- Home

- »

- Medical Devices

- »

-

Exoskeleton Market Size, Share And Growth Report, 2030GVR Report cover

![Exoskeleton Market Size, Share & Trends Report]()

Exoskeleton Market Size, Share & Trends Analysis Report By Mobility (Mobile, Fixed/Stationary), By Technology (Powered, Non-powered), By Extremity, By Structure, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-071-2

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Exoskeleton Market Size & Trends

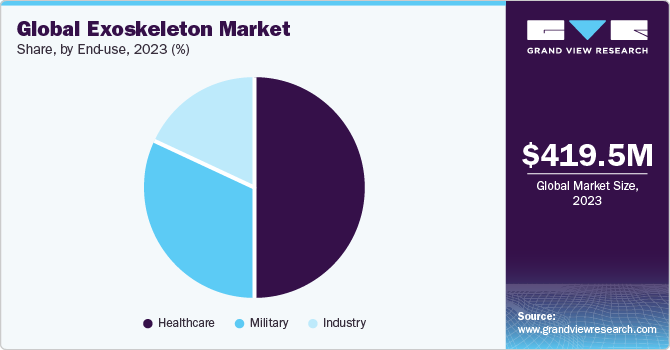

The global exoskeleton market size was estimated at USD 419.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.6% from 2024 to 2030. In terms of volume, the market volume was 13,643 units in 2023 and is projected to grow at a CAGR of 9.3% from 2024 to 2030. Rapidly growing global geriatric population, rising adoption rates of medical devices in different industries such as automobile, military, defense, and construction, and rising incidence of stroke are some of the key driving forces responsible for the market growth.

Furthermore, the growing incidence rate of spinal cord injuries (SCI) is expected to drive the demand across global markets. For instance, as per the National Spinal Cord Injury Statistical Center (NSCISC), in the U.S., 17,730 new SCIs are diagnosed annually, and approximately 291,000 live with SCIs.

Exoskeleton solutions are widely adopted across industries to support employee health and boost productivity. Growing demand has led to emergence of several startups expertizing in exoskeleton technology and providing solutions for rehabilitation. Furthermore, constantly evolving exoskeleton industry is driving market players to devise innovative product development strategies to boost adoption over the forecast period. For instance, in June 2022, Ekso Bionics received 510(k) FDA clearance for marketing the EksoNR robotic exoskeleton. It is the latest generation of devices that can be used for rehabilitation of multiple sclerosis patients.

Some of the most common musculoskeletal injuries and disorders affecting the construction industry are occupational overuse syndrome (OOS), cumulative trauma disorders (CTD), and repetitive strain injury (RSI). For instance, as per WHO data estimates published in July 2022, approximately 1.71 billion individuals across the globe have musculoskeletal disorders that include neck pain, lower back pain, fractures, amputation, rheumatoid arthritis, and osteoarthrit is. Similarly, in 2022, according to the U.S. Bureau of Labor Statistics, approximately 502,380 workers have occupation-related musculoskeletal disorders across several industries. These are some of the driving factors boosting adoption of exoskeleton solutions owing to benefits associated with exoskeleton technology, such as augmenting or assisting users’ physical activity or capability, improving users’ health & productivity, and reducing fatigue experienced by industrial workers.

Rapid technological advancements in the global market are expected to boost the demand for exoskeletons. Increasing popularity and growing adoption of exoskeletons by companies are expected to contribute to market growth. In addition, increasing adoption of exoskeletons in manufacturing sector, logistics, automotive, and construction is leading to a rise in penetration of exoskeletons, thereby fueling the market growth. For instance, in December 2021, IKEA and BMW are using Bionic’s fifth generation Cray X, an AI-enabled, powered exoskeleton capable of lifting an additional 70 pounds, reducing the risk of repetitive stress injuries and back injuries. Such advancements are expected to boost market growth over the forecast period.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating.The global market is characterized by a moderate-to-high degree of growth due to increasing investment in the technological advancement of exoskeletons, growing adoption of exoskeletons in healthcare sector, and insurance coverage for exoskeletons. For instance, XoMotion, a next-generation exoskeleton developed by Simon Fraser University (SFU) researchers and Human in Motion Robotics (HMR) Inc., offers free and independent movement for individuals suffering from mobility issues.

The market is characterized by a high degree of innovation due to the rapid technological advancements driven by factors such as advancements in robotics and artificial intelligence technology. Novel and innovative applications of exoskeletons are constantly emerging, leading to the creation of new opportunities for market players.

The market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to access new robotic technologies needed to consolidate in a rapidly growing market and the increasing adoption of these newly developed exoskeletons.For instance, in December 2022, Ekso Bionics announced the acquisition of Parker Hannifin Corporation’s Human Motion and Control Business Unit, which includes the Indego line of lower limb exoskeleton products and the strategic development of robot-assisted prosthetic and orthotic devices.

Well-developed regulatory framework and rising approval for the exoskeleton products from these regulatory bodies positively impact market growth. The certifications and standards provided by government authorities for exoskeletons in their manufacture, deployment, and use would enhance their adoption at workplace.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising research and development activities create more opportunities for market players to enter new regions. For instance, in June 2022, CYBERDYNE Inc. announced its collaboration with the Social Security Organization (SOCSO) in Malaysia. This initiative led to the expansion of Cybernics Treatment using hybrid assistive limb (HAL) for SOCSO-insured patients.

End-Use Insights

Based on the end use, the healthcare segment dominated the market in 2023 with a largest revenue share of 50.0%, owing to the rising incidence rate of spinal cord injuries (SCIs), widespread adoption of these products & solutions in rehabilitation centers, and significant surge in treatment numbers are some of the key driving factors. Moreover, a growing number of regulatory approvals and rising awareness of technologically advanced systems are driving the demand & adoption rate of exoskeleton products in the healthcare industry. For instance, in October 2023, Wandercraft SAS launched in the U.S. commercial operations of its exoskeleton, Atalante X. The solution is used for individuals with mobility impairments.

The industry segment is anticipated to register the fastest CAGR during the forecast period owing to rising awareness levels towards the benefits of exoskeleton technologies in several industry applications and the rapidly growing incidence rate of occupation-related injuries. Furthermore, the surge in demand for novel technologies and growing adoption of the exoskeleton in multiple sectors such as construction, manufacturing, and distribution is expected to accelerate growth of the industry segment.

