- Home

- »

- Advanced Interior Materials

- »

-

Farm Tire Market Size, Share & Growth Analysis Report 2023GVR Report cover

![Farm Tire Market Size, Share & Trends Report]()

Farm Tire Market Size, Share & Trends Analysis Report By Product (Bias, Radial), By Application (Tractors, Harvesters), By Distribution (OEM, Aftermarket), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-707-0

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

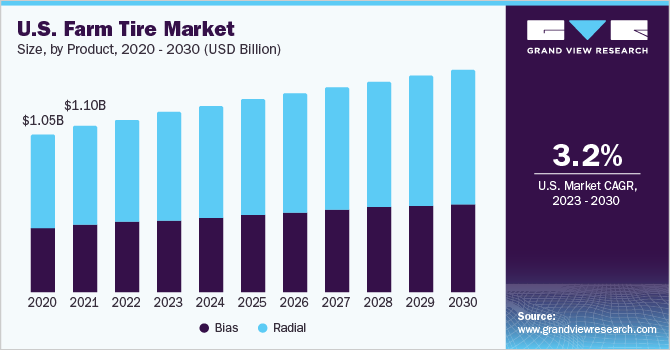

The global farm tire market size was valued at USD 7.68 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. The growing demand for farm tires in agricultural vehicles, coupled with the expansion of the agriculture sector, is projected to boost market growth over the forecast period. The adoption of advanced technologies by farmers to increase agricultural yield and meet the rising food demand is projected to be the key factor benefiting market growth. The market in the U.S. is expected to witness high growth in the years to come on account of the presence of a number of manufacturing facilities. In addition, improvements in farming technologies and favorable policies are expected to aid the growth of the agriculture industry, thereby driving the demand for related products, including tires.

Rapid urbanization, coupled with the increasing standards of living, has imposed high pressure on food production and productivity across the globe. The expansion of the agricultural sector in order to meet the rising demand for food products is anticipated to benefit the demand for agricultural vehicles, thereby fueling the demand for farm tires over the forecast period.

Increasing demand for products with superior properties, such as high puncture and wear and tear resistance, is likely to propel the production of quality products. In addition, the high production of farm tires, coupled with the rising consumption across the globe, is likely to propel the growth of the market.

Local players mostly focus on their specific strengths and retain their customers by providing custom services to tractor and harvester manufacturers. Companies in the industry also focus on increasing their production capacity as the demand for farm tire is growing in the agricultural industry on account of the increasing demand for agricultural produce.

Product Insights

The bias tire segment led the market and accounted for a 57.6% share of the global revenue in 2022. The use of bias tire is high in India and China as these tires are manufactured using natural rubber, which is produced majorly in the two countries. In addition, the crosshatch construction of the bias tire, coupled with its availability at low cost, is likely to fuel its demand.

The cost of raw materials is low, which, in turn, decreases the manufacturing cost of the product. However, the decreasing supply of natural rubber is likely to restrain the segment’s growth. In addition, natural rubber increases the rigidity of the tire, which loses uniformity after use, compromising the round shape of the farm tire and decreasing its shelf life.

Radial tires are manufactured with steel ply, which increases durability, along with bead-to-bead construction at an angle of 90 degrees to the circumferential centerline, which increases the flexibility of tires and reduces the rolling resistance, resulting in improved performance. This is likely to drive the demand for radial farm tires in agricultural vehicles over the forecast period.

The cost of radial tires is high on account of the use of synthetic rubber and modern manufacturing technology requiring high-cost machinery. As a result, the penetration of the product in the major agricultural markets and developing economies, such as India and China, is low. The aforementioned factors are likely to limit the market expansion.

Distribution Insights

The aftermarket segment led the market and accounted for a 32.8% share of the global revenue in 2022. The rising demand for the replacement of tires by farmers on account of the expansion of agricultural activities across the globe is anticipated to benefit the segment growth over the forecast period.

The use of bias tires is reducing as they are being replaced with radial tires having high-performance characteristics. In addition, the growth of new vehicle sales is lower owing to which the demand for the tires is lower through OEM distribution than that of replacement. These factors are projected to drive the demand for farm tires through aftermarket sales.

The demand for new farm tires through aftermarket channels is increasing owing to the presence of different types of platforms, such as online, authorized dealers, and third-party dealers. However, the popularity of tire retreading in developing economies, such as India and China, is likely to restrain the demand for farm tires through the aftermarket.

