with 14.9% of purchases being made from this channel in the U.K. While 13.6% of consumers purchased from Tesco and 8.8% from ASDA in the same country. This is expected to drive the segment in the coming years.

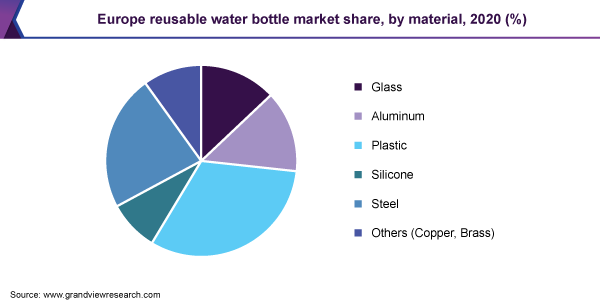

Material Insights

In terms of revenue, the plastic segment dominated the market with a share of over 32.0% in 2020. The demand for plastic-based reusable bottles is increasing among consumers owing to the large availability of the product as a result of the low cost of manufacturing by producers. The greater life expectancy of the plastic reusable water bottles has increased consumers’ interest in the consumption of reusable water bottles, which is supporting the growth of the segment. As per blogs published by Mathematics for Sustainability, purchasing a reusable bottle costing USD 20 can save up to USD 6,180, compared to buying disposable plastic bottles, after using them for five years, which is considered to be the bare minimum life expectancy of plastic-based reusable water bottles.

The steel segment is projected to expand at the fastest revenue-based CAGR of 5.0% from 2021 to 2028. Since water is packed in plastic bottles for long durations under various conditions dissolves harmful chemicals from the bottle surface, and thereby does not meet the safe drinking water standards and is unfit and unhealthy for consumption. In such cases, RO and UV filtered water filled in reusable stainless-steel bottles is a healthier and safer alternative, which is driving the demand for steel reusable water bottles.

Country Insights

In terms of revenue, Germany dominated the European market by accounting for 28.7% share in 2020. The growing trend of refill campaigns in the country is driving the demand for reusable water bottles among consumers. With the introduction of services like cafes and restaurants, businesses, and private individuals, and companies are offering free tap water to consumers, which is boosting the usability of reusable water bottles across the country.

With the advancements made in PET bottle recycling, local and provincial governments in Germany are pushing for regulations that encourage the use of reusable water bottles. This regulatory push is aimed at reducing the dependence on single-use or recycled plastics, especially mineral water packaged in plastic bottles. One such example would be the Mayor of Berlin’s push to encourage the city’s population to switch to tap water and refill their water bottles from various water dispensing systems in public spaces.

Great Britain is projected to expand at the fastest revenue-based CAGR of 5.1%from 2021 to 2028. As per the Keep Britain Tidy campaign, about 58% of the population uses reusable water bottles in Great Britain; this factor acts as a major driver for the market. Additionally, the increasing availability of filtered or tap water is encouraging people to use reusable water bottles instead of packaged water in single-use PET bottles.

Key Companies & Market Share Insights

The European market for reusable water bottle is highly fragmented due to the presence of a few established players and several small and medium companies. The impact of major players on the market is quite high as a majority of them have vast distribution networks to reach out to a large customer base. A majority of the new companies in the market are focusing on establishing a portfolio of stainless-steel bottles as they are naturally BPA-free and an excellent alternative to single-use plastics. Some prominent players in the Europe reusable water bottle market include:

-

Tupperware Brands Corporation

-

SIGG Switzerland AG

-

CamelBak Products, LLC

-

S’well

-

Hydro Flask

-

Klean Kanteen

-

Contigo

-

Hydaway

Europe Reusable Water Bottle Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.77 billion

Revenue forecast in 2028

USD 2.36 billion

Growth Rate

CAGR of 4.1% from 2021 to 2028 (Revenue-based)

Market demand in 2021

USD 258.2 million units

Volume forecast in 2028

USD 310.4 million units

Growth Rate

CAGR of 2.7% from 2021 to 2028 (Volume-based)

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, distribution channel, country

Regional scope

Europe

Country scope

Germany; Austria; Switzerland; France; Great Britain; Spain; Italy

Key companies profiled

Tupperware Brands Corporation; SIGG Switzerland AG; CamelBak Products, LLC; S’well; Hydro Flask; Klean Kanteen; Contigo; Hydaway;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional& segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the Europe reusable water bottle market report on the basis of material, type, distribution channel, and country:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

-

Glass

-

Aluminum

-

Plastic

-

Silicone

-

Steel

-

Others (Copper, Brass)

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

-

Insulated

-

Non-insulated

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

-

Online

-

Offline

-

Wholesale

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Sport Stores

-

Local Stores

-

-

-

Country Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

-

Germany

-

Austria

-

Switzerland

-

France

-

Great Britain

-

Spain

-

Italy

-

Frequently Asked Questions About This Report

b. In terms of revenue, Germany dominated the Europe reusable water bottle market by accounting for a 28.7% share in 2020.

b. Some key players operating in the Europe reusable water bottle market include Tupperware Brands Corporation, SIGG Switzerland AG, and CamelBak Products, LLC, in addition to several small and medium companies such as S’well, Hydro Flask, Klean Kanteen, Contigo, and Hydaway.

b. Key factors that are driving the market growth include rising awareness towards plastic pollution levels across the region is influencing consumers to disregard bottled water thereby enhancing market growth for the reusable water bottle in Europe. In addition, the adoption of a healthier lifestyle among consumers to keep themselves hydrated is also expected to boost the sales of the product in the forecast period.

b. The Europe reusable water bottle market size was estimated at USD 1.72 billion in 2020 and is expected to reach USD 1.77 billion in 2021.

b. The Europe reusable water bottle market is expected to grow at a compound annual growth rate of 4.1% from 2021 to 2028 to reach USD 2.36 billion by 2028.

b. In terms of revenue, the non-insulated segment dominated the Europe reusable water bottle market with a share of over 77.0% in 2020.

b. In terms of revenue, the offline segment dominated the Europe reusable water bottle market with a share of 87.0% in 2020.

b. In terms of revenue, the plastic segment dominated the Europe reusable water bottle market with a share of over 32.0% in 2020.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."