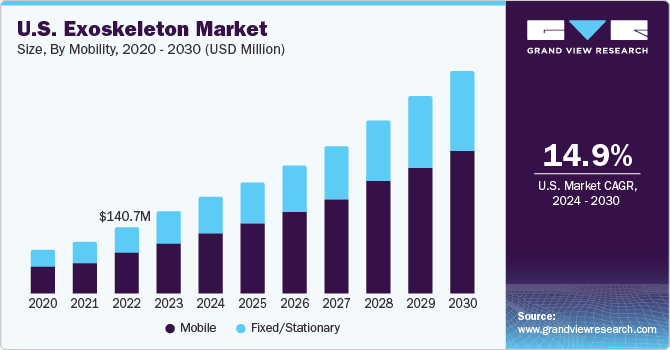

Mobility Insights

Based on the mobility, the mobile segment led the market in 2023 with the largest revenue share of 62.1% and volume share of 63.1%. The mobile segment is anticipated to witness fastest CAGR over the forecast period. Factors such as a rise in research and development activities and a surge in demand for motor-equipped robots aiding human body mechanics are attributed to market growth. For instance, in October 2022, a research team at Stanford University funded by NIH developed an exoskeleton that can assist with walking.

Moreover, availability of favorable reimbursement policies promoting adoption of exoskeleton technologies in emerging economies & developing nations directly contributes to the segment's development and growth. Furthermore, key participants are constantly introducing innovative solutions for various industries that support user's health, boost productivity, reduce fatigue, and minimize risks of serious injuries, further driving the market growth.

Regional Insights

North America dominated the market with a revenue share of 45.9% and volume share of 27.0% in 2023, owing to rising expenditure on research activities, growing prevalence of disabled individuals, increasing number of partnerships & collaborations amongst key participants, availability of technologically advanced products, and growing public & private support. For instance, in March 2021, Ekso Bionics, an exoskeleton technology company, partnered with U.S. Physiatry (USP) to educate clinicians or physicians on the clinical benefits of an EksoNR exoskeleton. Moreover, rising disposable income, a rapidly growing geriatric population, widespread presence of key market players, growing human augmentation in industry and military verticals, and availability of public & private investors are driving the growth.

Asia Pacific is anticipated to register the fastest CAGR during the forecast period owing to a growing patient pool requiring rehabilitation support. Availability of government support & funding and developing & advancing healthcare infrastructure are driving the development & market growth in Asia Pacific. Constant economic development in economies such as China, Japan, and India, coupled with favorable public & private support, is expected to bolster the development & growth.

Technology Insights

Based on the technology, the powered segment led the market in 2023 with the largest revenue share of 73.0% owing to rising implementation of powered exoskeleton solutions in several industries to enhance personal safety and boost productivity. Furthermore, rise in innovative product launches and benefits associated with powered technology products are smoother lifting motion, reduced strain on worker’s body, increased strength, force multiplier, and enhanced productivity. For instance, in December 2021, German Bionic, a manufacturer of robotic exoskeleton, introduced its 5th generation Cray X. It is a smart AI-powered exoskeleton that assists in walking, outdoor capabilities, and other pioneering technologies.

The non-powered technology segment is anticipated to register the fastest CAGR over the forecast period, owing to growing number of innovative product launches. For instance, in November 2021, Ottobock, a developer of orthotics, prosthetics, and exoskeletons acquired suitx. Through this acquisition, the two companies are going to combine their resources and expertise in the field of exoskeleton to develop innovative products & solutions and expand into the global market.

Extremity Insights

Based on the extremity, the lower body segment led the market with a largest revenue share of 42.0% in 2023, owing to rising investments, growing incidence of lower body disabilities, and increasing adoption rates of exoskeleton products by geriatric populations and paralyzed patients for weight-bearing capabilities and mobility. In addition, defense and military personnel utilize lower-body solutions to support soldiers or improve their speed and motion. For instance, in February 2021, Paramount Group and Sarcos Robotics signed a Memorandum of Understanding (MoU) to bring revolutionary robotic systems for defense applications to industrial customers and governments in the Middle East and Africa.

The upper body segment is anticipated to register the fastest CAGR over the forecast period, due to benefits provided by exoskeleton products in the upper extremities, such as supporting disabled communities and rehabilitation aid in post-stroke, neurological, or musculoskeletal impairments. Furthermore, growing prevalence of neurological disorders led to a rise in market growth. For instance, in May 2022, according to data published by the European Academy of Neurology, globally, a neurological disease affects 1 in 3 people at some point in their life.

Key Companies & Market Share Insights

Some of the key players operating in the market includeEkso Bionics, Suit X, ReWalk Robotics, and Cyberdyne, Inc. On the other hand Rex Bionics PLC, RB3D, and Lockheed Martin Corporation are some of the emerging market players in this industry.

-

Ekso Bionics specializes in bionic exoskeletons, robotics, and rehabilitation. Ekso Bionics received its first FDA clearance for exoskeleton for patients affected with spinal cord injuries and stroke. The company is a leader in technology innovation and is one of pioneers in the market. The company also focuses on partnering with established healthcare facilities to expand their distribution channels and enhance care delivery in newer business geographies

-

Cyberdyne, Inc. develops and distributes exoskeleton suits widely used in medicine, caregiving, and living & labor support. The company has been devising various business expansion strategies such as mergers and technological collaborations. The company focuses on collaborating with different stakeholders of the supply chain, thereby increasing its clientele and expanding their business geography

-

Lockheed Martin Corporation is a large company dealing in aerospace, security, defense, and other technologies. The company has expertise in developing exoskeleton or exo-robots for the military and defense industries. The company focuses on obtaining defense service contracts

Key Exoskeleton Companies:

- Ekso Bionics

- Hocoma

- Lockheed Martin Corporation

- Suit X

- Rex Bionics Plc.

- RB3D

- ReWalk Robotics

- Cyberdyne, Inc.