The demand for farm tires through the OEM channel is expected to witness growth owing to the increasing demand for new agricultural vehicles, such as tractors and harvesters. The demand for these vehicles is high in developed economies as farmers are able to afford the newly introduced, expensive farm equipment that aids in executing farming activities on large patches of land.

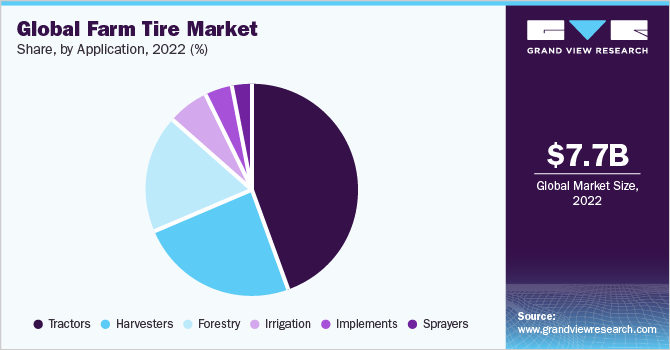

Application Insights

The tractors segment led the market and accounted for 44.1% share of the global revenue in 2022 owing to its multipurpose nature. Tractors with high horsepower are widely preferred as they can be used for different farming activities. As a result, the demand for tires is also witnessing growth with the increasing popularity and use of tractors in the industry.

The demand for farm tires in the harvesters segment is expected to witness growth owing to the introduction of several types of harvesters to suit farming needs. For instance, John Deere has introduced crop-specific harvesters to meet the requirements of farmers, resulting in the ease of harvesting crops, such as sugarcane and corn. This has led to an increased demand for harvesters for long patches of farm.

The growing demand for technologically advanced machinery for forestry operations is expected to drive the demand for tires. In addition, high penetration of forestry equipment in mature markets, including North America and Europe, results in rising aftermarket sales for the tires, which is likely to propel the market growth of farm tire over the forecast period.

The growth in the mechanization of irrigation processes on account of increased efficiency and superior crop yield supported by mechanized irrigation is expected to drive the market for irrigation equipment. This is further likely to drive the demand for irrigation equipment, including farm tires, thereby propelling the market growth.

Regional Insights

The market in Asia Pacific dominated the global market and accounted for a 42.8% share of the revenue in 2022. This is attributed to factors such as increasing population, rising disposable income of the middle-class population, and rapid industrialization and urbanization. In addition, the presence of small and large-scale manufacturers in the region is likely to benefit the farm tire industry growth.

The manufacturing technology and material used for the production of bias farm tire ensure high load capacities at a low cost. The major raw material required for manufacturing bias tires is natural rubber. Thus, the abundant availability of natural rubber in Thailand, India, Vietnam, Indonesia, China, and Malaysia in the Asia Pacific is expected to boost the demand for bias tires in the region.

Favorable government policies such as funding support and low-interest rates have benefited the expansion of the agricultural sector in Europe. In addition, ascending demand for agricultural vehicles in economies, such as Germany, Russia, and France, owing to the expansion of agricultural activities in the region is likely to augment the demand for farm tires over the forecast period.

Agricultural equipment manufacturers in North America are at the forefront in terms of evolution and change in the agriculture industry, aiding the growth of modern-day integrated farming activities. Upgradation in farm equipment is expected to propel the demand for farm tires. In addition, good consumer adherence to maintenance schedules is likely to augment product demand.

Key Companies & Market Share Insights

Small-scale players cater to the particular country or region where they are located and compete on the basis of product differentiation by providing innovative products. They also compete on the basis of regional demand and their penetration in the regional markets. Many regional players adopt an expansion strategy by becoming a distribution partner for global players.

The market is characterized by the presence of large, multinational companies catering to global demand. These large players compete on the basis of manufacturing technology and the application scope of farm tires. In addition, many market players undergo mergers and collaborations to expand their reach, thereby increasing their market share. Some prominent players in the global farm tire market include:

-

Balkrishna Industries Limited (BKT)

-

Bridgestone Corporation

-

Continental AG

-

Compagnie Générale des Établissements Michelin (CGEM)

-

Sumitomo Rubber Industries, Ltd.

-

Titan International, Inc.

-

Mitas

-

TBC Corporation

-

Apollo Tyres Ltd.

