- Home

- »

- Healthcare IT

- »

-

Femtech Market Size, Share & Growth Report, 2030GVR Report cover

![Femtech Market Size, Share & Trends Report]()

Femtech Market Size, Share & Trends Analysis Report By Product Type (Wearable, Mobile Apps), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-923-6

- Number of Pages: 153

- Format: Electronic (PDF)

- Historical Range: 2016 - 2020

- Industry: Healthcare

Femtech Market Overview

The global femtech market size was valued at USD 5.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.1% from 2022 to 2030. Growing health consciousness amongst the female population, normalizing & proactively addressing women’s health issues will contribute to the high market growth. Increasing disposable income, digital literacy, smartphone penetration, internet connectivity, digital health infrastructure, and the emergence of startups focusing on women’s health present lucrative opportunities to new and existing market participants. The growing availability of smart wearable devices is contributing to market development and growth. Health tech developers and investors are capitalizing on untapped opportunities and funding innovative product development strategies to address women’s health issues.

Key Investment & Product/Market Development Trends:

-

According to the industry journals, in 2020, approximately 45 to 50 new women’s health startups were founded, and these startups raised funding of approximately USD 2.5 billion in 2020-2021.

-

Digital health startups focused on women observed an increase in funding by around 105% in 2020. This signifies growth in the FemTech market, thereby presenting potential growth opportunities for businesses in the coming years.

Manufacturers of smart wearable devices and developers of advanced mobile applications are integrating their innovative product development strategies to efficiently utilize resources serving women’s health needs. Through these applications and devices (wearable and non-wearable), female users can easily track their health & wellbeing, receive informational content on multiple health queries, and actively engage with female communities or healthcare professionals. For instance, in July 2021, the U.S. FDA approved and gave clearance to Natural Cycles to use body temperature data readings collected by smart wearables, such as Oura smart ring, for assessing a woman’s fertility and managing pregnancy.

Few players that are integrating the app and devices are Natural Cycles & Oura smart ring, AVA Fertility Tracker wearable and AVA Fertility Tracker application, Google and Fitbit, and a few others. App and device combination is mainly offering period cycle tracking, fertility & ovulation management, menstrual health management, and pregnancy care management solutions. Through these innovative solutions, the market players focus on improving user engagement and desired outcomes amongst female users. The societal shift toward normalizing women’s health issues and actively addressing them through different digital health technologies are boosting the market growth. Customized health approaches allow women users to better understand their bodies and prioritize their health issues in an appropriate manner.

COVID19 Femtech market impact: 15.8% increase in revenue growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The femtech market growth increased by 15.8% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 10.2% to 11.3% in the next 5 years

The pandemic challenged the existing healthcare systems simultaneously offering multiple opportunities for digital health solutions to grow. The pandemic boosted the adoption of technological solutions in addressing disease surveillance and frontline care services.

Femtech solutions received significant exposure and witnessed a dramatic adoption rate by the healthcare fraternity and female users in maintaining lifestyles and understanding their bodies better. According to a study published in the Maternal and Child Health Journal in 2021, it stated approximately 77.9% of female respondents were using pregnancy care management apps during the pandemic.

Global healthcare systems are rapidly adopting advanced digital health solutions to enhance patient-provider engagement and make healthcare more accessible. For instance, the director-general of the Finnish Ministry of Social Affairs and Health stated that the pandemic accelerated digital health transformation in Finland.

Market players are constantly focusing on their strategic initiatives to expand their competitive edge in the market. In addition, as per an article published in Fierce Healthcare, the femtech industry attracted high investments in 2020. The digital health startups focused on women witnessed an increase in funding by around 105% in 2020.