- ActiveLink (Panasonic Corporation)

Recent Developments

-

In December 2023, German Bionic introduced the Apogee exoskeleton with robotic motors for healthcare workers to lift and move heavy patients with greater ease, less strain, and improved stamina

-

In June 2022, CYBERDYNE Inc. formed a business and capital alliance with LIFESCAPES Inc. This collaboration highlighted the combined effort to further leverage the exoskeleton technology arena and improve rehabilitation options for patients with severe paralysis

-

In June 2022, Ekso Bionics received 510(k) FDA clearance for marketing the EksoNR robotic exoskeleton. It is the latest generation of devices that can be used for the rehabilitation of multiple sclerosis patients

-

In February 2020, Ekso Bionics launched EksoPulse platform, a cloud-deployed platform to measure and analyze EksoNR robotic exoskeleton. The platform is integrated with a user-friendly interface and dashboard to measure activity & progress in rehabilitation sessions

-

In November 2018, Lockheed Martin received a USD 6.9 million development contract from the U.S. Army Natick Soldier Research, Development, and Engineering Center (NSRDEC) to further develop the Onyx exoskeleton for soldier demonstrations

Exoskeleton Market Report Scope

Report Attribute

Details

Market size value in 2024 (revenue)

USD 498.3 million

Market size value in 2024 (Volume)

15,284 units

Revenue forecast in 2030

USD 1.25 billion

Volume forecast in 2030

26,114 units

Growth rate

CAGR of 16.6% (Revenue) and 9.3% (Volume) from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mobility, technology, extremity, structure, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Spain; Italy; France; Russia; Japan; China; India; Australia; Singapore; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Ekso Bionics; Hocoma; Lockheed Martin Corporation; Suit X; Rex Bionics Plc.; RB3D; ReWalk Robotics Ltd; Cyberdyne, Inc.; and ActiveLink (Panasonic Corporation)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Exoskeleton Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this report, Grand View Research, Inc. has segmented the global exoskeleton market report based on the mobility, technology, extremity, structure, end-use, and region:

-

Mobility Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Fixed/Stationary

-

-

Technology Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

Powered

-

Non-powered

-

-

Extremity Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

Upper Body

-

Lower Body

-

Full Body

-

-

Structure Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

Rigid Exoskeletons

-

Soft Exoskeletons

-

-

End-Use Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Military

-

Industry

-

-

Regional Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global exoskeleton market size was valued at USD 419.5 million in 2023 and is expected to reach USD 498.3 million in 2024.

b. The global exoskeleton market is expected to grow at a compound annual growth rate of 16.6% from 2024 to 2030 to reach USD 1.25 billion by 2030.

b. Mobile segment dominated the exoskeleton market with a revenue share of 62.1% in 2023. This is attributable to the introduction of innovative mobile exoskeletons by manufacturers for the aging and disabled population.

b. Some key players operating in the exoskeleton market include Rex Bionics Plc.; Hocoma; Lockheed Martin Corporation; Suit X; ReWalk Robotics; RB3D; ReWalk Robotics Ltd; Cyberdyne, Inc.; and ActiveLink (Panasonic Corporation).

b. Key factors that are driving the exoskeleton market growth include the growing adoption of exoskeletons in healthcare and non-healthcare settings, technological advancements, and the increasing prevalence of spinal cord injuries (SCIs).

Table of Contents

Chapter 1. Exoskeleton Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Mobility

1.2.2. Technology

1.2.3. Extremity

1.2.4. Structure

1.2.5. End Use

1.2.6. Regional scope

1.2.7. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for Primary Interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for Primary Interviews in Latin America

1.4.5.5. Data for Primary Interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Exoskeleton Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Mobility outlook

2.2.2. Technology outlook

2.2.3. Extremity outlook

2.2.4. Structure outlook

2.2.5. End-use outlook

2.3. Competitive Insights

Chapter 3. Exoskeleton Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing incidence of spinal cord injury

3.2.1.2. Increasing incidence of musculoskeletal disorders

3.2.1.3. Technological advancements

3.2.2. Market Restraint Analysis

3.2.2.1. High development and maintenance costs

3.3. Exoskeleton Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic Landscape

Chapter 4. Exoskeleton Market: Mobility Estimates & Trend Analysis

4.1. Mobility Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Exoskeleton Market by Mobility Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Mobile

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2. Market estimates and forecasts 2018 to 2030 (Units)

4.4.2. Fixed/Stationary

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2. Market estimates and forecasts 2018 to 2030 (Units)

Chapter 5. Exoskeleton Market: Technology Estimates & Trend Analysis

5.1. Technology Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Exoskeleton Market by Technology Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Powered

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.1.2. Market estimates and forecasts 2018 to 2030 (Units)

5.4.2. Non-powered

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2.2. Market estimates and forecasts 2018 to 2030 (Units)

Chapter 6. Exoskeleton Market: Extremity Estimates & Trend Analysis

6.1. Extremity Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Global Exoskeleton Market by Extremity Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Upper body

6.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

6.4.1.2. Market estimates and forecasts 2018 to 2030 (Units)

6.4.2. Lower body

6.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.2.2. Market estimates and forecasts 2018 to 2030 (Units)

6.4.3. Full body

6.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.3.2. Market estimates and forecasts 2018 to 2030 (Units)

Chapter 7. Exoskeleton Market: Structure Estimates & Trend Analysis

7.1. Extremity Market Share, 2023 & 2030

7.2. Structure Dashboard

7.3. Global Exoskeleton Market by Structure Outlook

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.4.1. Rigid exoskeletons

7.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.1.2. Market estimates and forecasts 2018 to 2030 (Units)

