- Home

- »

- Consumer F&B

- »

-

Fast Food Market Size, Share Trends & Growth Report, 2029GVR Report cover

![Fast Food Market Size, Share & Trends Report]()

Fast Food Market Size, Share & Trends Analysis Report By Product (Burgers/Sandwich, Asian/Latin American), By End Users (Fast Casual Restaurants, QSRs), By Region (North America, APAC), And Segment Forecasts, 2022 - 2029

- Report ID: GVR-4-68038-387-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global fast-food market size was valued at USD 595.93 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2022 to 2029. The rise in consumer spending and the growing influence of food delivery applications are the major factors driving the market growth. The COVID-19 pandemic adversely affected the food industry owing to the rising cases and fear of contracting the infection from food. Disruptions in supply-chain coupled with labor restraints impacted the demand for fast food in the early months of the pandemic. According to the National Restaurant Association, close to 7 million workers in the United States lost their jobs in June 2020.

In addition, an increased awareness level about the consumption of healthy foods affected the market growth during the pandemic. However, the market is expected to regain its demand post-pandemic owing to a rise in the number of fast-food franchises and increasing demand for online food deliveries.

Furthermore, a rise in the working population is supporting market growth. During the pandemic, several restaurants offered delivery services and meal kits, which increased the demand for fast food services. The rise in snacking habits among consumers is also driving the demand for fast foods.

Product Insights

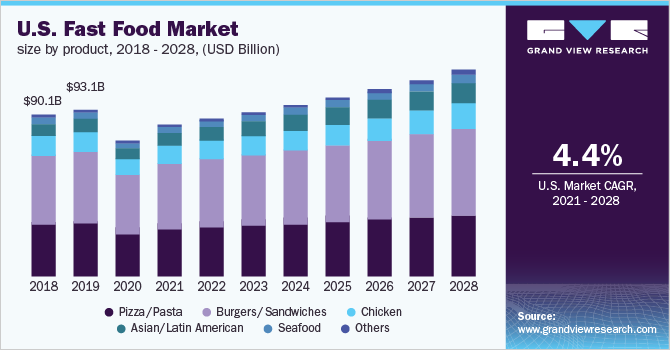

Based on product, the market is segmented into pizza/pasta, burgers/sandwiches, chicken, Asian/Latin American, seafood, and others. The burgers/sandwich segment accounted for the maximum revenue share of more than 42% in 2020 owing to the high product demand. Furthermore, as per the U.S. Department of Agriculture(USDA), consumers consume close to 50 billion burgers per year.

The growing demand for burgers/sandwiches can be attributed to the wide availability of burger options, which include products with protein options like beef, venison, and several others. In addition, several food-service operators are experimenting with different fillings of cheese, bacon, onions, meatloaf, etc. In 2021, Subway introduced several Italian fillings and various options for sandwich toppings.

On the other hand, the Asian/Latin American fast-food segment is anticipated to register the fastest CAGR over the forecast period. Increasing demand for diverse food products is driving the growth of this segment. In the U.S., a rise in the Hispanic population is driving the demand for Mexican food. For instance, as per the Simmons National Consumer Survey and the U.S. Census, close to 110 million Americans consumed tortillas in 2017.

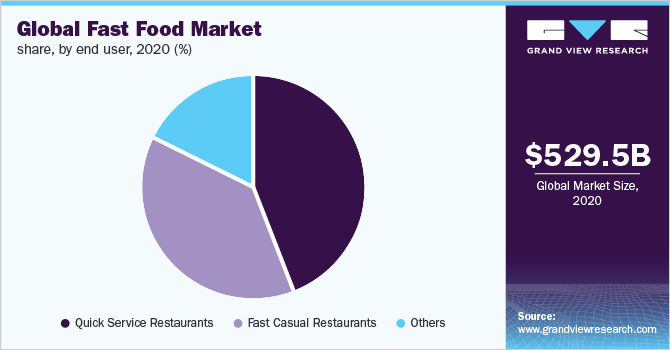

End-user Insights

On the basis of end-user, the market has been divided into Quick Service Restaurants (QSRs), fast-casual restaurants, and others. The QSRs segment accounted for the largest revenue share of more than 44% in 2020. The segment is estimated to expand further at the fastest CAGR from 2021 to 2028 retaining the leading position. During the pandemic, several quick-service restaurants expanded their off-premise businesses. Increased support for delivery applications augmented the segment growth.