-

Hankook Tire

-

MRF Limited

-

JK Tyre & Industries Ltd.

-

CEAT

-

The Carlstar Group, LLC

-

Specialty Tires of America, Inc.

-

Alliance Tire Group (ATG)

-

Trelleborg AB

Farm Tire Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8,045.3 million

Revenue forecast in 2030

USD 11,801.4 million

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in thousand units, Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Russia; Turkey; China; India; Japan; Australia; Brazil; Argentina; South Africa

Key companies profiled

Balkrishna Industries Limited (BKT); Bridgestone Corporation; Continental AG; Compagnie Générale des Établissements Michelin (CGEM); Sumitomo Rubber Industries, Ltd.; Titan International, Inc.; Mitas; TBC Corporation; Apollo Tyres Ltd.; Hankook Tire; MRF Limited; JK Tyre & Industries Ltd.; CEAT; The Carlstar Group, LLC; Specialty Tires of America, Inc.; Alliance Tire Group (ATG); Trelleborg AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Farm Tire Market Report Segmentation

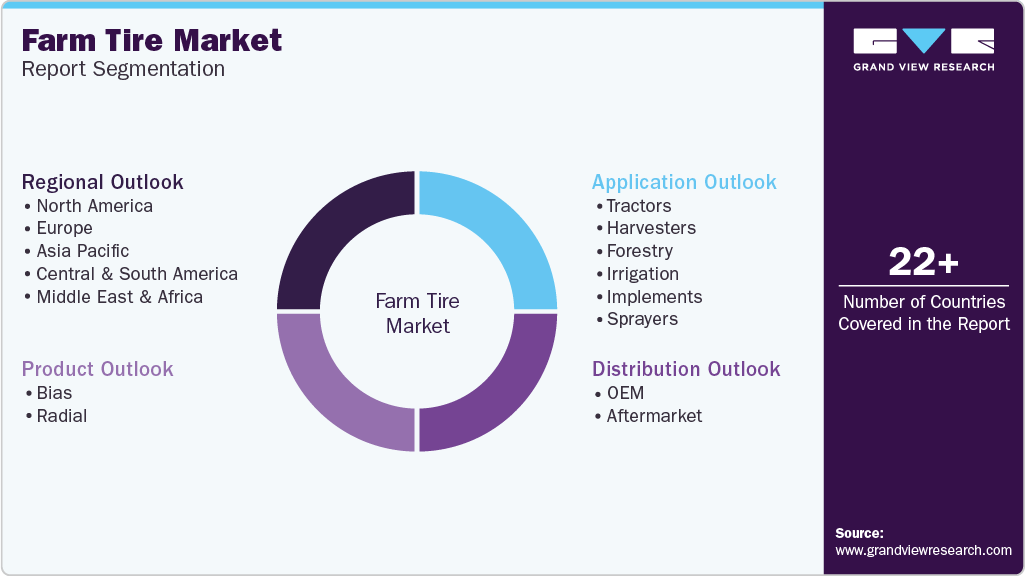

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global farm tire market on the basis of product, application, distribution, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million; 2018 - 2030)

-

Bias

-

Radial

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million; 2018 - 2030)

-

Tractors

-

Harvesters

-

Forestry

-

Irrigation

-

Implements

-

Sprayers

-

-

Distribution Outlook (Volume, Thousand Units; Revenue, USD Million; 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Volume, Thousand Units; Revenue; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global farm tire market size was estimated at USD 7.68 billion in 2022 and is expected to reach USD 8,045.3 million in 2023.

b. The farm tire market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 11,801.4 million by 2030.

b. Bias tire dominated the farm tire market with a share of 72.6% in 2022, on account of crosshatch construction of the tires and low cost as compared to its counterpart.

b. Some of the key players operating in the farm tire market include Balkrishna Industries Limited (BKT), Bridgestone Corporation, Continental AG, Compagnie Générale des Etablissements Michelin, Sumitomo Rubber Industries, Ltd., Titan International, Inc., Mitas, TBC Corporation, Apollo Tyres Ltd., Hankook Tire, MRF Limited, JK Tyre & Industries Ltd., CEAT, The Carlstar Group, LLC, Specialty Tires of America, Inc., Alliance Tire Group (ATG), Trelleborg AB

b. The key factors that are driving the farm tire market include the expansion of the agricultural sector across the globe coupled with the use of advanced agricultural equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."