7.4.2. Soft exoskeletons

7.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

7.4.2.2. Market estimates and forecasts 2018 to 2030 (Units)

Chapter 8. Exoskeleton Market: End Use Estimates & Trend Analysis

8.1. End Use Market Share, 2023 & 2030

8.2. Segment Dashboard

8.3. Global Exoskeleton Market by End Use Outlook

8.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

8.4.1. Healthcare

8.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

8.4.1.2. Market estimates and forecasts 2018 to 2030 (Units)

8.4.2. Military

8.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

8.4.2.2. Market estimates and forecasts 2018 to 2030 (Units)

8.4.3. Industry

8.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

8.4.3.2. Market estimates and forecasts 2018 to 2030 (Units)

Chapter 9. Exoskeleton Market: Regional Estimates & Trend Analysis

9.1. Regional Market Share Analysis, 2023 & 2030

9.2. Regional Market Dashboard

9.3. Global Regional Market Snapshot

9.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

9.5. North America

9.5.1. U.S.

9.5.1.1. Key country dynamics

9.5.1.2. Regulatory framework/ reimbursement structure

9.5.1.3. Competitive scenario

9.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

9.5.1.5. U.S. market estimates and forecasts 2018 to 2030 (USD Units)

9.5.2. Canada

9.5.2.1. Key country dynamics

9.5.2.2. Regulatory framework/ reimbursement structure

9.5.2.3. Competitive scenario

9.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

9.5.2.5. Canada market estimates and forecasts 2018 to 2030 (USD Units)

9.6. Europe

9.6.1. UK

9.6.1.1. Key country dynamics

9.6.1.2. Regulatory framework/ reimbursement structure

9.6.1.3. Competitive scenario

9.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

9.6.1.5. UK market estimates and forecasts 2018 to 2030 (USD Units)

9.6.2. Germany

9.6.2.1. Key country dynamics

9.6.2.2. Regulatory framework/ reimbursement structure

9.6.2.3. Competitive scenario

9.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

9.6.2.5. Germany market estimates and forecasts 2018 to 2030 (USD Units)

9.6.3. France

9.6.3.1. Key country dynamics

9.6.3.2. Regulatory framework/ reimbursement structure

9.6.3.3. Competitive scenario

9.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

9.6.3.5. France Market Estimates and forecasts 2018 to 2030 (USD Units)

9.6.4. Italy

9.6.4.1. Key country dynamics

9.6.4.2. Regulatory framework/ reimbursement structure

9.6.4.3. Competitive scenario

9.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

9.6.4.5. Italy market estimates and forecasts 2018 to 2030 (USD Units)

9.6.5. Spain

9.6.5.1. Key country dynamics

9.6.5.2. Regulatory framework/ reimbursement structure

9.6.5.3. Competitive scenario

9.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

9.6.5.5. Spain market estimates and forecasts 2018 to 2030 (USD Units)

9.6.6. Norway

9.6.6.1. Key country dynamics

9.6.6.2. Regulatory framework/ reimbursement structure

9.6.6.3. Competitive scenario

9.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

9.6.6.5. Norway market estimates and forecasts 2018 to 2030 (USD Units)

9.6.7. Sweden

9.6.7.1. Key country dynamics

9.6.7.2. Regulatory framework/ reimbursement structure

9.6.7.3. Competitive scenario

9.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

9.6.7.5. Sweden market estimates and forecasts 2018 to 2030 (USD Units)

9.6.8. Denmark

9.6.8.1. Key country dynamics

9.6.8.2. Regulatory framework/ reimbursement structure

9.6.8.3. Competitive scenario

9.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

9.6.8.5. Denmark market estimates and forecasts 2018 to 2030 (USD Units)

9.7. Asia Pacific

9.7.1. Japan

9.7.1.1. Key country dynamics

9.7.1.2. Regulatory framework/ reimbursement structure

9.7.1.3. Competitive scenario

9.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

9.7.1.5. Japan market estimates and forecasts 2018 to 2030 (USD Units)

9.7.2. China

9.7.2.1. Key country dynamics

9.7.2.2. Regulatory framework/ reimbursement structure

9.7.2.3. Competitive scenario

9.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

9.7.2.5. China market estimates and forecasts 2018 to 2030 (USD Units)

9.7.3. India

9.7.3.1. Key country dynamics

9.7.3.2. Regulatory framework/ reimbursement structure

9.7.3.3. Competitive scenario

9.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

9.7.3.5. India market estimates and forecasts 2018 to 2030 (USD Units)

9.7.4. Australia

9.7.4.1. Key country dynamics

9.7.4.2. Regulatory framework/ reimbursement structure

9.7.4.3. Competitive scenario

9.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

9.7.4.5. Australia market estimates and forecasts 2018 to 2030 (USD Units)

9.7.5. South Korea

9.7.5.1. Key country dynamics

9.7.5.2. Regulatory framework/ reimbursement structure

9.7.5.3. Competitive scenario

9.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

9.7.5.5. South Korea market estimates and forecasts 2018 to 2030 (USD Units)

9.7.6. Thailand

9.7.6.1. Key country dynamics

9.7.6.2. Regulatory framework/ reimbursement structure

9.7.6.3. Competitive scenario

9.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

9.7.6.5. Thailand market estimates and forecasts 2018 to 2030 (USD Units)

9.8. Latin America

9.8.1. Brazil

9.8.1.1. Key country dynamics

9.8.1.2. Regulatory framework/ reimbursement structure

9.8.1.3. Competitive scenario

9.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

9.8.1.5. Brazil market estimates and forecasts 2018 to 2030 (USD Units)

9.8.2. Mexico

9.8.2.1. Key country dynamics

9.8.2.2. Regulatory framework/ reimbursement structure

9.8.2.3. Competitive scenario

9.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

9.8.2.5. Mexico market estimates and forecasts 2018 to 2030 (USD Units)

9.8.3. Argentina

9.8.3.1. Key country dynamics

9.8.3.2. Regulatory framework/ reimbursement structure

9.8.3.3. Competitive scenario

9.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

9.8.3.5. Argentina market estimates and forecasts 2018 to 2030 (USD Units)

9.9. MEA

9.9.1. South Africa

9.9.1.1. Key country dynamics

9.9.1.2. Regulatory framework/ reimbursement structure

9.9.1.3. Competitive scenario

9.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

9.9.1.5. South Africa market estimates and forecasts 2018 to 2030 (USD Units)

9.9.2. Saudi Arabia

9.9.2.1. Key country dynamics

9.9.2.2. Regulatory framework/ reimbursement structure

9.9.2.3. Competitive scenario

9.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

9.9.2.5. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Units)

9.9.3. UAE

9.9.3.1. Key country dynamics

9.9.3.2. Regulatory framework/ reimbursement structure

9.9.3.3. Competitive scenario

9.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

9.9.3.5. UAE market estimates and forecasts 2018 to 2030 (USD Units)

9.9.4. Kuwait

9.9.4.1. Key country dynamics

9.9.4.2. Regulatory framework/ reimbursement structure

9.9.4.3. Competitive scenario

9.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

9.9.4.5. Kuwait market estimates and forecasts 2018 to 2030 (USD Units)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company/Competition Categorization