The rising demand for international cuisines is also driving the growth of this segment. For example, the rapid globalization opportunities and demand from developing countries, such as India and Brazil, are helping the segment to gain traction. In addition, the introduction of novel foods and flavors will support the segment growth. For example, McDonald’s introduced BTS meal inspired by the popular band to cater to the changing needs and demands of consumers.

Regional Insights

In 2020, North America accounted for the maximum revenue share of more than 27%. A rise in consumer spending on fast foods in the region is driving the market growth. Factors, such as the availability of a variety of cuisines and budget-friendly snacks and add-ons in various flavors, are driving the market growth in the region.

On the other hand, the market in Asia Pacific is expected to register the fastest CAGR over the forecast period. Changing consumer preferences coupled with the presence of a large customer base is driving the demand for fast-foods in the region. In addition, a rise in discretionary income is supporting regional market growth.

Key Companies & Market Share Insights

The market has a strong presence of global players, such as McDonald’s, Burger King, and Domino’s Pizza. The key players in the market have strong distribution networks worldwide. Companies in the market are improving their menus and services to cater to the changing consumer preferences. In addition, a rise in the number of quick-service restaurants in the industry is helping companies to garner sales. McDonald’s is increasingly promoting and investing in media and partnerships with content creators to expand its reach worldwide. The company has also launched an application for its employees for choosing their desired career options. Some of the prominent players in the global fast-food market are:

-

Auntie Anne’s Franchisor SPV LLC

-

Domino’s Pizza, Inc.

-

CKE Restaurants Holdings, Inc.

-

Firehouse Restaurant Group, Inc.

-

Jack in the Box, Inc.

-

McDonald’s

-

Restaurant Brands International, Inc.

-

Yum Brands Inc.

-

Inspire Brands, Inc.

-

Doctor's Associates, Inc.

Recent Development

- In September 2021, Yum! Brands, Inc. acquired Dragontail System Limited, an innovative provider of technological solutions. This acquisition aimed at managing the complete food preparation process from order to delivery using intelligent AI-based solutions

Fast Food Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 595.93 billion

Revenue forecast in 2029

USD 851.34 billion

Growth rate

CAGR of 5.0% from 2022 to 2029

Base year for estimation

2021

Historic data

2017 - 2020

Forecast period

2022 - 2029

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2029

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors and trends

Segments covered

Product, end user, region

Regional scope

North America; Europe; Asia Pacific; Central &South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Brazil; South Africa

Key companies profiled

Auntie Anne’s Franchisor SPV LLC; Domino’s Pizza, Inc.; CKE Restaurants Holdings, Inc.; Firehouse Restaurant Group, Inc.; Jack in the Box, Inc.; McDonald’s; Restaurant Brands International, Inc.; Yum Brands Inc.; Inspire Brands, Inc.; Doctor's Associates, Inc.

Customization scop

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global fast food market report on the basis of product, end user, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2029)

-

Pizza/Pasta

-

Burgers/Sandwich

-

Chicken

-

Asian/Latin American

-

Seafood

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2017 - 2029)

-

Quick Service Restaurants

-

Fast Casual Restaurants

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2029)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fast food market size was estimated at USD 529.5 billion in 2020 and is expected to reach USD 593.3 billion in 2021.

b. The global fast food market is expected to grow at a compound annual growth rate of 4.6% from 2021 to 2028 to reach USD 813.9 billion by 2028.

b. North America dominated the fast food market with a share of 27.3% in 2020. Factors such as affordability, availability of snacks and add-ons, and availability in several flavors and cuisines are driving the demand for the fast food industry in the region.

b. Some key players operating in the fast food market include Auntie Anne’s Inc.; McDonald’s; Domino’s Pizza; Wendy’s International; Doctor’s Associates.

b. A rise in consumer spending coupled with the growing influence of food delivery applications are the major factors driving the fast food market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."