Product Type Insights

-

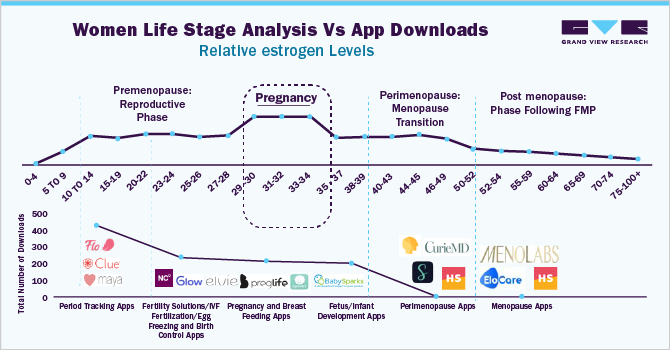

Period tracking followed by fertility and pregnancy are the most lucrative life stages with the highest number of Femtech app downloads.

-

Low IT literacy and awareness of Femtech apps among baby boomers is hindering the growth of pre-menopause and menopause solutions.

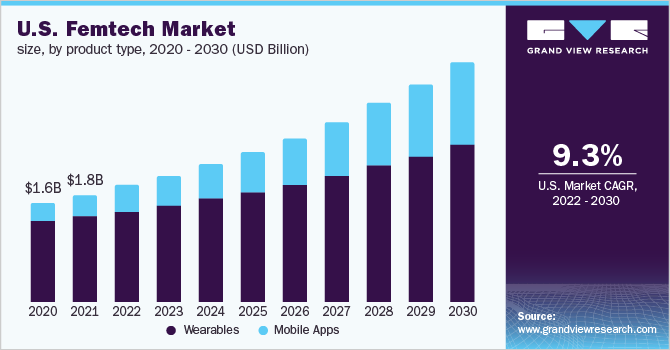

The wearables segment holds the largest market share of 79.5% owing to the growing health consciousness among female users and the increasing prevalence of women’s health issues are boosting the demand for wearables in the market. The shifting trend toward value-based care and a consumer-led model is driving growth. Moreover, wearable devices are evolving and working as an essential tool, as the population is focusing more & more on self-health care, wellness, and digitalization. Seamless smartphone integration, longer battery life, and wireless connectivity are some of the key features that female users are seeking in wearable devices.

According to Pew Research Center, as of June 2019, around 21% of individuals in the U.S. used a wearable device. Rapid advancements in the design of these wearables are expected to propel their demand. Cloud synchronization, predictive analytics, and gamification are some of the major developments in wearable technology.

On the other hand, mobile apps are anticipated to register the fastest growth rate over the forthcoming years owing to the developing trend of precautionary healthcare and growing smartphone penetration coupled with improving internet connectivity is driving consumer adoption of smartphone health applications in the market. Continuous improvement in network infrastructure and increase in coverage are propelling the demand for women’s health mobile applications. Mobile network operators view health apps as a beneficial opportunity for investment with the growing adoption of smartphones, increasing demand to address unmet needs (women’s health gaps), rising health consciousness, and growing awareness about health & well-being, especially among women.

The availability of low or no-cost health applications addressing multiple women’s health issues, such as period cycle tracking, fertility & ovulation management, pregnancy care management, and sexual wellness, has increased the number of free trials of several apps by female consumers. Furthermore, providing features such as scheduling pill reminders, alerts, remote monitoring, medical reference, diagnostics, and e-Learning has contributed to the growth in the adoption of mobile applications.

Regional Insights

-

Based on demographic analysis, the Asia Pacific followed by the Americas, accounts for the highest consumer pool. However, the penetration of FemTech apps is relatively restricted in Asia Pacific and Latin American countries.

-

The presence of a large number of FemTech companies offering novel solutions and high IT literacy in North America and Europe are the factors for the adoption of FemTech solutions at all life stages.

North America accounted for the largest market share of 38.3%. North America has witnessed rapid digitalization of healthcare owing to various factors such as growing smartphone penetration as well as rising demand for health-related smart solutions. According to Mobile Economy North America 2021 estimates, the number of mobile internet users in North America in 2020 was 296 million, and it is estimated that the number will reach 323 million by 2025. Increasing adoption of smart wearable devices and mobile health applications for health tracking coupled with growing health consciousness & awareness and rising transition toward preventive care is expected to drive the growth of the North American femtech market. In addition, favorable government initiatives and increasing healthcare IT spending & advancing digital health infrastructure are among the factors driving the market growth.