10.3. Vendor Landscape

10.3.1. List of key distributors and channel partners

10.3.2. Key customers

10.3.3. Key company market share analysis, 2023

10.3.4. Ekso Bionics

10.3.4.1. Company overview

10.3.4.2. Financial performance

10.3.4.3. Product benchmarking

10.3.4.4. Strategic initiatives

10.3.5. Hocoma

10.3.5.1. Company overview

10.3.5.2. Financial performance

10.3.5.3. Product benchmarking

10.3.5.4. Strategic initiatives

10.3.6. Lockheed Martin Corporation

10.3.6.1. Company overview

10.3.6.2. Financial performance

10.3.6.3. Product benchmarking

10.3.6.4. Strategic initiatives

10.3.7. Suit X

10.3.7.1. Company overview

10.3.7.2. Financial performance

10.3.7.3. Product benchmarking

10.3.7.4. Strategic initiatives

10.3.8. Rex Bionics Plc.

10.3.8.1. Company overview

10.3.8.2. Financial performance

10.3.8.3. Product benchmarking

10.3.8.4. Strategic initiatives

10.3.9. RB3D

10.3.9.1. Company overview

10.3.9.2. Financial performance

10.3.9.3. Product benchmarking

10.3.9.4. Strategic initiatives

10.3.10. ReWalk Robotics

10.3.10.1. Company overview

10.3.10.2. Financial performance

10.3.10.3. Product benchmarking

10.3.10.4. Strategic initiatives

10.3.11. Cyberdyne, Inc.

10.3.11.1. Company overview

10.3.11.2. Financial performance

10.3.11.3. Product benchmarking

10.3.11.4. Strategic initiatives

10.3.12. ActiveLink (Panasonic Corporation)

10.3.12.1. Company overview

10.3.12.2. Financial performance

10.3.12.3. Product benchmarking

10.3.12.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America exoskeleton market, by region, 2018 - 2030 (USD Million)

Table 3 North America exoskeleton market, by region, 2018 - 2030 (Units)

Table 4 North America exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 5 North America exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 6 North America exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 7 North America exoskeleton market, by technology, 2018 - 2030 (Units)

Table 8 North America exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 9 North America exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 10 North America exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 11 North America exoskeleton market, by structure, 2018 - 2030 (Units)

Table 12 North America exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 13 North America exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 14 U.S. exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 15 U.S. exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 16 U.S. exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 17 U.S. exoskeleton market, by technology, 2018 - 2030 (Units)

Table 18 U.S. exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 19 U.S. exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 20 U.S. exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 21 U.S. exoskeleton market, by structure, 2018 - 2030 (Units)

Table 22 U.S. exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 23 U.S. exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 24 Canada exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 25 Canada exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 26 Canada exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 27 Canada exoskeleton market, by technology, 2018 - 2030 (Units)

Table 28 Canada exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 29 Canada exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 30 Canada exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 31 Canada exoskeleton market, by structure, 2018 - 2030 (Units)

Table 32 Canada exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 33 Canada exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 34 Europe exoskeleton market, by region, 2018 - 2030 (USD Million)

Table 35 Europe exoskeleton market, by region, 2018 - 2030 (Units)

Table 36 Europe exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 37 Europe exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 38 Europe exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 39 Europe exoskeleton market, by technology, 2018 - 2030 (Units)

Table 40 Europe exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 41 Europe exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 42 Europe exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 43 Europe exoskeleton market, by structure, 2018 - 2030 (Units)

Table 44 Europe exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 45 Europe exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 46 Germany exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 47 Germany exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 48 Germany exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 49 Germany exoskeleton market, by technology, 2018 - 2030 (Units)

Table 50 Germany exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 51 Germany exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 52 Germany exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 53 Germany exoskeleton market, by structure, 2018 - 2030 (Units)

Table 54 Germany exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 55 Germany exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 56 UK exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 57 UK exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 58 UK exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 59 UK exoskeleton market, by technology, 2018 - 2030 (Units)

Table 60 UK exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 61 UK exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 62 UK exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 63 UK exoskeleton market, by structure, 2018 - 2030 (Units)

Table 64 UK exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 65 UK exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 66 France exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 67 France exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 68 France exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 69 France exoskeleton market, by technology, 2018 - 2030 (Units)

Table 70 France exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 71 France exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 72 France exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 73 France exoskeleton market, by structure, 2018 - 2030 (Units)

Table 74 France exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 75 France exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 76 Italy exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 77 Italy exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 78 Italy exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 79 Italy exoskeleton market, by technology, 2018 - 2030 (Units)

Table 80 Italy exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 81 Italy exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 82 Italy exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 83 Italy exoskeleton market, by structure, 2018 - 2030 (Units)

Table 84 Italy exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 85 Italy exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 86 Spain exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 87 Spain exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 88 Spain exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 89 Spain exoskeleton market, by technology, 2018 - 2030 (Units)

Table 90 Spain exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 91 Spain exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 92 Spain exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 93 Spain exoskeleton market, by structure, 2018 - 2030 (Units)

Table 94 Spain exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 95 Spain exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 96 Denmark exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 97 Denmark exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 98 Denmark exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 99 Denmark exoskeleton market, by technology, 2018 - 2030 (Units)

Table 100 Denmark exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 101 Denmark exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 102 Denmark exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 103 Denmark exoskeleton market, by structure, 2018 - 2030 (Units)

Table 104 Denmark exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 105 Denmark exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 106 Sweden exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 107 Sweden exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 108 Sweden exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 109 Sweden exoskeleton market, by technology, 2018 - 2030 (Units)

Table 110 Sweden exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 111 Sweden exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 112 Sweden exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 113 Sweden exoskeleton market, by structure, 2018 - 2030 (Units)

Table 114 Sweden exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 115 Sweden exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 116 Norway exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 117 Norway exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 118 Norway exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 119 Norway exoskeleton market, by technology, 2018 - 2030 (Units)

Table 120 Norway exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 121 Norway exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 122 Norway exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 123 Norway exoskeleton market, by structure, 2018 - 2030 (Units)

Table 124 Norway exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 125 Norway exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 126 Asia Pacific exoskeleton market, by region, 2018 - 2030 (USD Million)

Table 127 Asia Pacific exoskeleton market, by region, 2018 - 2030 (Units)

Table 128 Asia Pacific exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 129 Asia Pacific exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 130 Asia Pacific exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 131 Asia Pacific exoskeleton market, by technology, 2018 - 2030 (Units)

Table 132 Asia Pacific exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 133 Asia Pacific exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 134 Asia Pacific exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 135 Asia Pacific exoskeleton market, by structure, 2018 - 2030 (Units)

Table 136 Asia Pacific exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 137 Asia Pacific exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 138 China exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 139 China exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 140 China exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 141 China exoskeleton market, by technology, 2018 - 2030 (Units)

Table 142 China exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 143 China exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 144 China exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 145 China exoskeleton market, by structure, 2018 - 2030 (Units)

Table 146 China exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 147 China exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 148 Japan exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 149 Japan exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 150 Japan exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 151 Japan exoskeleton market, by technology, 2018 - 2030 (Units)

Table 152 Japan exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 153 Japan exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 154 Japan exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 155 Japan exoskeleton market, by structure, 2018 - 2030 (Units)

Table 156 Japan exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 157 Japan exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 158 India exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 159 India exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 160 India exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 161 India exoskeleton market, by technology, 2018 - 2030 (Units)

Table 162 India exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 163 India exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 164 India exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 165 India exoskeleton market, by structure, 2018 - 2030 (Units)

Table 166 India exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 167 India exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 168 South Korea exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 169 South Korea exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 170 South Korea exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 171 South Korea exoskeleton market, by technology, 2018 - 2030 (Units)

Table 172 South Korea exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 173 South Korea exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 174 South Korea exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 175 South Korea exoskeleton market, by structure, 2018 - 2030 (Units)

Table 176 South Korea exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 177 South Korea exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 178 Australia exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 179 Australia exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 180 Australia exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 181 Australia exoskeleton market, by technology, 2018 - 2030 (Units)

Table 182 Australia exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 183 Australia exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 184 Australia exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 185 Australia exoskeleton market, by structure, 2018 - 2030 (Units)

Table 186 Australia exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 187 Australia exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 188 Thailand exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 189 Thailand exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 190 Thailand exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 191 Thailand exoskeleton market, by technology, 2018 - 2030 (Units)

Table 192 Thailand exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 193 Thailand exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 194 Thailand exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 195 Thailand exoskeleton market, by structure, 2018 - 2030 (Units)

Table 196 Thailand exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 197 Thailand exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 198 Latin America exoskeleton market, by region, 2018 - 2030 (USD Million)

Table 199 Latin America exoskeleton market, by region, 2018 - 2030 (Units)

Table 200 Latin America exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 201 Latin America exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 202 Latin America exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 203 Latin America exoskeleton market, by technology, 2018 - 2030 (Units)

Table 204 Latin America exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 205 Latin America exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 206 Latin America exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 207 Latin America exoskeleton market, by structure, 2018 - 2030 (Units)

Table 208 Latin America exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 209 Latin America exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 210 Brazil exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 211 Brazil exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 212 Brazil exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 213 Brazil exoskeleton market, by technology, 2018 - 2030 (Units)

Table 214 Brazil exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 215 Brazil exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 216 Brazil exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 217 Brazil exoskeleton market, by structure, 2018 - 2030 (Units)

Table 218 Brazil exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 219 Brazil exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 220 Mexico exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 221 Mexico exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 222 Mexico exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 223 Mexico exoskeleton market, by technology, 2018 - 2030 (Units)

Table 224 Mexico exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 225 Mexico exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 226 Mexico exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 227 Mexico exoskeleton market, by structure, 2018 - 2030 (Units)

Table 228 Mexico exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 229 Mexico exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 230 Argentina exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 231 Argentina exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 232 Argentina exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 233 Argentina exoskeleton market, by technology, 2018 - 2030 (Units)

Table 234 Argentina exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 235 Argentina exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 236 Argentina exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 237 Argentina exoskeleton market, by structure, 2018 - 2030 (Units)

Table 238 Argentina exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 239 Argentina exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 240 MEA exoskeleton market, by region, 2018 - 2030 (USD Million)

Table 241 MEA exoskeleton market, by region, 2018 - 2030 (Units)

Table 242 MEA exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 243 MEA exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 244 MEA exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 245 MEA exoskeleton market, by technology, 2018 - 2030 (Units)

Table 246 MEA exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 247 MEA exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 248 MEA exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 249 MEA exoskeleton market, by structure, 2018 - 2030 (Units)

Table 250 MEA exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 251 MEA exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 252 South Africa exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 253 South Africa exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 254 South Africa exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 255 South Africa exoskeleton market, by technology, 2018 - 2030 (Units)

Table 256 South Africa exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 257 South Africa exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 258 South Africa exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 259 South Africa exoskeleton market, by structure, 2018 - 2030 (Units)

Table 260 South Africa exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 261 South Africa exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 262 Saudi Arabia exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 263 Saudi Arabia exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 264 Saudi Arabia exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 265 Saudi Arabia exoskeleton market, by technology, 2018 - 2030 (Units)

Table 266 Saudi Arabia exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 267 Saudi Arabia exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 268 Saudi Arabia exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 269 Saudi Arabia exoskeleton market, by structure, 2018 - 2030 (Units)

Table 270 Saudi Arabia exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 271 Saudi Arabia exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 272 UAE exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 273 UAE exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 274 UAE exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 275 UAE exoskeleton market, by technology, 2018 - 2030 (Units)

Table 276 UAE exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 277 UAE exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 278 UAE exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 279 UAE exoskeleton market, by structure, 2018 - 2030 (Units)

Table 280 UAE exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 281 UAE exoskeleton market, by end-use, 2018 - 2030 (Units)

Table 282 Kuwait exoskeleton market, by mobility, 2018 - 2030 (USD Million)

Table 283 Kuwait exoskeleton market, by mobility, 2018 - 2030 (Units)

Table 284 Kuwait exoskeleton market, by technology, 2018 - 2030 (USD Million)

Table 285 Kuwait exoskeleton market, by technology, 2018 - 2030 (Units)

Table 286 Kuwait exoskeleton market, by extremity, 2018 - 2030 (USD Million)

Table 287 Kuwait exoskeleton market, by extremity, 2018 - 2030 (Units)

Table 288 Kuwait exoskeleton market, by structure, 2018 - 2030 (USD Million)

Table 289 Kuwait exoskeleton market, by structure, 2018 - 2030 (Units)