On the other hand, Asia Pacific is anticipated to register the fastest growth rate over the forthcoming years. Asia Pacific femtech market is driven by increased demand for effective health technology coupled with growing digital infrastructure, increasing smartphone & wearable devices penetration, improving internet coverage, and growing health consciousness. According to The Mobile Economy 2020 by GSMA, unique mobile subscriptions in the Asia Pacific reached 2.8 billion by the end of 2019 and are estimated to reach 3.0 billion by 2025. It has been estimated that by 2025, the number of mobile internet users in the Asia Pacific will be 2.7 billion, as compared to 2 billion in 2019. Government agencies are making efforts to promote advancements in mobile health technology by providing improved 3G & 4G network infrastructure & digital health technology roadmaps and formulating policies that would attract investments in the region.

Femtech Market Share Insights

-

Flo is the highest downloaded/subscribed app, with over 200 million downloads by 2021. This app majorly caters to period & fertility tracking.

-

Clue and Natural Cycles are a few FDA approved digital contraceptive apps that use Bayesian modeling for the prediction of the most fertile days (The high-risk window)

Flo Health, Inc; Apple, Inc; Clue by Biowink GmbH; Glow, Inc; Google, Inc; Natural Cycles USA Corp; Withings; Fitbit, Inc are some of the dominant players in the market. The growing demands arising from the unmet healthcare needs of the female population are driving market players across the globe to develop innovative product offerings and technological solutions. For instance, in March 2021, Clue received the U.S. FDA clearance for the launch of Clue Birth Control—a digital contraceptive built-in Clue application that can predict ovulation statistically by using a tool for birth control.

Key participants are focusing on mergers & acquisitions and technological collaboration strategies to expand their business footprint. For instance, in August 2021, Labcorp acquired Ovia Health, formerly known as Ovuline, a personalized data-driven solution for reproductive health companies. Through this acquisition, Labcorp strengthened its business position as a go-to source for women’s health insights and ventured into new avenues for personalized care.

Femtech Market Report Scope

Report Attribute

Details

The market size value in 2022

USD 5.6 billion

The revenue forecast in 2030

USD 13.1 billion

Growth Rate

CAGR of 11.1% from 2022 to 2030

The base year for estimation

2021

Historical data

2016 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, region

Regional scope

North America; Europe; Asia Pacific; Latin America

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Russia; Denmark; Finland; Iceland; Norway; Sweden Japan; China; India; Singapore; Australia; South Korea; Brazil; Mexico; Argentina

Key companies profiled

Flo Health, Inc; Natural Cycles USA Corp; Glow, Inc; Clue by Biowink GmbH; Google, Inc; Apple, Inc; Withings; Fitbit, Inc

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the report

This report forecasts revenue growth at the global, regional, and country level, and provides an analysis of industry trends in each of the subsegments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the global femtech market report based on product type and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Wearables

-

Mobile Apps

-

Fitness & Nutrition

-

Menstrual Health

-

Fertility Management/ Assisted Reproductive Technology Apps

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Russia

-

Denmark

-

Iceland

-

Finland

-

Norway

-

Sweden

-

-

The Asia Pacific

-

Japan

-

China

-

India

-

Singapore

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global femtech market size was estimated at USD 5.1 billion in 2021 and is expected to reach USD 5.6 billion in 2022.

b. The global femtech market is expected to grow at a compound annual growth rate of 11.1% from 2022 to 2030 to reach USD 13.1 billion by 2030.

b. Key factors that are driving the femtech market growth include the evolution of the smartphone industry and rapidly improving internet connectivity are supporting market growth. Growing health consciousness and awareness of the unmet healthcare needs of women are driving innovation & technological advancements in the market.

b. Some key players operating in the femtech market include Natural Cycles USA Corp; Flo Health, Inc.; Clue by Biowink GmbH; Glow, Inc.; Withings; Google, Inc.; Apple, Inc.; and Fitbit

b. North America dominated the femtech market with a share of 38.3% in 2021. This is attributable to owing to increasing penetration of smartphones, growing internet connectivity, rising healthcare IT expenditure, and advancements in digital infrastructure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."