Table 290 Kuwait exoskeleton market, by end-use, 2018 - 2030 (USD Million)

Table 291 Kuwait exoskeleton market, by end-use, (Units) 2018 – 2030

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Exoskeleton market: market outlook

Fig. 14 Exoskeleton competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Exoskeleton market driver impact

Fig. 20 Exoskeleton market restraint impact

Fig. 21 Exoskeleton market strategic initiatives analysis

Fig. 22 Exoskeleton market: Mobility movement analysis (USD Million)

Fig. 23 Exoskeleton market: Mobility movement analysis (Units)

Fig. 24 Exoskeleton market: Mobility outlook and key takeaways (USD Million)

Fig. 25 Exoskeleton market: Mobility outlook and key takeaways (Units)

Fig. 26 Mobile market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 27 Mobile market estimates and forecast, 2018 - 2030 (Units)

Fig. 28 Fixed/Stationary market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 29 Fixed/Stationary market estimates and forecast, 2018 - 2030 (Units)

Fig. 30 Exoskeleton Market: Technology movement Analysis

Fig. 31 Exoskeleton Market: Technology movement Analysis (Units)

Fig. 32 Exoskeleton market: Technology outlook and key takeaways

Fig. 33 Exoskeleton market: Technology outlook and key takeaways (Units)

Fig. 34 Powered market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Powered market estimates and forecasts, 2018 - 2030 (Units)

Fig. 36 Non-powered market estimates and forecasts,2018 - 2030 (USD Million)

Fig. 37 Non-powered market estimates and forecasts,2018 - 2030 (Units)

Fig. 38 Exoskeleton market: Extremity movement analysis (USD Million)

Fig. 39 Exoskeleton market: Extremity movement analysis (Units)

Fig. 40 Exoskeleton market: Extremity outlook and key takeaways (USD Million)

Fig. 41 Exoskeleton market: Extremity outlook and key takeaways (Units)

Fig. 42 Upper body market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Upper body market estimates and forecasts, 2018 - 2030 (Units)

Fig. 44 Lower body market estimates and forecasts,2018 - 2030 (USD Million)

Fig. 45 Lower body market estimates and forecasts,2018 - 2030 (Units)

Fig. 46 Full body market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Full body market estimates and forecasts, 2018 - 2030 (Units)

Fig. 48 Exoskeleton market: Structure movement analysis (USD Million)

Fig. 49 Exoskeleton market: Structure movement analysis (Units)

Fig. 50 Exoskeleton market: Structure outlook and key takeaways (USD Million)

Fig. 51 Exoskeleton market: Structure outlook and key takeaways (Units)

Fig. 52 Rigid exoskeletons market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Rigid exoskeletons market estimates and forecasts, 2018 - 2030 (Units)

Fig. 54 Soft exoskeletons market estimates and forecasts,2018 - 2030 (USD Million)

Fig. 55 Soft exoskeletons market estimates and forecasts,2018 - 2030 (Units)

Fig. 56 Exoskeleton market: End Use movement analysis (USD Million)

Fig. 57 Exoskeleton market: End Use movement analysis (Units)

Fig. 58 Exoskeleton market: End Use outlook and key takeaways (USD Million)

Fig. 59 Exoskeleton market: End Use outlook and key takeaways (Units)

Fig. 60 Healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Healthcare market estimates and forecasts, 2018 - 2030 (Units)

Fig. 62 Military market estimates and forecasts,2018 - 2030 (USD Million)

Fig. 63 Military market estimates and forecasts,2018 - 2030 (Units)

Fig. 64 Industry market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 65 Industry market estimates and forecasts, 2018 - 2030 (Units)

Fig. 66 Global exoskeleton market: Regional movement analysis (USD Million)

Fig. 67 Global exoskeleton market: Regional movement analysis (Units)

Fig. 68 Global exoskeleton market: Regional outlook and key takeaways (USD Million)

Fig. 69 Global exoskeleton market: Regional outlook and key takeaways (Units)

Fig. 70 Global exoskeleton market share and leading players

Fig. 71 North America market share and leading players

Fig. 72 Europe market share and leading players

Fig. 73 Asia Pacific market share and leading players

Fig. 74 Latin America market share and leading players

Fig. 75 Middle East & Africa market share and leading players

Fig. 76 North America: SWOT

Fig. 77 Europe SWOT

Fig. 78 Asia Pacific SWOT

Fig. 79 Latin America SWOT

Fig. 80 MEA SWOT

Fig. 81 North America

Fig. 82 North America market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 83 North America market estimates and forecasts, 2018 - 2030 (Units)

Fig. 84 U.S.

Fig. 85 U.S. market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 86 U.S. market estimates and forecasts, 2018 - 2030 (Units)

Fig. 87 Canada

Fig. 88 Canada market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 89 Canada market estimates and forecasts, 2018 - 2030 (Units)

Fig. 90 Europe

Fig. 91 Europe market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 92 Europe market estimates and forecasts, 2018 - 2030 (Units)

Fig. 93 UK

Fig. 94 UK market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 95 UK market estimates and forecasts, 2018 - 2030 (Units)

Fig. 96 Germany

Fig. 97 Germany market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 98 Germany market estimates and forecasts, 2018 - 2030 (Units)

Fig. 99 France

Fig. 100 France market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 101 France market estimates and forecasts, 2018 - 2030 (Units)

Fig. 102 Italy

Fig. 103 Italy market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 104 Italy market estimates and forecasts, 2018 - 2030 (Units)

Fig. 105 Spain

Fig. 106 Spain market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 107 Spain market estimates and forecasts, 2018 - 2030 (Units)

Fig. 108 Denmark

Fig. 109 Denmark market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 110 Denmark market estimates and forecasts, 2018 - 2030 (Units)

Fig. 111 Sweden

Fig. 112 Sweden market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 113 Sweden market estimates and forecasts, 2018 - 2030 (Units)

Fig. 114 Norway

Fig. 115 Norway market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 116 Norway market estimates and forecasts, 2018 - 2030 (Units)

Fig. 117 Asia Pacific

Fig. 118 Asia Pacific market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 119 Asia Pacific market estimates and forecasts, 2018 - 2030 (Units)

Fig. 120 China

Fig. 121 China market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 122 China market estimates and forecasts, 2018 - 2030 (Units)

Fig. 123 Japan

Fig. 124 Japan market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 125 Japan market estimates and forecasts, 2018 - 2030 (Units)

Fig. 126 India

Fig. 127 India market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 128 India market estimates and forecasts, 2018 - 2030 (Units)

Fig. 129 Thailand

Fig. 130 Thailand market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 131 Thailand market estimates and forecasts, 2018 - 2030 (Units)

Fig. 132 South Korea

Fig. 133 South Korea market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 134 South Korea market estimates and forecasts, 2018 - 2030 (Units)

Fig. 135 Australia

Fig. 136 Australia market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 137 Australia market estimates and forecasts, 2018 - 2030 (Units)

Fig. 138 Latin America

Fig. 139 Latin America market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 140 Latin America market estimates and forecasts, 2018 - 2030 (Units)

Fig. 141 Brazil

Fig. 142 Brazil market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 143 Brazil market estimates and forecasts, 2018 - 2030 (Units)

Fig. 144 Mexico

Fig. 145 Mexico market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 146 Mexico market estimates and forecasts, 2018 - 2030 (Units)

Fig. 147 Argentina

Fig. 148 Argentina market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 149 Argentina market estimates and forecasts, 2018 - 2030 (Units)

Fig. 150 Middle East and Africa

Fig. 151 Middle East and Africa market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 152 Middle East and Africa market estimates and forecasts, 2018 - 2030 (Units)

Fig. 153 South Africa

Fig. 154 South Africa market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 155 South Africa market estimates and forecasts, 2018 - 2030 (Units)

Fig. 156 Saudi Arabia

Fig. 157 Saudi Arabia market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 158 Saudi Arabia market estimates and forecasts, 2018 - 2030 (Units)

Fig. 159 UAE

Fig. 160 UAE market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 161 UAE market estimates and forecasts, 2018 - 2030 (Units)

Fig. 162 Kuwait

Fig. 163 Kuwait market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 164 Kuwait market estimates and forecasts, 2018 - 2030 (Units)

Fig. 165 Market share of key market players- Exoskeleton marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Exoskeleton Mobility Outlook (Volume, Revenue, USD Million, 2018 - 2030)

- Mobile

- Fixed/Stationary

- Exoskeleton Technology Outlook (Volume, Revenue, USD Million, 2018 - 2030)

- Powered

- Non-powered

- Exoskeleton Extremity Outlook (Volume, Revenue, USD Million, 2018 - 2030)

- Upper Body

- Lower Body

- Full Body

- Exoskeleton Structure Outlook (Volume, Revenue, USD Million, 2018 - 2030)

- Rigid Exoskeletons

- Soft Exoskeletons

- Exoskeleton End-Use Outlook (Volume, Revenue, USD Million, 2018 - 2030)

- Healthcare

- Military

- Industry

- Exoskeleton Regional Outlook (Volume, Revenue, USD Million, 2018 - 2030)

- North America

- North America Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- North America Exoskeleton Market, By Technology

- Powered

- Non-powered

- North America Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- North America Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- North America Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- U.S.

- U.S. Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- U.S. Exoskeleton Market, By Technology

- Powered

- Non-powered

- U.S. Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- U.S. Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- U.S. Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- U.S. Exoskeleton Market, By Mobility

- Canada

- Canada Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Canada Exoskeleton Market, By Technology

- Powered

- Non-powered

- Canada Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Canada Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Canada Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Canada Exoskeleton Market, By Mobility

- North America Exoskeleton Market, By Mobility

- Europe

- Europe Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Europe Exoskeleton Market, By Technology

- Powered

- Non-powered

- Europe Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Europe Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Europe Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Germany

- Germany Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Germany Exoskeleton Market, By Technology

- Powered

- Non-powered

- Germany Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Germany Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Germany Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Germany Exoskeleton Market, By Mobility

- U.K.

- U.K. Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- U.K. Exoskeleton Market, By Technology

- Powered

- Non-powered

- U.K. Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- U.K. Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- U.K. Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- U.K. Exoskeleton Market, By Mobility

- Spain

- Spain Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Spain Exoskeleton Market, By Technology

- Powered

- Non-powered

- Spain Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Spain Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Spain Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Spain Exoskeleton Market, By Mobility

- Italy

- Italy Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Italy Exoskeleton Market, By Technology

- Powered

- Non-powered

- Italy Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Italy Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Italy Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Italy Exoskeleton Market, By Mobility

- France

- France Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- France Exoskeleton Market, By Technology

- Powered

- Non-powered

- France Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- France Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- France Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- France Exoskeleton Market, By Mobility

- Denmark

- Denmark Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Denmark Exoskeleton Market, By Technology

- Powered

- Non-powered

- Denmark Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Denmark Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Denmark Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Denmark Exoskeleton Market, By Mobility

- Norway

- Norway Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Norway Exoskeleton Market, By Technology

- Powered

- Non-powered

- Norway Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Norway Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Norway Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Norway Exoskeleton Market, By Mobility

- Sweden

- Sweden Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Sweden Exoskeleton Market, By Technology

- Powered

- Non-powered

- Sweden Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Sweden Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Sweden Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Sweden Exoskeleton Market, By Mobility

- Europe Exoskeleton Market, By Mobility

- Asia Pacific

- Asia Pacific Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Asia Pacific Exoskeleton Market, By Technology

- Powered

- Non-powered

- Asia Pacific Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Asia Pacific Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Asia Pacific Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Japan

- Japan Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Japan Exoskeleton Market, By Technology

- Powered

- Non-powered

- Japan Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Japan Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Japan Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Japan Exoskeleton Market, By Mobility

- China

- China Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- China Exoskeleton Market, By Technology

- Powered

- Non-powered

- China Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- China Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- China Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- China Exoskeleton Market, By Mobility

- India

- India Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- India Exoskeleton Market, By Technology

- Powered

- Non-powered

- India Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- India Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- India Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- India Exoskeleton Market, By Mobility

- Australia

- Australia Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Australia Exoskeleton Market, By Technology

- Powered

- Non-powered

- Australia Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Australia Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Australia Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Australia Exoskeleton Market, By Mobility

- Thailand

- Thailand Exoskeleton Market, By Mobility

- Mobile

- Fixed/Stationary

- Thailand Exoskeleton Market, By Technology

- Powered

- Non-powered

- Thailand Exoskeleton Market, By Extremity

- Upper Body

- Lower Body

- Full Body

- Thailand Exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

- Thailand Exoskeleton Market, By End-Use

- Healthcare

- Military

- Industry

- Thailand Exoskeleton Market, By Mobility

- South Korea